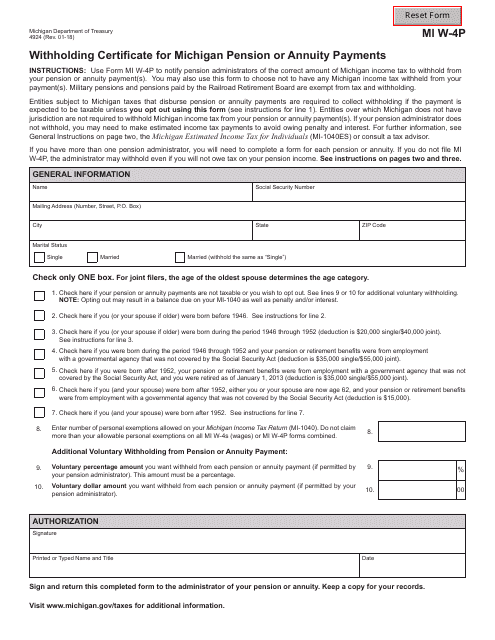

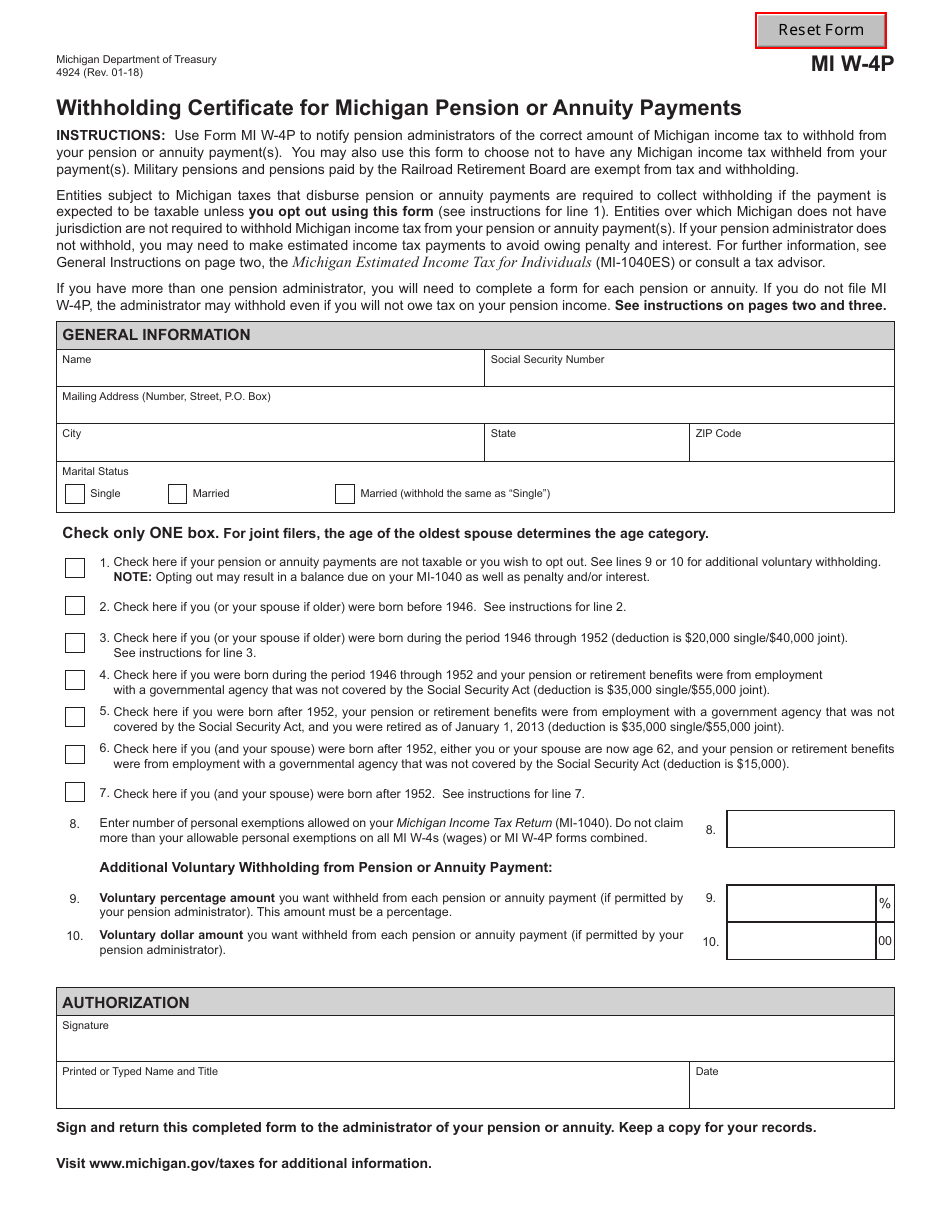

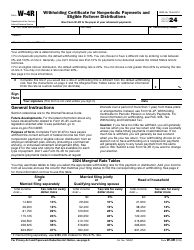

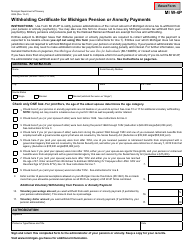

Form MIW-4P Withholding Certificate for Michigan Pension or Annuity Payments - Michigan

What Is Form MIW-4P?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MIW-4P?

