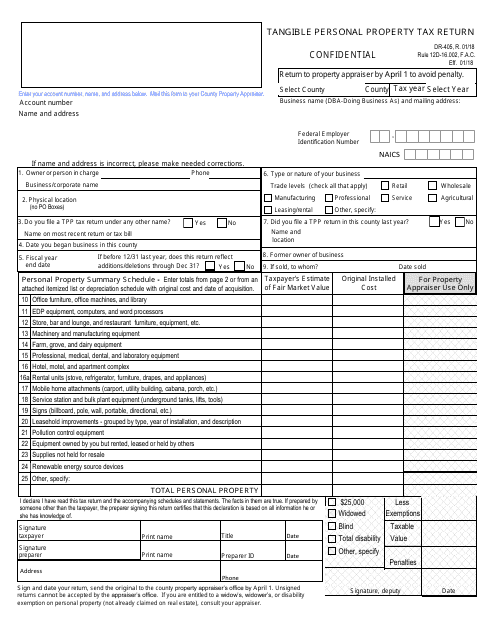

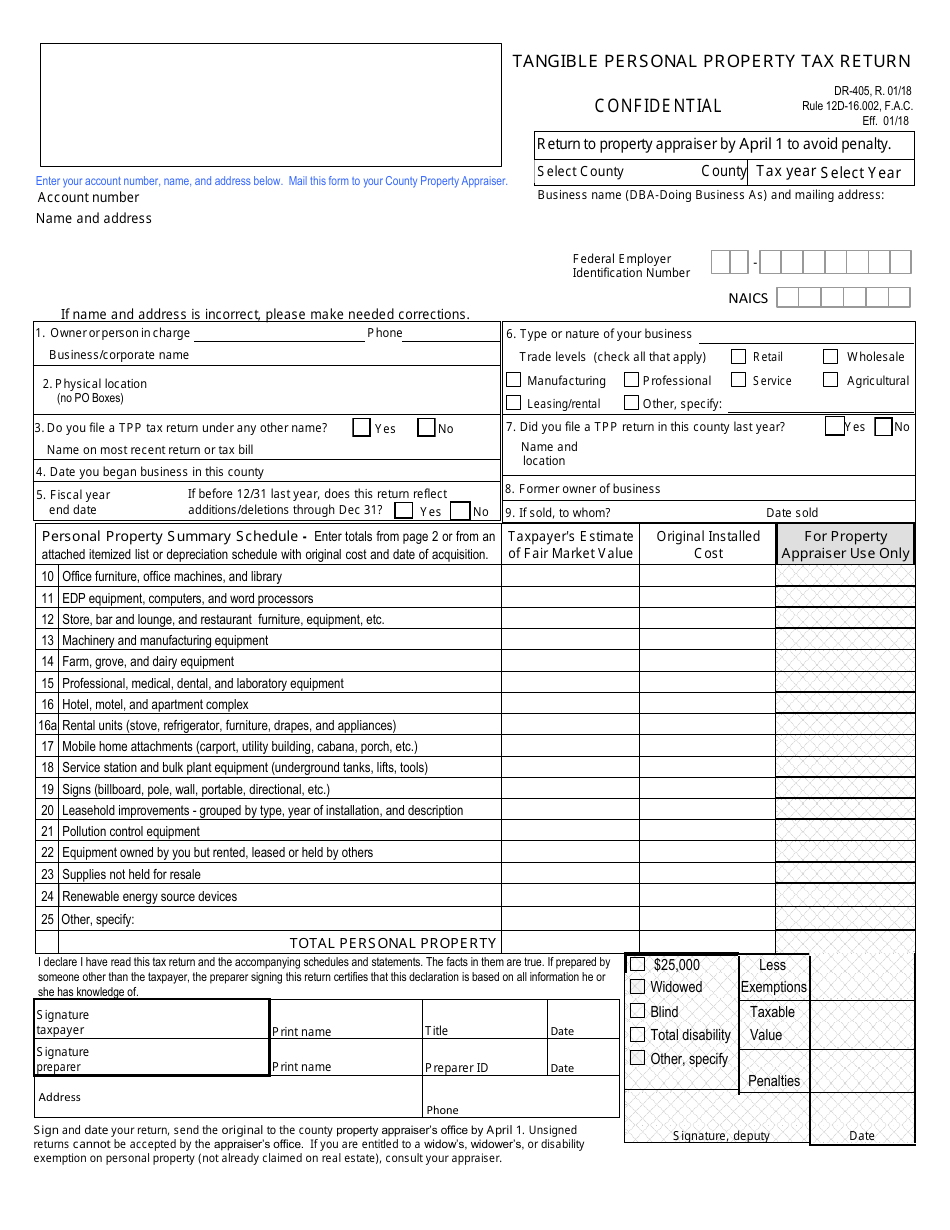

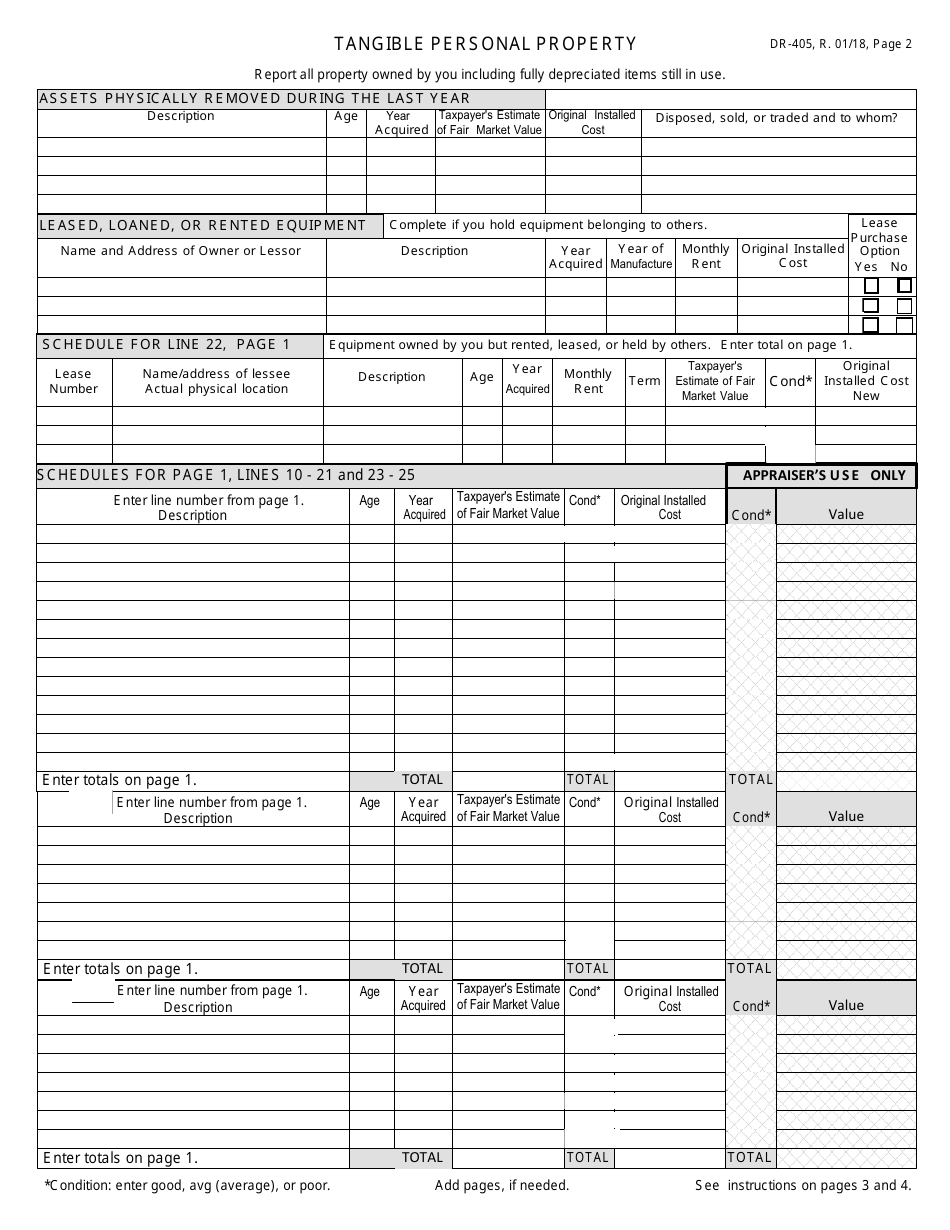

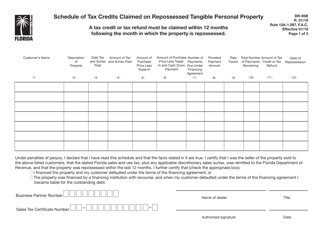

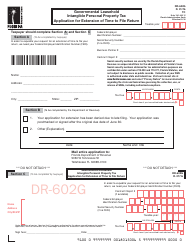

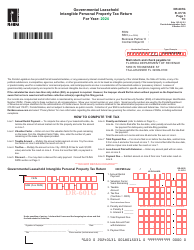

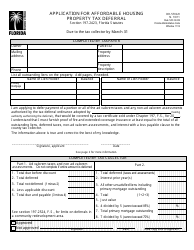

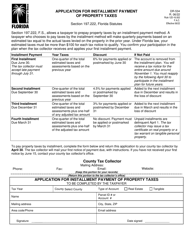

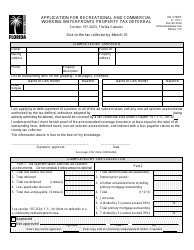

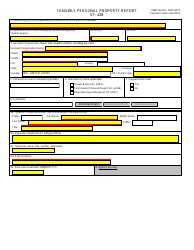

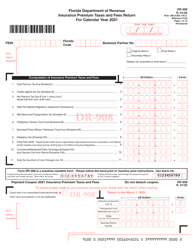

Form DR-405 Tangible Personal Property Tax Return - Florida

What Is Form DR-405?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-405?

