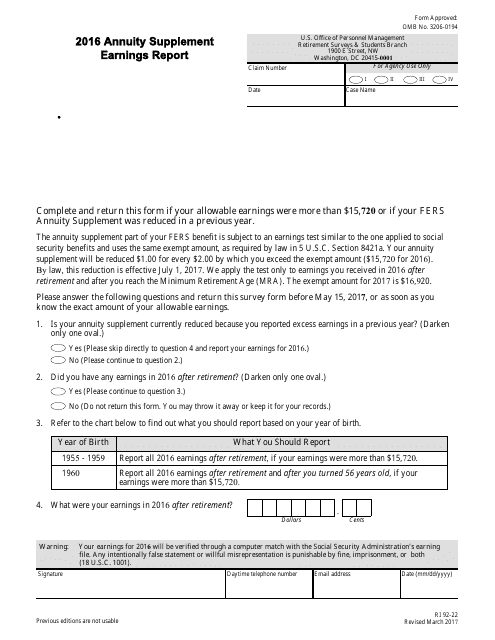

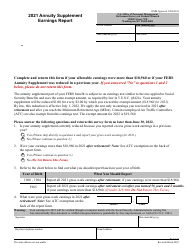

OPM Form RI92-22 Annuity Supplement Earnings Report

What Is OPM Form RI92-22?

This is a legal form that was released by the U.S. Office of Personnel Management on March 1, 2017 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OPM Form RI92-22?

A: OPM Form RI92-22 is the Annuity Supplement Earnings Report form.

Q: What is the purpose of OPM Form RI92-22?

