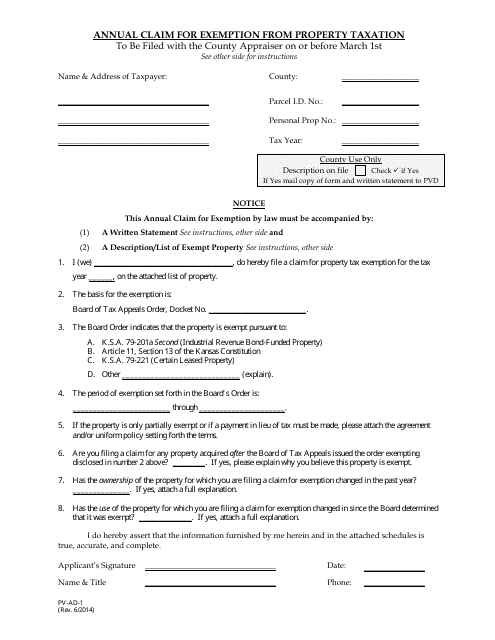

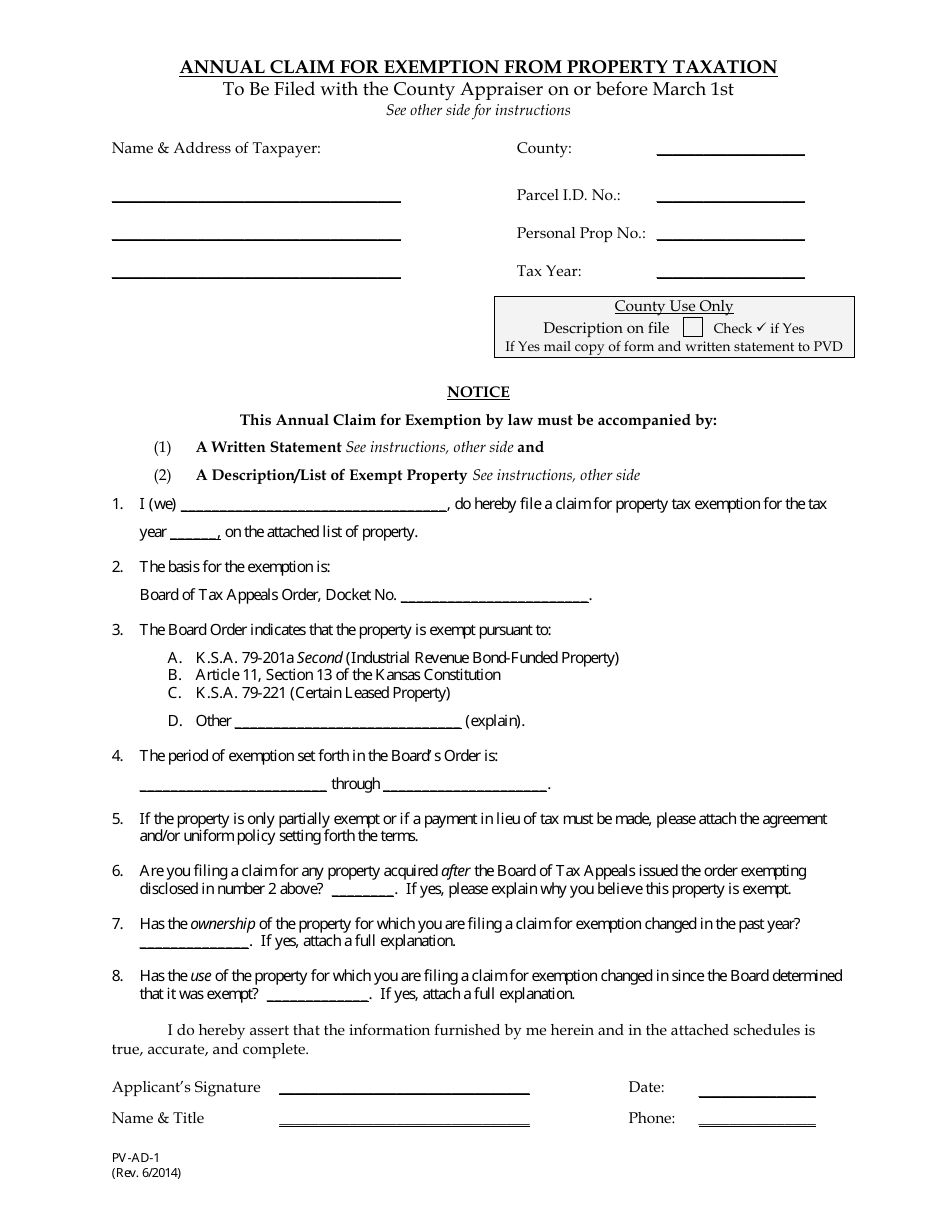

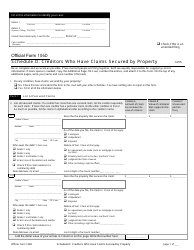

Form PV-AD-1 Annual Claim for Exemption From Property Taxation - Kansas

What Is Form PV-AD-1?

