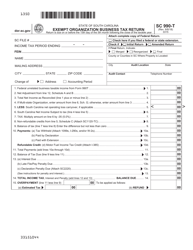

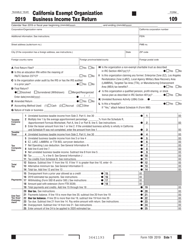

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990-T

for the current year.

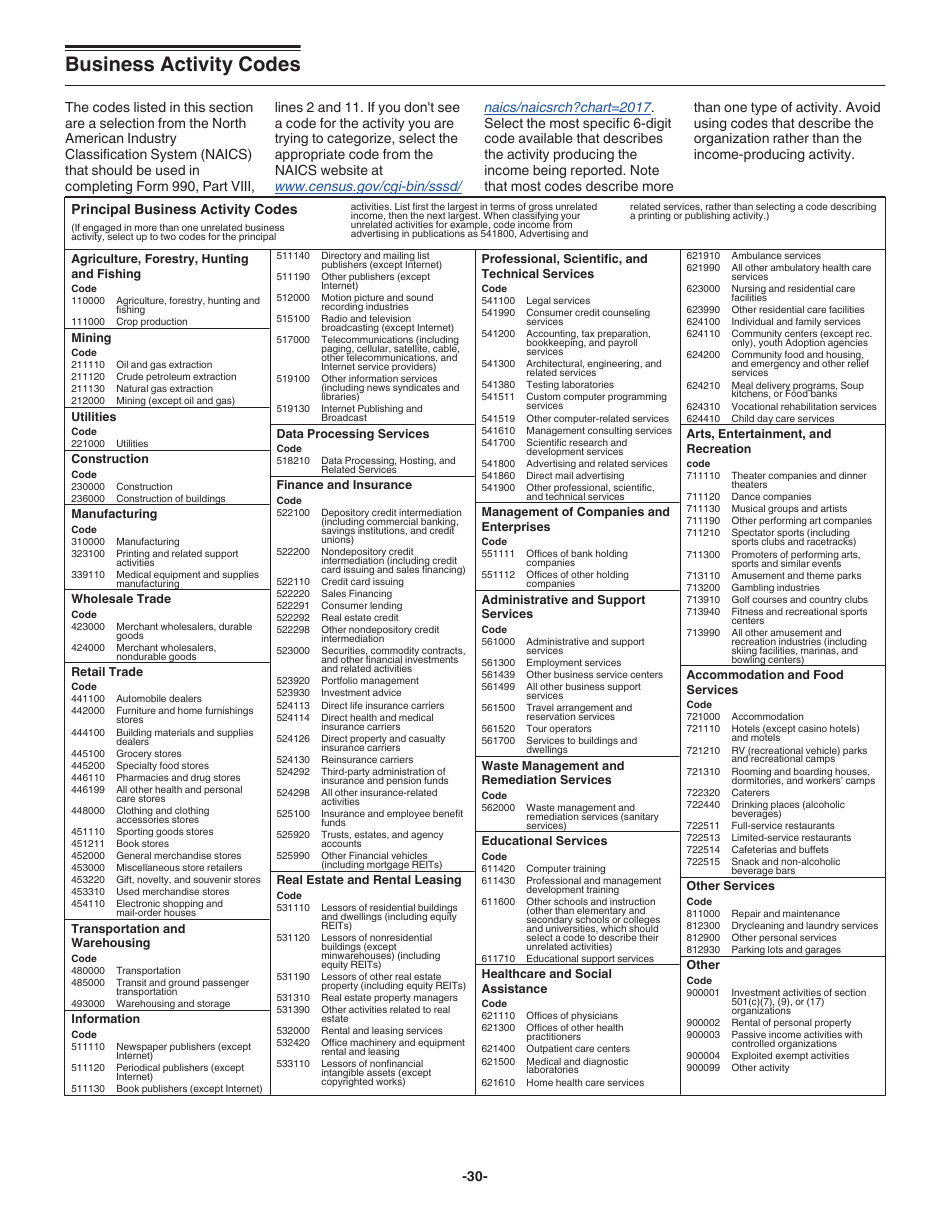

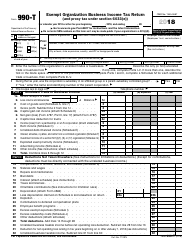

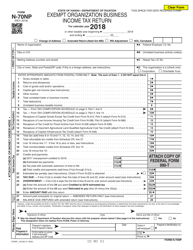

Instructions for IRS Form 990-T Exempt Organization Business Income Tax Return (And Proxy Tax Under Section 6033(E))

This document contains official instructions for IRS Form 990-T , Exempt Organization Proxy Tax Under Section 6033(E)) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 990-T?

A: IRS Form 990-T is the Exempt Organization Business Income Tax Return.

Q: Who needs to file IRS Form 990-T?

A: Exempt organizations that have unrelated business income over $1,000 must file Form 990-T.

Q: What is unrelated business income?

A: Unrelated business income is income earned by an exempt organization from activities that are not substantially related to its tax-exempt purpose.

Q: What is the purpose of filing IRS Form 990-T?

A: The purpose of filing Form 990-T is to report and pay taxes on the unrelated business income of an exempt organization.

Q: What is proxy tax under Section 6033(E)?

A: Proxy tax under Section 6033(E) is a tax imposed on certain exempt organizations that spend excessive amounts on lobbying activities.

Instruction Details:

- This 31-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.