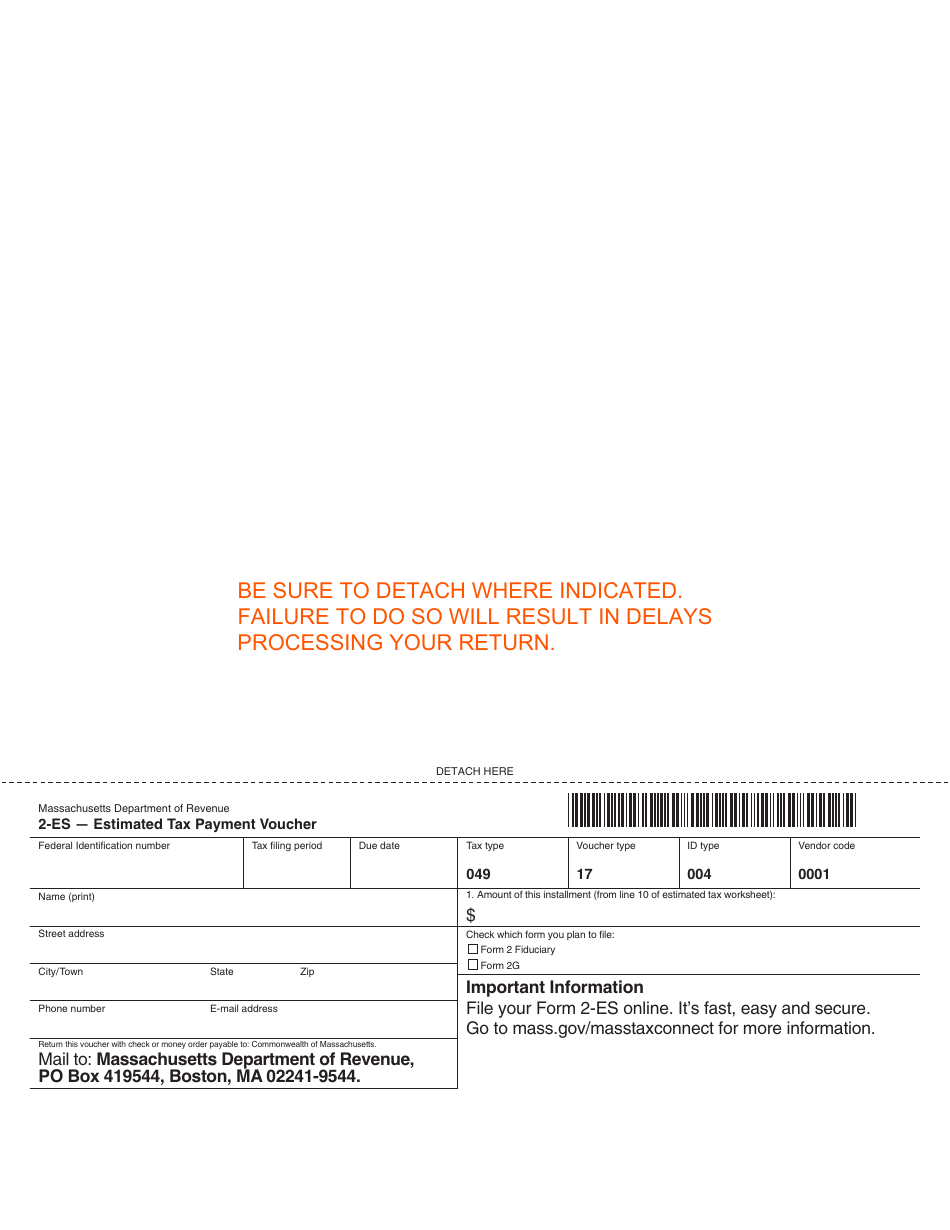

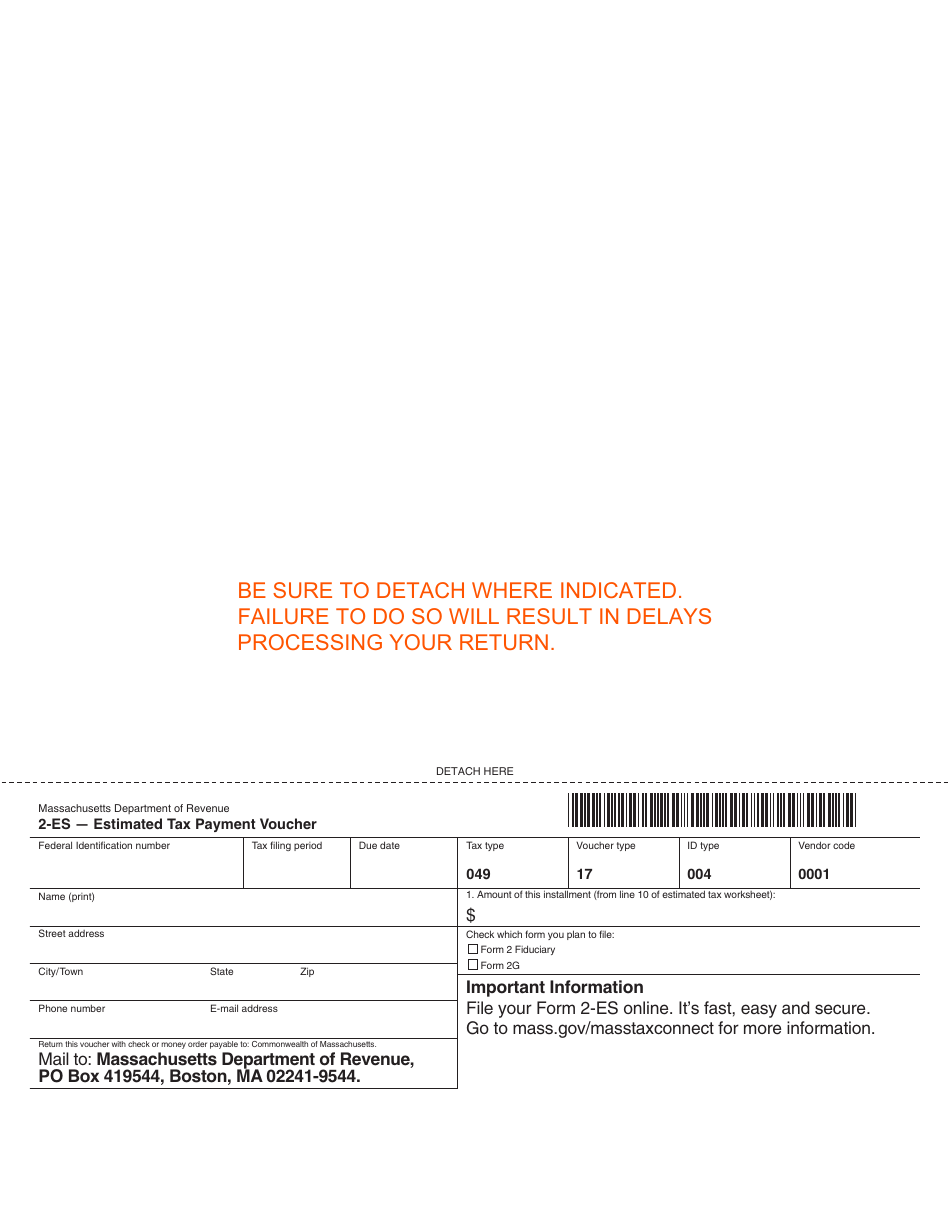

