This version of the form is not currently in use and is provided for reference only. Download this version of

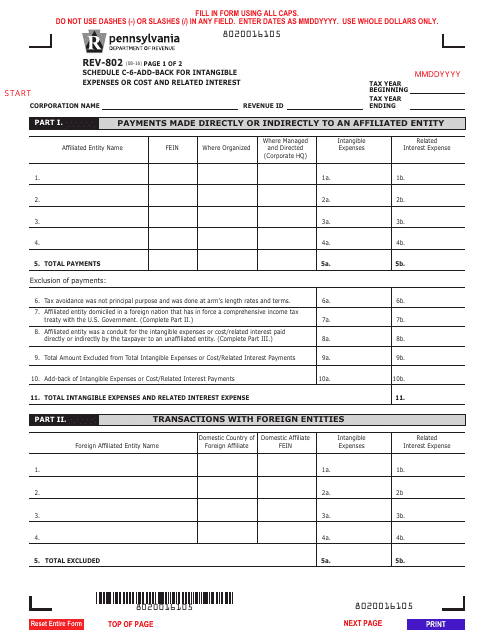

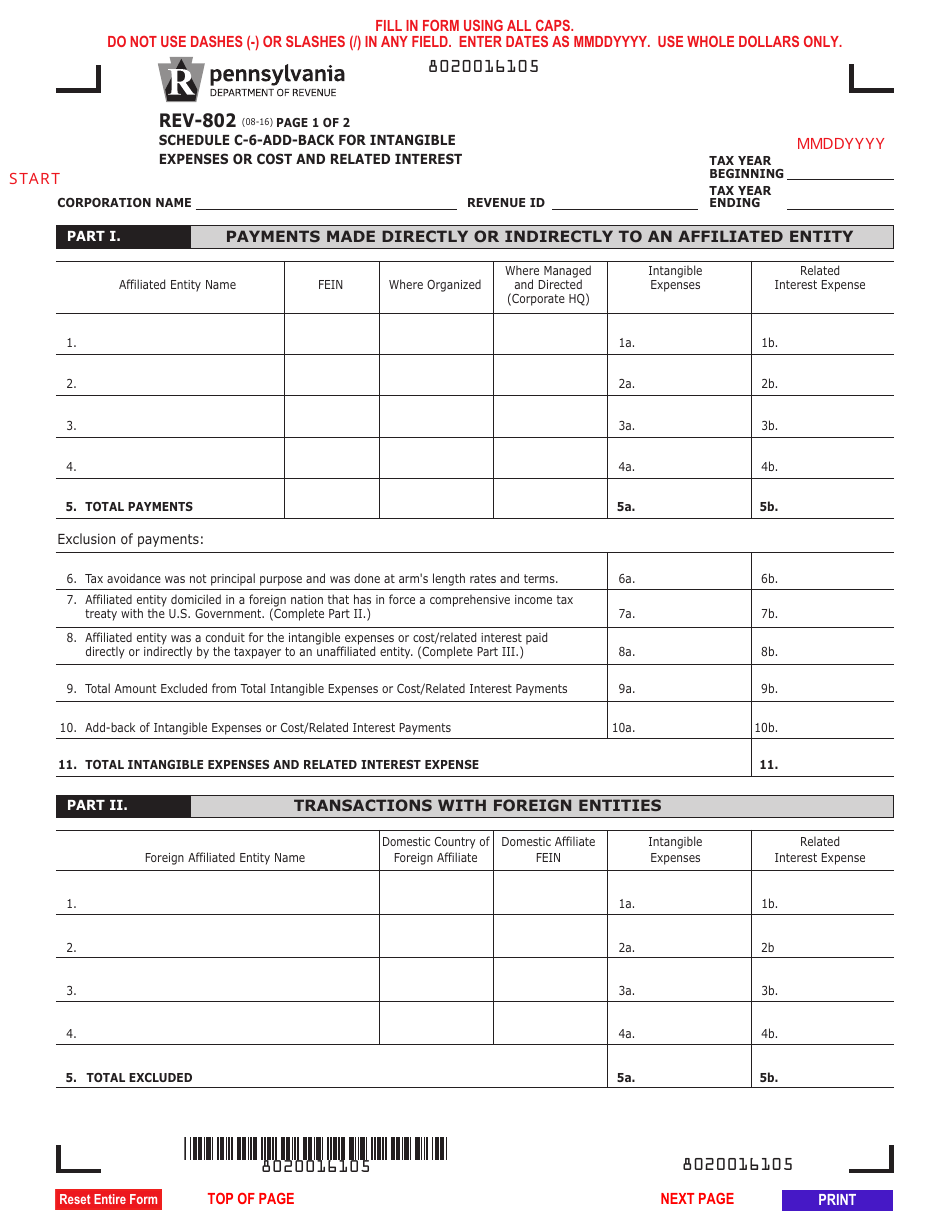

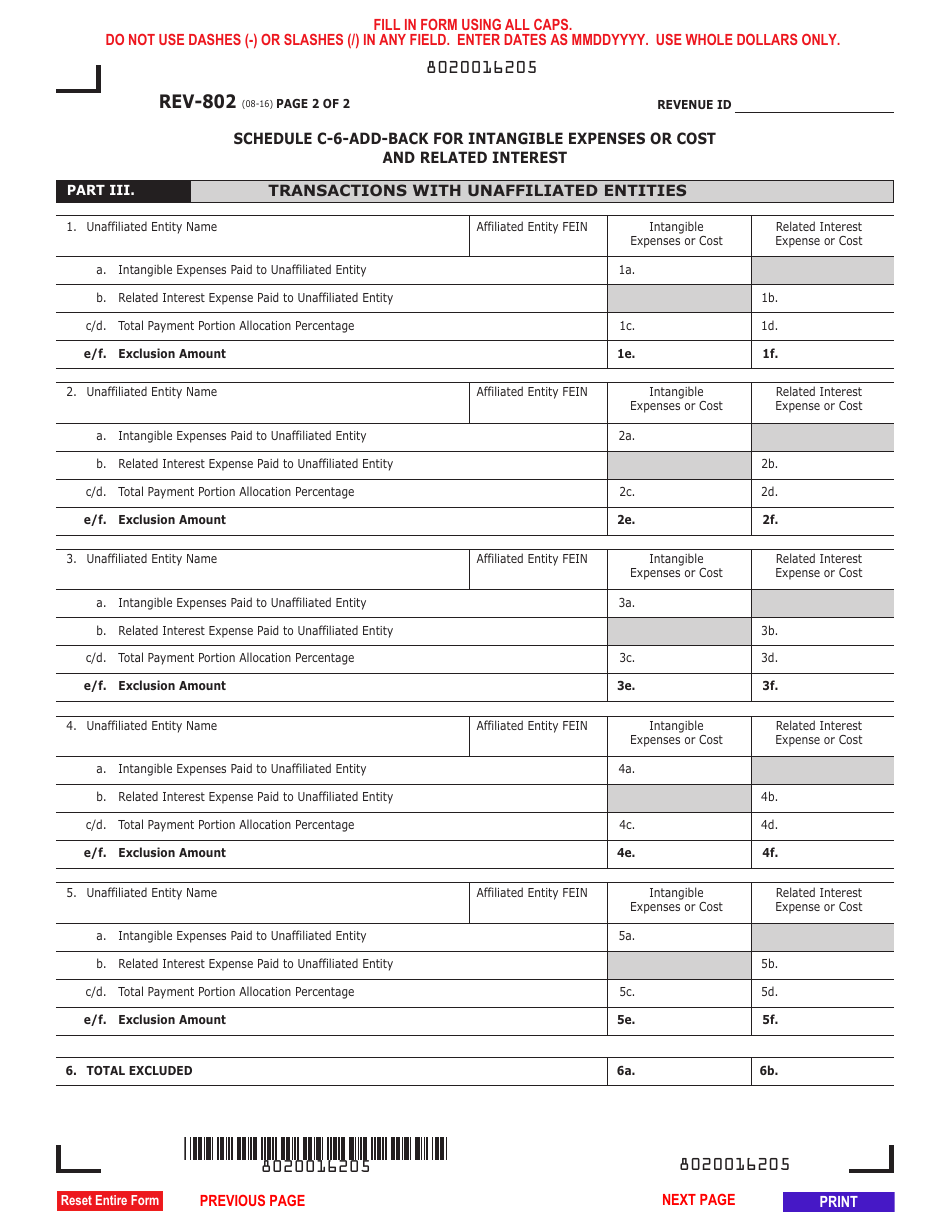

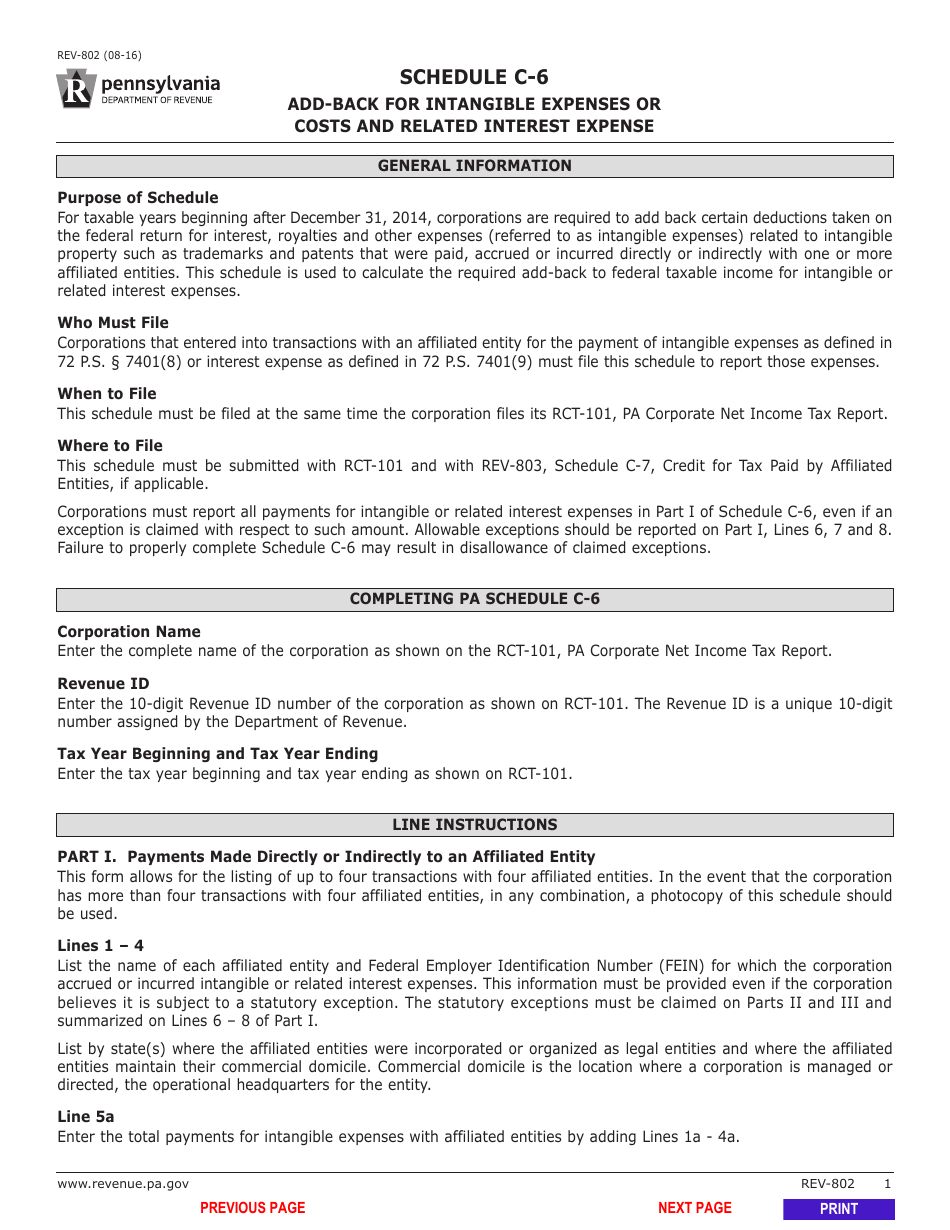

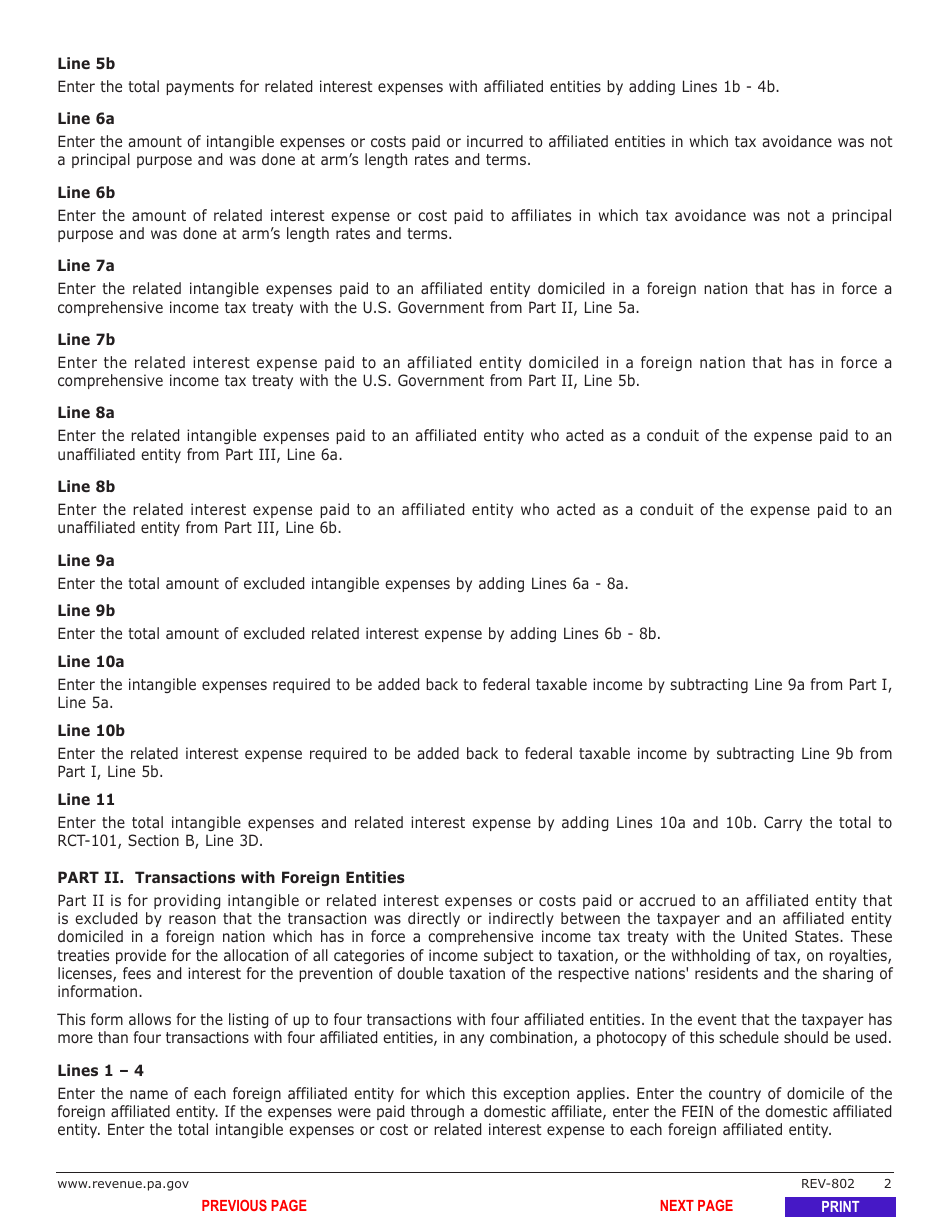

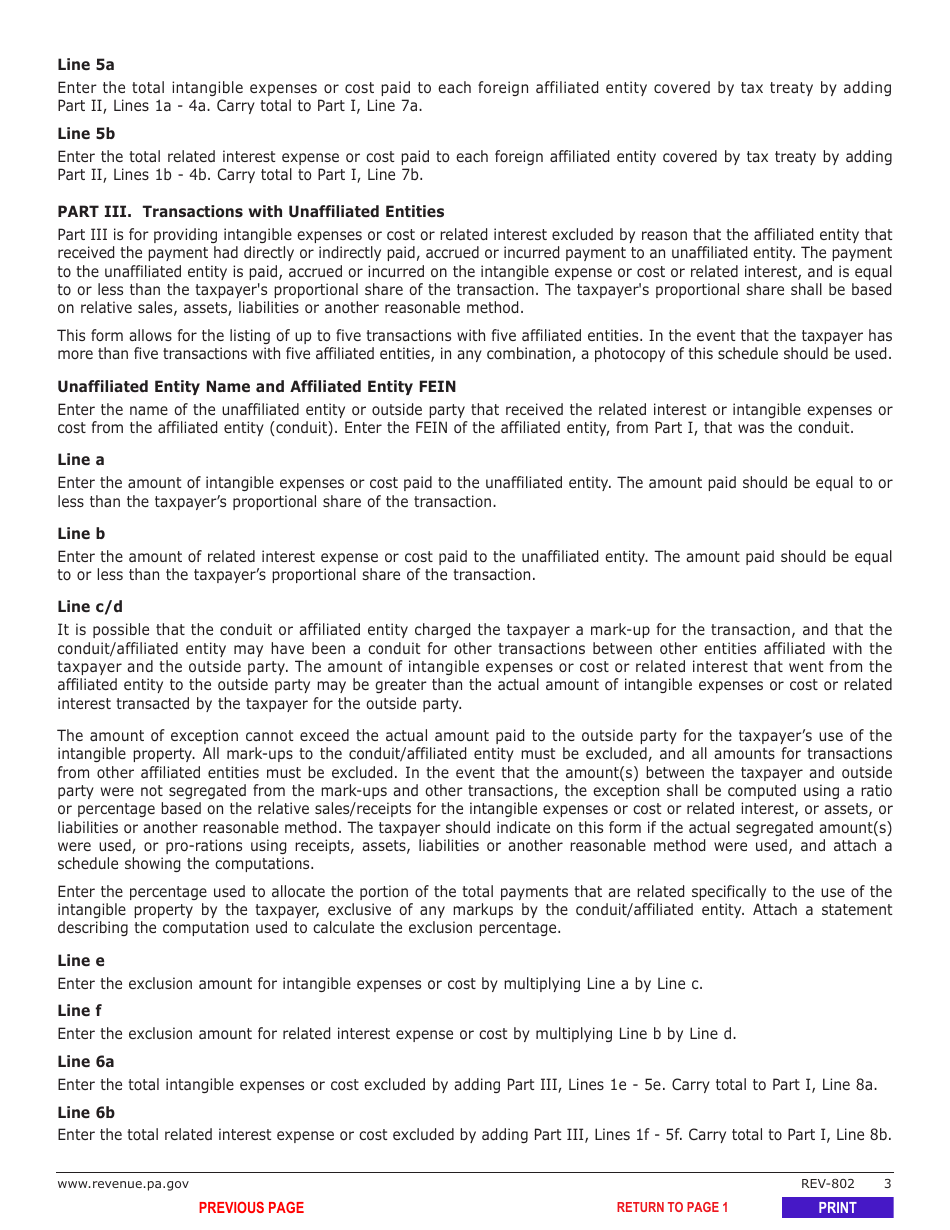

Form REV-802 Schedule C-6

for the current year.

