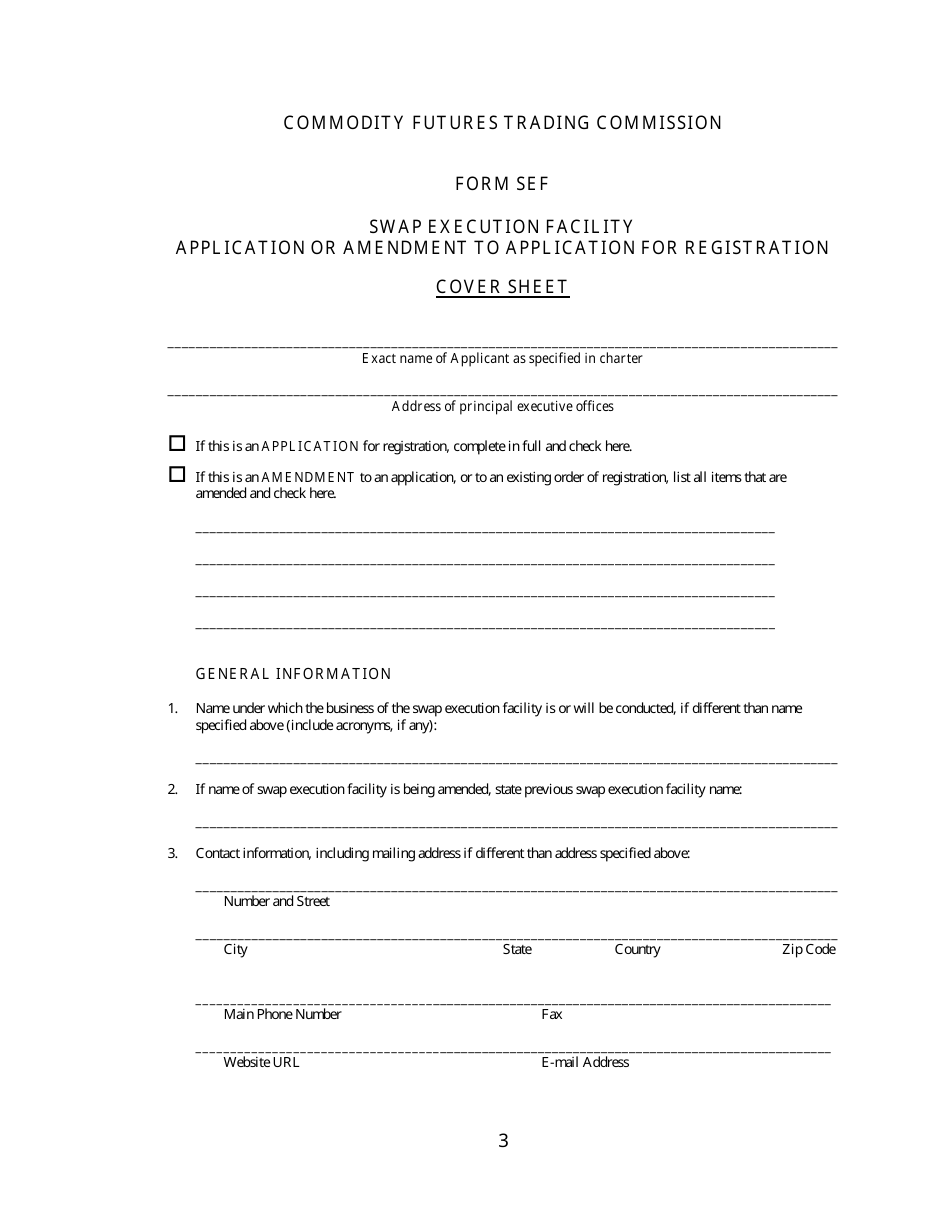

CFTC Form SEF Swap Execution Facility Application or Amendment to Application for Registration

What Is CFTC Form SEF?

