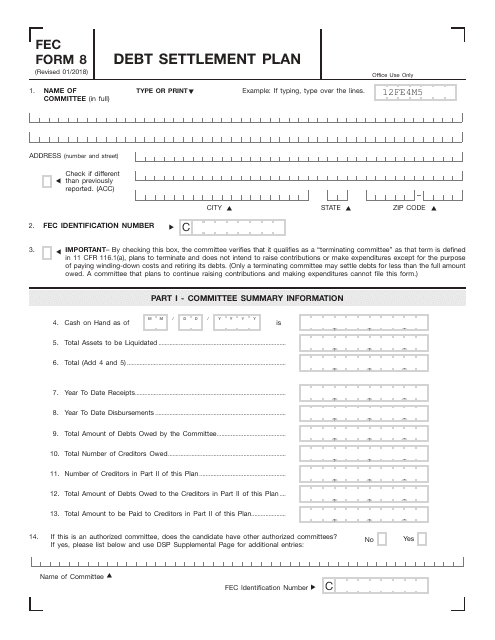

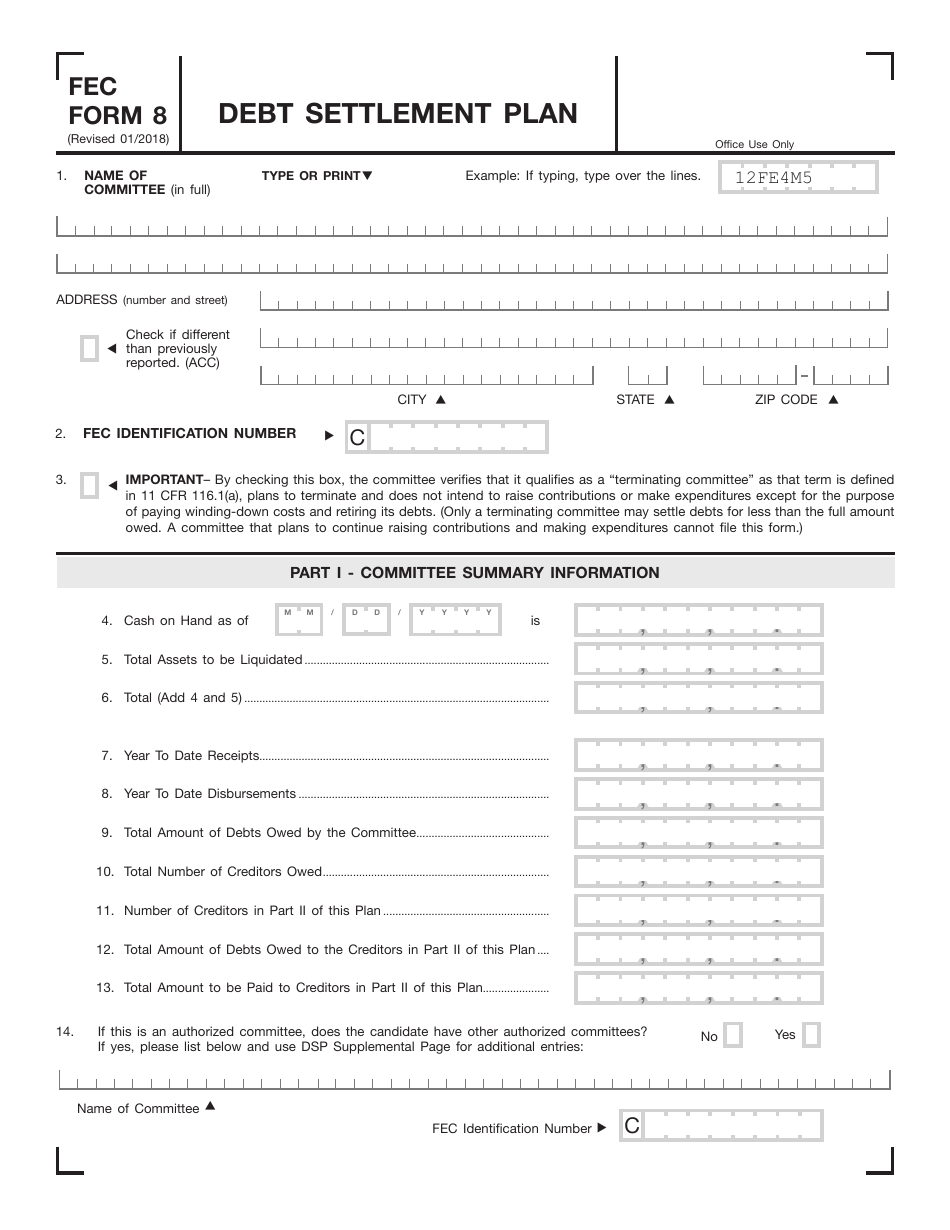

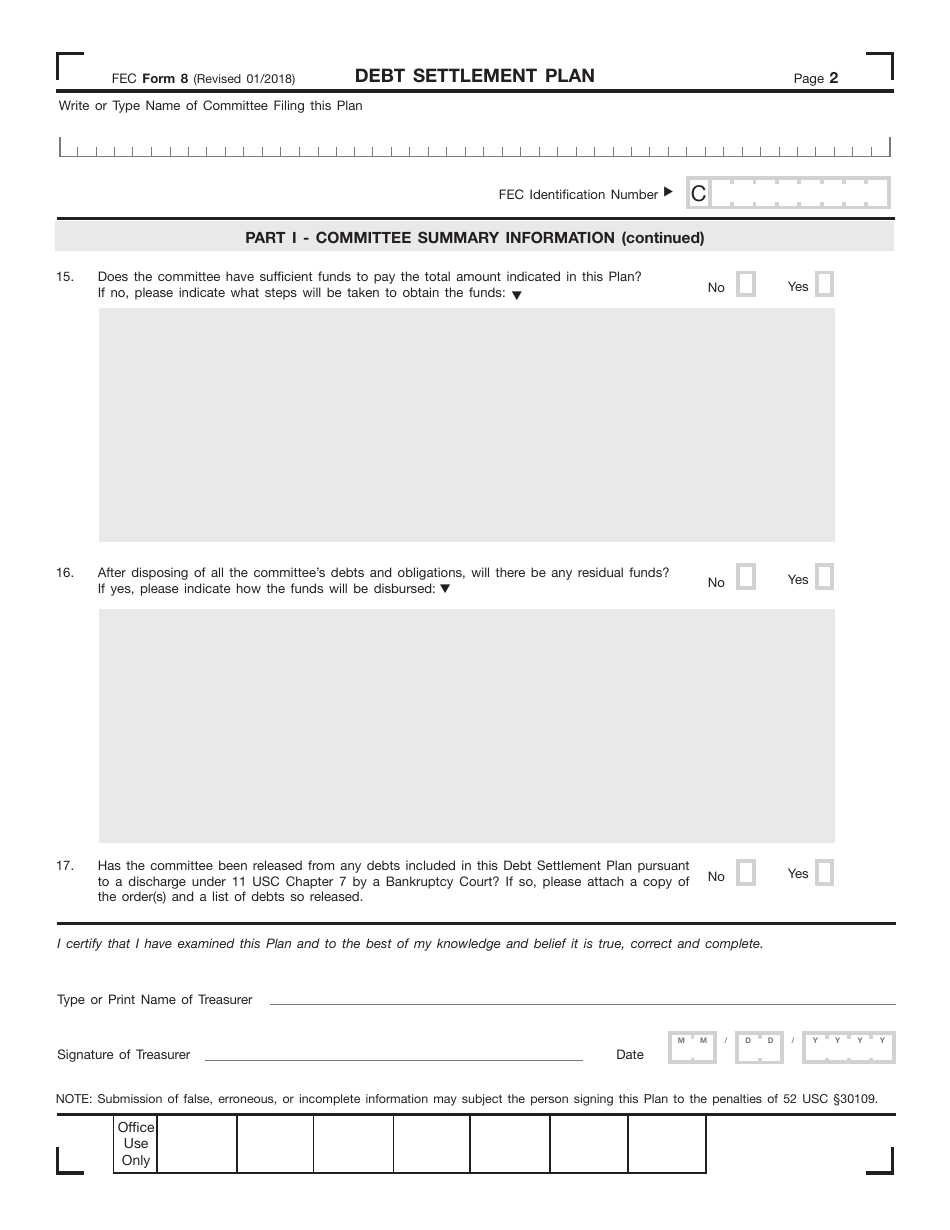

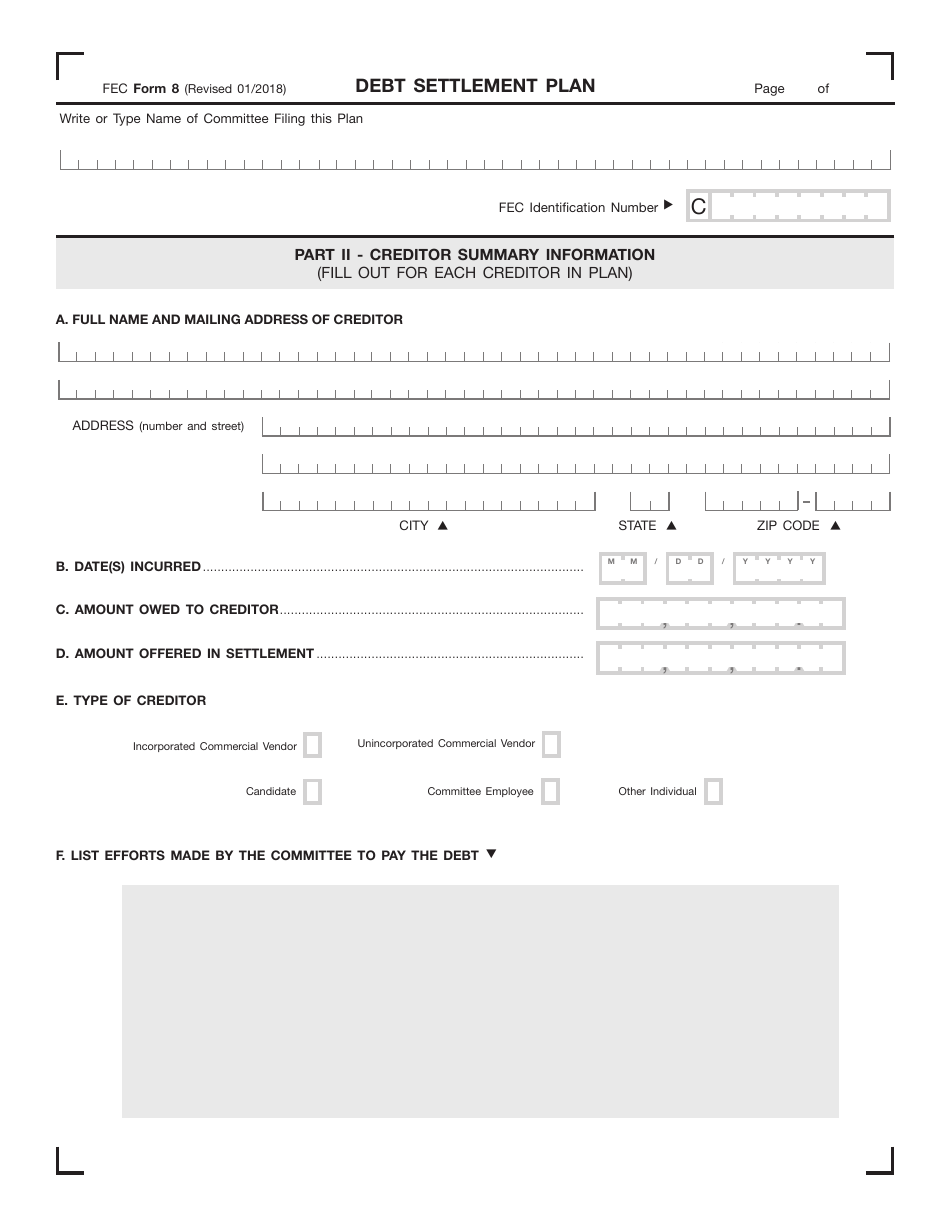

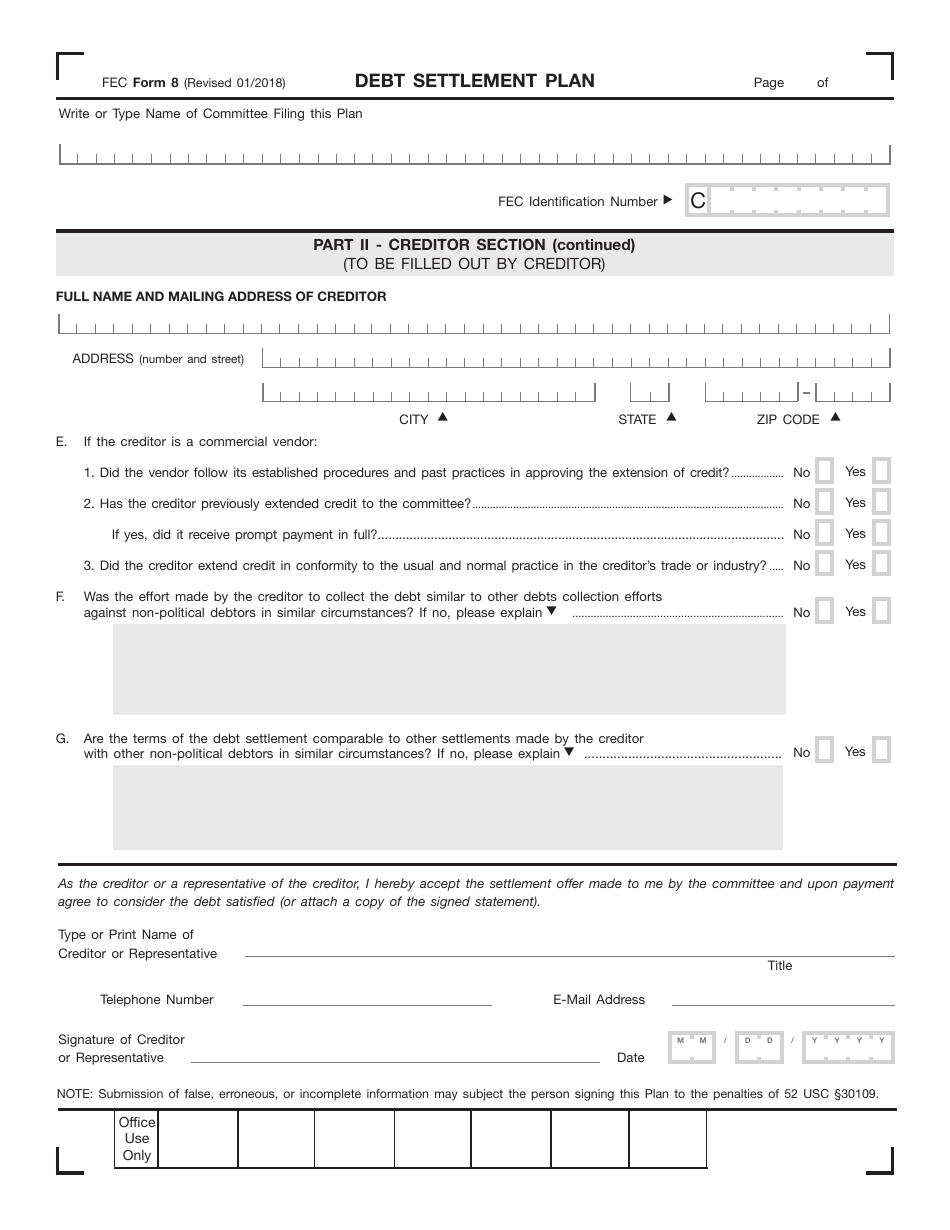

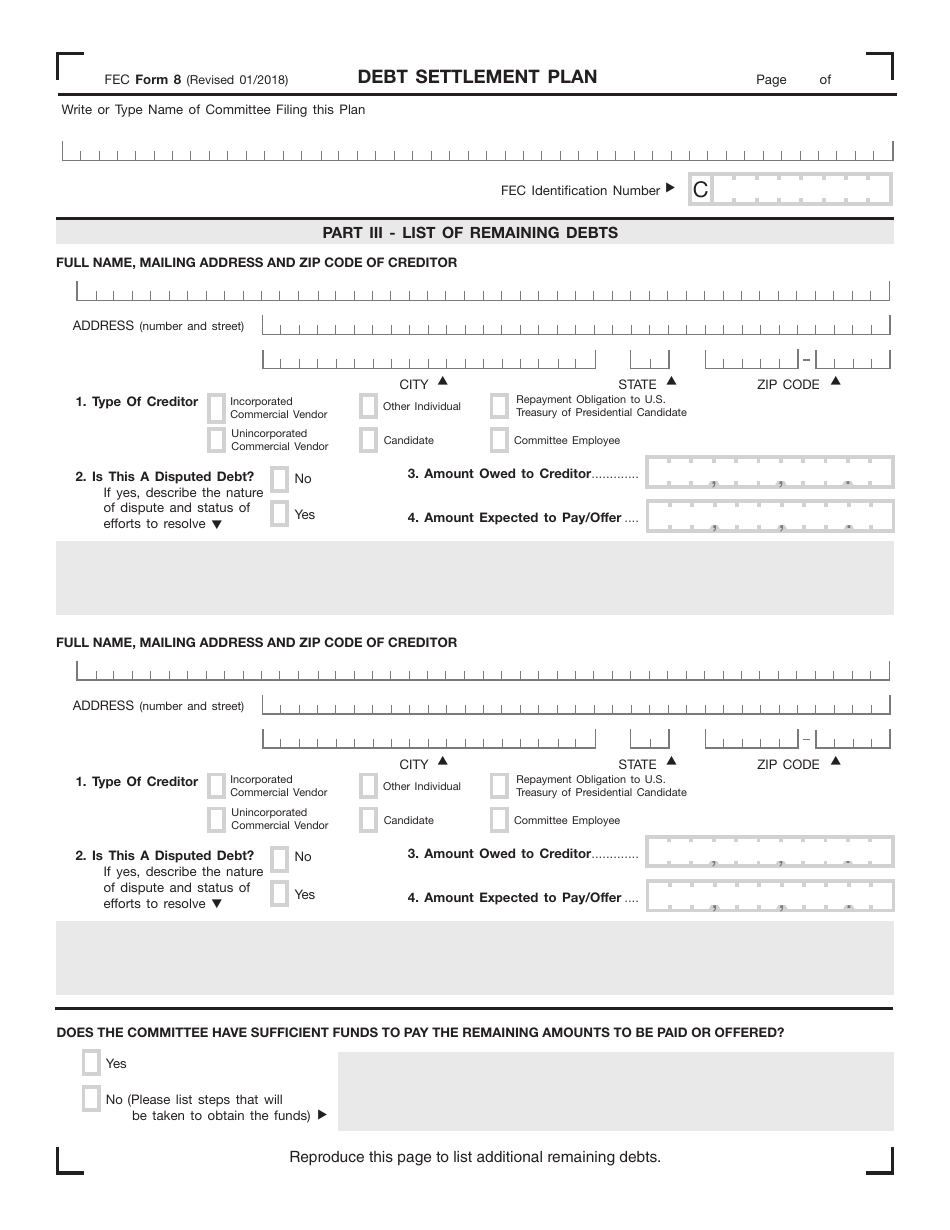

FEC Form 8 Debt Settlement Plan

What Is FEC Form 8?

This is a legal form that was released by the Federal Election Commission on January 1, 2018 and used country-wide. Check the official instructions before completing and submitting the form.

FAQ

Q: What is a FEC Form 8?

