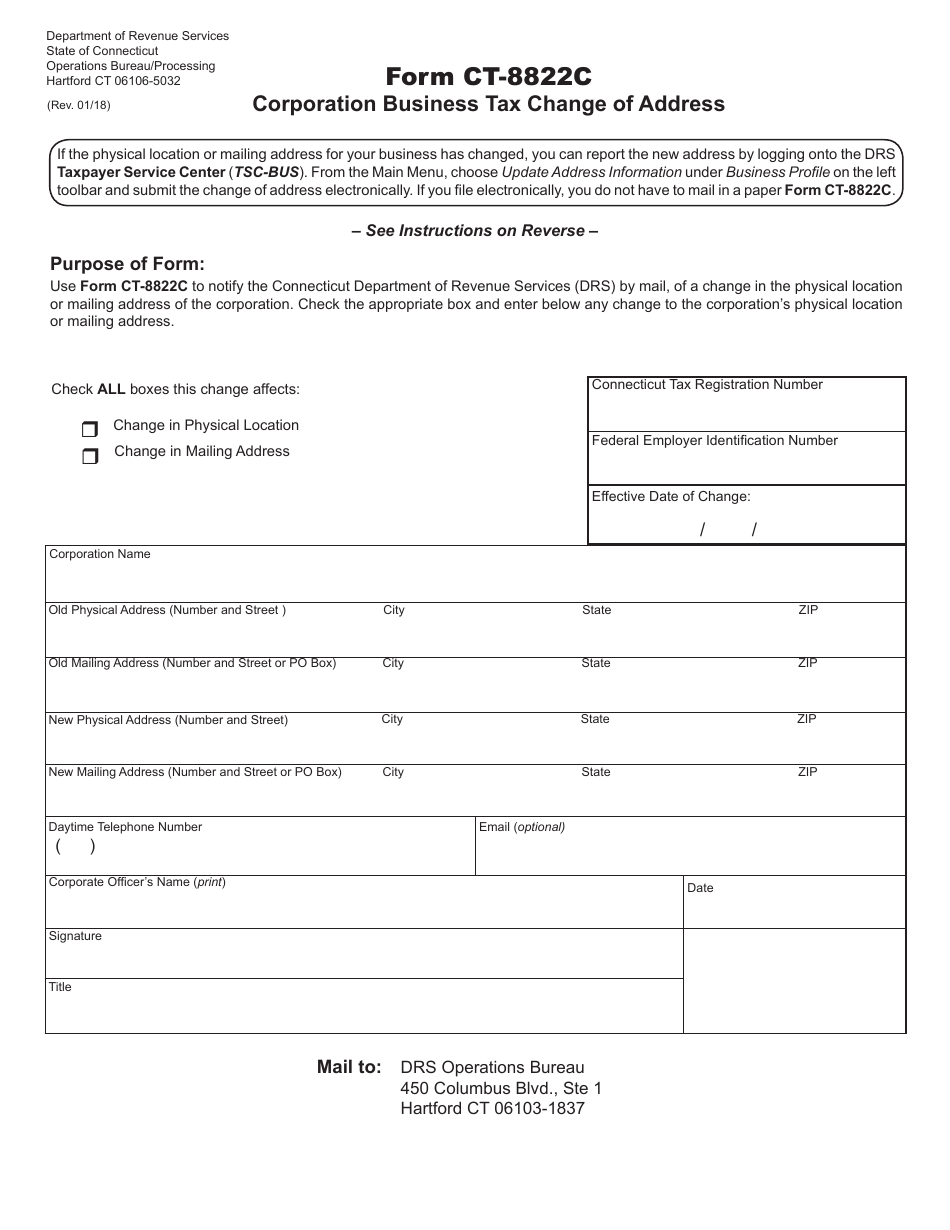

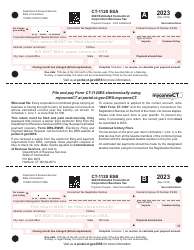

Form CT-8822C Corporation Business Tax Change of Address - Connecticut

What Is Form CT-8822C?

