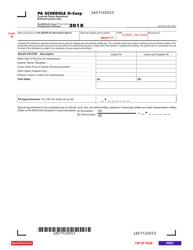

This version of the form is not currently in use and is provided for reference only. Download this version of

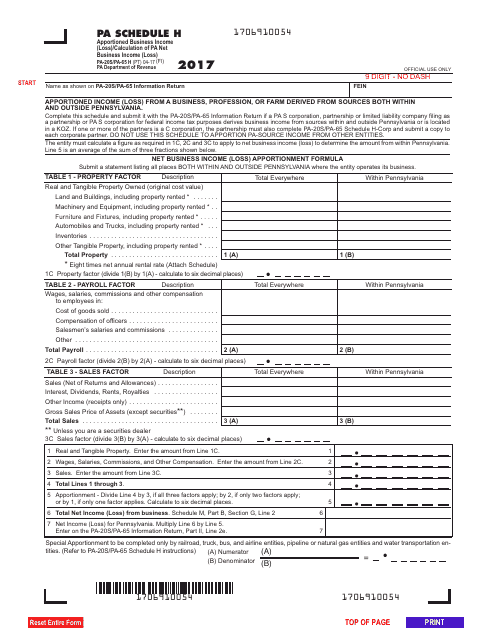

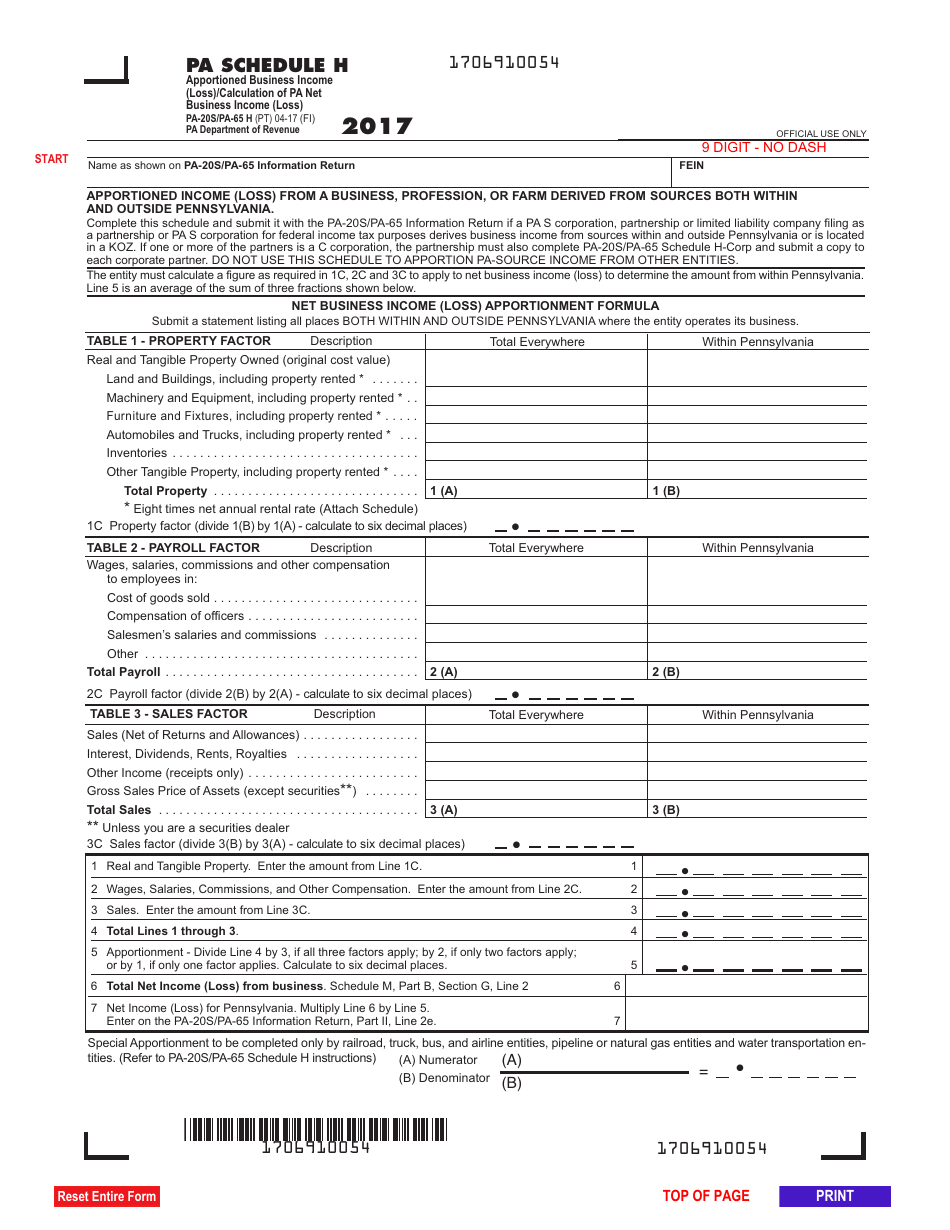

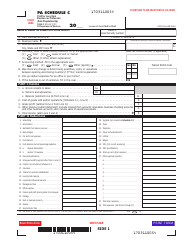

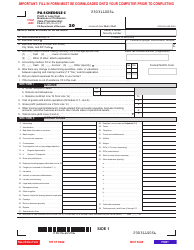

Form PA-20S (PA-65 H) Schedule H

for the current year.

