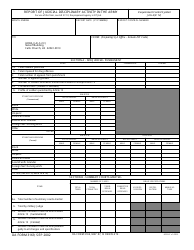

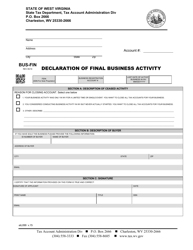

This version of the form is not currently in use and is provided for reference only. Download this version of

Form BAR-0

for the current year.

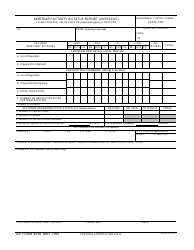

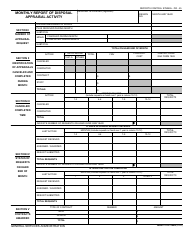

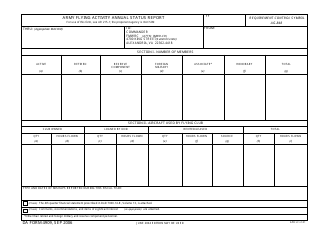

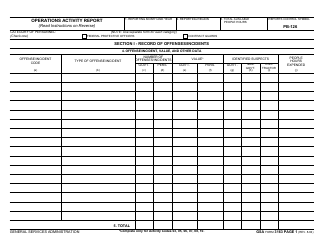

Form BAR-0 West Virginia Business Activity Report - West Virginia

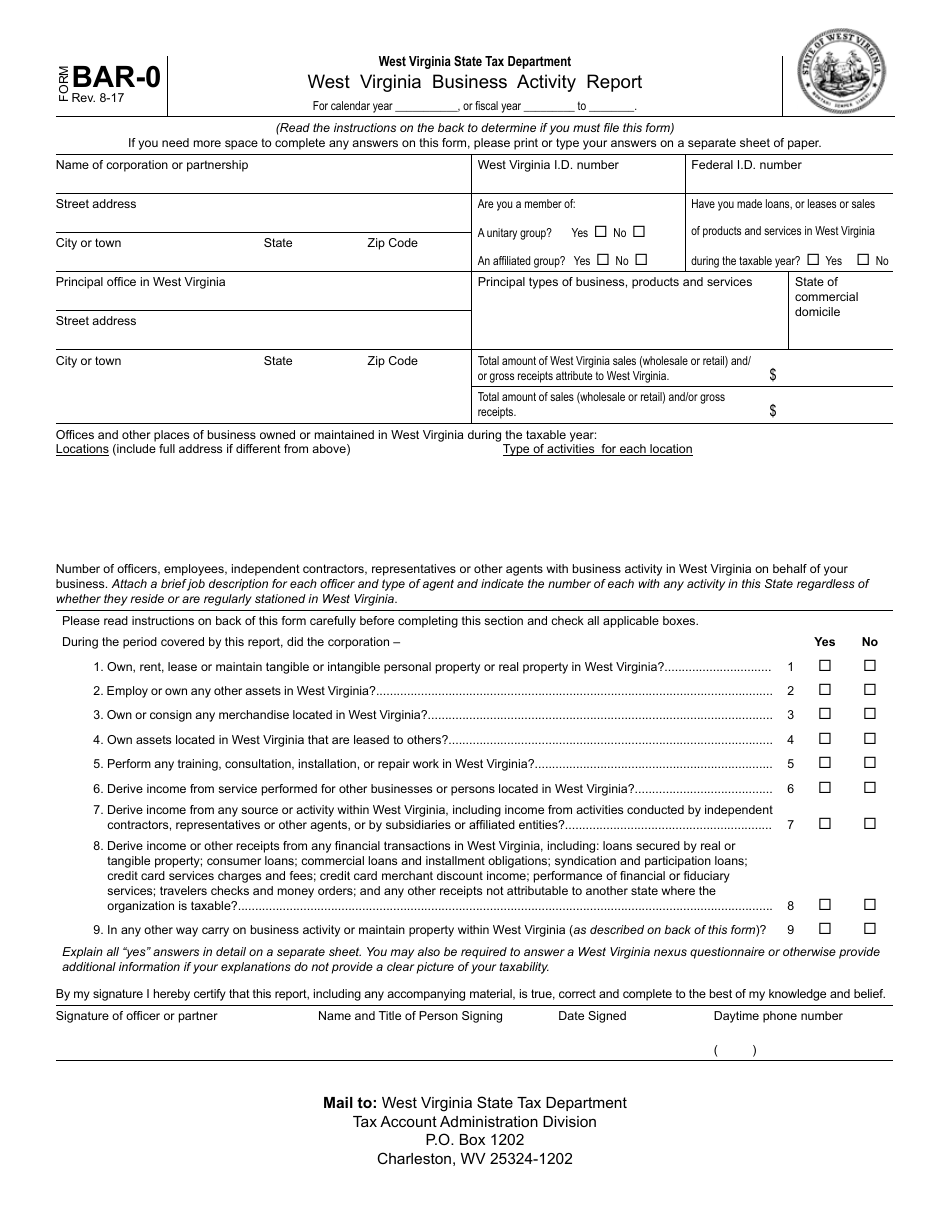

What Is Form BAR-0?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BAR-0?

