This version of the form is not currently in use and is provided for reference only. Download this version of

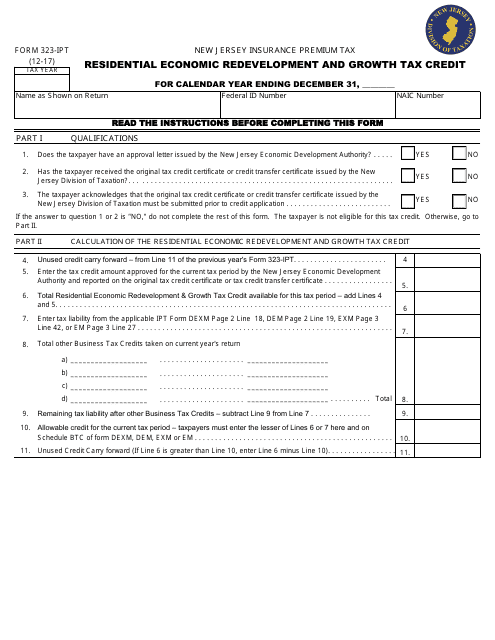

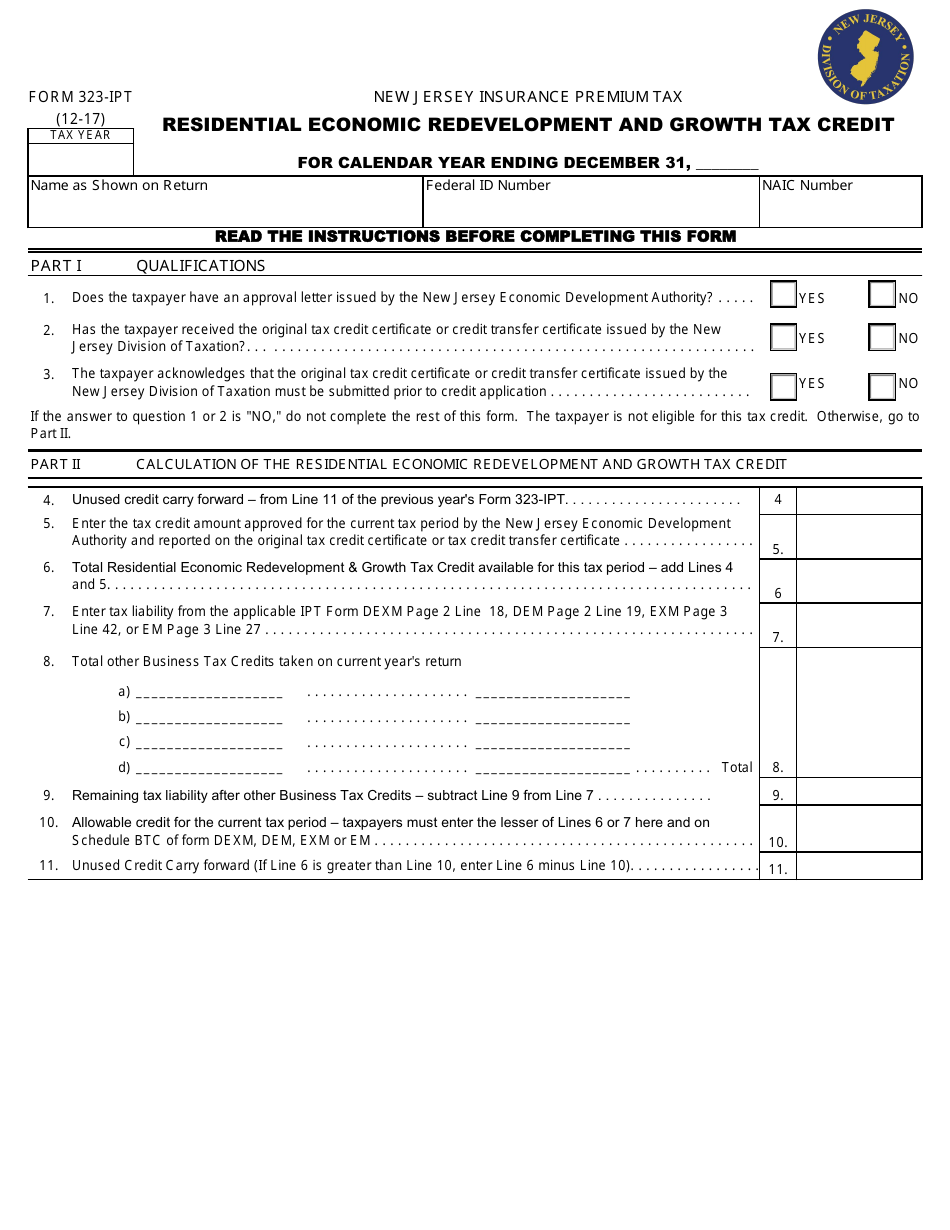

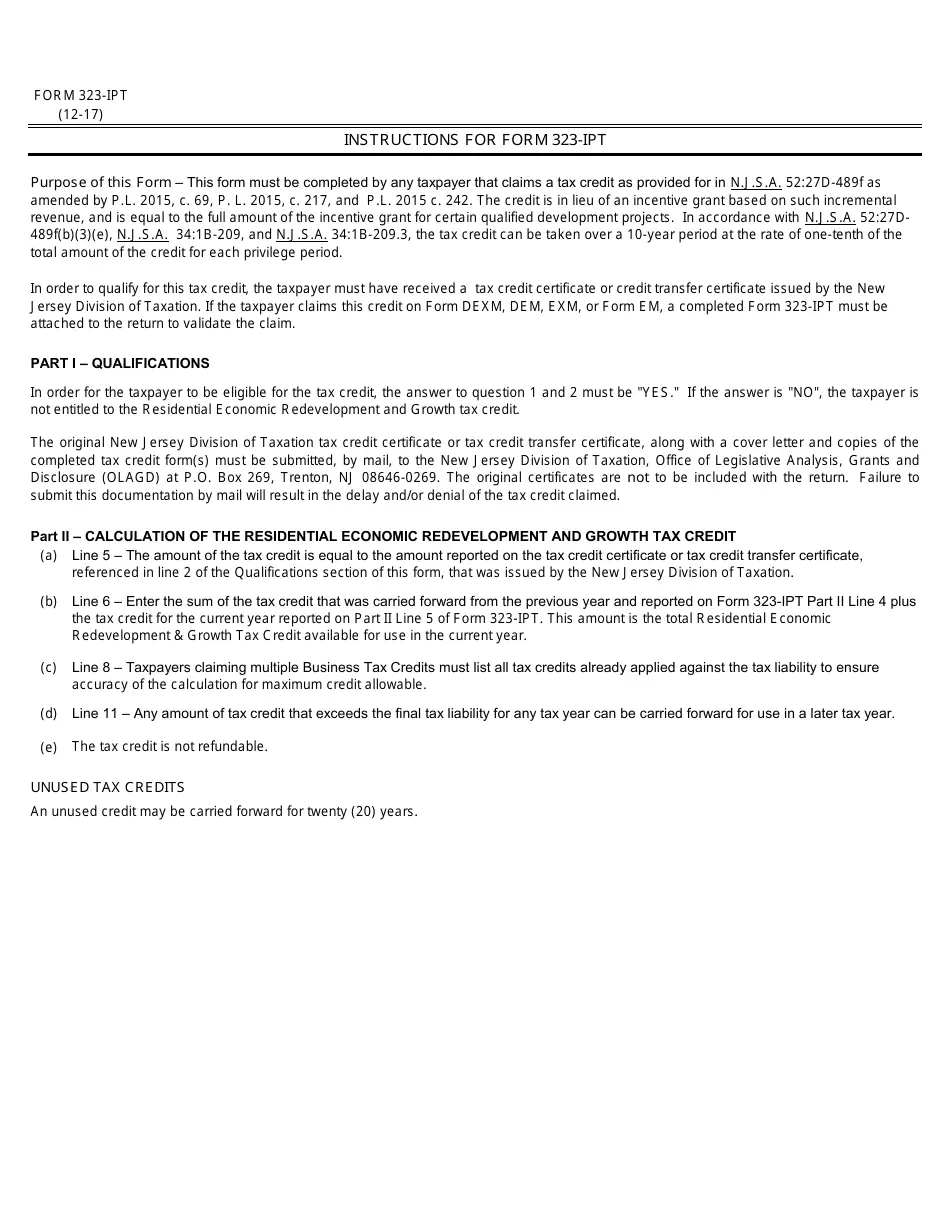

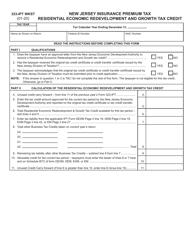

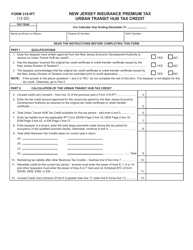

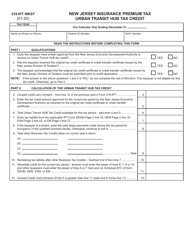

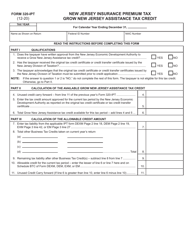

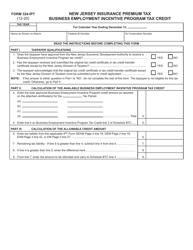

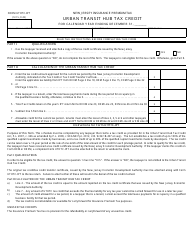

Form 323-IPT

for the current year.

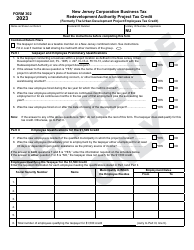

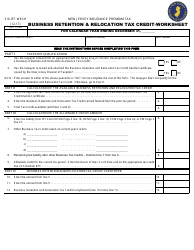

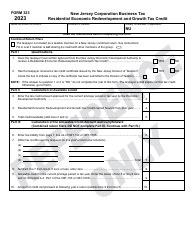

Form 323-IPT Residential Economic Redevelopment and Growth Tax Credit - New Jersey

What Is Form 323-IPT?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 323-IPT?

A: Form 323-IPT is a form in New Jersey for applying for the Residential Economic Redevelopment and Growth Tax Credit.

Q: What is the purpose of Form 323-IPT?

A: The purpose of Form 323-IPT is to apply for the Residential Economic Redevelopment and Growth Tax Credit in New Jersey.

Q: What is the Residential Economic Redevelopment and Growth Tax Credit?

A: The Residential Economic Redevelopment and Growth Tax Credit is a tax credit in New Jersey that aims to promote residential economic redevelopment and growth.

Q: Who is eligible for the tax credit?

A: Eligibility for the tax credit depends on meeting certain criteria, such as investing in eligible projects that result in residential economic redevelopment and growth in New Jersey.

Q: Are there any deadlines for filing Form 323-IPT?

A: Yes, the form must be filed by the due date specified by the New Jersey Division of Taxation.

Q: What supporting documentation is required with Form 323-IPT?

A: Supporting documentation, such as project plans, financial statements, and other relevant documents, may be required to be submitted along with Form 323-IPT.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 323-IPT by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.