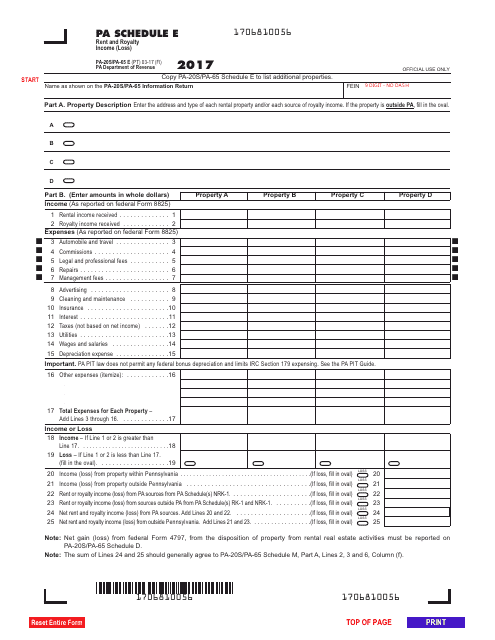

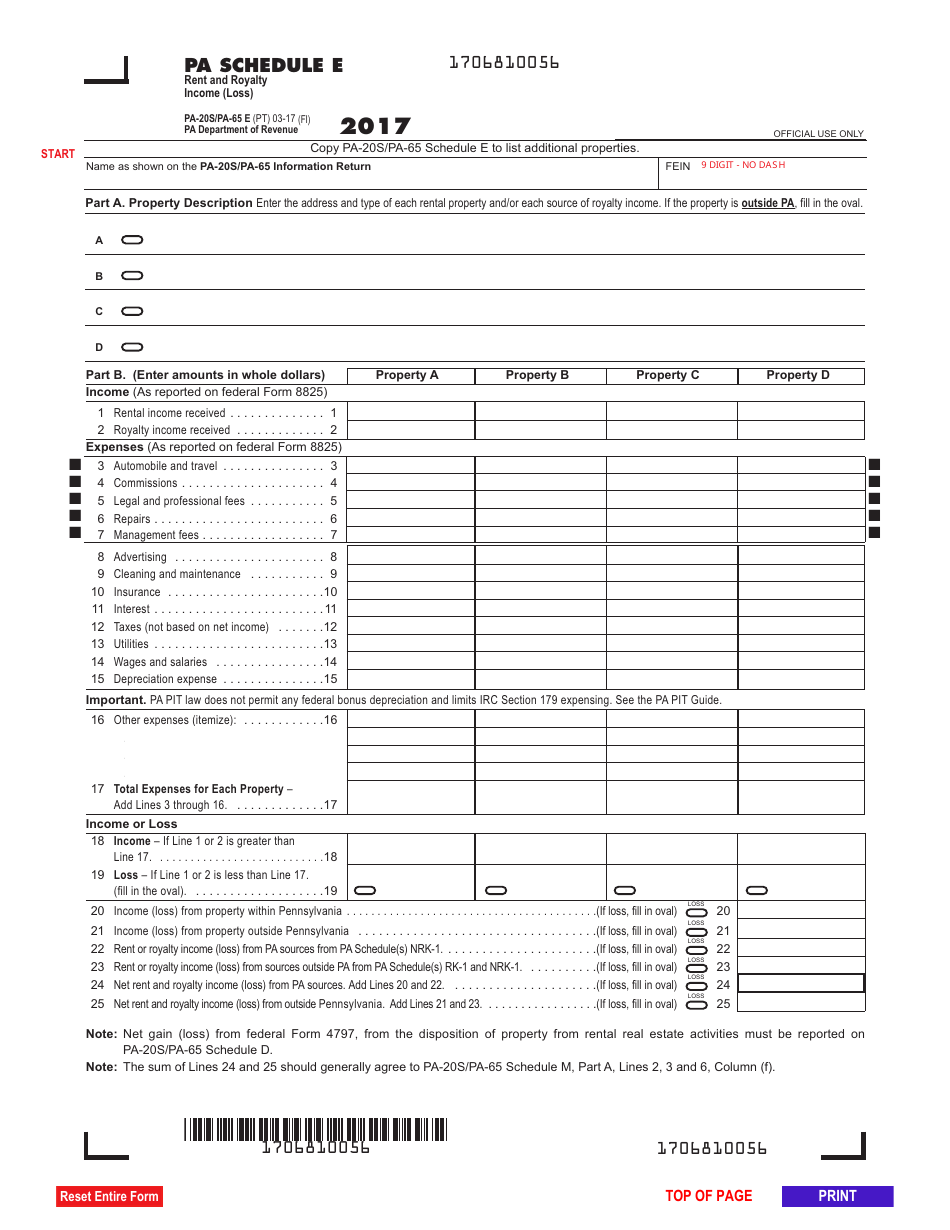

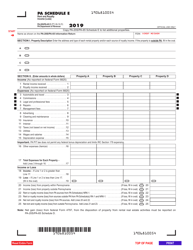

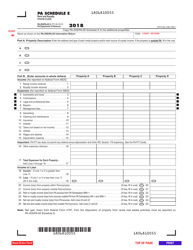

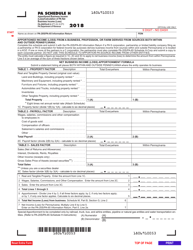

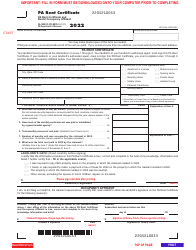

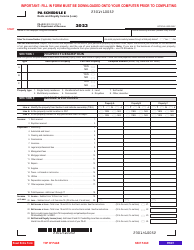

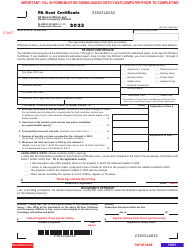

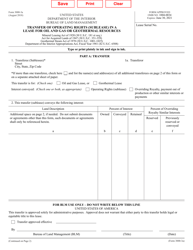

Form PA-20S / 65E Schedule E Rent and Royalty Income (Loss) - Pennsylvania

What Is Form PA-20S/65E Schedule E?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20S/65E?

