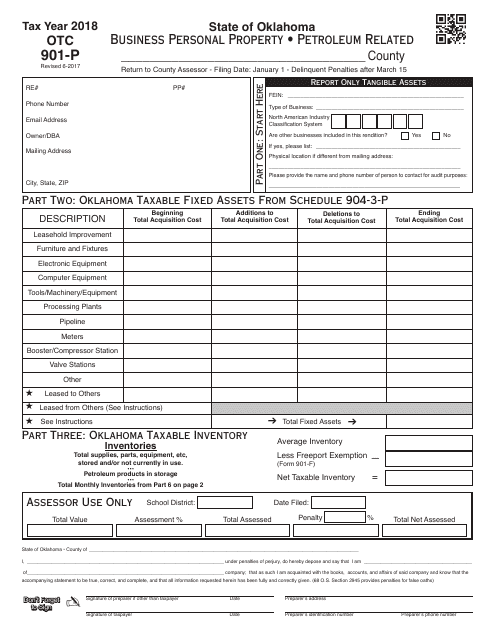

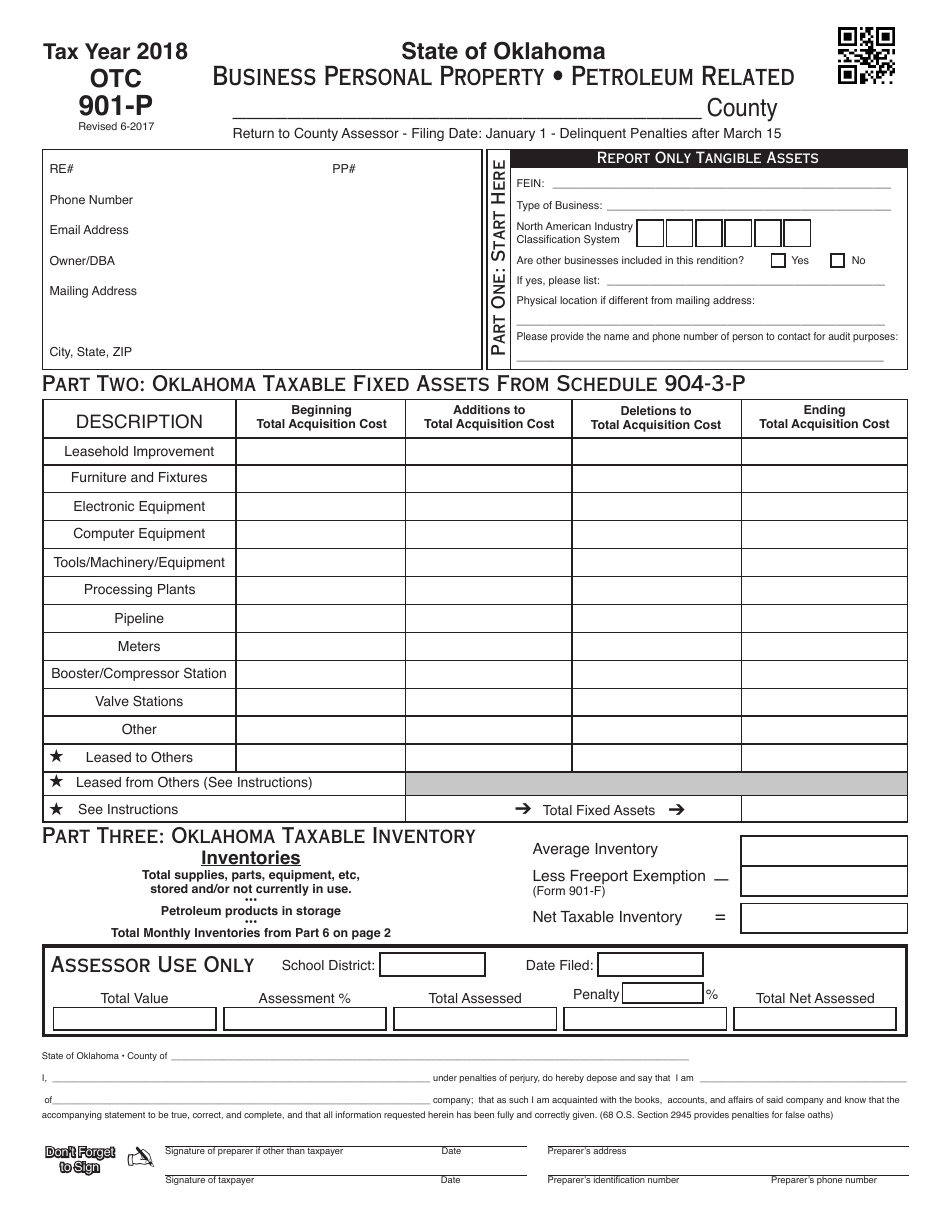

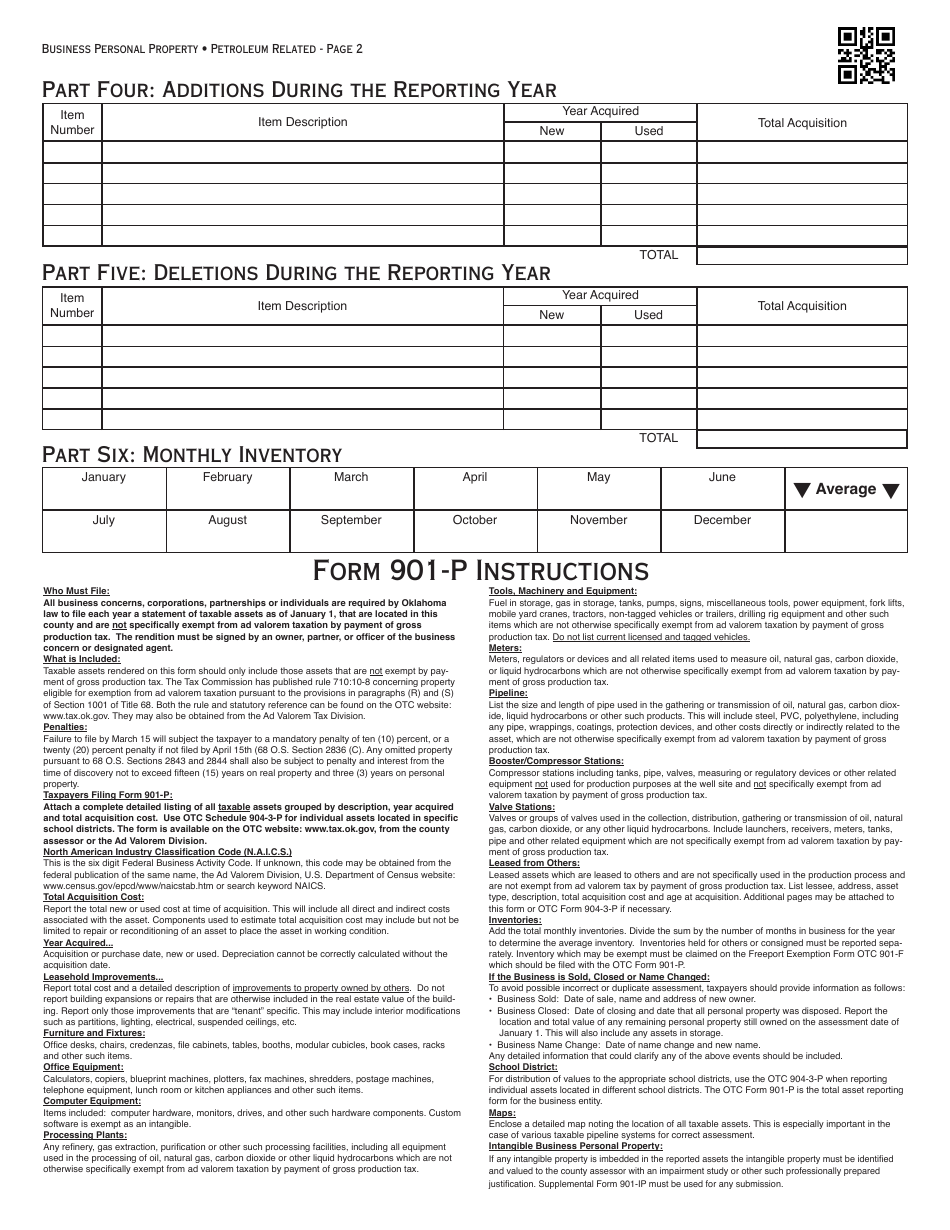

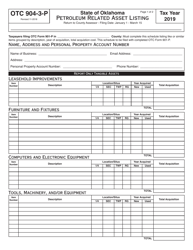

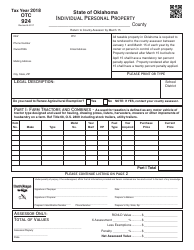

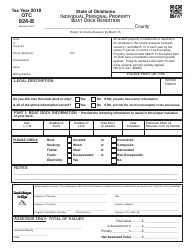

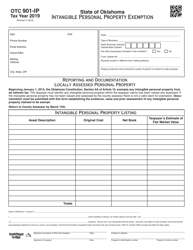

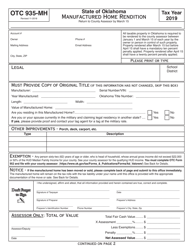

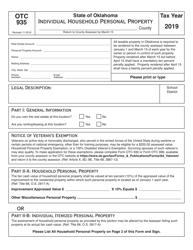

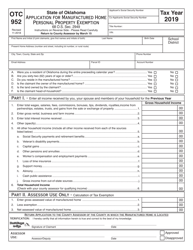

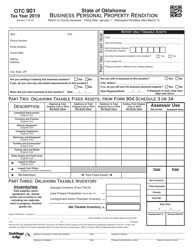

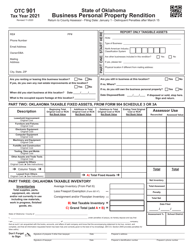

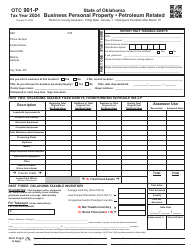

OTC Form OTC901-P Business Personal Property - Petroleum Related - Oklahoma

What Is OTC Form OTC901-P?

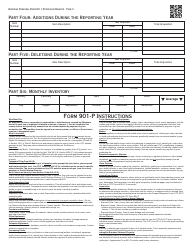

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OTC901-P?

