This version of the form is not currently in use and is provided for reference only. Download this version of

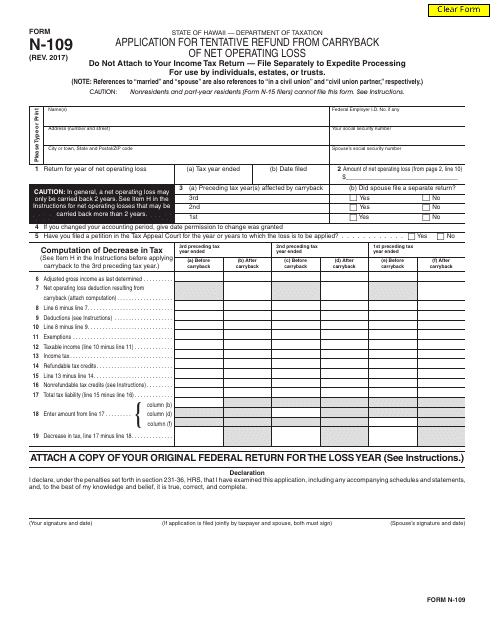

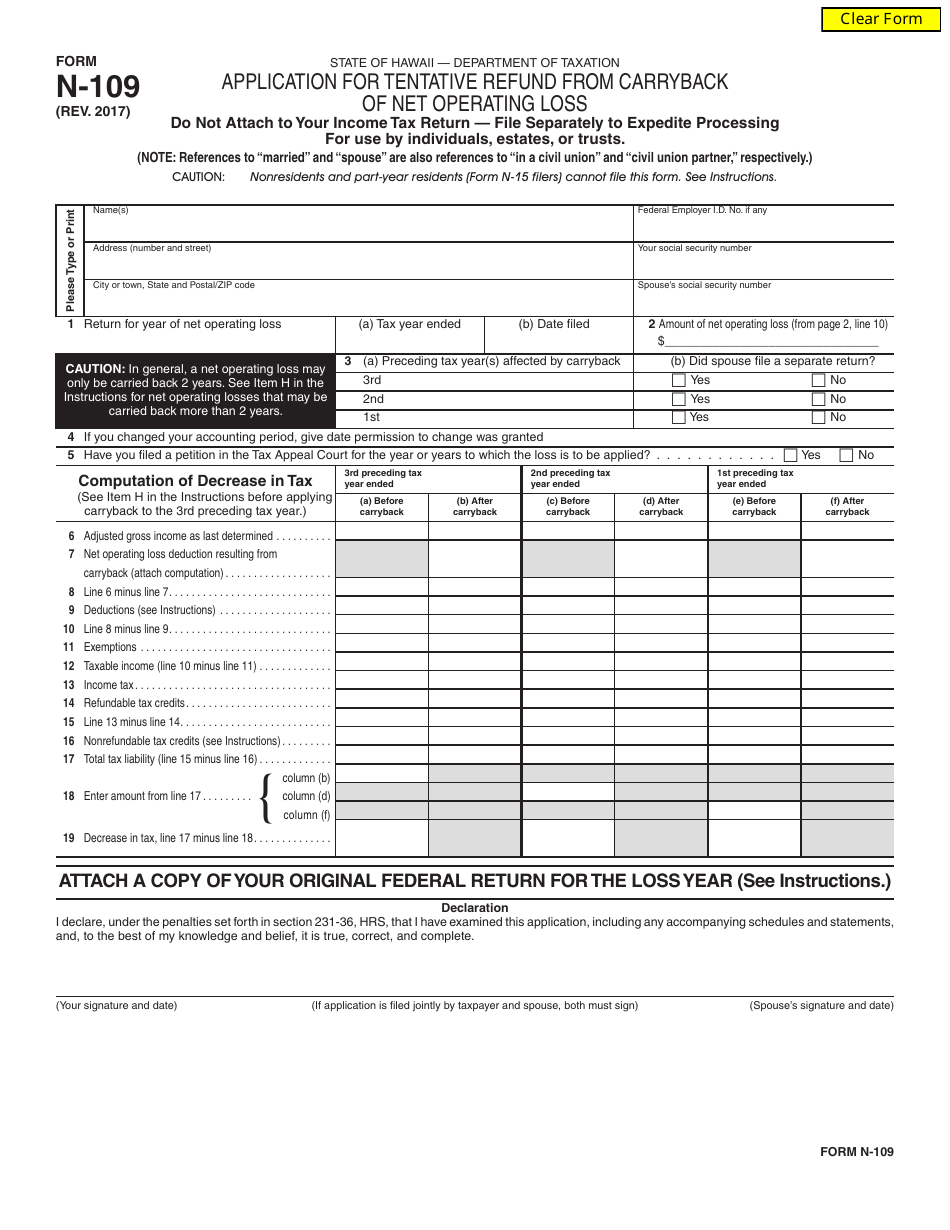

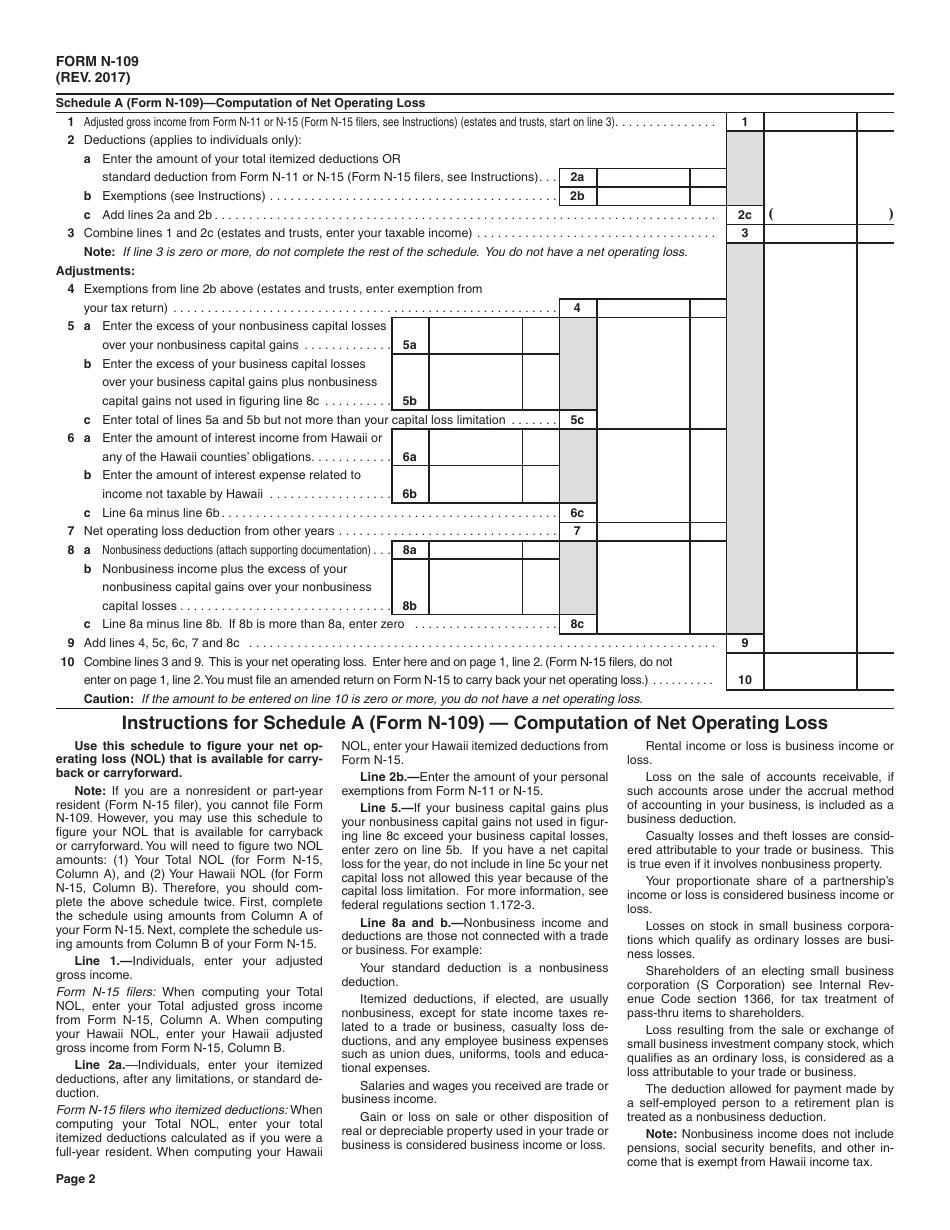

Form N-109

for the current year.

Form N-109 Application for Tentative Refund From Carryback of Net Operating Loss - Hawaii

What Is Form N-109?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-109?

A: Form N-109 is an application for a tentative refund from carryback of a net operating loss in Hawaii.

Q: What is a net operating loss?

A: A net operating loss occurs when a taxpayer's deductible expenses exceed their income.

Q: Who can use Form N-109?

A: Individuals or corporations with a net operating loss from a business or trade in Hawaii can use Form N-109.

Q: What is a tentative refund?

A: A tentative refund is an estimated refund that is subject to verification and adjustment by the tax authorities.

Q: Does Form N-109 apply to residents of other states or countries?

A: No, Form N-109 is specific to taxpayers with a net operating loss from a business or trade in Hawaii.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-109 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.