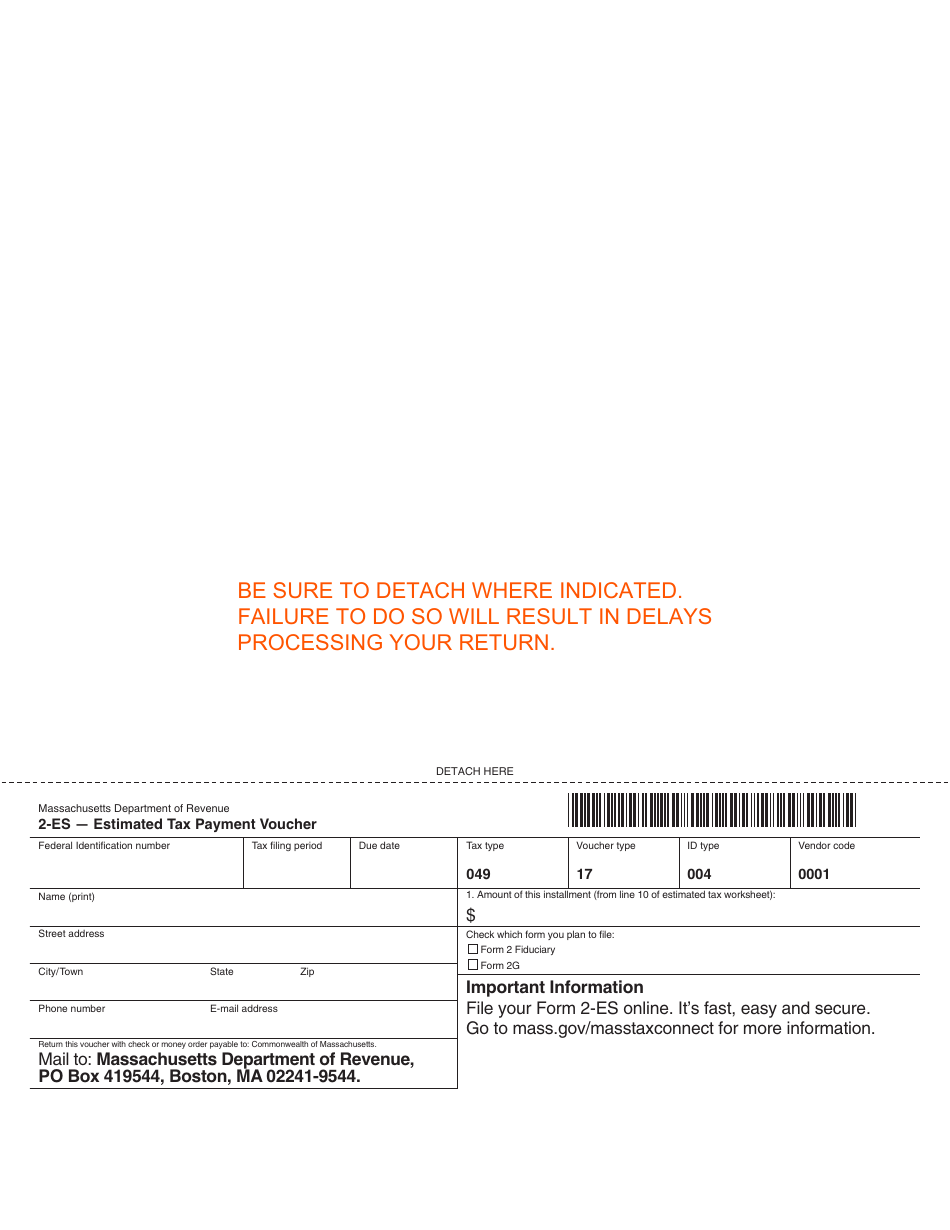

