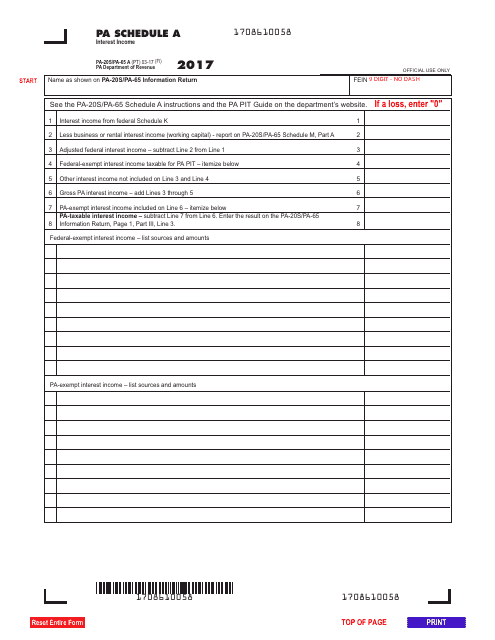

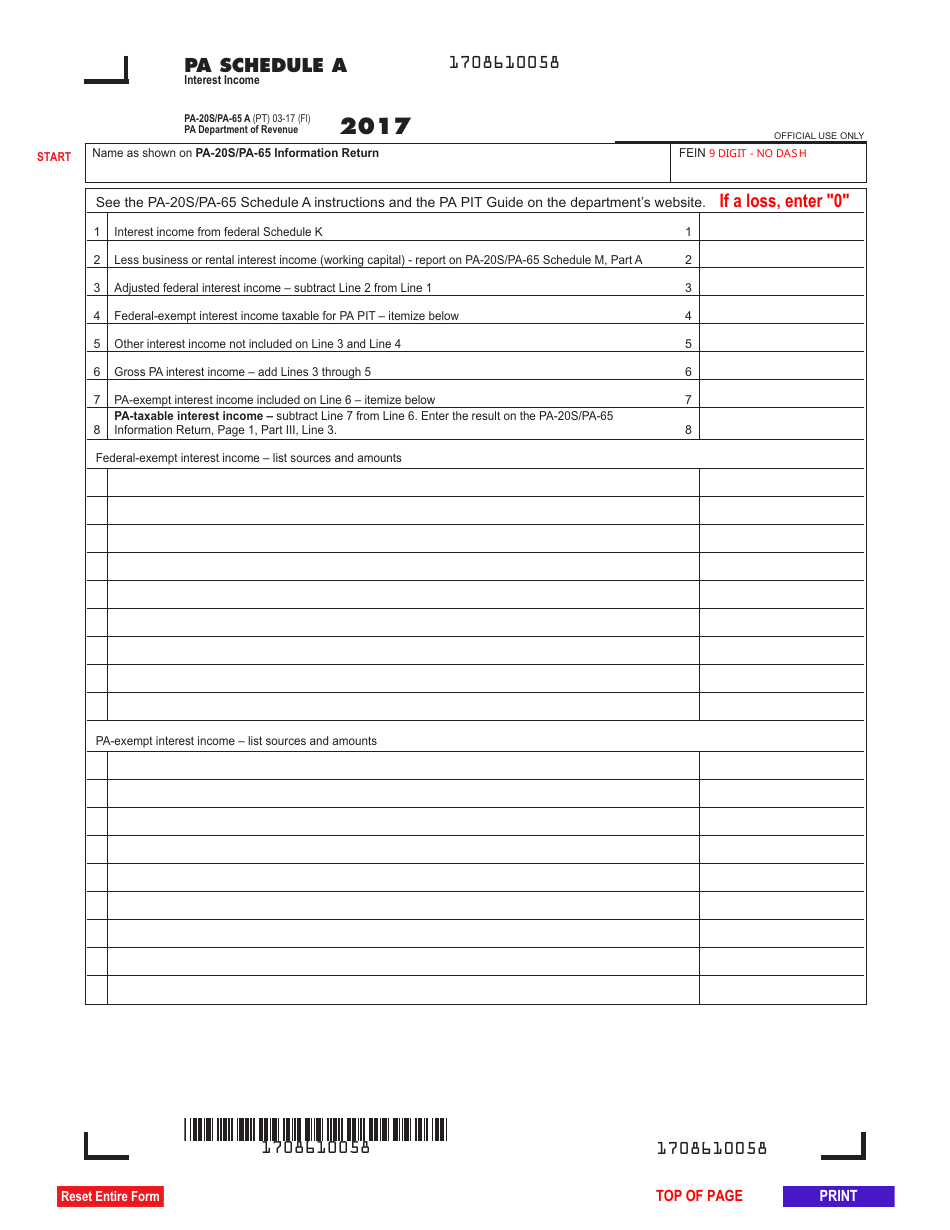

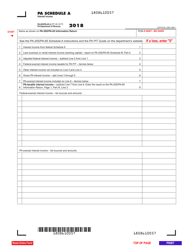

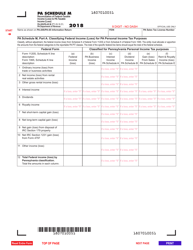

Form PA-20S / 65A Schedule A Interest Income - Pennsylvania

What Is Form PA-20S/65A Schedule A?