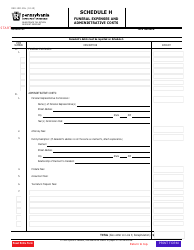

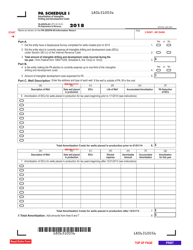

Form REV-802 Schedule C-6 Add-Back for Intangible Expenses or Cost and Related Interested - Pennsylvania

What Is Form REV-802 Schedule C-6?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-802?

A: Form REV-802 is a schedule used in Pennsylvania tax filing.

Q: What is Schedule C-6?

A: Schedule C-6 is a specific form within Form REV-802.

Q: What does Schedule C-6 deal with?

A: Schedule C-6 deals with add-back for intangible expenses or cost and related interested.

Q: What are intangible expenses or costs?

A: Intangible expenses or costs refer to non-physical assets such as copyrights, patents, and trademarks.

Q: Why is there a need for add-back for intangible expenses or costs?

A: The add-back is necessary to ensure that businesses cannot deduct certain expenses related to intangible assets when calculating their taxable income.

Q: Who needs to complete Schedule C-6?

A: Businesses operating in Pennsylvania that have intangible expenses or costs need to complete Schedule C-6.

Q: Do I need to attach additional documentation when filing Schedule C-6?

A: Yes, you may need to attach supporting documentation to verify the intangible expenses or costs being reported.

Q: Is there a deadline for filing Form REV-802 Schedule C-6?

A: Yes, the deadline for filing Form REV-802 Schedule C-6 is typically the same as the deadline for your Pennsylvania tax return.

Q: Can I e-file Form REV-802 Schedule C-6?

A: No, currently Pennsylvania does not support e-filing for Schedule C-6. It must be filed by mail.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-802 Schedule C-6 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.