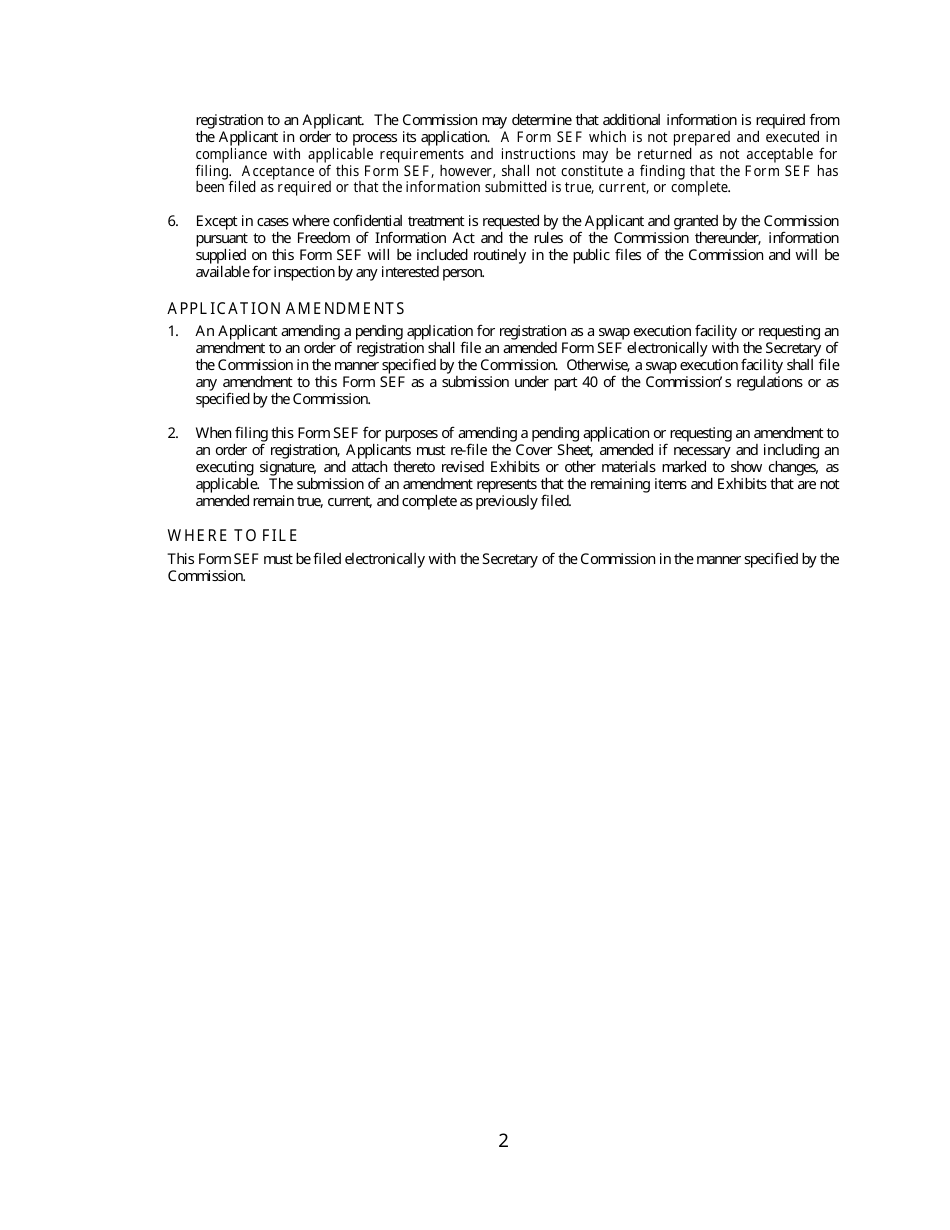

This is a legal form that was released by the U.S. Commodity Futures Trading Commission and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CFTC Form SEF?

A: CFTC Form SEF refers to the Swap Execution Facility Application form or Amendment to Application for Registration.

Q: What is a Swap Execution Facility?

A: A Swap Execution Facility (SEF) is a trading platform that facilitates the trading of swaps.

Q: Who needs to file CFTC Form SEF?

