This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-K

for the current year.

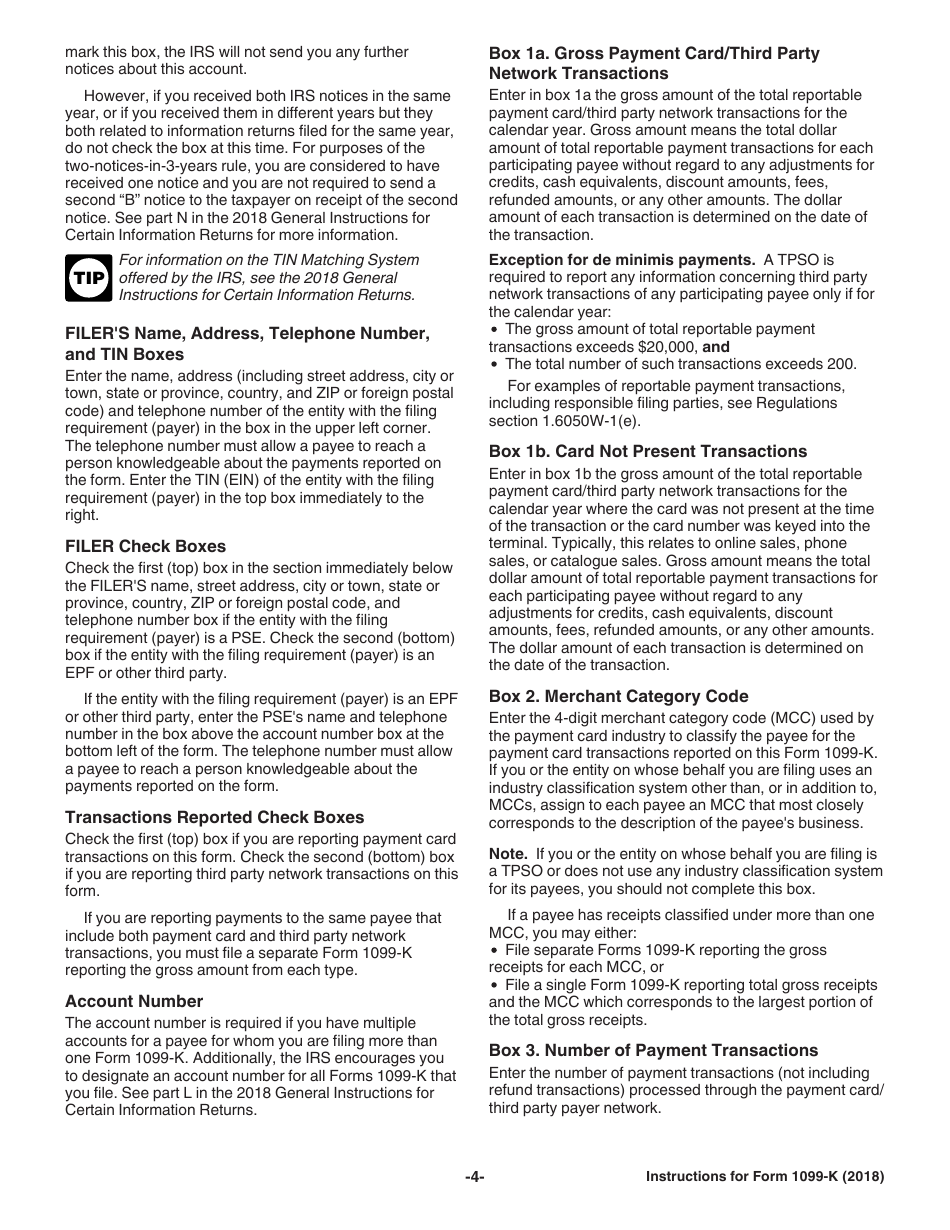

Instructions for IRS Form 1099-K Payment Card and Third Party Network Transactions

This document contains official instructions for IRS Form 1099-K , Payment Card and Third Party Network Transactions - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-K is available for download through this link.

FAQ

Q: What is IRS Form 1099-K?

A: IRS Form 1099-K is a tax form used to report payment card and third party network transactions.

Q: Who needs to file IRS Form 1099-K?

A: Businesses and individuals who receive payment card or third party network transactions totaling $20,000 or more and have 200 or more transactions must file IRS Form 1099-K.

Q: What are payment card transactions?

A: Payment card transactions include any transactions made with credit cards, debit cards, or stored value cards.

Q: What are third party network transactions?

A: Third party network transactions are transactions that are processed by a third party payment settlement organization.

Q: What information is required to be reported on IRS Form 1099-K?

A: IRS Form 1099-K requires the reporting of the gross amount of reportable payment card and third party network transactions.

Q: When is the deadline to file IRS Form 1099-K?

A: The deadline to file IRS Form 1099-K is usually January 31st of the year following the calendar year in which the transactions were made.

Q: What are the consequences of not filing IRS Form 1099-K?

A: Failure to file IRS Form 1099-K or reporting incorrect information may result in penalties and fines.

Q: Can I e-file IRS Form 1099-K?

A: Yes, you can e-file IRS Form 1099-K using the IRS's FIRE system or through an authorized e-file provider.

Q: Do I need to send a copy of IRS Form 1099-K to the recipient?

A: Yes, you are required to send a copy of IRS Form 1099-K to the recipient by January 31st of the year following the calendar year in which the transactions were made.

Instruction Details:

- This 5-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.