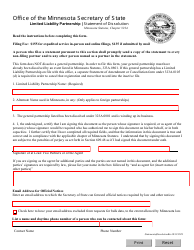

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

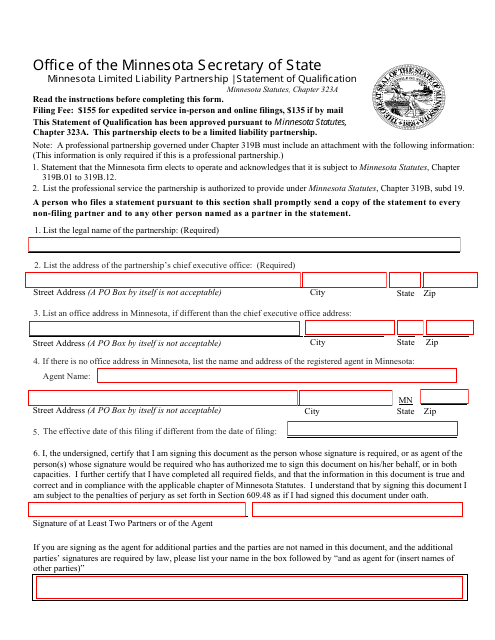

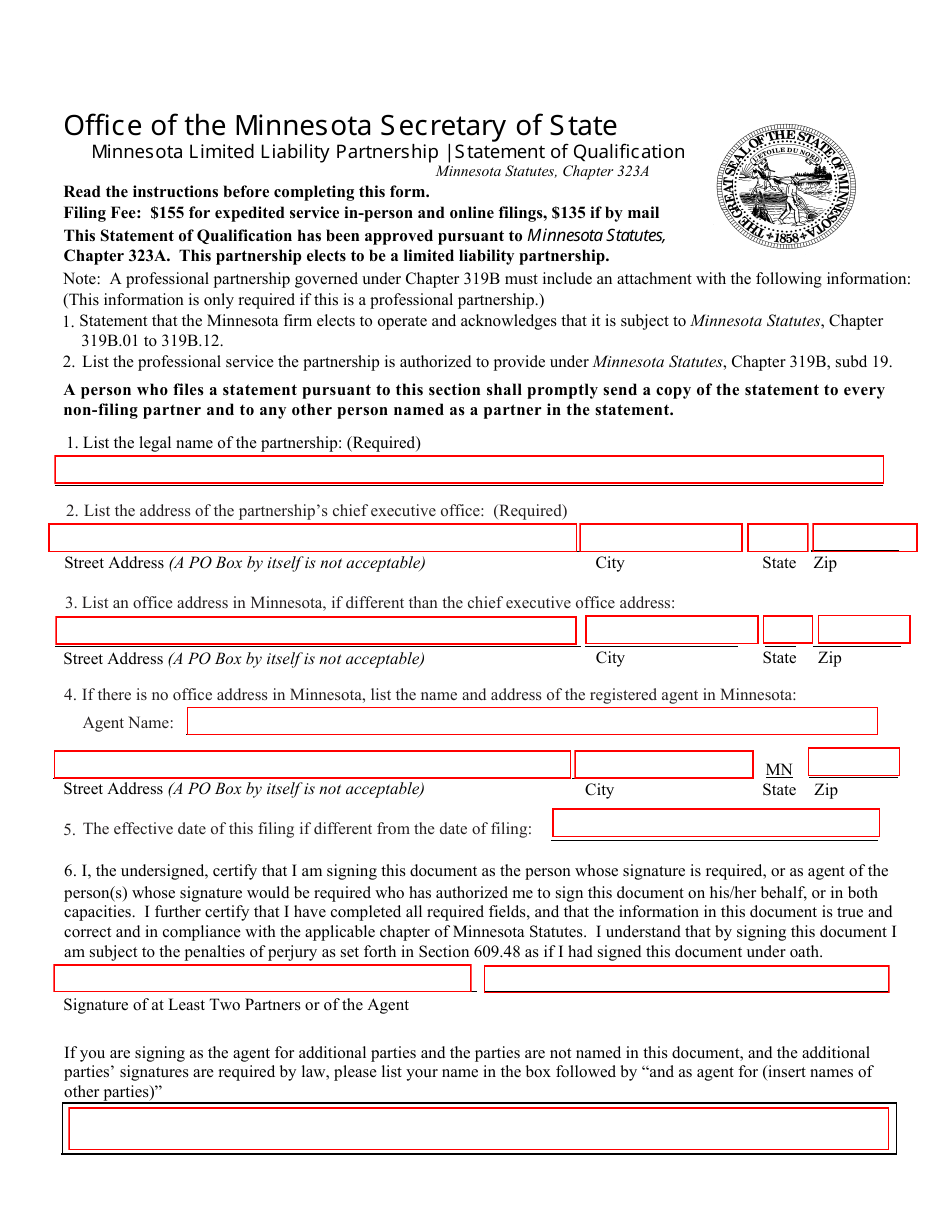

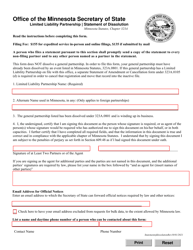

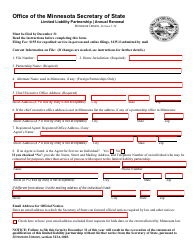

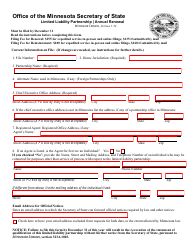

Minnesota Limited Liability Partnership Statement of Qualification - Minnesota

Minnesota Limited Liability Partnership Statement of Qualification is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

Q: What is a Limited Liability Partnership (LLP) in Minnesota?

A: A Limited Liability Partnership (LLP) is a legal business structure where the partners have limited personal liability for the debts and liabilities of the partnership.

Q: How do I form a Limited Liability Partnership (LLP) in Minnesota?

