This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 941-SS

for the current year.

Instructions for IRS Form 941-SS Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

This document contains official instructions for IRS Form 941-SS , Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 941-SS?

A: IRS Form 941-SS is the Employer's Quarterly Federal Tax Return specifically for businesses located in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands.

Q: Who needs to file IRS Form 941-SS?

A: Businesses located in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands need to file IRS Form 941-SS.

Q: What taxes are reported on IRS Form 941-SS?

A: IRS Form 941-SS is used to report and pay Social Security and Medicare taxes for employees.

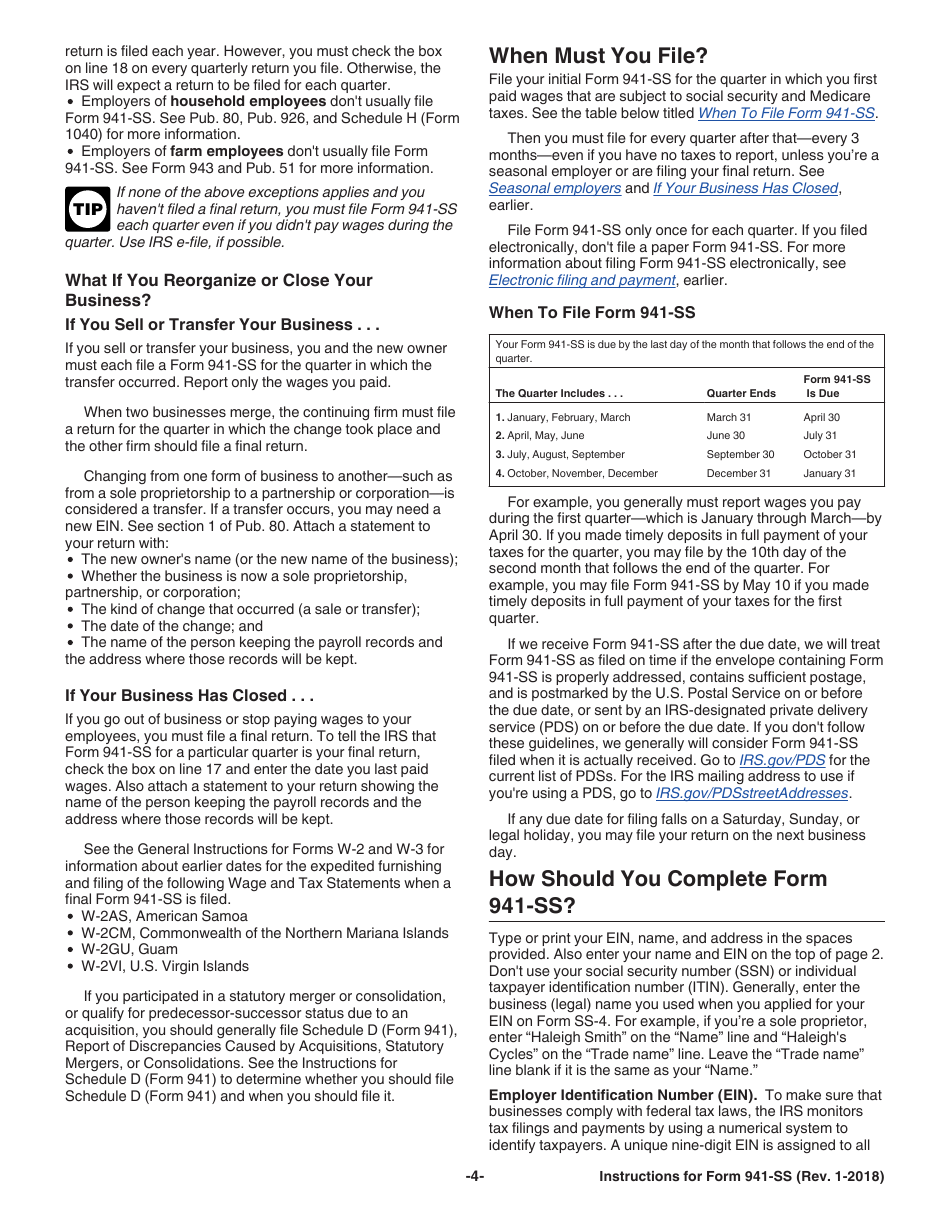

Q: When is IRS Form 941-SS due?

A: IRS Form 941-SS is due every quarter, with the deadline falling on the last day of the month following the end of the quarter (April 30, July 31, October 31, and January 31).

Q: How can I file IRS Form 941-SS?

A: You can file IRS Form 941-SS electronically or by mail. Electronic filing is the preferred method.

Q: Are there any penalties for not filing IRS Form 941-SS?

A: Yes, there are penalties for not filing or late filing of IRS Form 941-SS. It's important to file on time to avoid these penalties.

Instruction Details:

- This 11-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.