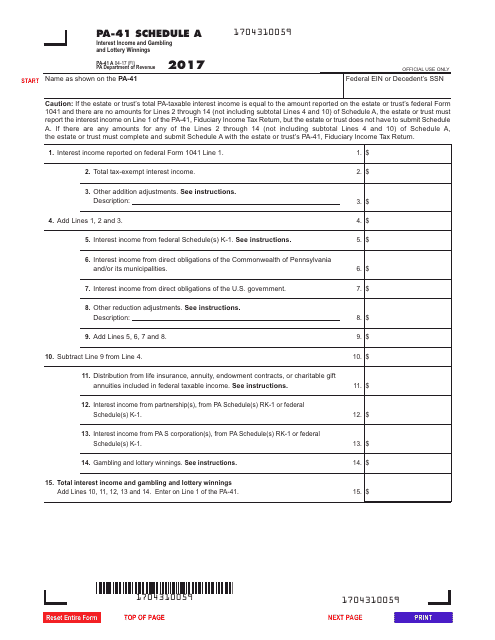

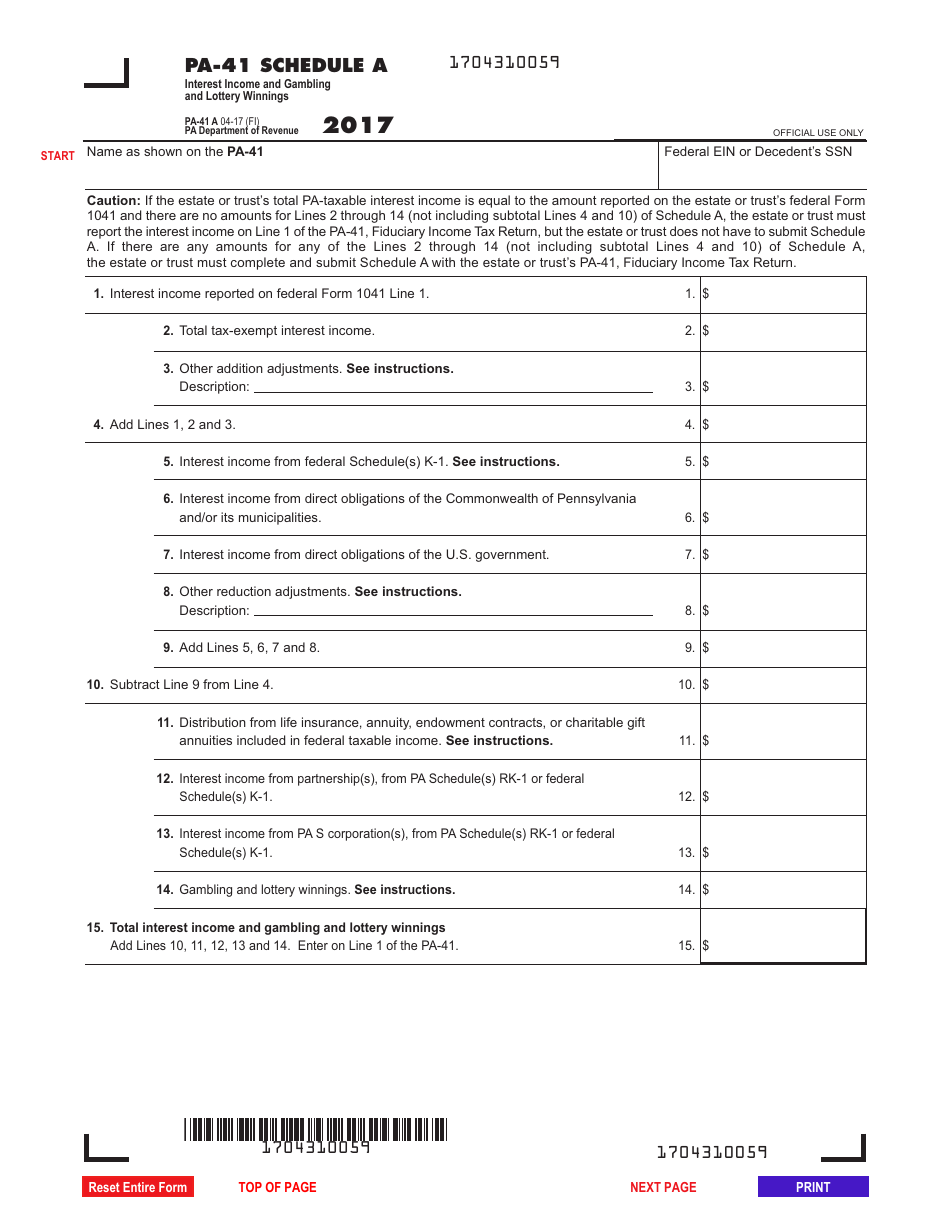

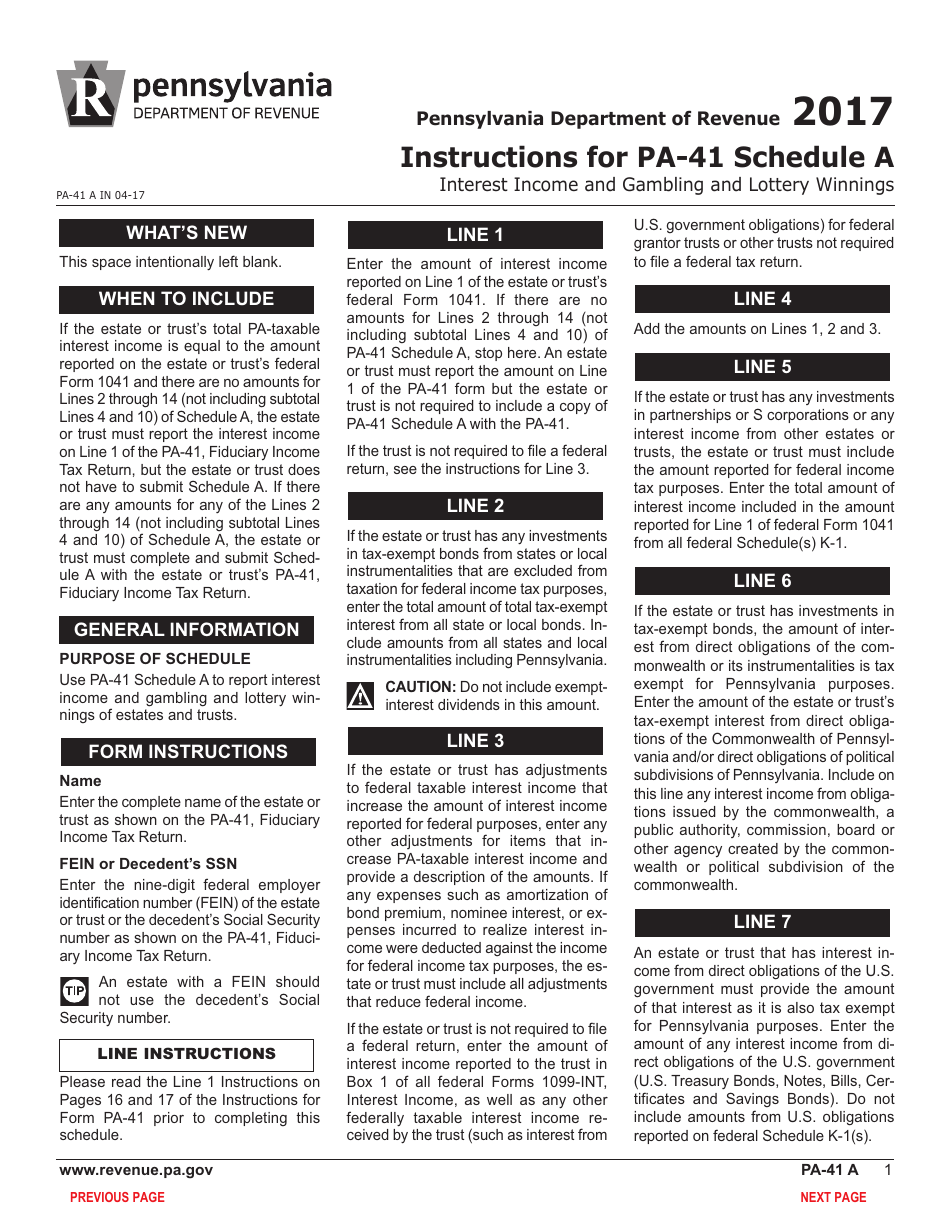

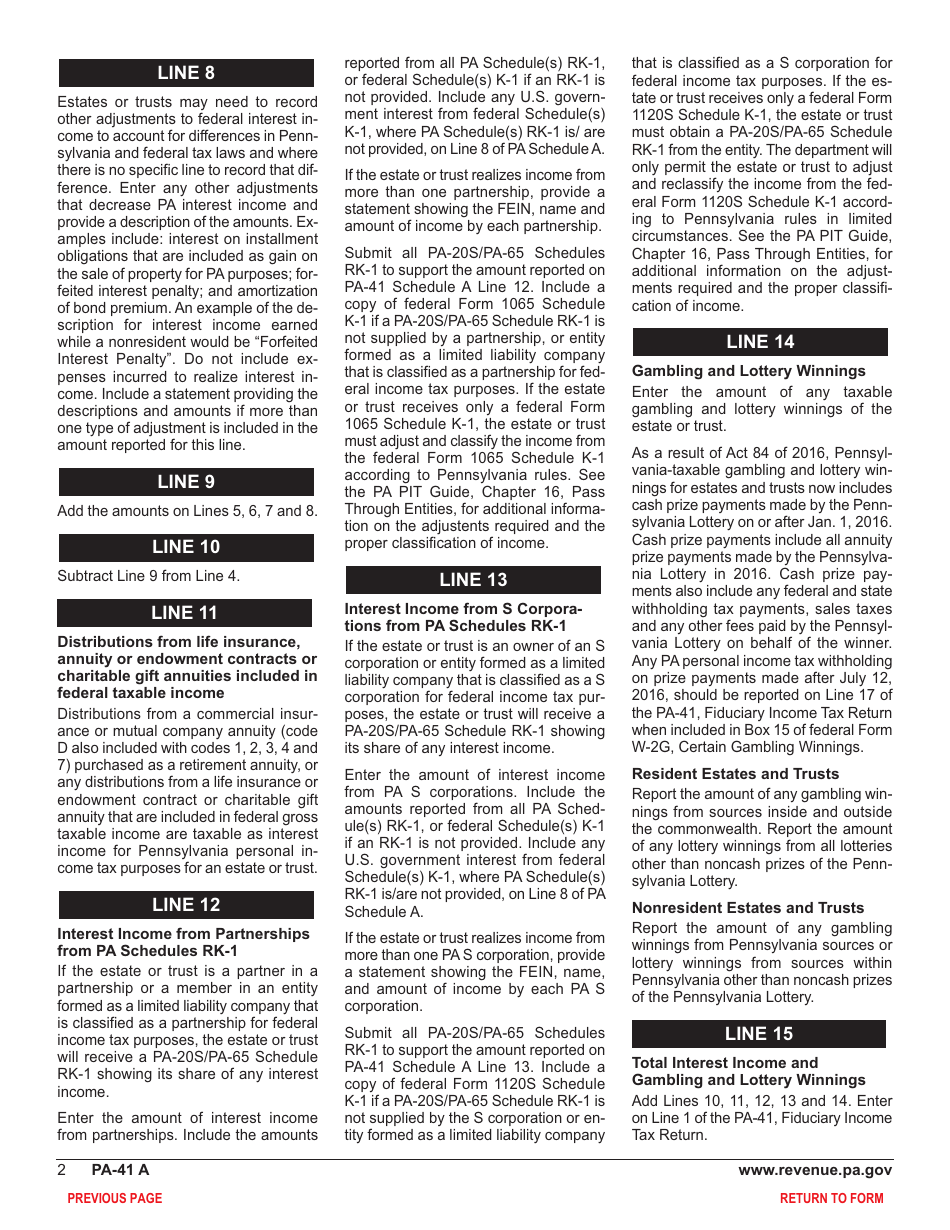

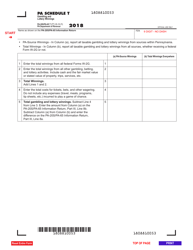

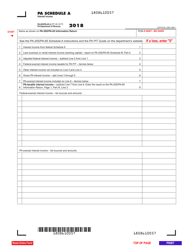

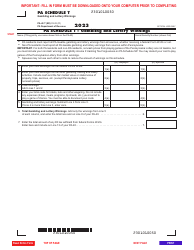

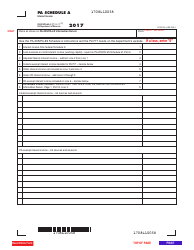

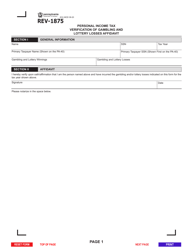

Form PA-41A Schedule A Interest Income and Gambling and Lottery Winnings - Pennsylvania

What Is Form PA-41A Schedule A?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41A Schedule A?

A: Form PA-41A Schedule A is a form used by residents of Pennsylvania to report interest income and gambling and lottery winnings.

Q: Who needs to file Form PA-41A Schedule A?

A: Residents of Pennsylvania who have received interest income or gambling and lottery winnings need to file Form PA-41A Schedule A.

Q: What should be reported on Form PA-41A Schedule A?

A: Form PA-41A Schedule A should be used to report any interest income earned during the tax year, as well as any gambling and lottery winnings.

Q: When is the deadline to file Form PA-41A Schedule A?

A: The deadline to file Form PA-41A Schedule A is the same as the deadline for filing your Pennsylvania state tax return.

Q: Can I file Form PA-41A Schedule A electronically?

A: Yes, you can file Form PA-41A Schedule A electronically through the Pennsylvania Department of Revenue's e-file system.

Q: What happens if I don't file Form PA-41A Schedule A?

A: If you fail to file Form PA-41A Schedule A and report your interest income and gambling and lottery winnings, you may be subject to penalties and interest.

Q: Do I need to attach any documents to Form PA-41A Schedule A?

A: You may need to attach relevant supporting documents, such as statements from banks or gambling establishments, to Form PA-41A Schedule A.

Q: Can I make changes to Form PA-41A Schedule A after filing?

A: If you need to make changes to Form PA-41A Schedule A after filing, you will need to file an amended return using Form PA-40X.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41A Schedule A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.