This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule L

for the current year.

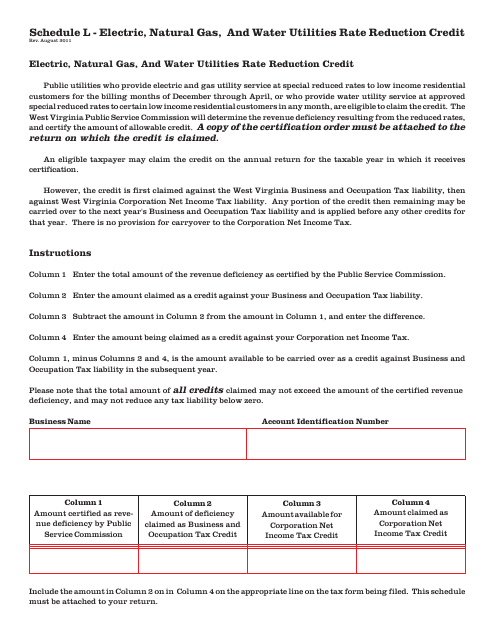

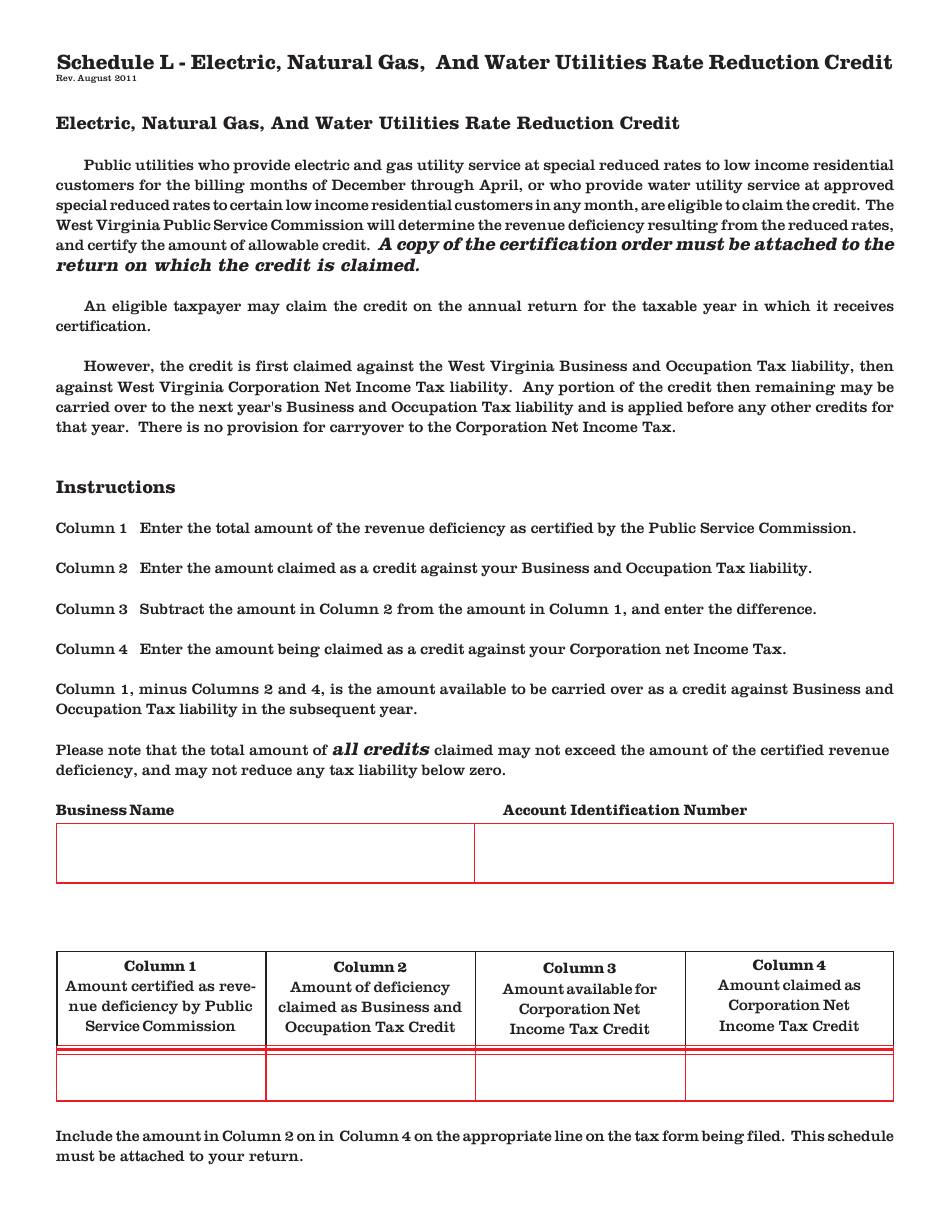

Schedule L Electric, Natural Gas, and Water Utilities Rate Reduction Credit - West Virginia

What Is Schedule L?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule L Electric, Natural Gas, and Water Utilities Rate Reduction Credit?

A: Schedule L Electric, Natural Gas, and Water Utilities Rate Reduction Credit is a credit available to West Virginia residents.

Q: Who is eligible for Schedule L Electric, Natural Gas, and Water Utilities Rate Reduction Credit?

A: West Virginia residents who pay for electric, natural gas, or water utilities are eligible for this credit.

Q: How can I claim Schedule L Electric, Natural Gas, and Water Utilities Rate Reduction Credit?

A: You can claim this credit by filling out Schedule L of your West Virginia state tax return.

Q: What expenses are covered by Schedule L Electric, Natural Gas, and Water Utilities Rate Reduction Credit?

A: This credit covers expenses related to electric, natural gas, and water utilities.

Q: Is Schedule L Electric, Natural Gas, and Water Utilities Rate Reduction Credit refundable?

A: No, this credit is non-refundable. It can only be used to offset your tax liability.

Form Details:

- Released on August 1, 2011;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule L by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.