A: Form DR-405 is the Tangible Personal Property Tax Return for businesses in Florida.

Q: Who needs to file Form DR-405?

A: Businesses in Florida that own tangible personal property must file Form DR-405.

Q: What is tangible personal property?

A: Tangible personal property refers to physical assets that can be touched or moved, such as furniture, equipment, and machinery.

Q: When is the deadline for filing Form DR-405?

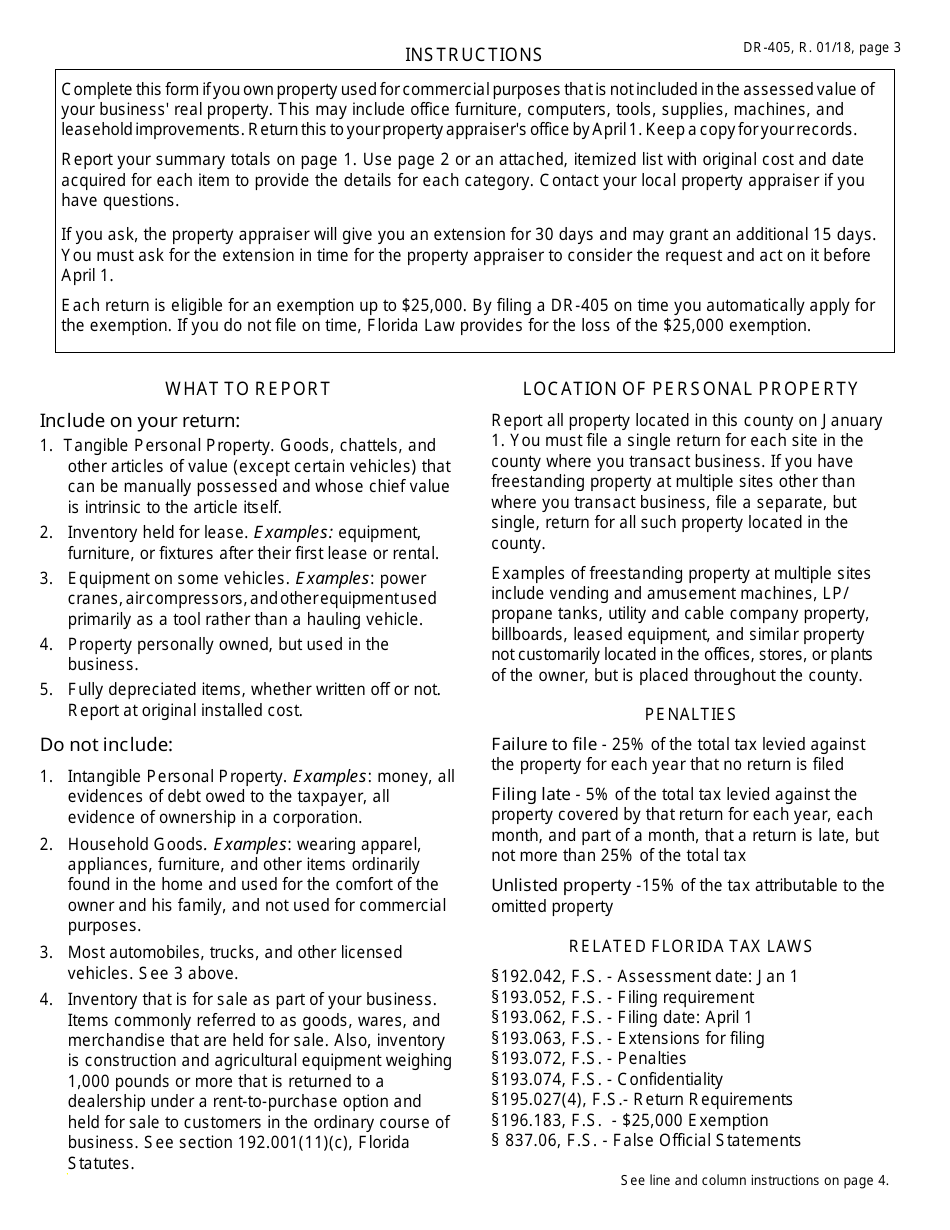

A: The deadline for filing Form DR-405 in Florida is April 1st of each year.