A: BAR-0 is the West Virginia Business Activity Report form.

Q: What is the purpose of BAR-0?

A: The purpose of BAR-0 is to report the business activities in West Virginia.

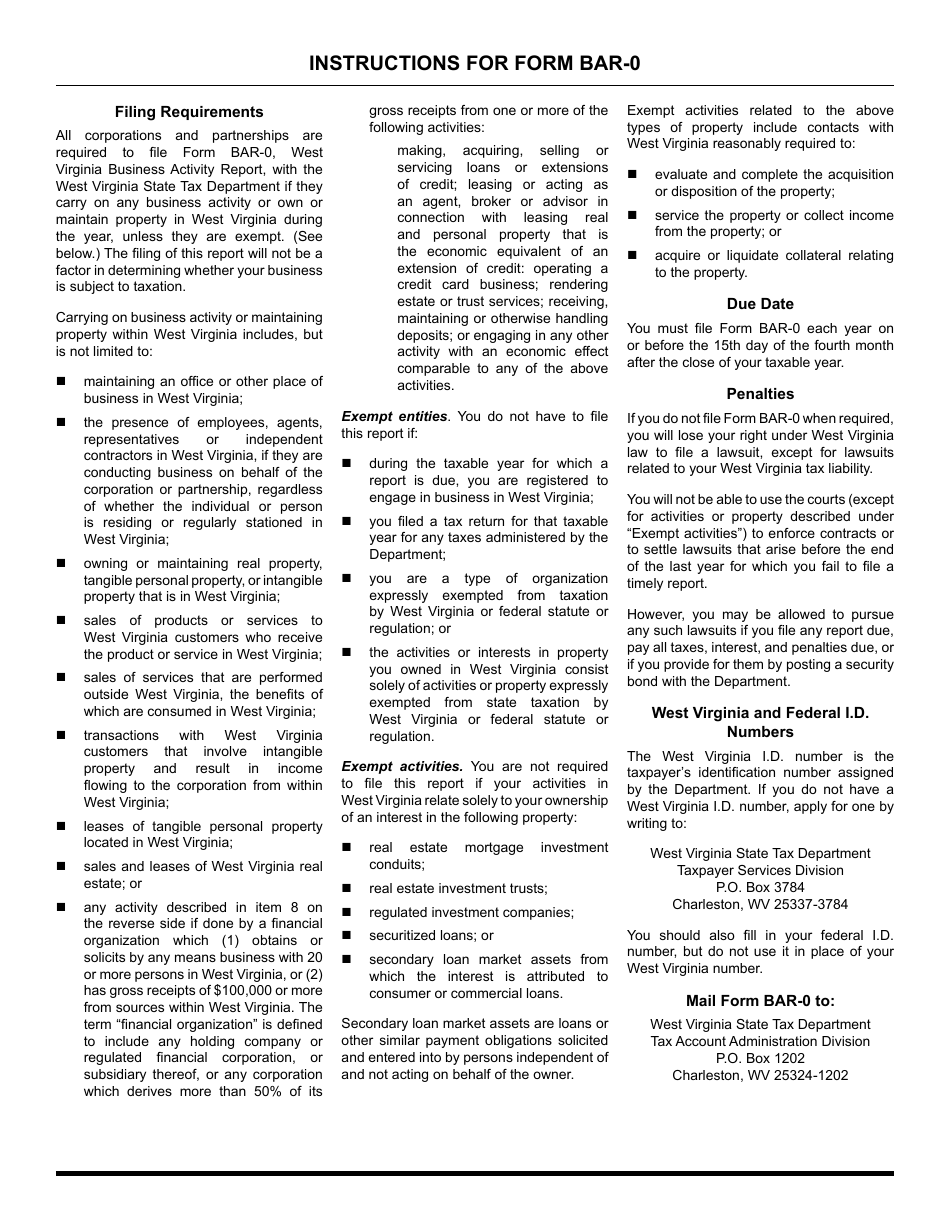

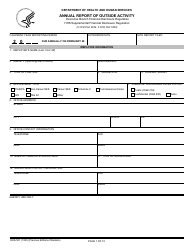

Q: Who needs to file BAR-0?

A: Businesses operating in West Virginia need to file BAR-0.

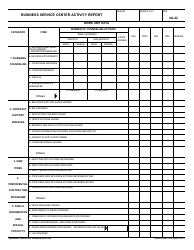

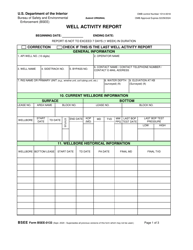

Q: What information is required in BAR-0?

A: BAR-0 requires information about the business's activities, including revenue, expenses, and employment.

Q: When is BAR-0 due?

A: BAR-0 is due annually by a specified date.

Q: What are the consequences of not filing BAR-0?

A: Failure to file BAR-0 may result in penalties or legal consequences.

Q: Are there any exemptions to filing BAR-0?

A: Some businesses may be exempt from filing BAR-0, depending on their type and revenue.

Q: Is there a fee for filing BAR-0?

A: There is no fee for filing BAR-0.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BAR-0 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.