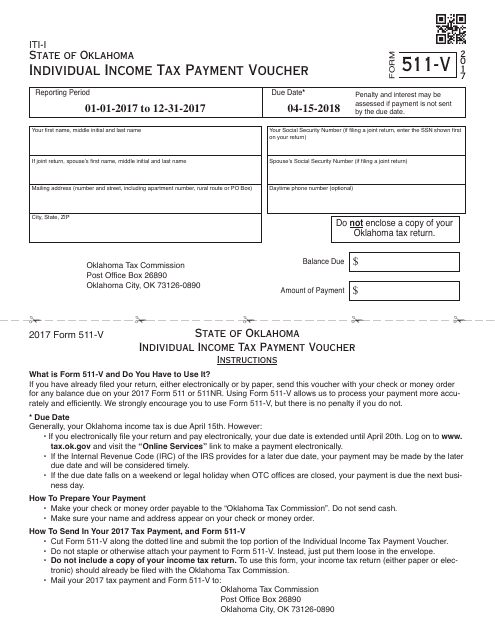

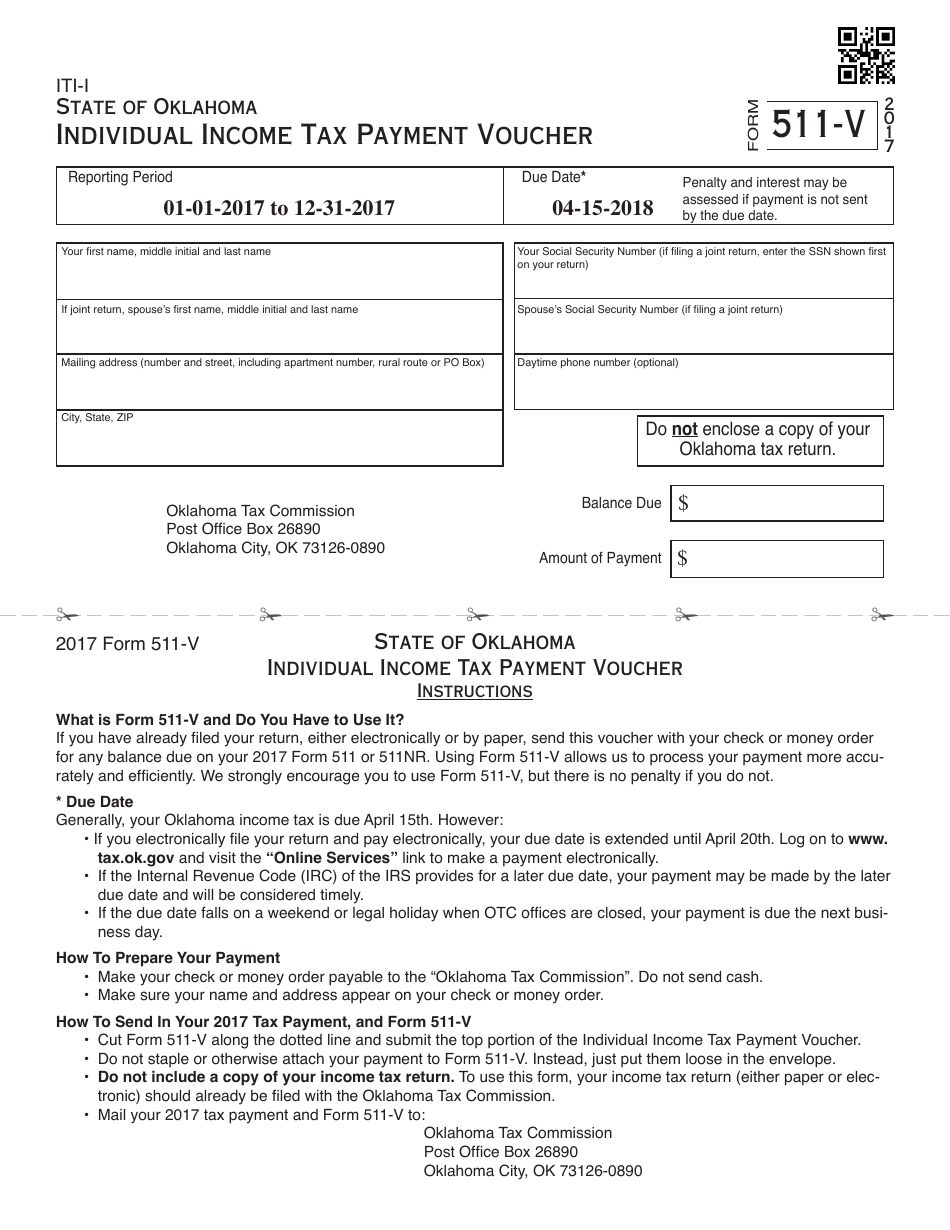

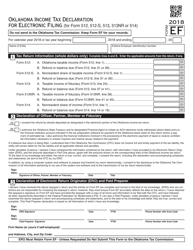

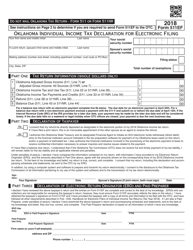

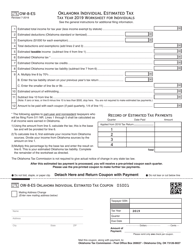

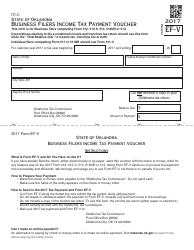

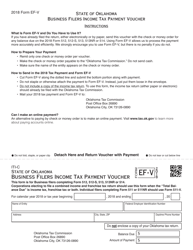

OTC Form 511-V Individual Income Tax Payment Voucher - Oklahoma

What Is OTC Form 511-V?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 511-V?

A: OTC Form 511-V is the Individual Income Tax Payment Voucher specifically for Oklahoma.

Q: Who needs to use OTC Form 511-V?

A: Anyone who is making an individual income tax payment in Oklahoma may need to use OTC Form 511-V.

Q: What is the purpose of OTC Form 511-V?

A: OTC Form 511-V is used to submit payment for Oklahoma individual income taxes.

Q: Do I need to file OTC Form 511-V if I am getting a refund?

A: No, OTC Form 511-V is only used for making tax payments.

Q: When is the deadline to submit OTC Form 511-V?

A: The deadline to submit OTC Form 511-V is the same as the deadline for filing your Oklahoma individual income tax return.

Q: What if I don't pay my Oklahoma individual income taxes on time?

A: If you don't pay your Oklahoma individual income taxes on time, you may be subject to penalties and interest.

Q: Can I use OTC Form 511-V for other types of taxes?

A: No, OTC Form 511-V is specifically for submitting payment for Oklahoma individual income taxes.

Q: What should I do with OTC Form 511-V after I submit it?

A: Once you submit OTC Form 511-V and make your payment, keep a copy for your records.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 511-V by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.