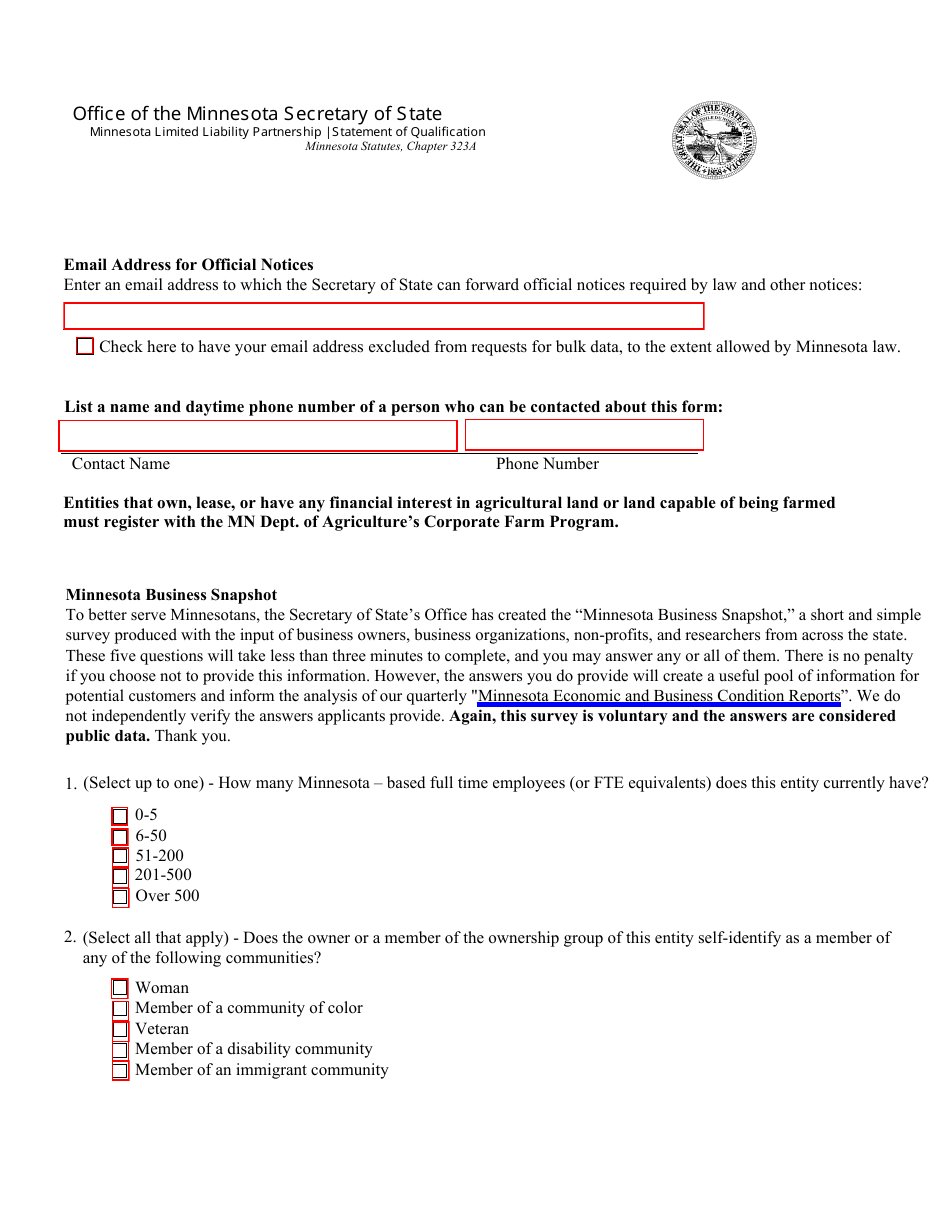

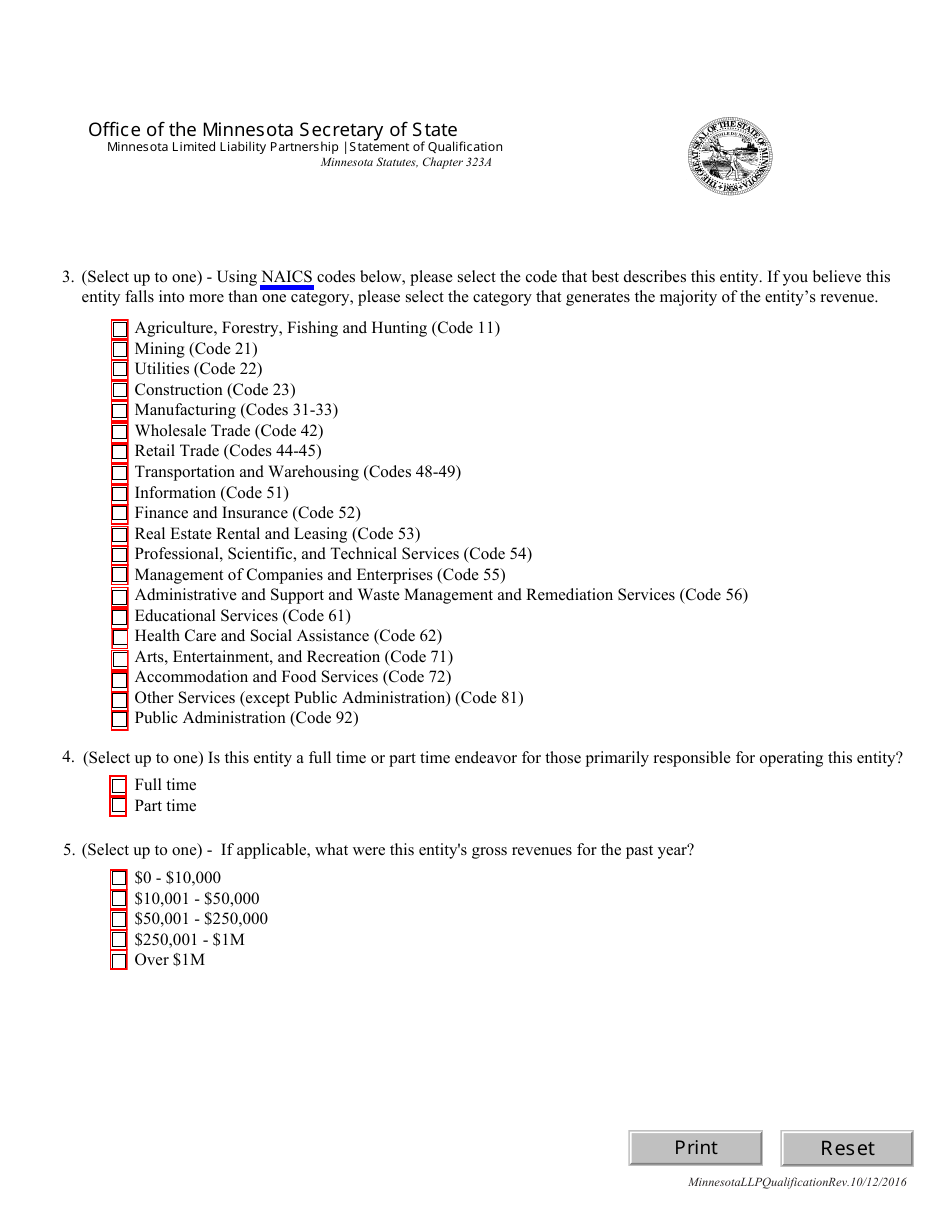

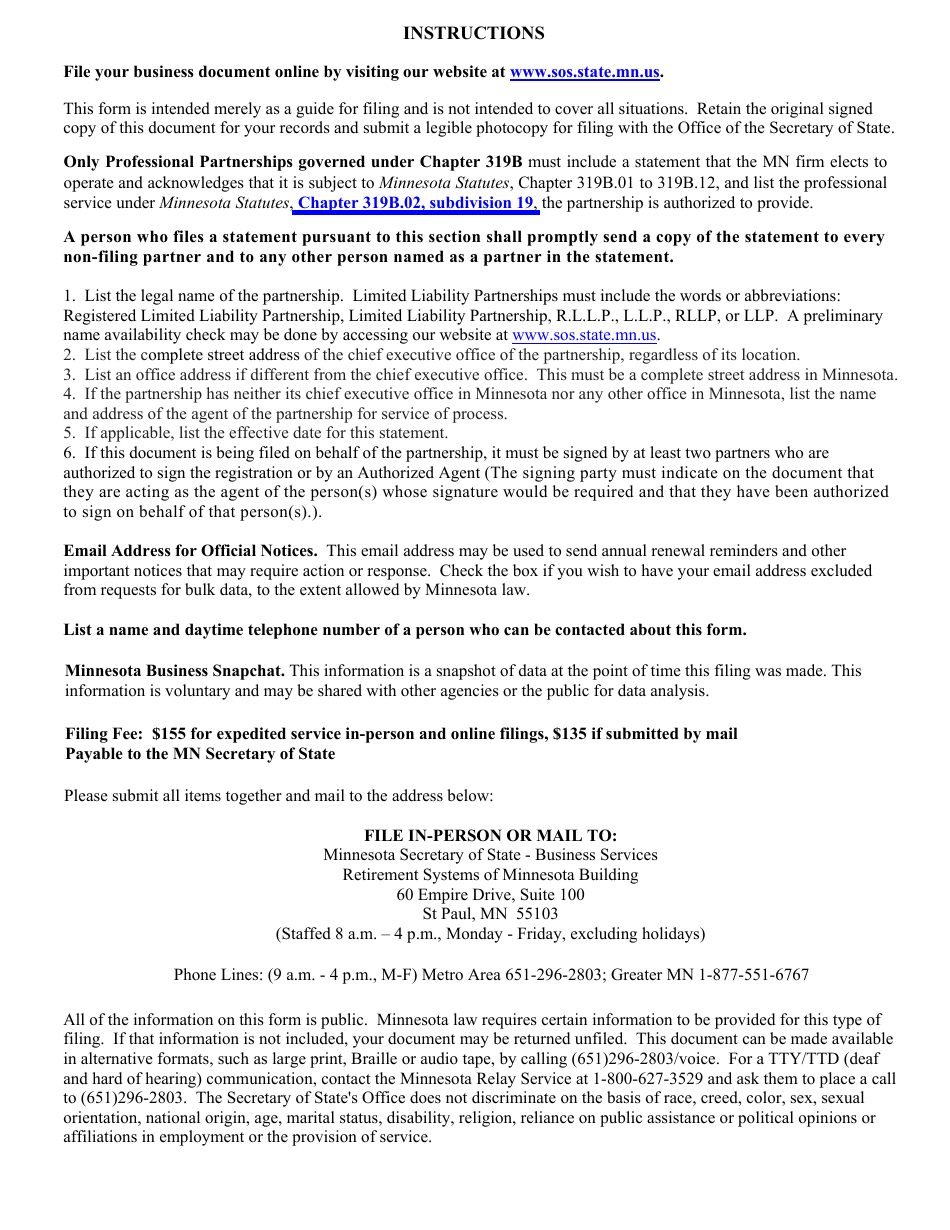

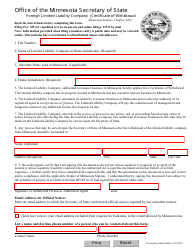

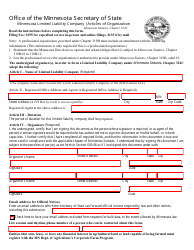

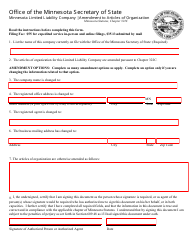

A: To form an LLP in Minnesota, you need to file a Statement of Qualification with the Minnesota Secretary of State and pay the required filing fee.

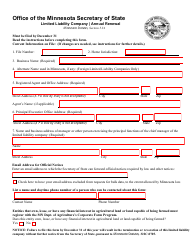

Q: What information is required in the Statement of Qualification for a Minnesota LLP?

A: The Statement of Qualification for a Minnesota LLP must include the name and address of the partnership, the name and address of the registered agent, and the effective date of the LLP.

Q: What are the advantages of forming a Limited Liability Partnership (LLP) in Minnesota?