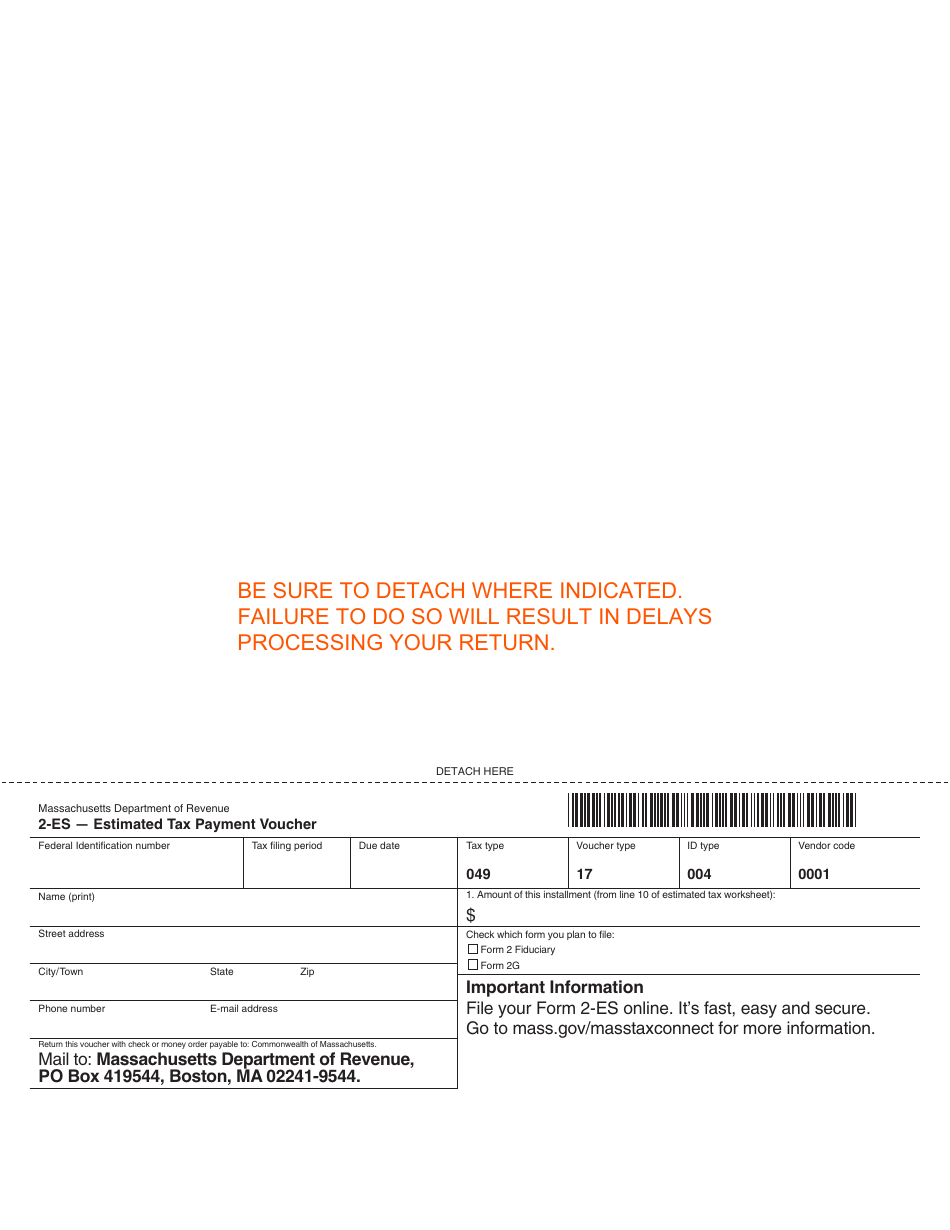

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 2-ES

for the current year.

