This version of the form is not currently in use and is provided for reference only. Download this version of

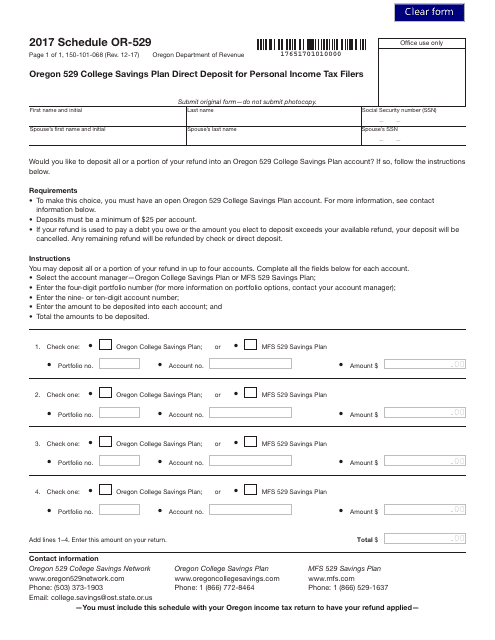

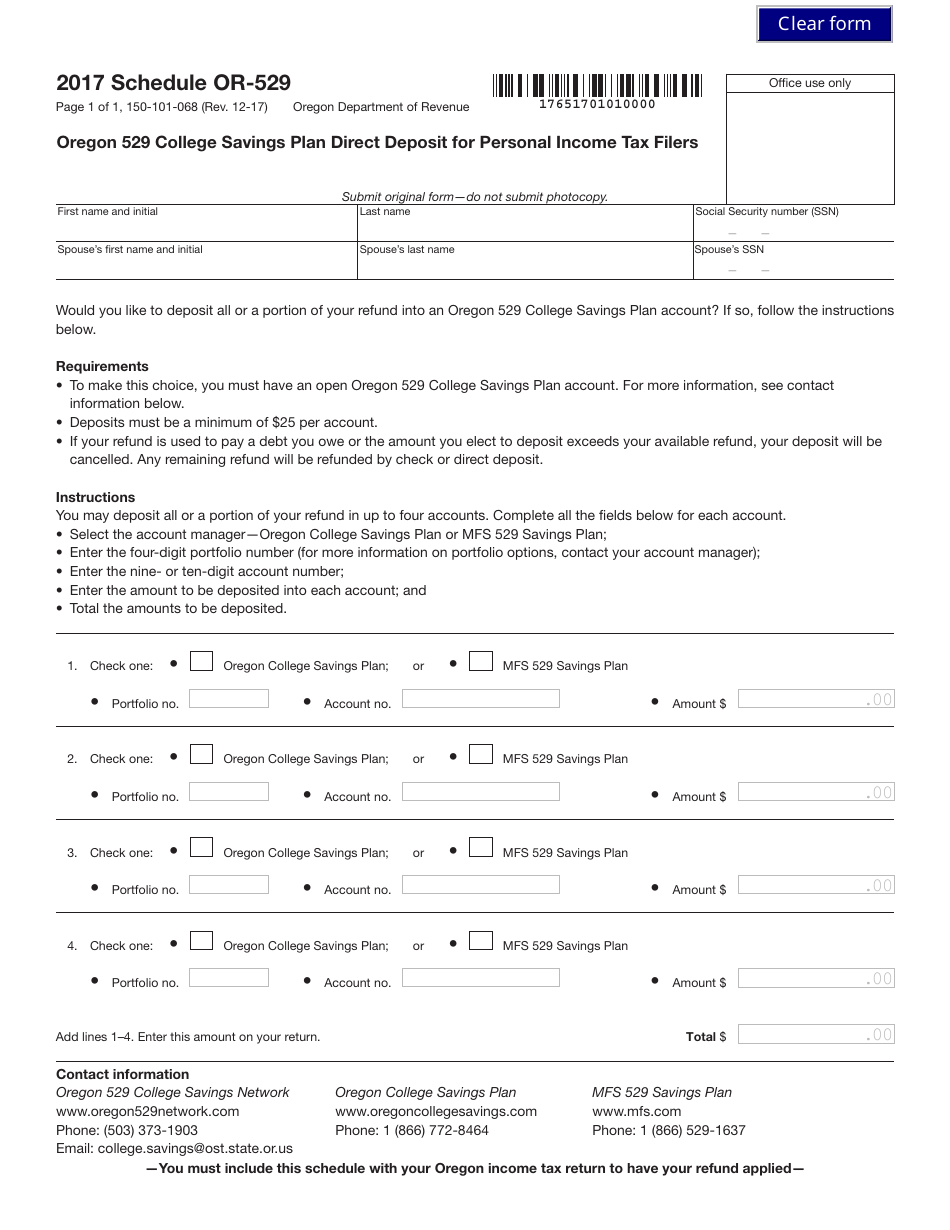

Form 150-101-068 Schedule OR-529

for the current year.

Form 150-101-068 Schedule OR-529 Oregon 529 College Savings Plan Direct Deposit for Personal Income Tax Filers - Oregon

What Is Form 150-101-068 Schedule OR-529?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-068?

A: Form 150-101-068 is a schedule for Oregon 529 College Savings Plan Direct Deposit for Personal Income Tax Filers.

Q: What is the purpose of Form 150-101-068?

A: The purpose of Form 150-101-068 is to allow Oregon residents to request direct deposit of their state income tax refunds into their Oregon 529 College Savings Plan.

Q: Who can use Form 150-101-068?

A: Oregon residents who have an Oregon 529 College Savings Plan and are eligible for a state income tax refund can use Form 150-101-068.

Q: What information do I need to fill out Form 150-101-068?

A: You will need to provide your Oregon 529 College Savings Plan account number, your Social Security number, and your bank account information.

Q: How do I file Form 150-101-068?

A: You can file Form 150-101-068 along with your Oregon state income tax return. You can either file it electronically or mail it to the Oregon Department of Revenue.

Q: Is there a deadline for filing Form 150-101-068?

A: Yes, Form 150-101-068 must be filed by the same deadline as your Oregon state income tax return.

Q: Can I request direct deposit of my tax refund into a different account?

A: No, Form 150-101-068 is specifically for direct deposit into the Oregon 529 College Savings Plan.

Q: Can I still receive a paper check for my tax refund?

A: Yes, if you do not fill out Form 150-101-068 or if the direct deposit is rejected, you will receive a paper check for your tax refund.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-068 Schedule OR-529 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.