This version of the form is not currently in use and is provided for reference only. Download this version of

Form MI-1040D

for the current year.

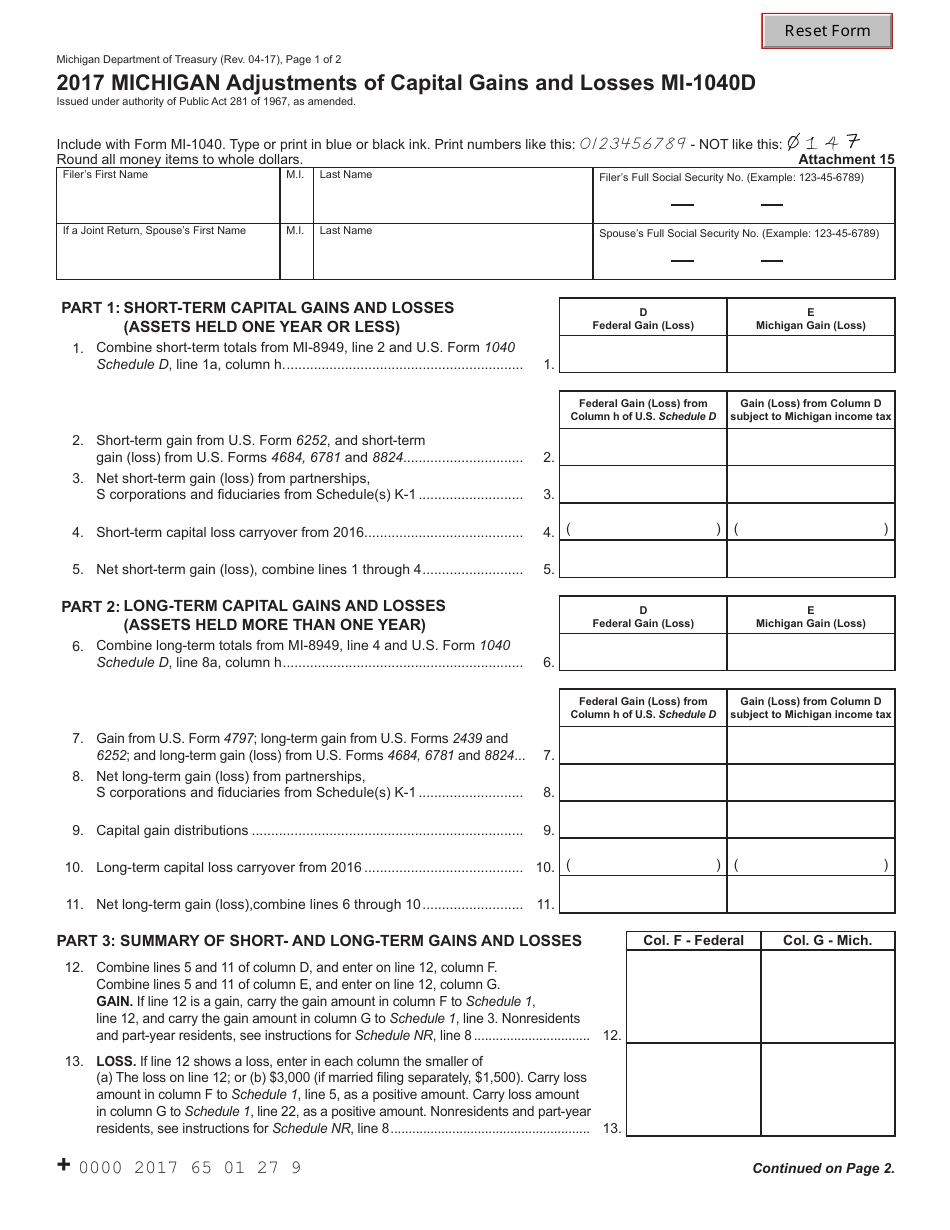

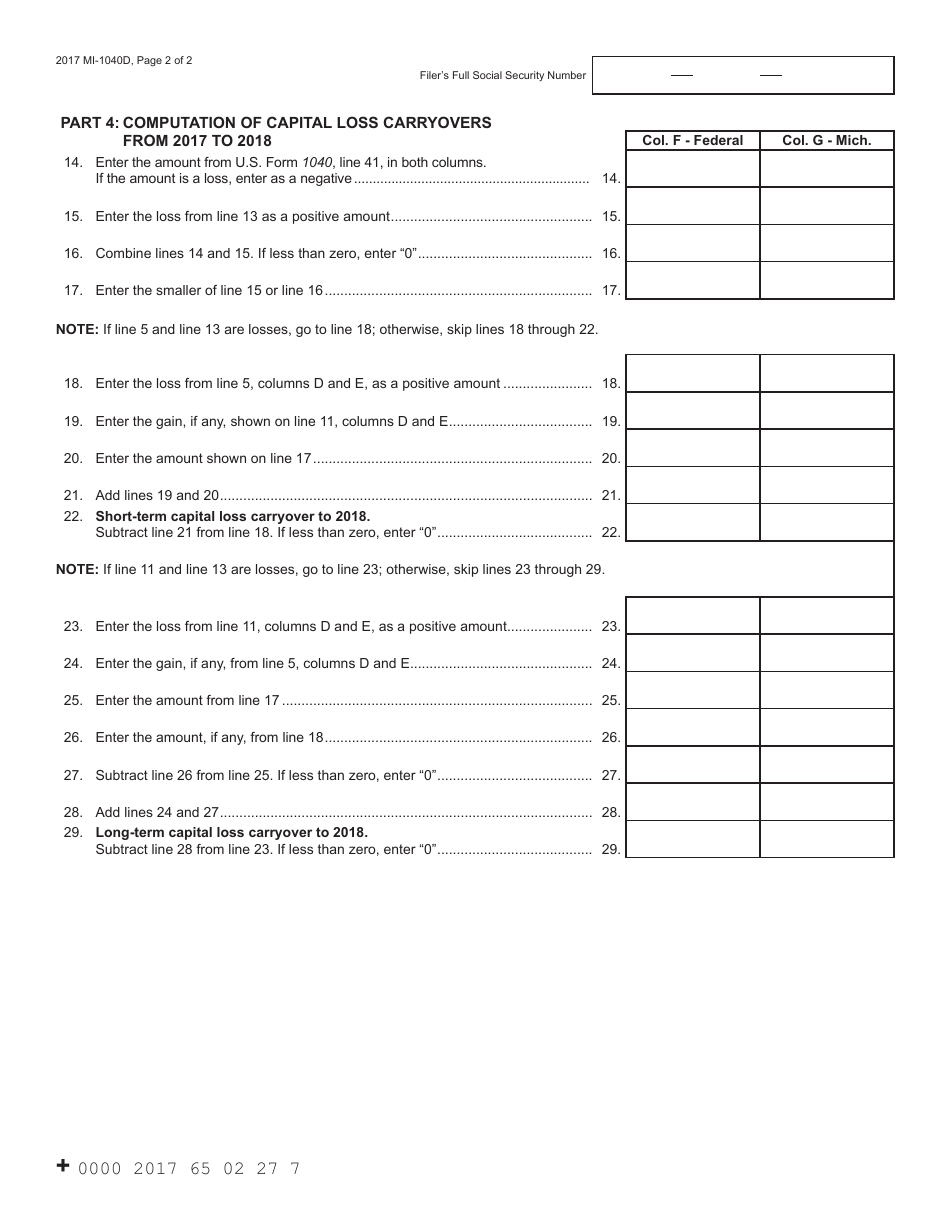

Form MI-1040D Michigan Adjustments of Capital Gains and Losses - Michigan

What Is Form MI-1040D?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MI-1040D?

A: Form MI-1040D is the Michigan Adjustments of Capital Gains and Losses form.

Q: What is the purpose of Form MI-1040D?

A: The purpose of Form MI-1040D is to report and calculate adjustments to capital gains and losses for Michigan tax purposes.

Q: Who needs to file Form MI-1040D?

A: Any Michigan resident who has capital gains or losses that need to be adjusted for state tax purposes.

Q: What types of capital gains and losses are included on Form MI-1040D?

A: Form MI-1040D includes adjustments for various types of capital gains and losses, including those from the sale of property or investments.

Q: When is the deadline to file Form MI-1040D?

A: The deadline to file Form MI-1040D is the same as the deadline to file your Michigan state income tax return, which is usually April 15th.

Q: Are there any additional forms or schedules that need to be filed with Form MI-1040D?

A: Depending on your individual tax situation, you may also need to file other forms or schedules, such as Form MI-1040 or Schedule D.

Q: Can I e-file Form MI-1040D?

A: Yes, you can e-file Form MI-1040D using approved tax preparation software or through a tax professional.

Q: What if I have questions or need assistance with Form MI-1040D?

A: If you have questions or need assistance with Form MI-1040D, you can contact the Michigan Department of Treasury or seek help from a tax professional.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1040D by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.