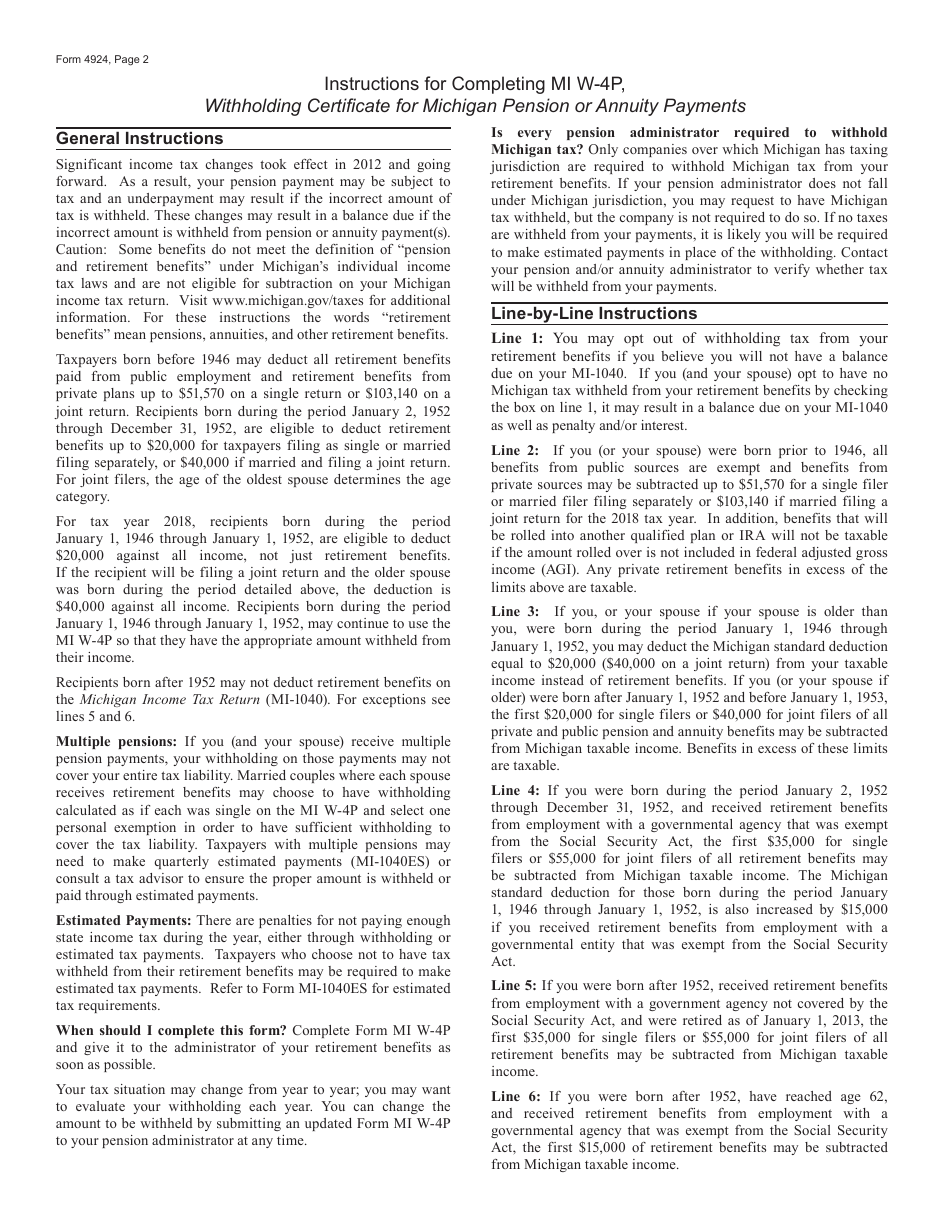

A: Form MIW-4P is a withholding certificate that individuals can use to specify the amount of Michigan income tax to be withheld from their pension or annuity payments.

Q: Who needs to complete Form MIW-4P?

A: Individuals who receive pension or annuity payments from sources in Michigan and want to specify the amount of state income tax to be withheld.

Q: When should I submit Form MIW-4P?

A: You should submit Form MIW-4P as soon as possible after you start receiving pension or annuity payments, or whenever you want to change your withholding.

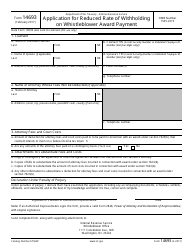

Q: Do I need to attach any documents with Form MIW-4P?

A: No, you do not need to attach any documents with Form MIW-4P.

Q: Can I make changes to my withholding by submitting a new Form MIW-4P?

A: Yes, you can make changes to your withholding by submitting a new Form MIW-4P at any time.

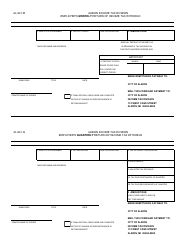

Q: Are there any penalties for not submitting Form MIW-4P?

A: There are no penalties for not submitting Form MIW-4P, but it is recommended to submit the form to ensure accurate withholding of Michigan income tax.

Q: Is there an electronic filing option for Form MIW-4P?

A: No, there is currently no electronic filing option for Form MIW-4P. It must be submitted by mail.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MIW-4P by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.