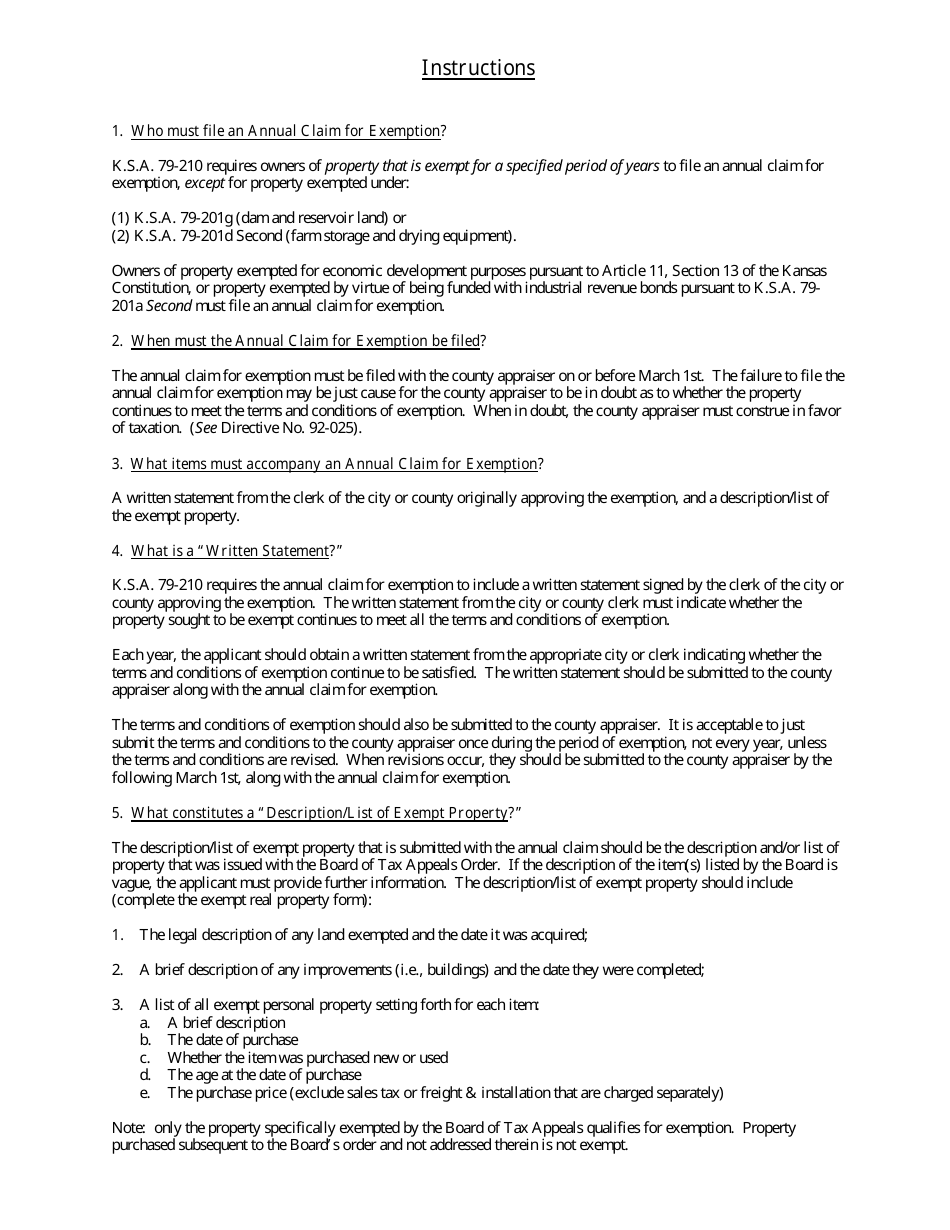

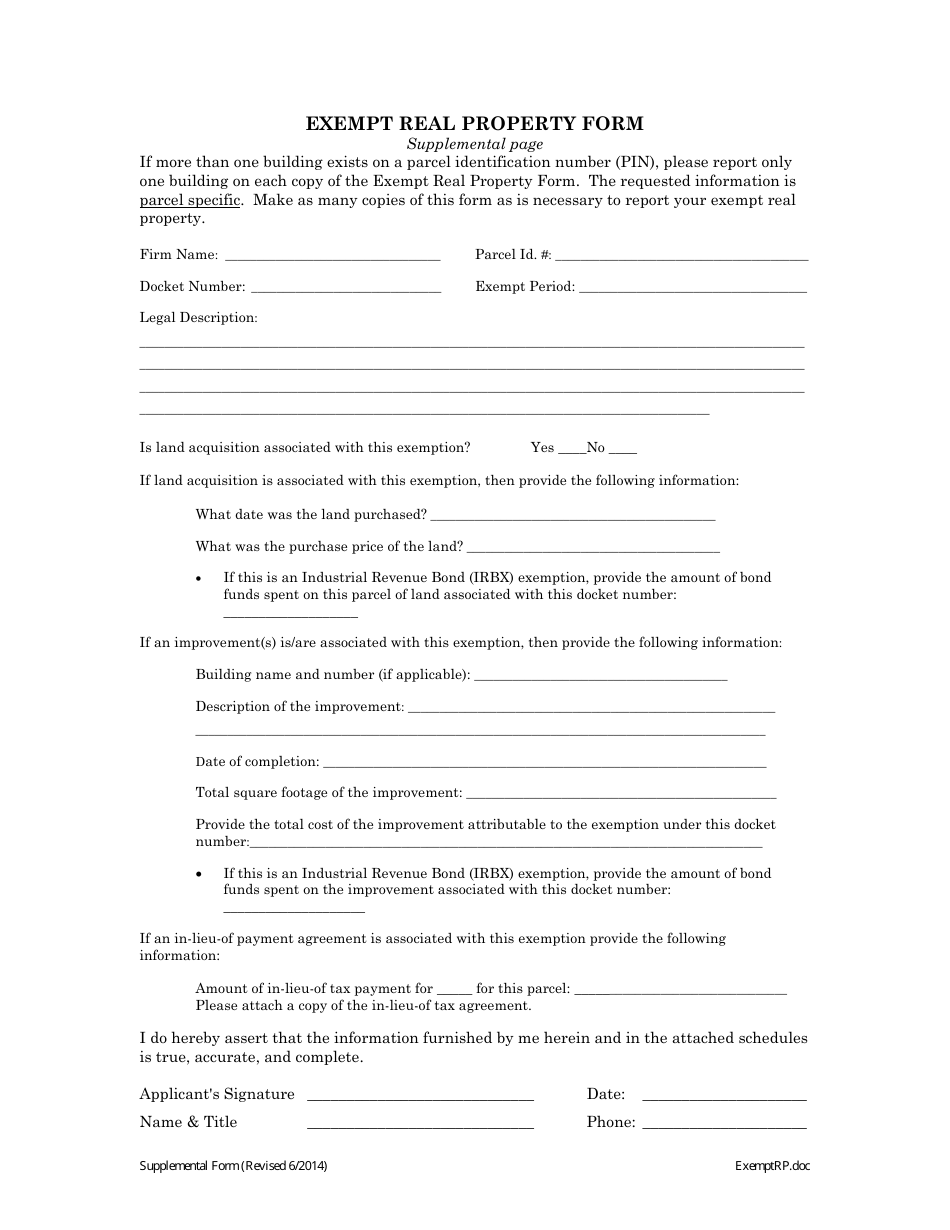

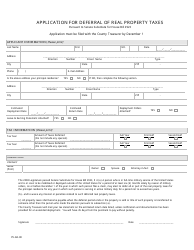

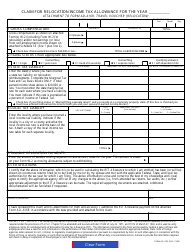

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PV-AD-1?

A: Form PV-AD-1 is the Annual Claim for Exemption From Property Taxation in Kansas.

Q: Who needs to fill out Form PV-AD-1?

A: Property owners in Kansas who wish to claim exemption from property taxation need to fill out Form PV-AD-1.

Q: What is the purpose of Form PV-AD-1?

A: The purpose of Form PV-AD-1 is to claim exemption from property taxation in Kansas.

Q: Can all property owners in Kansas claim exemption using Form PV-AD-1?

A: No, only property owners who meet the eligibility requirements for exemption can claim exemption using Form PV-AD-1.

Q: When is the deadline to submit Form PV-AD-1?

A: Form PV-AD-1 must be submitted annually by March 15th.

Q: What supporting documents do I need to include with Form PV-AD-1?

A: You may need to include supporting documents such as proof of ownership, proof of eligibility for exemption, and any other required documentation as specified by the county appraiser.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PV-AD-1 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.