This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120S Schedule D

for the current year.

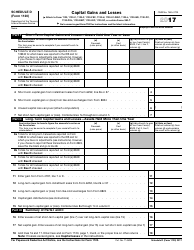

Instructions for IRS Form 1120S Schedule D Capital Gains and Losses and Built-In Gains

This document contains official instructions for IRS Form 1120S Schedule D, Capital Gains and Losses and Built-In Gains - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1120S Schedule D?

A: IRS Form 1120S Schedule D is a tax form used by S corporations to report capital gains, losses, and built-in gains.

Q: What are capital gains and losses?

A: Capital gains are profits from the sale of assets, while capital losses are losses incurred from the sale of assets.

Q: What is a built-in gain?

A: A built-in gain is a gain recognized when a C corporation converts to an S corporation and sells assets within a specific time period.

Q: What information is reported on Schedule D?

A: Schedule D reports details of capital gains, losses, and built-in gains, including the amount, type of asset, and the purchase and sale dates.

Q: When is Form 1120S Schedule D due?

A: Form 1120S Schedule D is typically due on the same date as the S corporation's federal income tax return, which is usually March 15th.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.