A: FEC Form 8 is a form used by political committees to report their outstanding debts and propose a plan to settle those debts.

Q: What is a debt settlement plan?

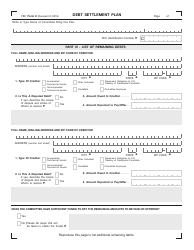

A: A debt settlement plan is a formal proposal by a political committee to pay off its outstanding debts over a period of time, usually through a series of scheduled payments.

Q: Who uses FEC Form 8?

A: Political committees, including campaigns, political parties, and PACs, use FEC Form 8 to report and propose settlement plans for their debts.

Q: What information is included in FEC Form 8?

A: FEC Form 8 includes details about the committee's outstanding debts, such as the creditor's name, the amount owed, and the nature of the debt.

Q: What happens after submitting FEC Form 8?

A: After submitting FEC Form 8, the committee's proposed debt settlement plan is reviewed by the Federal Election Commission (FEC) to ensure compliance with campaign finance regulations.

Q: Are debt settlement plans mandatory for political committees?

A: No, debt settlement plans are not mandatory for political committees. However, committees are required to report their outstanding debts on FEC Form 8, even if they do not propose a settlement plan.

Q: Can a debt settlement plan affect a committee's ability to raise funds?

A: Yes, a debt settlement plan can potentially affect a committee's ability to raise funds, as it may impact the committee's financial standing and reputation.

Q: What are the consequences of not fulfilling a debt settlement plan?

A: If a political committee fails to fulfill its proposed debt settlement plan, it may face penalties and legal consequences, including fines and possible legal action.

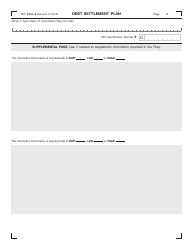

Q: Can a debt settlement plan be modified or amended?

A: Yes, a debt settlement plan can be modified or amended if both the committee and the debtor agree to the changes. However, any modifications should be reported to the FEC.

Form Details:

- Released on January 1, 2018;

- The latest available edition released by the Federal Election Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of FEC Form 8 by clicking the link below or browse more documents and templates provided by the Federal Election Commission.