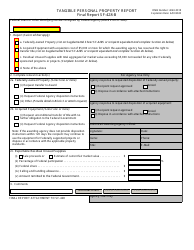

Q: Are there any penalties for not filing Form DR-405?

A: Yes, failure to file Form DR-405 or filing it late can result in penalties and interest charges.

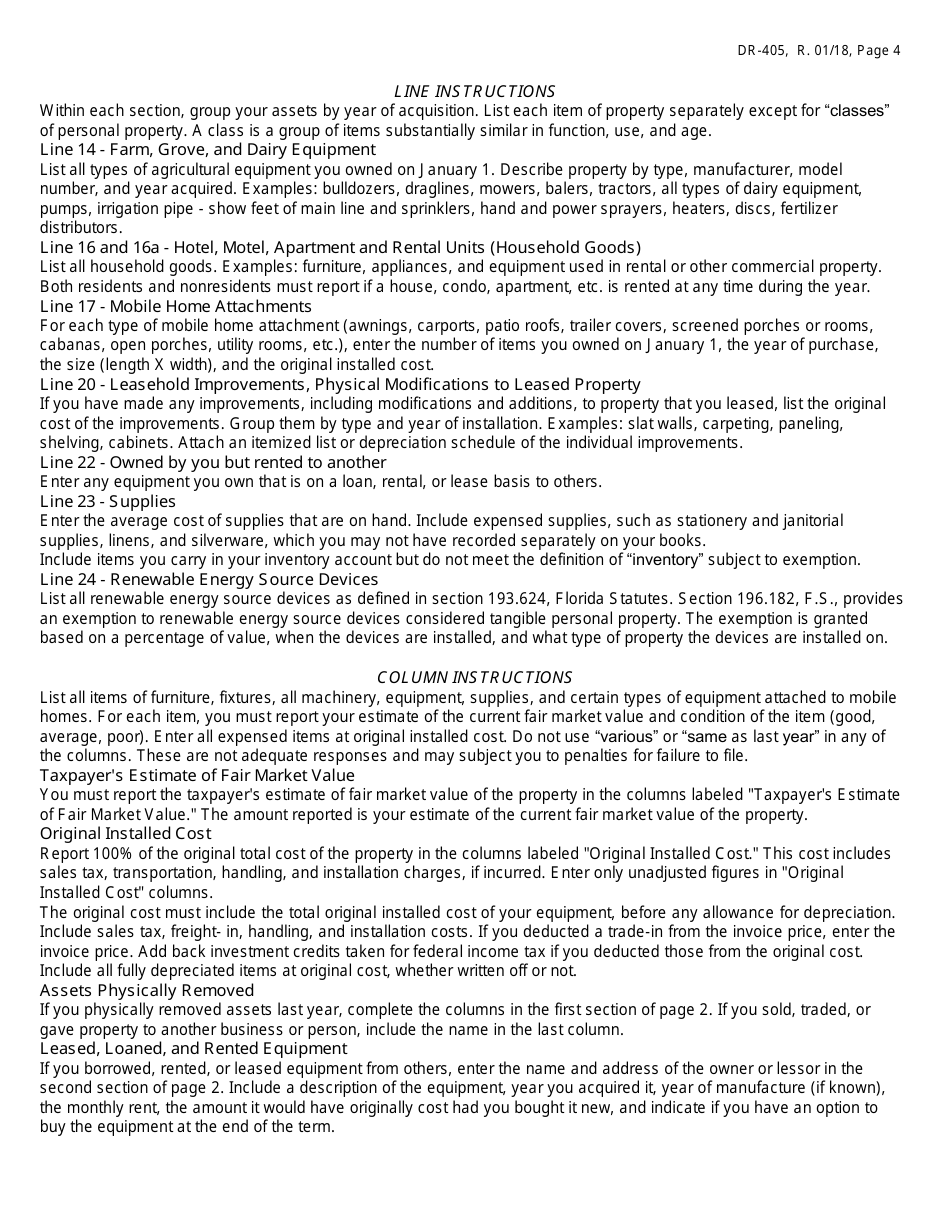

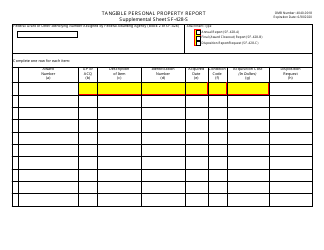

Q: What information is required to complete Form DR-405?

A: You will need to provide details about your business, a list of your tangible personal property, and its value.

Q: Is Form DR-405 used for both Florida and federal taxes?

A: No, Form DR-405 is specific to the Tangible Personal Property Tax in Florida and is not used for federal taxes.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-405 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.