This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-L

for the current year.

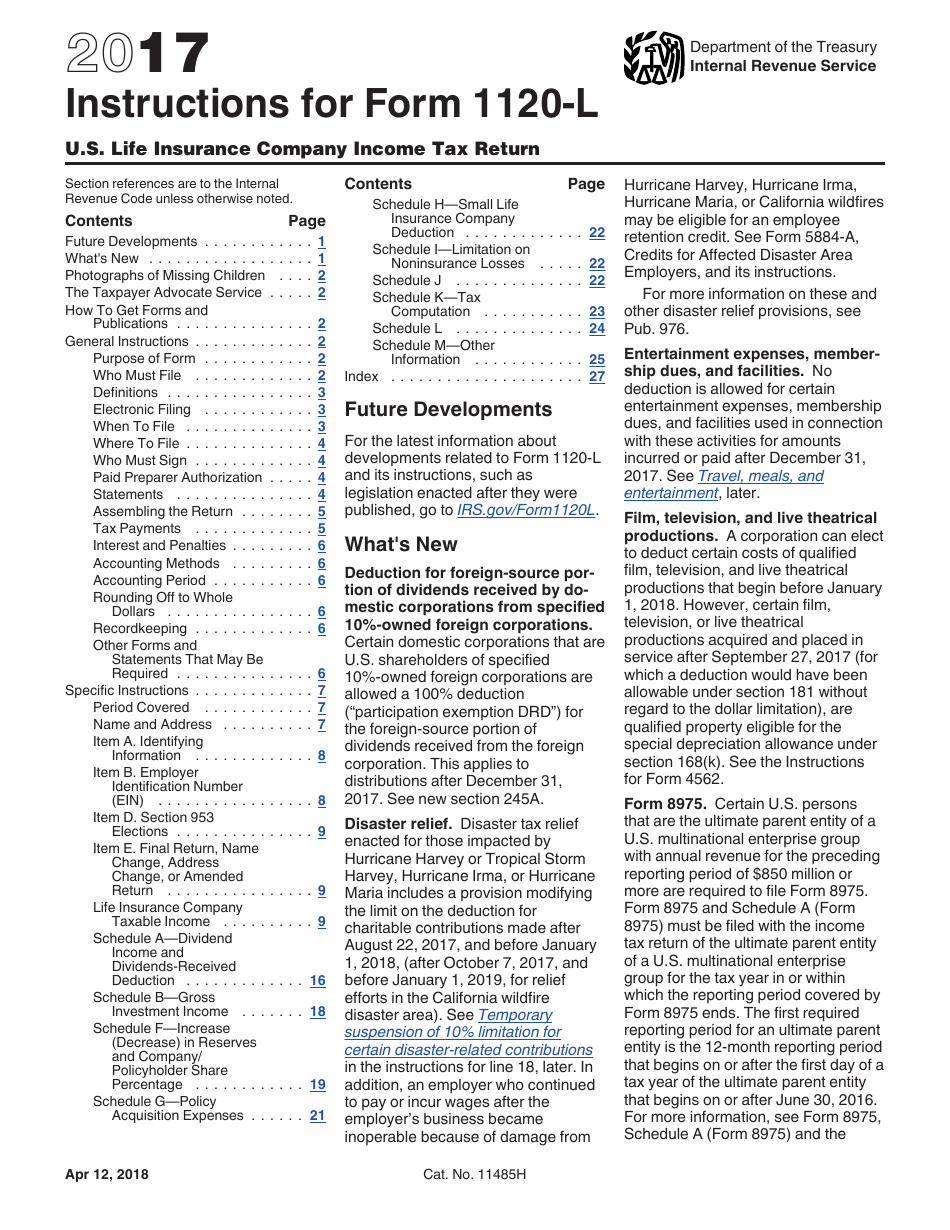

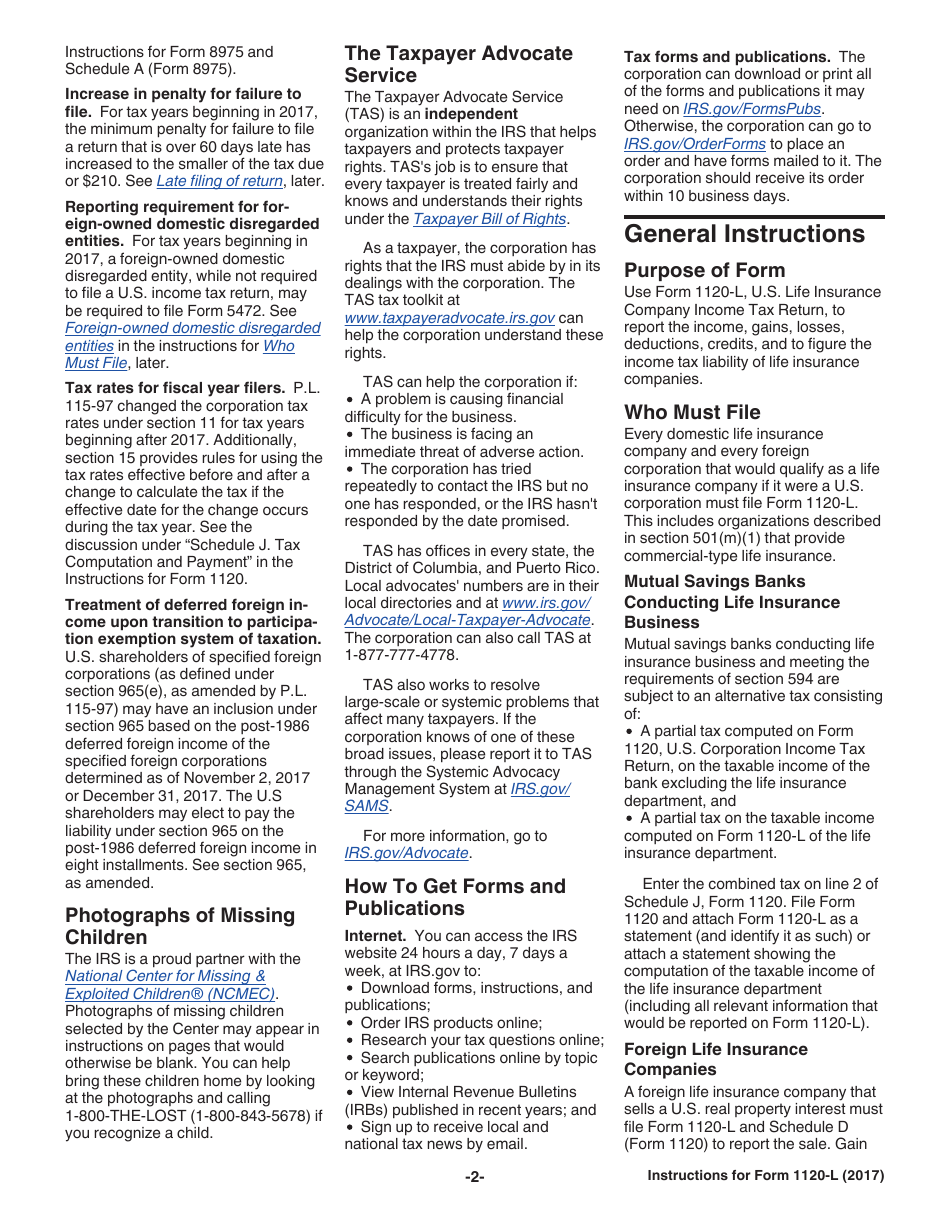

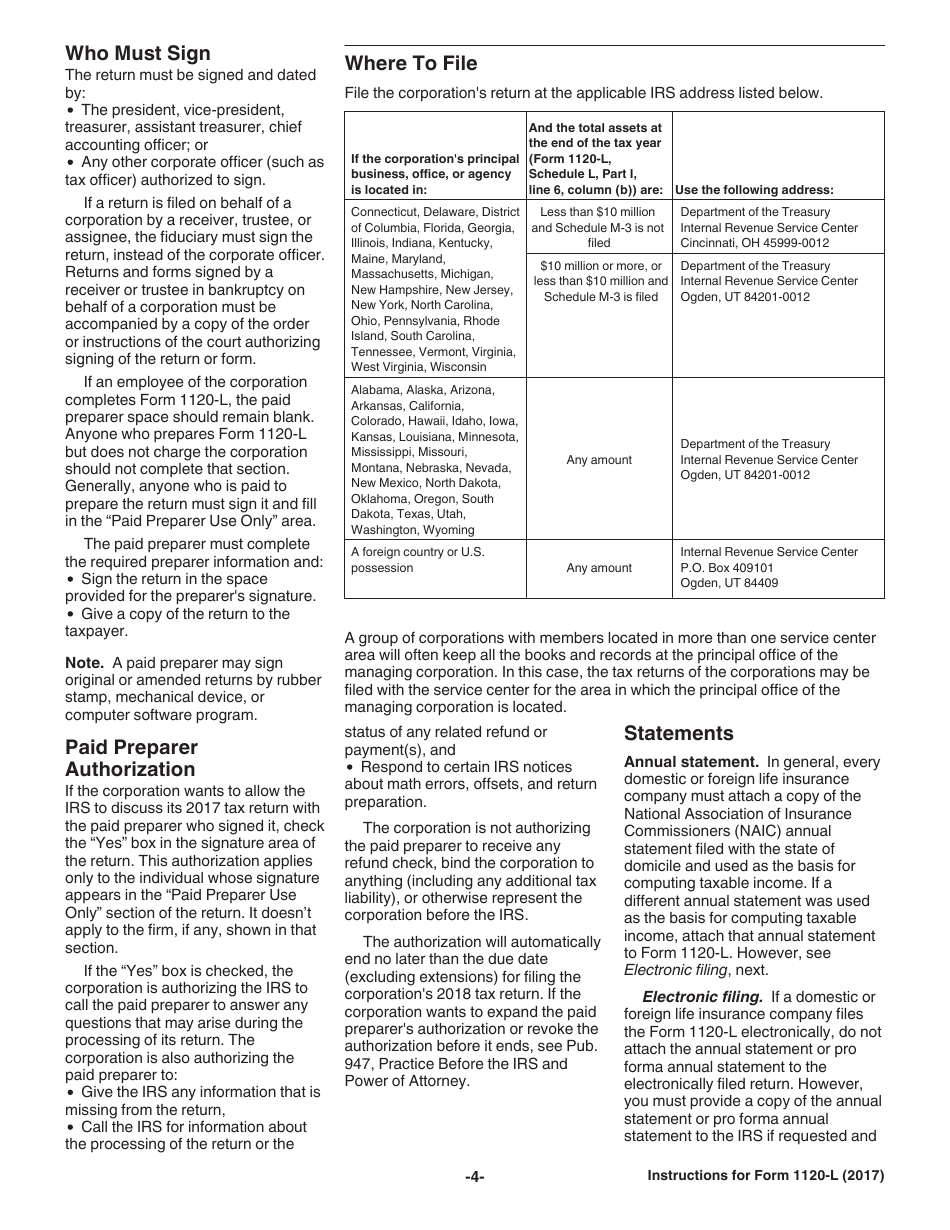

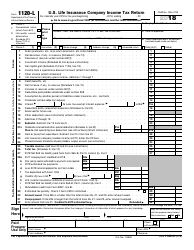

Instructions for IRS Form 1120-L U.S. Life Insurance Company Income Tax Return

This document contains official instructions for IRS Form 1120-L , U.S. Life Insurance Company Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1120-L?

A: IRS Form 1120-L is the U.S. Life Insurance Company Income Tax Return.

Q: Who needs to file IRS Form 1120-L?

A: U.S. life insurance companies need to file IRS Form 1120-L.

Q: What is the purpose of IRS Form 1120-L?

A: The purpose of IRS Form 1120-L is to report income, deductions, and credits for U.S. life insurance companies.

Q: When is IRS Form 1120-L due?

A: IRS Form 1120-L is due on the 15th day of the 3rd month after the end of the tax year.

Q: Are there any extensions available for filing IRS Form 1120-L?

A: Yes, extensions for filing IRS Form 1120-L can be requested.

Instruction Details:

- This 27-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.