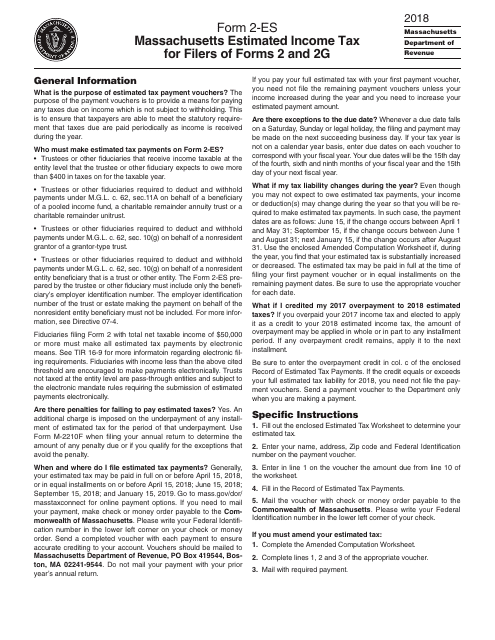

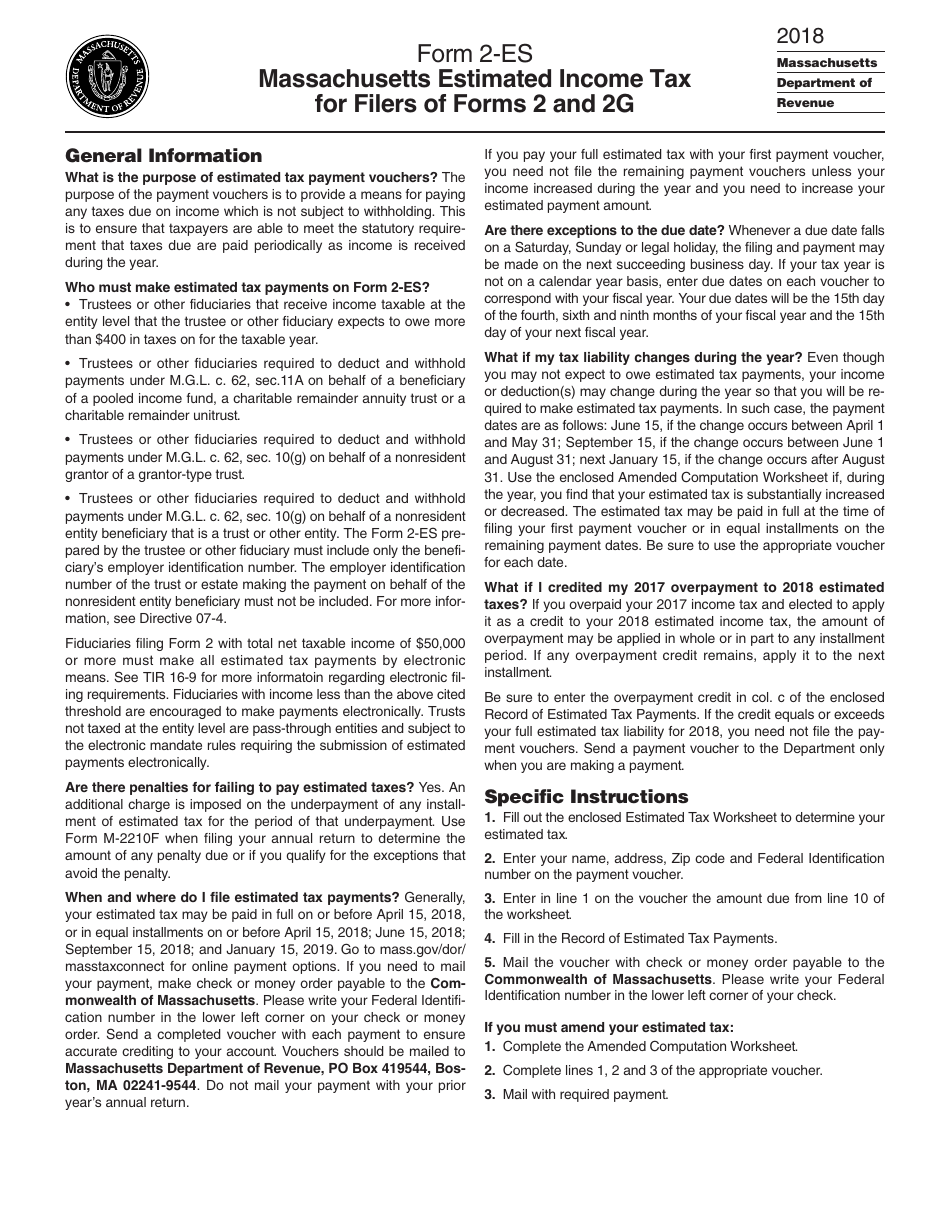

Form 2-ES Massachusetts Estimated Income Tax for Filers of Forms 2 and 2g - Massachusetts

What Is Form 2-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2-ES?

A: Form 2-ES is the Massachusetts Estimated Income Tax form for filers of Forms 2 and 2g.

Q: Who needs to file Form 2-ES?

A: Taxpayers who are required to file Forms 2 or 2g in Massachusetts need to file Form 2-ES.

Q: What is the purpose of Form 2-ES?

A: The purpose of Form 2-ES is to estimate and pay your income taxes throughout the year.

Q: When is Form 2-ES due?

A: Form 2-ES is due on April 15th or the 15th day of the 4th, 6th, and 9th months of the taxable year.