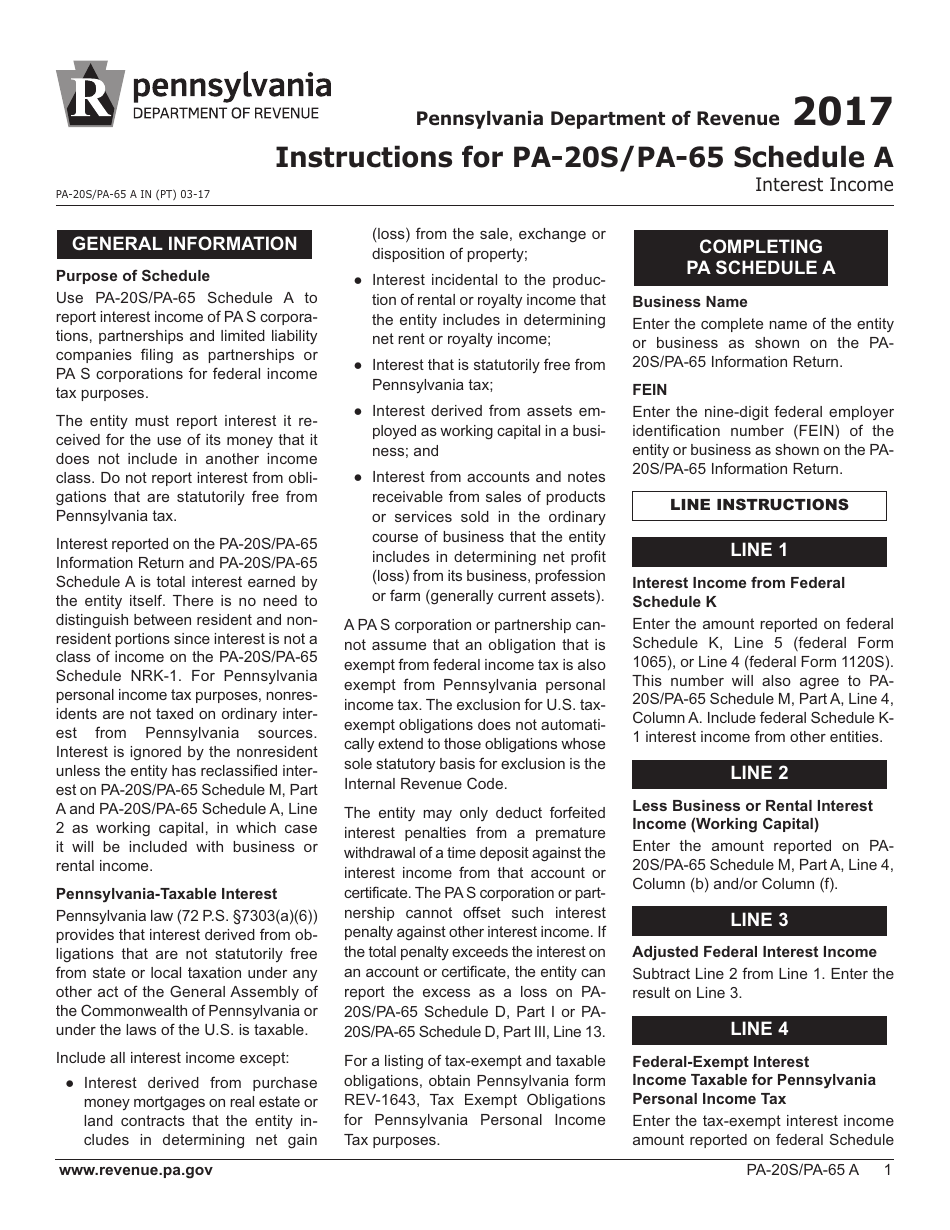

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20S/65A Schedule A?

A: Form PA-20S/65A Schedule A is a tax form used by Pennsylvania residents to report their interest income.

Q: Who needs to file Form PA-20S/65A Schedule A?

A: Pennsylvania residents who have earned interest income during the tax year need to file Form PA-20S/65A Schedule A.

Q: How do I report interest income on Form PA-20S/65A Schedule A?

A: You will need to enter the details of your interest income, including the amount earned and the source of the income, on Form PA-20S/65A Schedule A.

Q: Are there any exceptions to filing Form PA-20S/65A Schedule A?

A: If your interest income is below the required threshold set by the Pennsylvania Department of Revenue, you may be exempt from filing Form PA-20S/65A Schedule A.

Q: When is the deadline for filing Form PA-20S/65A Schedule A?

A: The deadline for filing Form PA-20S/65A Schedule A is typically April 15th, unless it falls on a weekend or holiday, in which case it is extended to the next business day.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S/65A Schedule A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.