A: OTC Form OTC901-P is a form used in Oklahoma to report business personal property related to petroleum activities.

Q: Who is required to file OTC Form OTC901-P?

A: Any business in Oklahoma engaged in petroleum activities is required to file OTC Form OTC901-P.

Q: What is considered business personal property related to petroleum activities?

A: Business personal property related to petroleum activities includes equipment, machinery, vehicles, and other assets used in the petroleum industry.

Q: When is OTC Form OTC901-P due?

A: OTC Form OTC901-P is typically due by March 15th of each year.

Q: Are there any penalties for not filing OTC Form OTC901-P?

A: Yes, failure to file OTC Form OTC901-P or filing it late can result in penalties and interest charges.

Q: Is there any exemption or relief available for OTC Form OTC901-P?

A: Certain exemptions and relief may be available for specific situations. It is recommended to consult the Oklahoma Tax Commission or a tax professional for guidance on exemptions and relief.

Q: What are the consequences of not filing OTC Form OTC901-P correctly?

A: Not filing OTC Form OTC901-P correctly may result in inaccurate tax assessments, penalties, and potential audits.

Q: What other forms may be required for businesses engaged in petroleum activities?

A: Depending on the nature of the business, additional forms such as OTC Form OTC901, OTC Form OTC960, or OTC Form OTC913 may be required in addition to OTC Form OTC901-P.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OTC901-P by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.