This version of the form is not currently in use and is provided for reference only. Download this version of

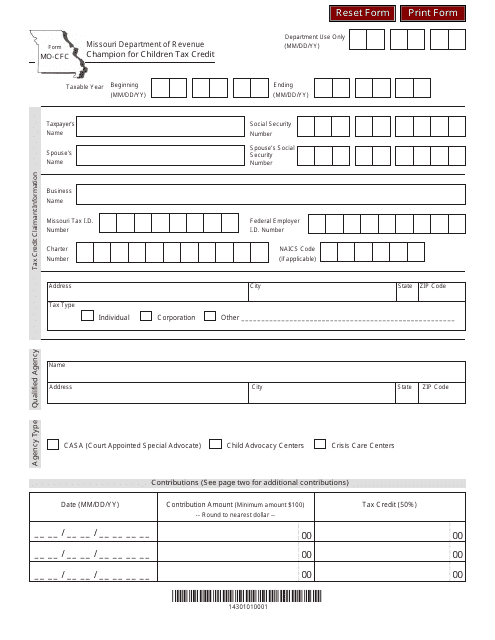

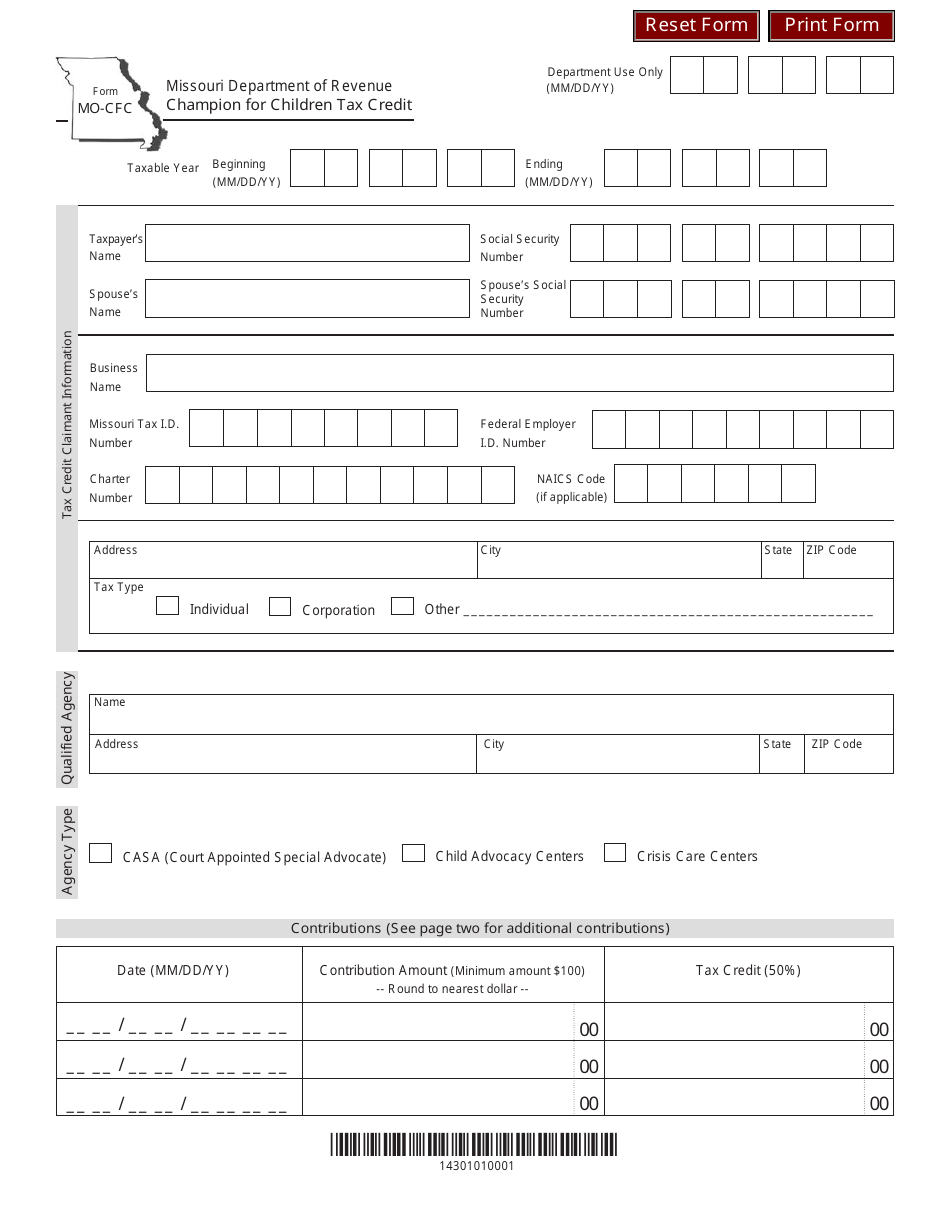

Form MO-CFC

for the current year.