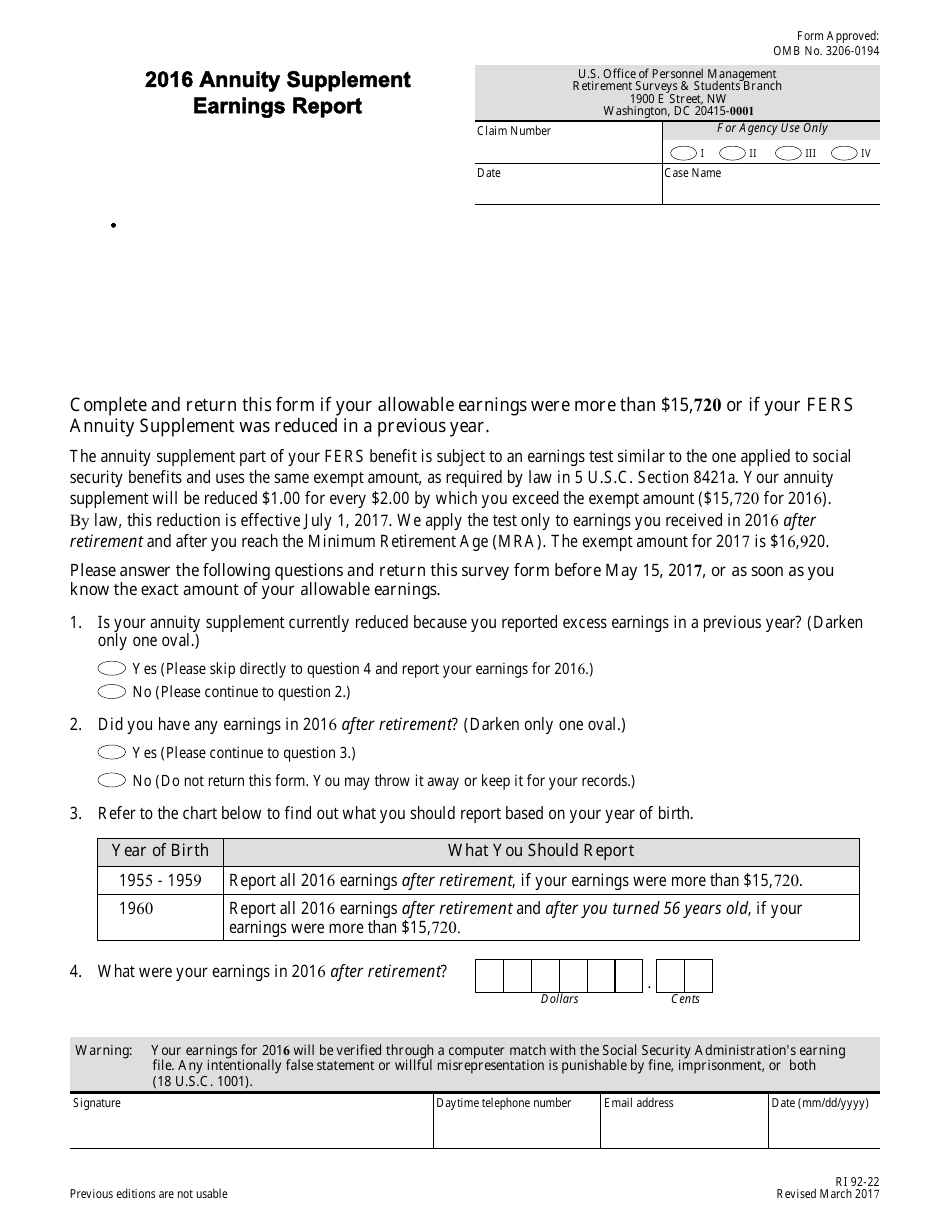

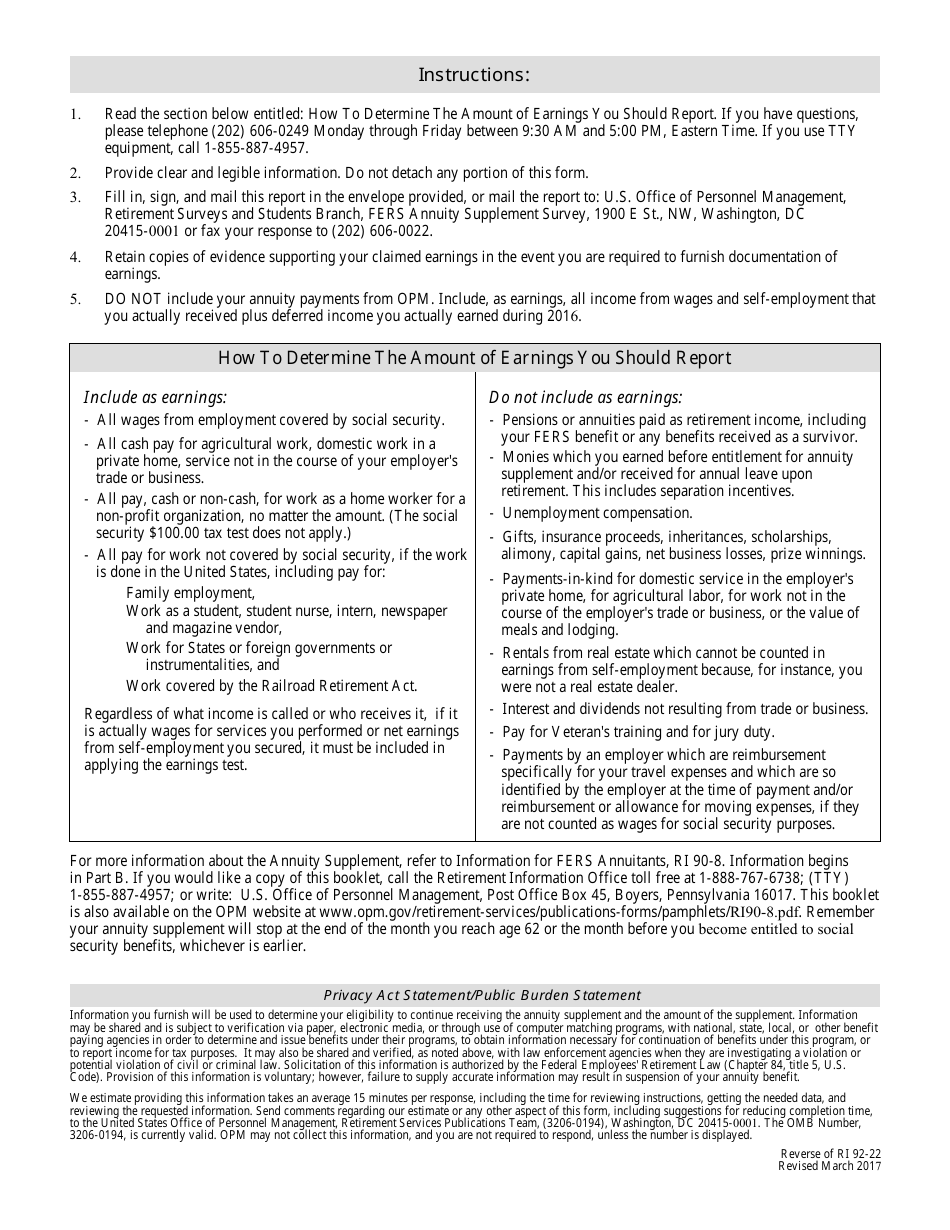

A: The purpose of OPM Form RI92-22 is to report additional earnings that may affect the annuity supplement.

Q: Who needs to fill out OPM Form RI92-22?

A: Retirees who receive an annuity supplement from the Office of Personnel Management (OPM) may be required to fill out OPM Form RI92-22 if they have additional earnings.

Q: Is OPM Form RI92-22 mandatory?

A: Yes, if you receive an annuity supplement and have additional earnings, you must fill out OPM Form RI92-22 as required by the Office of Personnel Management (OPM).

Q: When should I submit OPM Form RI92-22?

A: OPM Form RI92-22 should be submitted as soon as possible after the end of each calendar year to report any additional earnings that may affect the annuity supplement.

Q: What information is required on OPM Form RI92-22?

A: OPM Form RI92-22 requires information about your additional earnings, including the amount and the dates earned.

Form Details:

- Released on March 1, 2017;

- The latest available edition released by the U.S. Office of Personnel Management;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of OPM Form RI92-22 by clicking the link below or browse more documents and templates provided by the U.S. Office of Personnel Management.