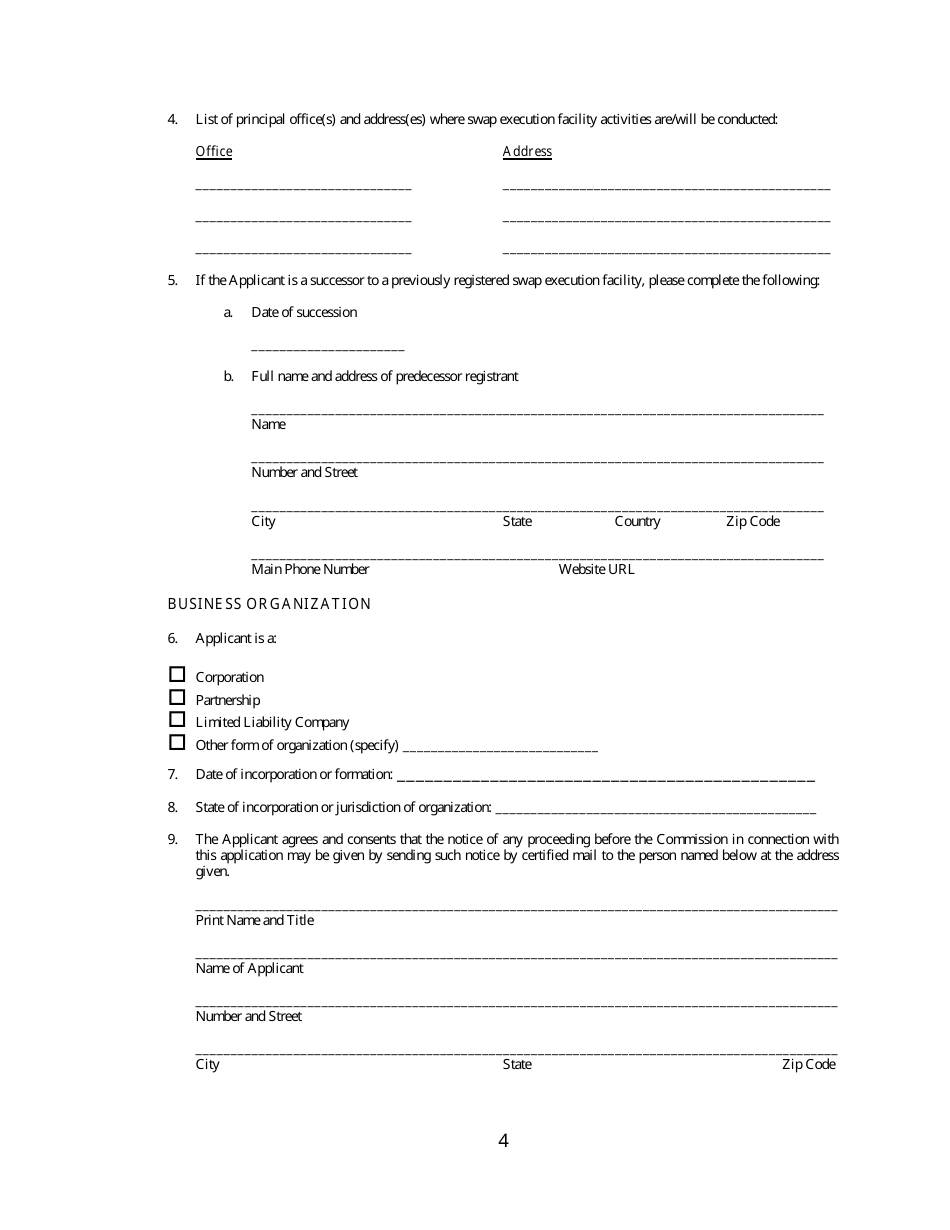

A: Entities operating or intending to operate as a Swap Execution Facility need to file CFTC Form SEF.

Q: What is the purpose of filing CFTC Form SEF?

A: The purpose of filing CFTC Form SEF is to apply for or amend the registration as a Swap Execution Facility.

Q: Is there a fee for filing CFTC Form SEF?

A: Yes, there is a fee associated with filing CFTC Form SEF. The fee amount can be found in the instructions accompanying the form.

Q: Are there any specific requirements for filing CFTC Form SEF?

