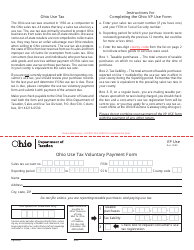

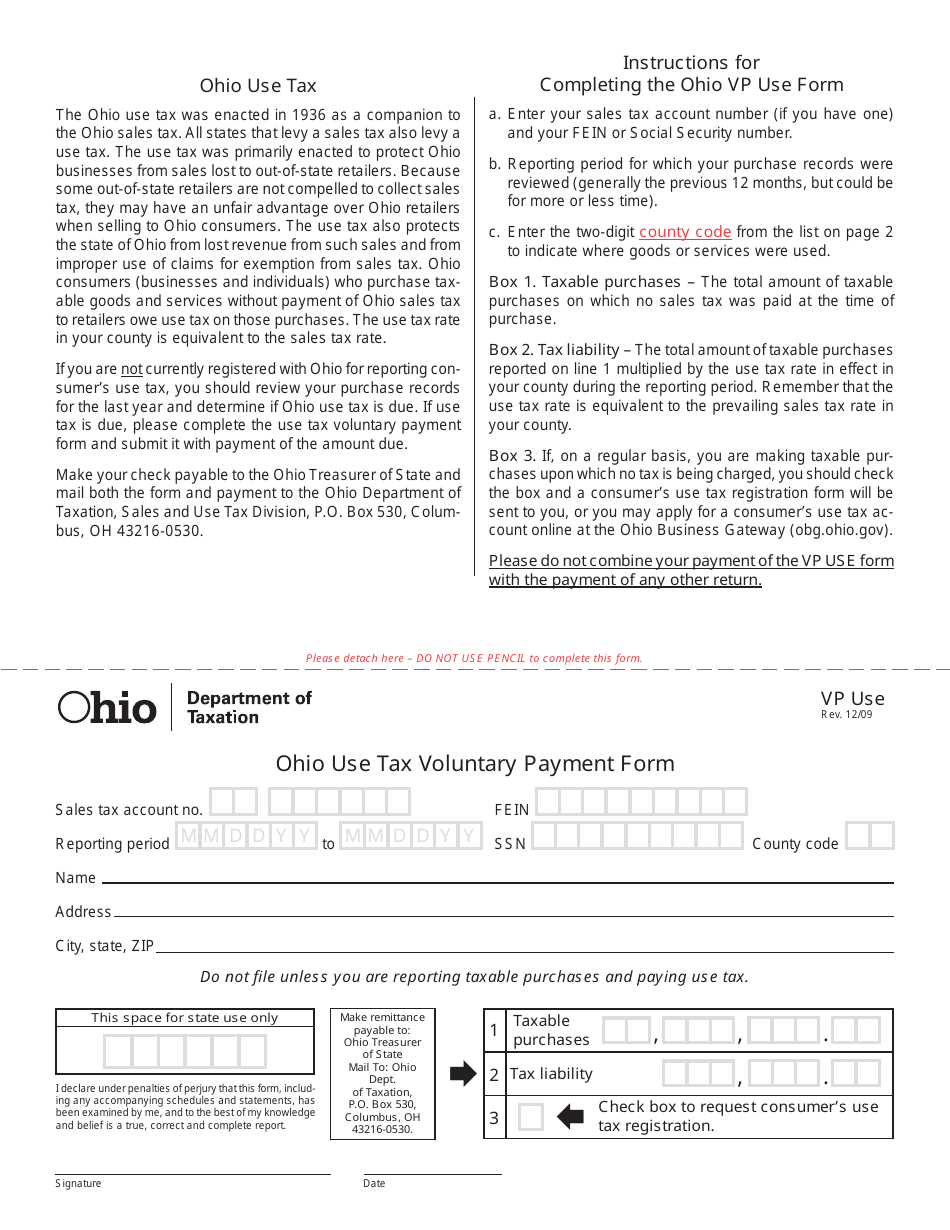

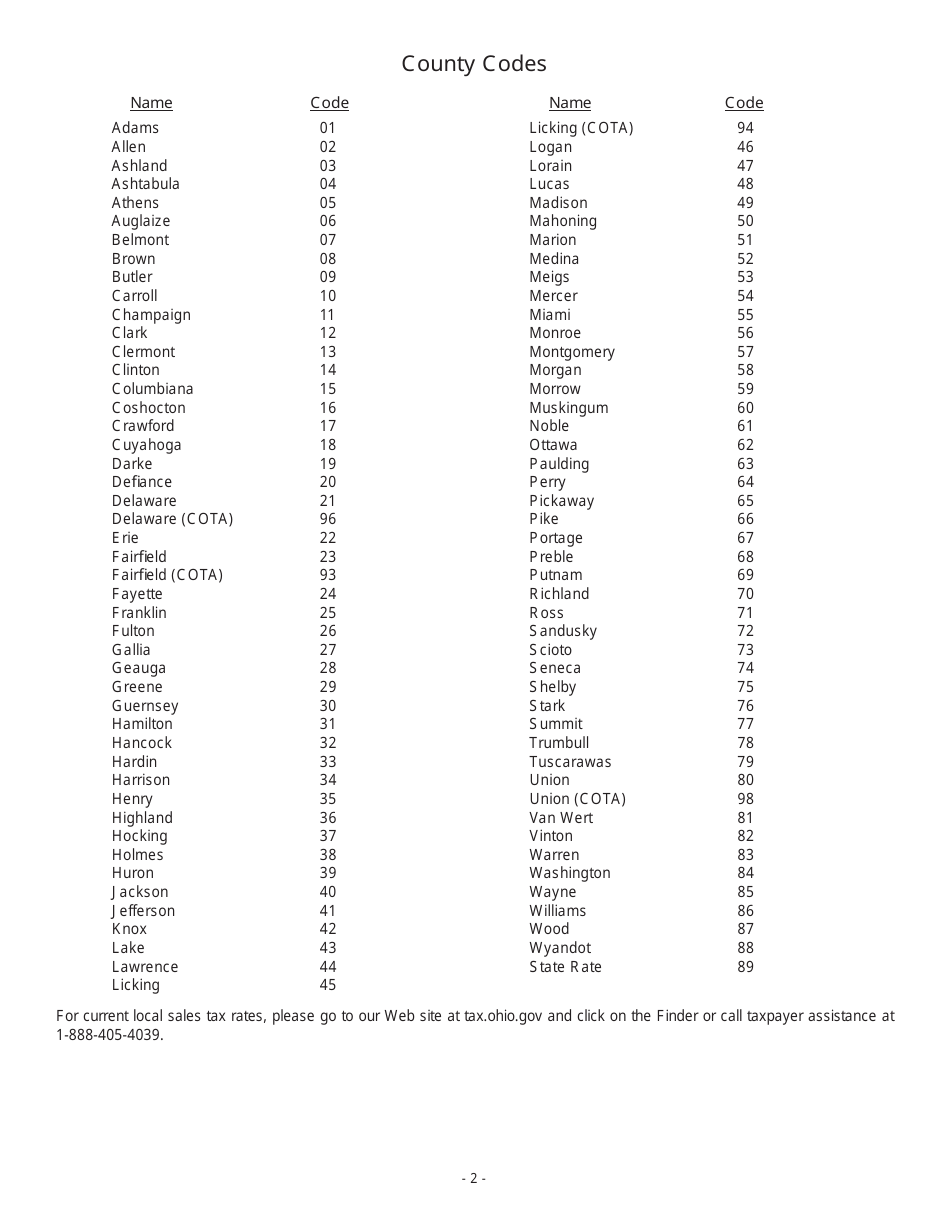

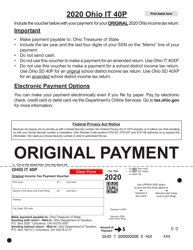

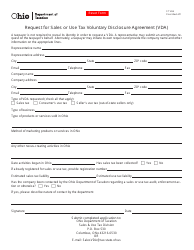

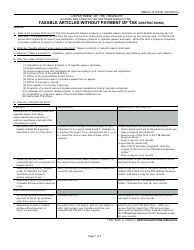

Form VP USE Ohio Use Tax Voluntary Payment Form - Ohio

What Is Form VP USE?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form VP USE Ohio Use Tax Voluntary Payment Form?

A: The Form VP USE Ohio Use Tax Voluntary Payment Form is a document used to voluntarily report and pay use tax in Ohio.

Q: What is use tax?

A: Use tax is a tax on the use, consumption, or storage of goods and services purchased outside of Ohio but used in the state.

Q: When should I use the Form VP USE Ohio Use Tax Voluntary Payment Form?

A: You should use the Form VP USE Ohio Use Tax Voluntary Payment Form if you have purchased goods or services from outside of Ohio and didn't pay sales tax at the time of purchase.

Q: Is the use tax payment voluntary?

A: Yes, the use tax payment is voluntary, but if you are liable for use tax and choose not to report and pay it, you may be subject to penalties.

Q: Do I have to file the Form VP USE Ohio Use Tax Voluntary Payment Form annually?

A: No, you do not have to file the Form VP USE Ohio Use Tax Voluntary Payment Form annually. You only need to file it if you have made taxable purchases and need to report and pay use tax.

Q: What happens if I don't report and pay use tax?

A: If you are liable for use tax and choose not to report and pay it, you may be subject to penalties, including interest and fines.

Q: Is there a deadline for filing the Form VP USE Ohio Use Tax Voluntary Payment Form?

A: There is no specific deadline for filing the Form VP USE Ohio Use Tax Voluntary Payment Form. However, it is recommended to report and pay use tax in a timely manner to avoid penalties.

Q: Can I deduct use tax paid on my federal income tax return?

A: Yes, you may be able to deduct use tax paid on your federal income tax return, but it is recommended to consult a tax professional for guidance.

Form Details:

- Released on December 1, 2009;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form VP USE by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.