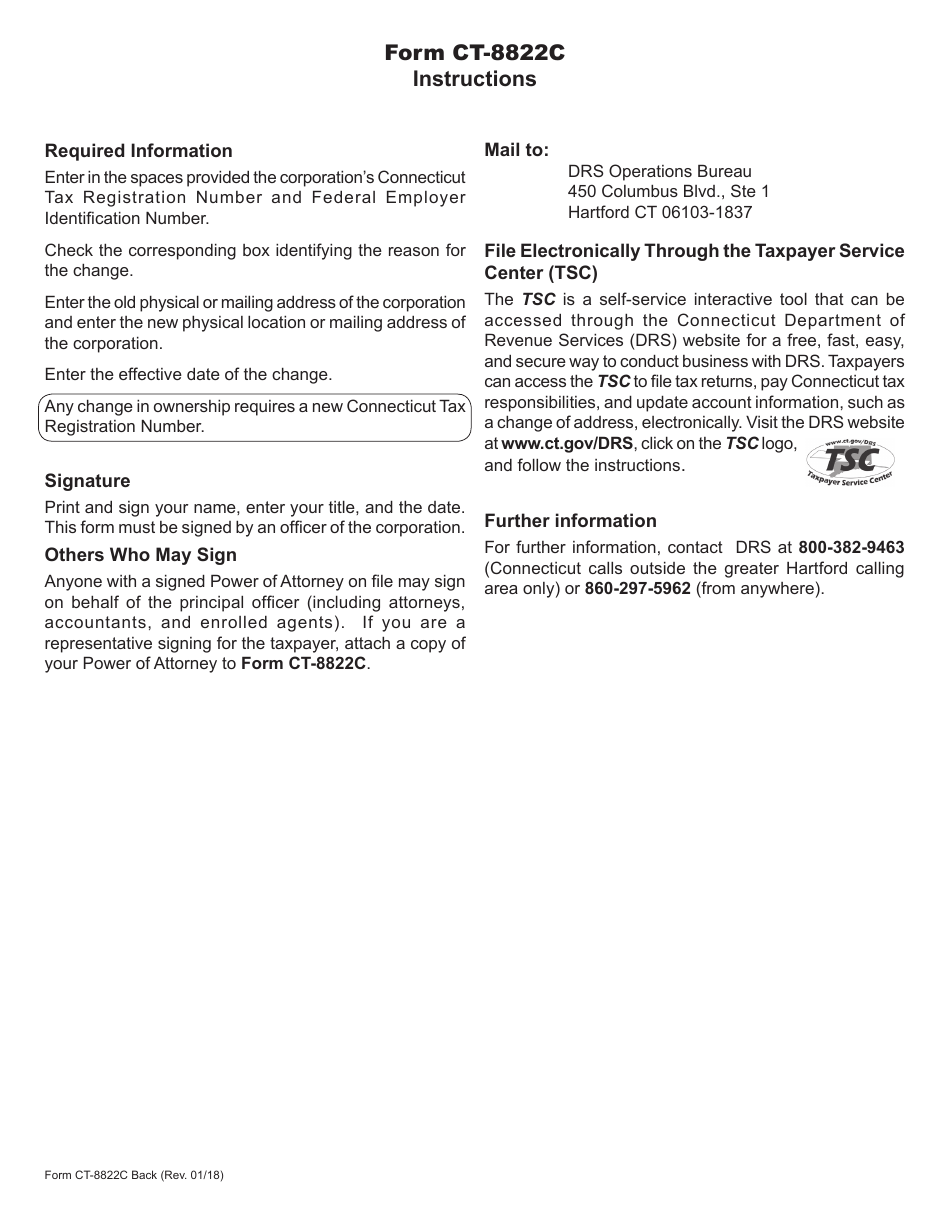

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-8822C?

A: Form CT-8822C is a form used for changing the address of your corporation for business tax purposes in Connecticut.

Q: Why would I need to file Form CT-8822C?

A: You would need to file Form CT-8822C if your corporation has changed its address for business tax purposes in Connecticut.

Q: Is there a fee to file Form CT-8822C?

A: No, there is no fee to file Form CT-8822C.

Q: How long does it take for my address change to be processed?

A: The processing time for an address change on Form CT-8822C can vary, but it typically takes a few weeks.

Q: Do I need to notify any other state agencies of my address change?

A: Yes, you may need to notify other state agencies, such as the Secretary of State or the Department of Labor, of your address change.

Q: What if my corporation has changed its name along with its address?

A: If your corporation has also changed its name, you will need to file Form CT-8822CB, which is specifically for name changes.

Q: Can I make address changes for multiple tax periods on one Form CT-8822C?

A: No, you will need to file a separate Form CT-8822C for each tax period that requires an address change.

Q: What should I do if I made a mistake on Form CT-8822C?

A: If you made a mistake on Form CT-8822C, you should file an amended form with the correct information as soon as possible.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-8822C by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.