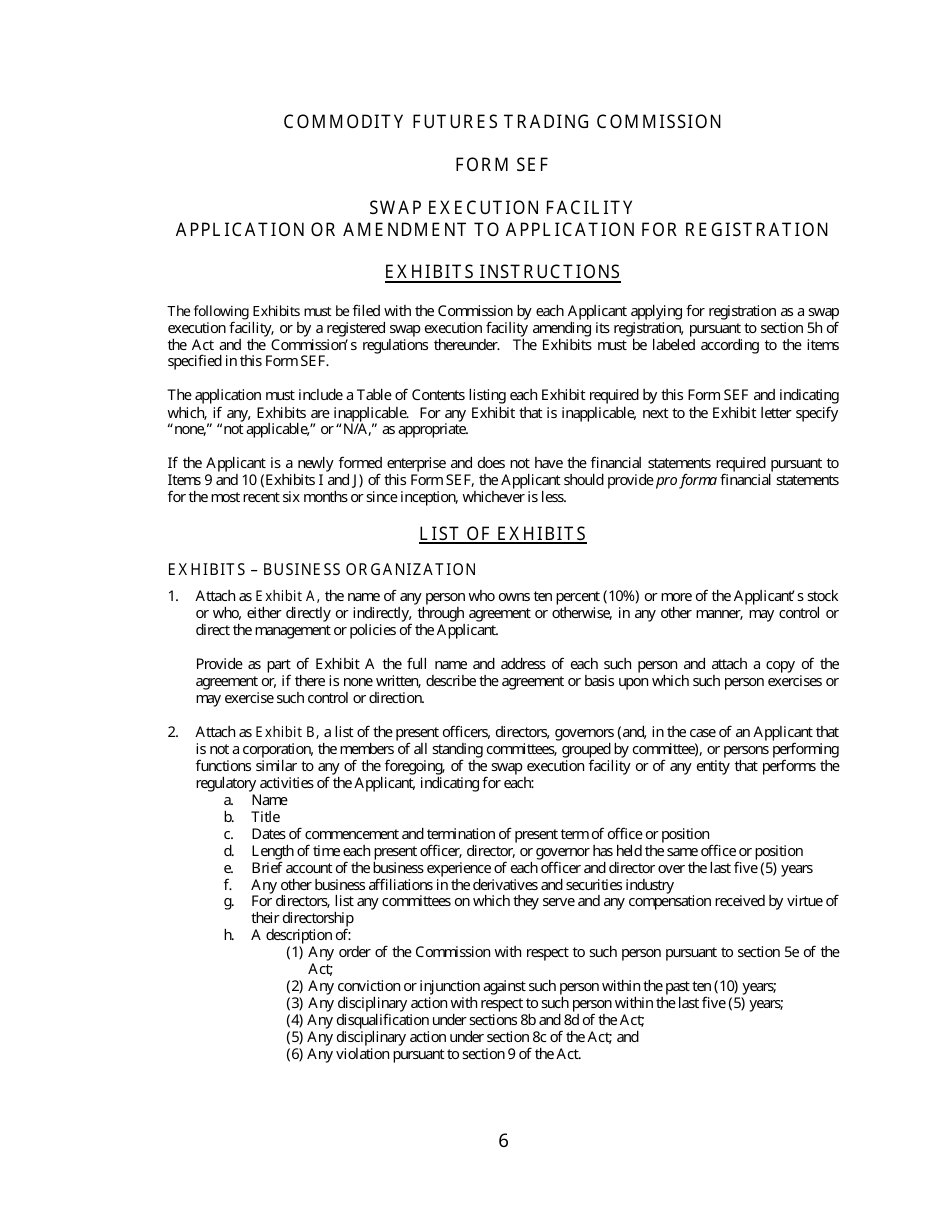

A: Yes, there are specific requirements outlined in the instructions accompanying CFTC Form SEF. These requirements may include providing information about the applicant's business operations, compliance policies, and financial condition.

Q: What happens after filing CFTC Form SEF?

A: After filing CFTC Form SEF, the application will be reviewed by the CFTC to determine whether the applicant meets the requirements for registration as a Swap Execution Facility.

Q: How long does it take to get registered as a Swap Execution Facility?

A: The processing time for registration as a Swap Execution Facility can vary. It is recommended to check with the CFTC for current processing times.

Q: Can I operate as a Swap Execution Facility without registering?

A: No, operating as a Swap Execution Facility without registration is not allowed. Registration with the CFTC is required for entities operating as Swap Execution Facilities.

Form Details:

- The latest available edition released by the U.S. Commodity Futures Trading Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of CFTC Form SEF by clicking the link below or browse more documents and templates provided by the U.S. Commodity Futures Trading Commission.