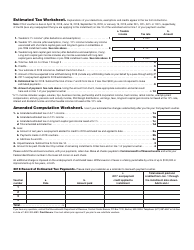

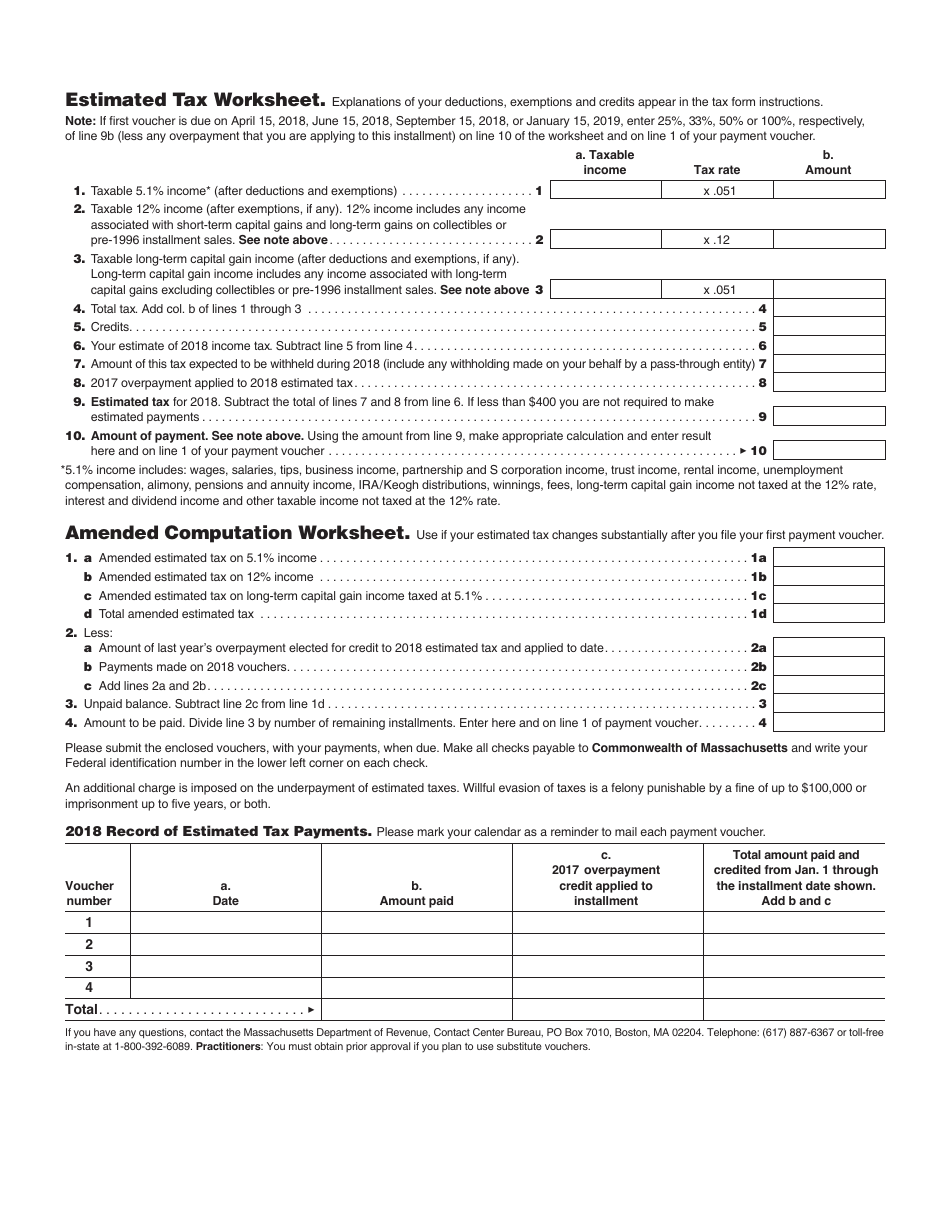

Q: How do I fill out Form 2-ES?

A: You need to provide your name, Social Security number, estimated income, and calculate your estimated tax liability on Form 2-ES.

Q: Can I make changes to Form 2-ES?

A: Yes, if your estimated income or tax liability changes during the year, you can make changes to your Form 2-ES.

Q: What happens if I don't file Form 2-ES?

A: If you don't file Form 2-ES or pay enough estimated taxes, you may be subject to penalties and interest.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 2-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.