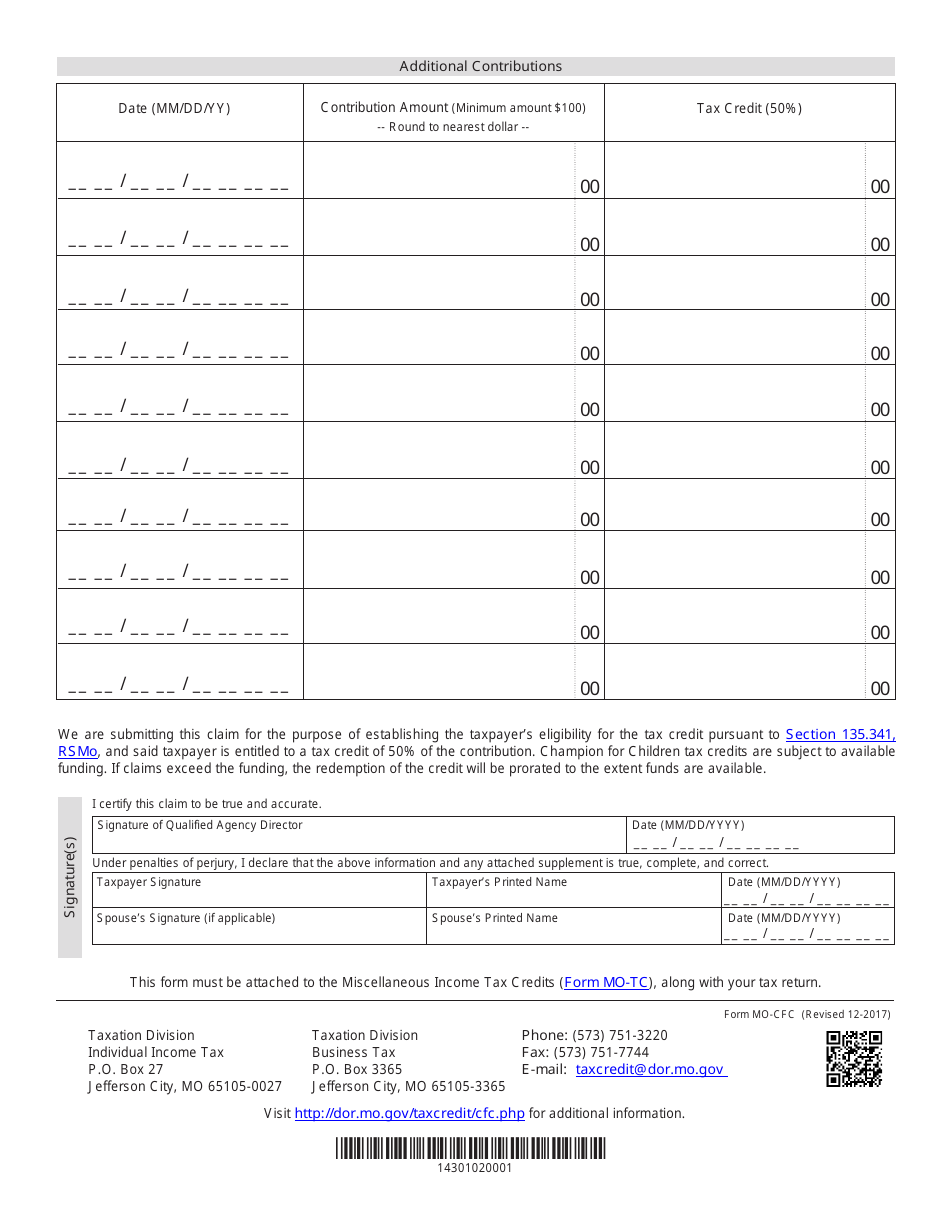

Form MO-CFC Champion for Children Tax Credit - Missouri

What Is Form MO-CFC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is MO-CFC Champion for Children Tax Credit?

A: MO-CFC Champion for Children Tax Credit is a tax credit available in Missouri.

Q: Who is eligible for MO-CFC Champion for Children Tax Credit?

A: Eligible individuals and businesses in Missouri are eligible for MO-CFC Champion for Children Tax Credit.

Q: How do I apply for MO-CFC Champion for Children Tax Credit?

A: You can apply for MO-CFC Champion for Children Tax Credit by filling out Form MO-CFC and submitting it to the Missouri Department of Revenue.

Q: What is the purpose of MO-CFC Champion for Children Tax Credit?

A: The purpose of MO-CFC Champion for Children Tax Credit is to encourage donations to qualified child advocacy organizations in Missouri.

Q: How much tax credit can I receive through MO-CFC Champion for Children Tax Credit?

A: The amount of tax credit you can receive through MO-CFC Champion for Children Tax Credit depends on the amount of your donation and the total available credits for the year.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-CFC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.