A: The main advantage of an LLP is that it provides partners with limited personal liability, protecting their personal assets from the partnership's debts and liabilities.

Q: Can professionals, such as lawyers or accountants, form a Limited Liability Partnership (LLP) in Minnesota?

A: Yes, professionals like lawyers or accountants can form an LLP in Minnesota, as long as they meet the state's requirements for professional licensing and practice.

Q: Do partners in a Minnesota LLP have to pay income taxes as a partnership?

A: No, partners in a Minnesota LLP are generally not required to pay income taxes as a partnership. Instead, they report their share of the LLP's income on their individual tax returns.

Q: Can a Limited Liability Partnership (LLP) in Minnesota have more than two partners?

A: Yes, a Minnesota LLP can have more than two partners. There is no limit on the number of partners an LLP can have.

Q: Can a Limited Liability Partnership (LLP) convert to a different business entity in Minnesota?

A: Yes, an LLP in Minnesota can convert to a different business entity by following the conversion process outlined by the Minnesota Secretary of State.

Q: Do Limited Liability Partnerships (LLPs) in Minnesota need to have a partnership agreement?

A: While not required by law, it is highly recommended for LLPs in Minnesota to have a partnership agreement that outlines the rights and responsibilities of the partners and the operating procedures of the LLP.

Form Details:

- Released on October 12, 2016;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.