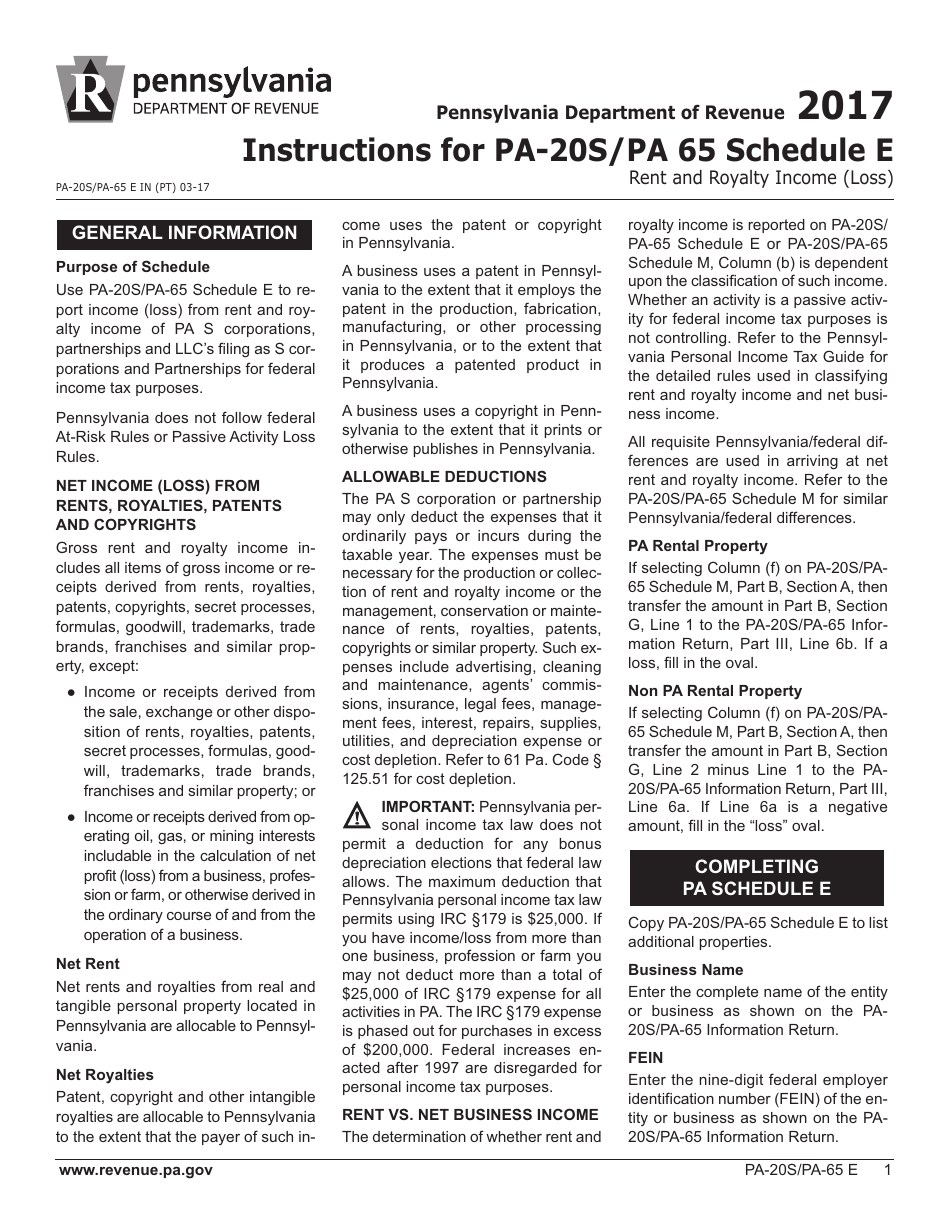

A: Form PA-20S/65E is a tax form used by partnerships and limited liability companies (LLCs) in Pennsylvania to report rental and royalty income or losses.

Q: What is Schedule E on Form PA-20S/65E?

A: Schedule E is the section of Form PA-20S/65E where partnerships and LLCs report their rental and royalty income or losses in Pennsylvania.

Q: Who needs to file Form PA-20S/65E Schedule E?

A: Partnerships and limited liability companies (LLCs) that have rental and royalty income or losses in Pennsylvania need to file Form PA-20S/65E Schedule E.

Q: What should be reported on Schedule E?

A: On Schedule E, partnerships and LLCs should report their rental and royalty income or losses in Pennsylvania.

Q: Is Schedule E filed separately or with the main tax form?

A: Schedule E is filed as an attachment to the main tax form, Form PA-20S/65E, for partnerships and LLCs in Pennsylvania.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S/65E Schedule E by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.