This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1097-BTC

for the current year.

Instructions for IRS Form 1097-BTC Bond Tax Credit

This document contains official instructions for IRS Form 1097-BTC , Bond Tax Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1097-BTC is available for download through this link.

FAQ

Q: What is IRS Form 1097-BTC?

A: IRS Form 1097-BTC is a form used for reporting the bond tax credit.

Q: Who needs to file IRS Form 1097-BTC?

A: Issuers of qualified tax credit bonds need to file IRS Form 1097-BTC.

Q: What is a bond tax credit?

A: A bond tax credit is a credit given to issuers of certain types of bonds.

Q: What are qualified tax credit bonds?

A: Qualified tax credit bonds are specific types of bonds that qualify for a tax credit.

Q: What information needs to be reported on IRS Form 1097-BTC?

A: IRS Form 1097-BTC requires the reporting of information about the issuer, the bondholder, and the bond.

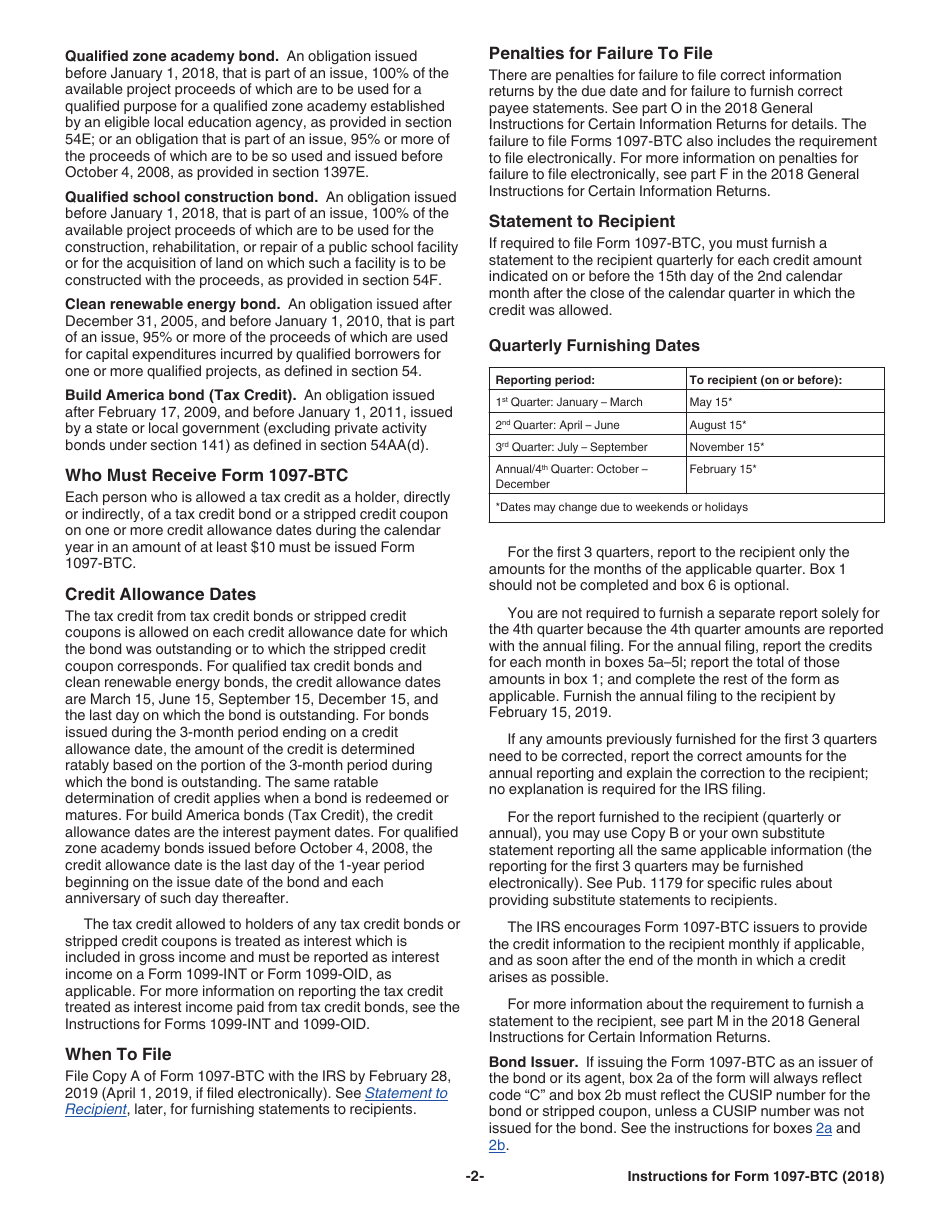

Q: When is the deadline for filing IRS Form 1097-BTC?

A: The deadline for filing IRS Form 1097-BTC is typically January 31 of the year following the calendar year in which the bond was issued.

Q: Are there any penalties for not filing IRS Form 1097-BTC?

A: Yes, there can be penalties for not filing IRS Form 1097-BTC or for filing it late.

Q: Can I file IRS Form 1097-BTC electronically?

A: Yes, you can file IRS Form 1097-BTC electronically if you meet certain requirements.

Q: Do I need to send a copy of IRS Form 1097-BTC to the bondholder?

A: Yes, you need to send a copy of IRS Form 1097-BTC to the bondholder.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.