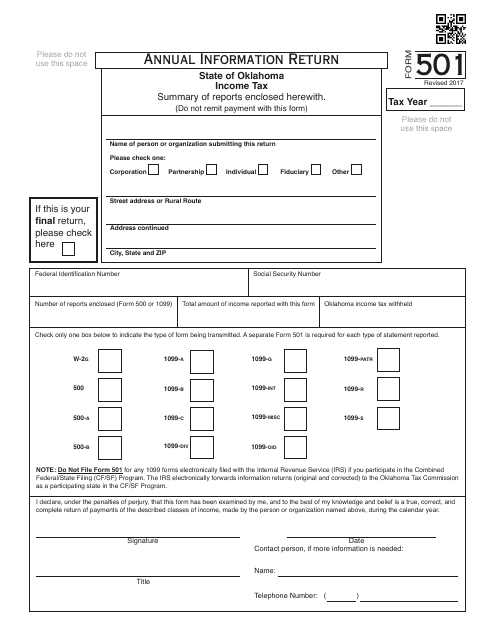

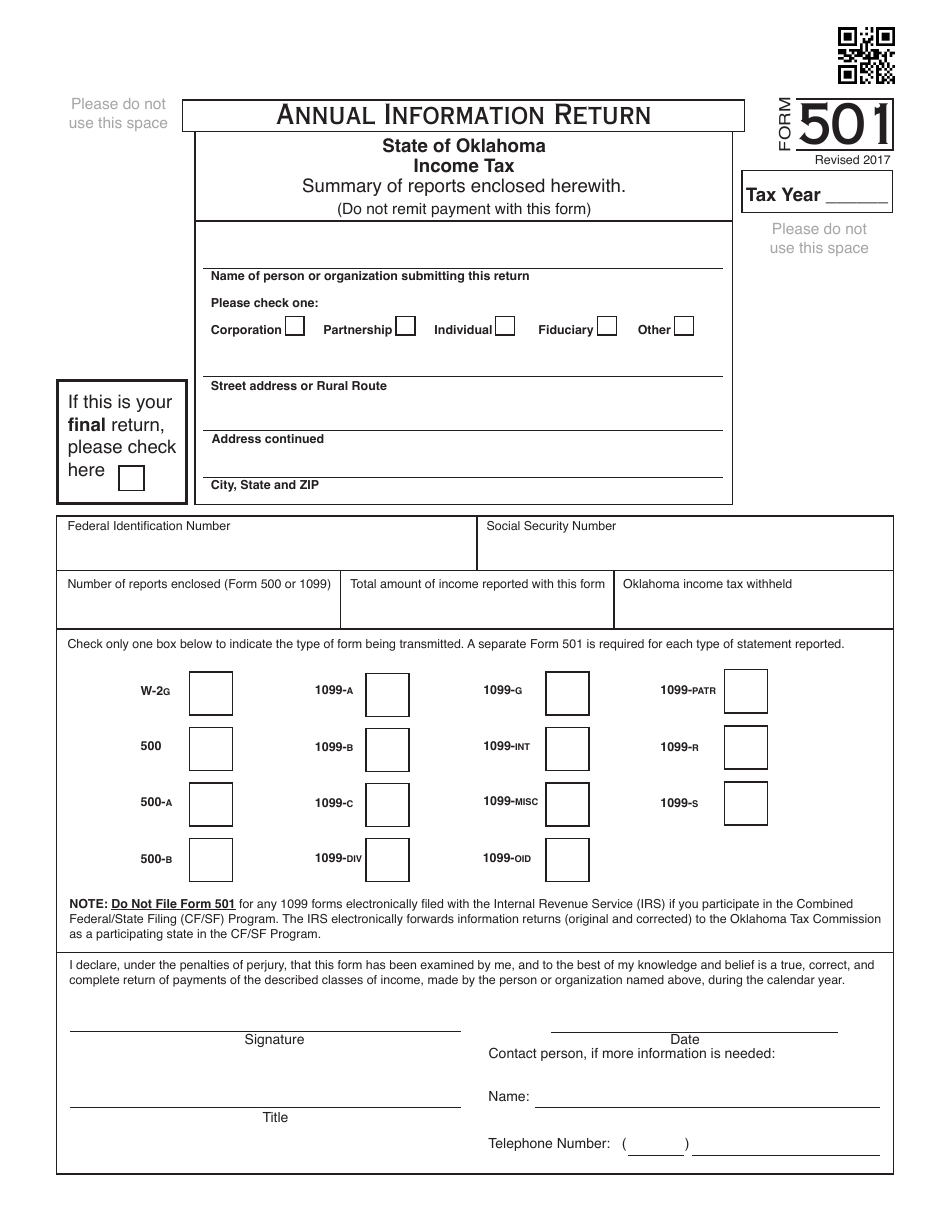

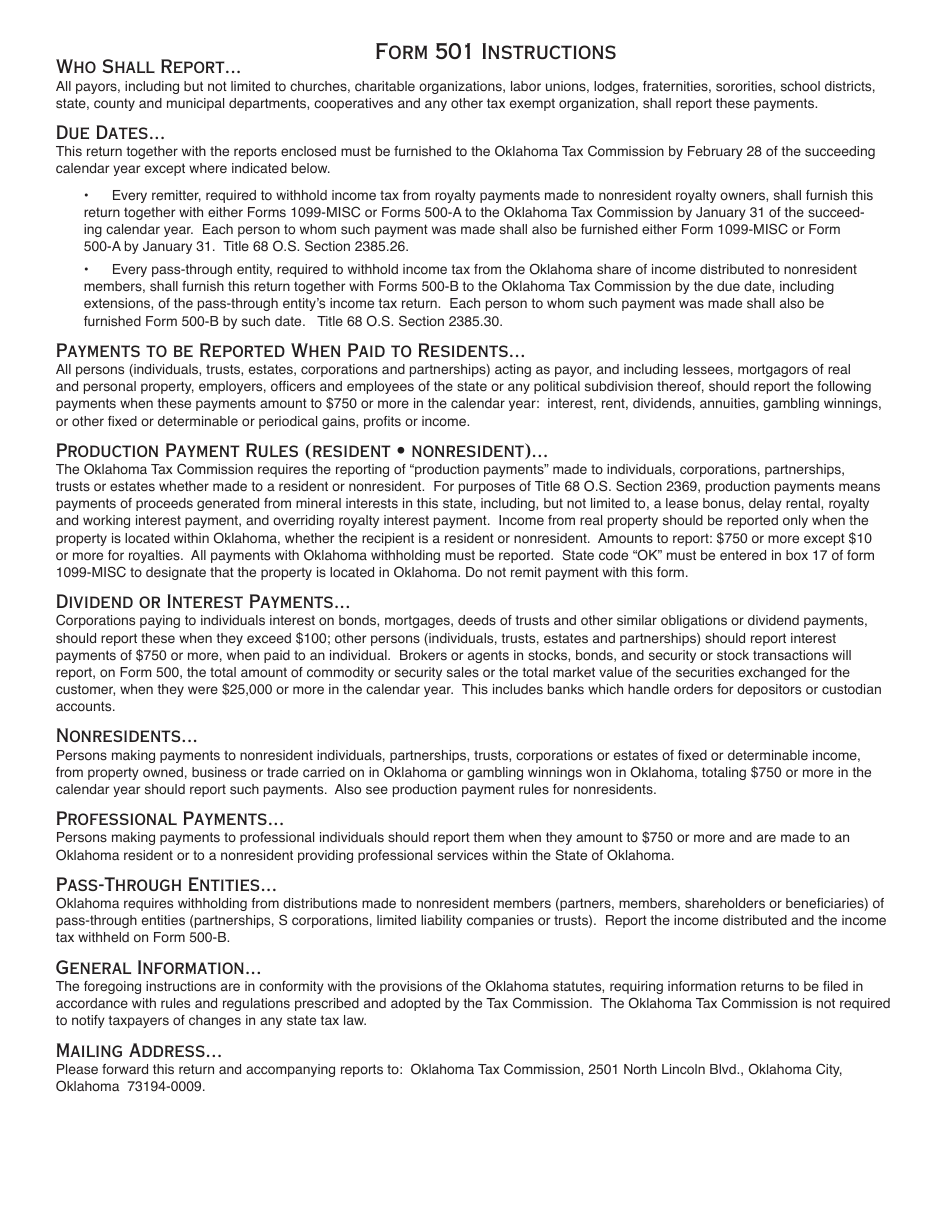

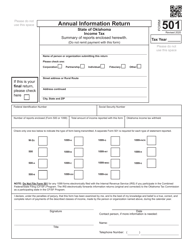

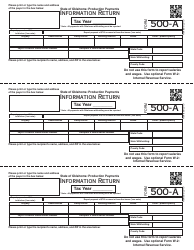

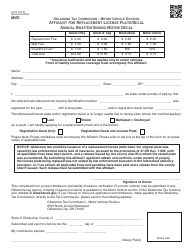

OTC Form 501 Annual Information Return - Oklahoma

What Is OTC Form 501?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 501?

A: OTC Form 501 is the Annual Information Return form used in Oklahoma.

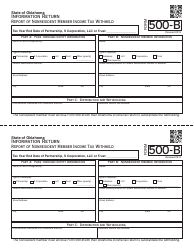

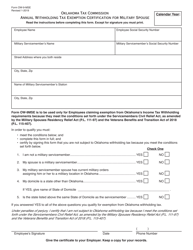

Q: Who needs to file OTC Form 501?

A: Businesses operating in Oklahoma need to file OTC Form 501.

Q: What is the purpose of OTC Form 501?

A: OTC Form 501 is used to report information about a business's activities and income in Oklahoma.

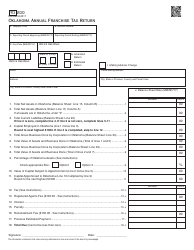

Q: When is OTC Form 501 due?

A: OTC Form 501 is due on or before the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing of OTC Form 501?

A: Yes, there are penalties for late filing of OTC Form 501, including late fees and interest charges.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 501 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.