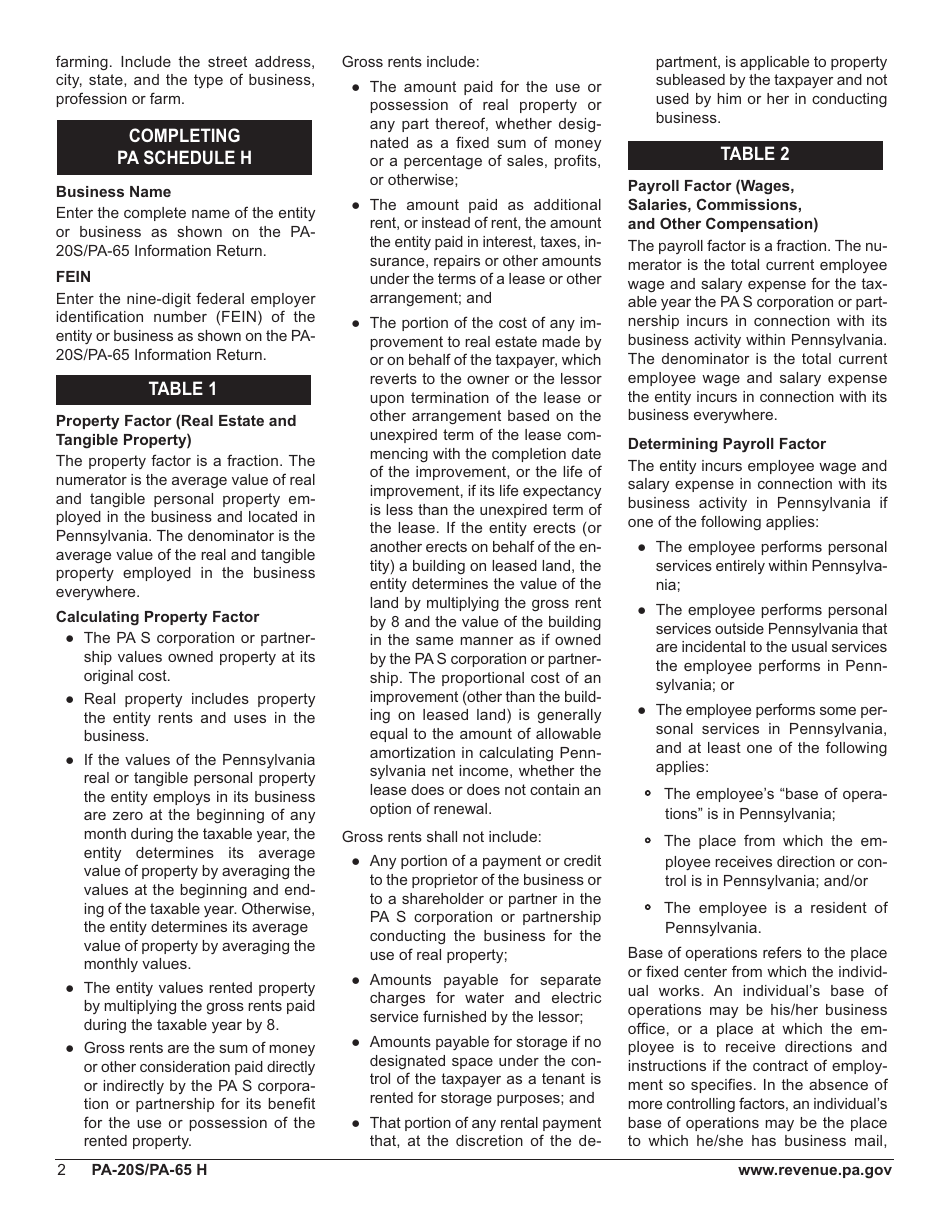

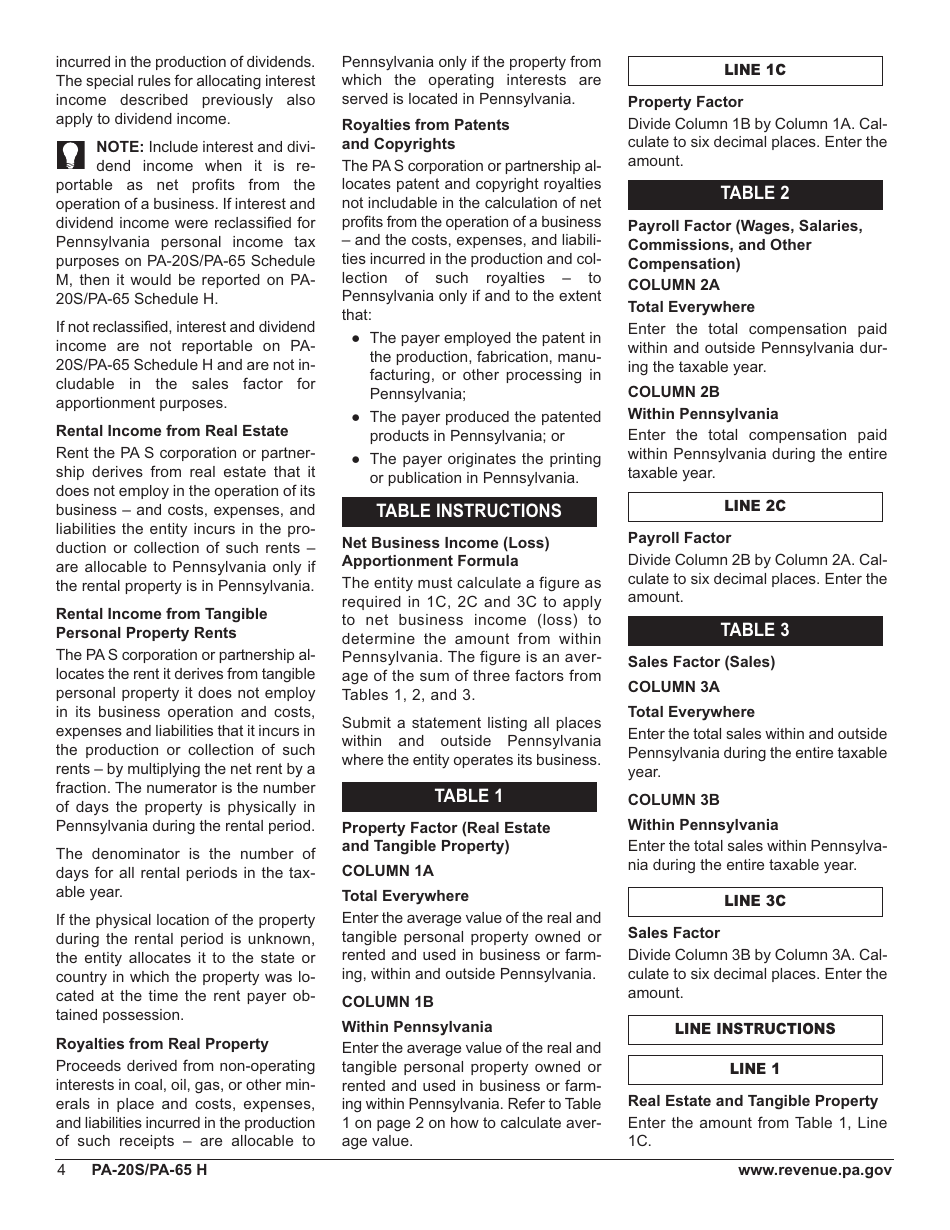

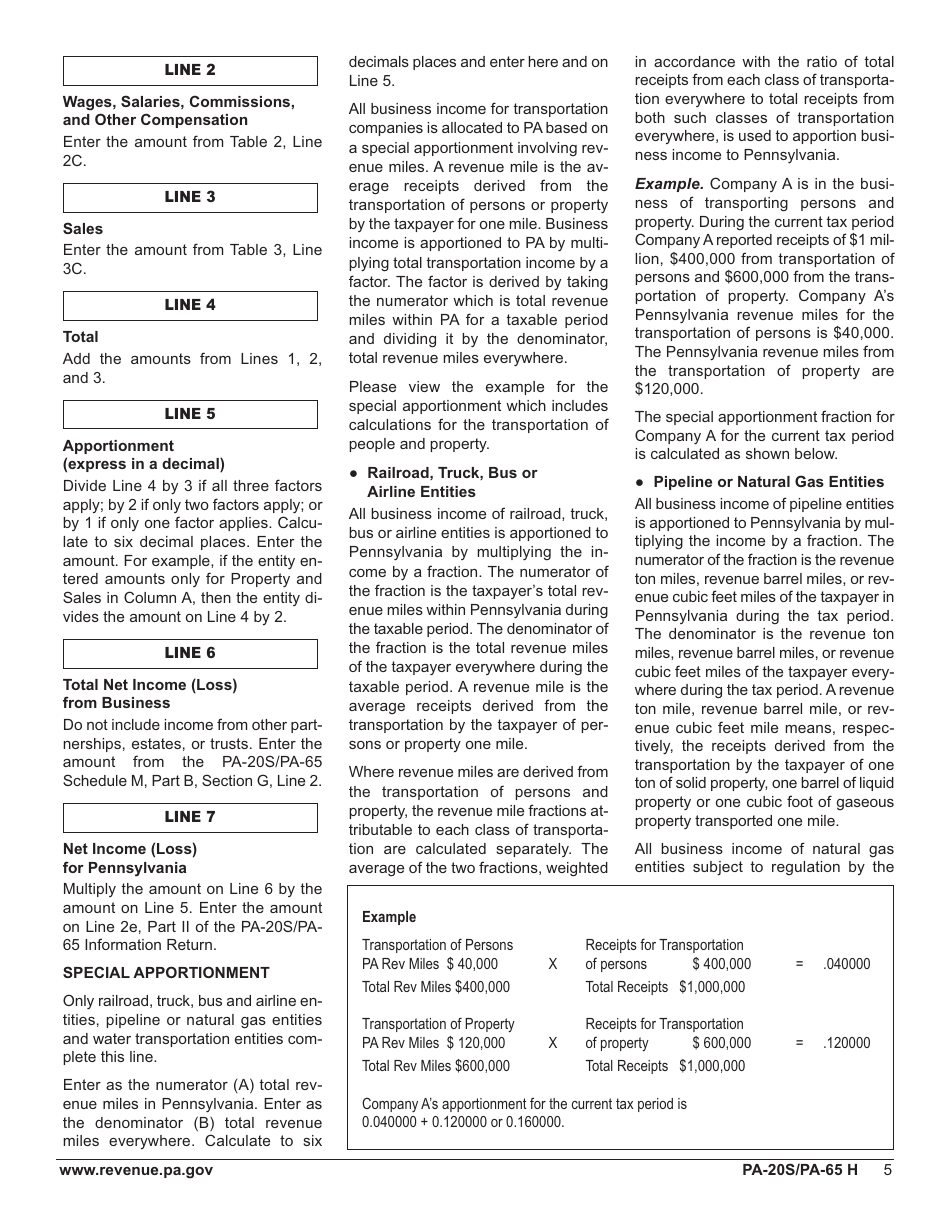

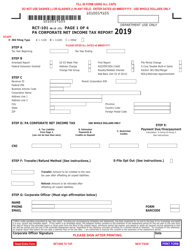

Form PA-20S (PA-65 H) Schedule H Apportioned Business Income (Loss) / Calculation of Pa Net Business Income (Loss) - Pennsylvania

What Is Form PA-20S (PA-65 H) Schedule H?

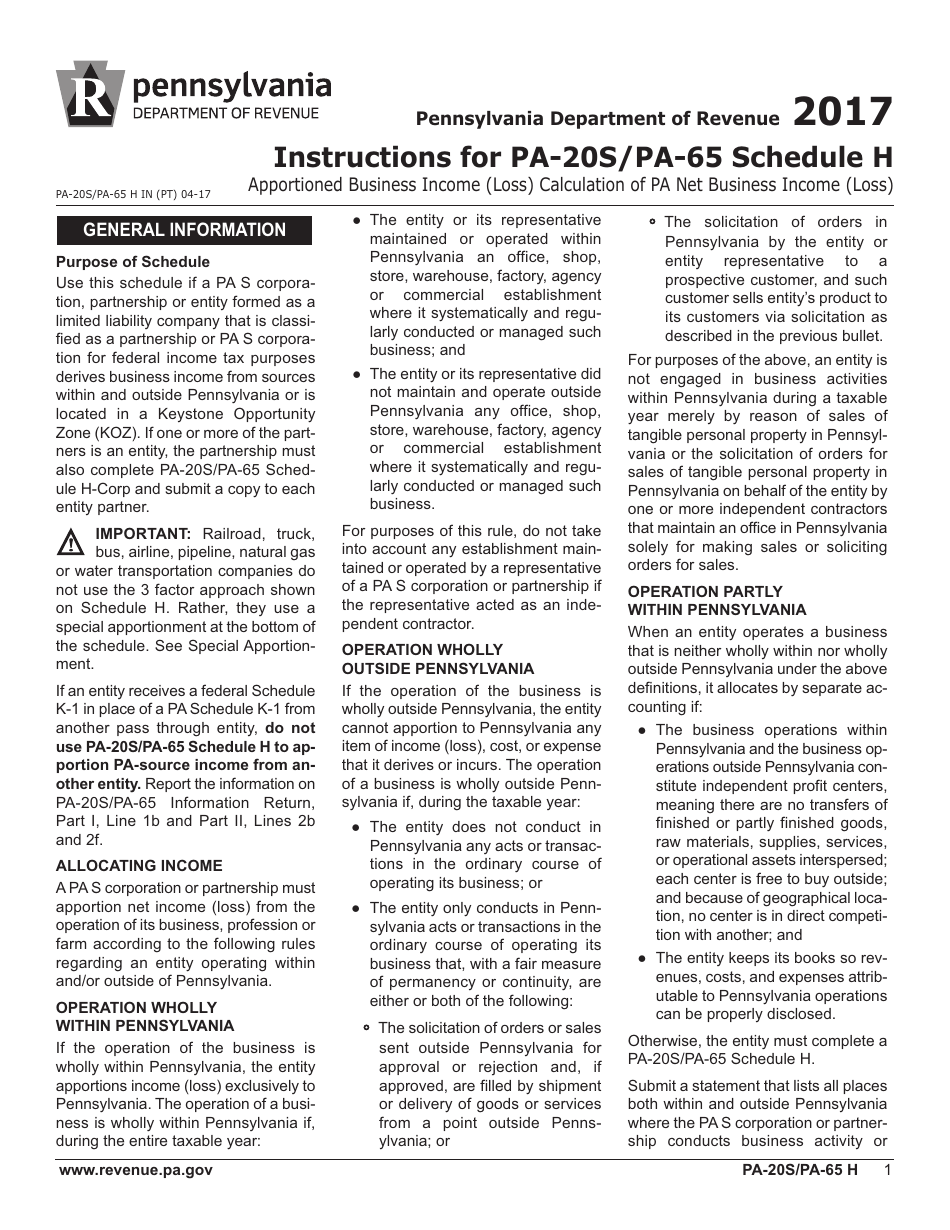

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20S?

A: Form PA-20S is a tax form used in Pennsylvania for the apportionment of business income or loss.

Q: What is PA-65 H?

A: PA-65 H is a schedule of Form PA-20S used to calculate the apportioned business income or loss.

Q: What is the purpose of Schedule H?

A: The purpose of Schedule H is to determine the net business income or loss in Pennsylvania.

Q: Who needs to file Form PA-20S (PA-65 H)?

A: Entities that have apportioned business income or loss in Pennsylvania need to file Form PA-20S and include Schedule H.

Q: How tofill out Form PA-20S (PA-65 H)?

A: You need to provide the necessary information related to your business income or loss and use the instructions provided with the form to fill it out accurately.

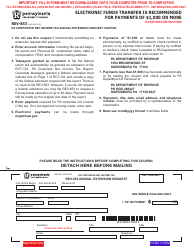

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S (PA-65 H) Schedule H by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.