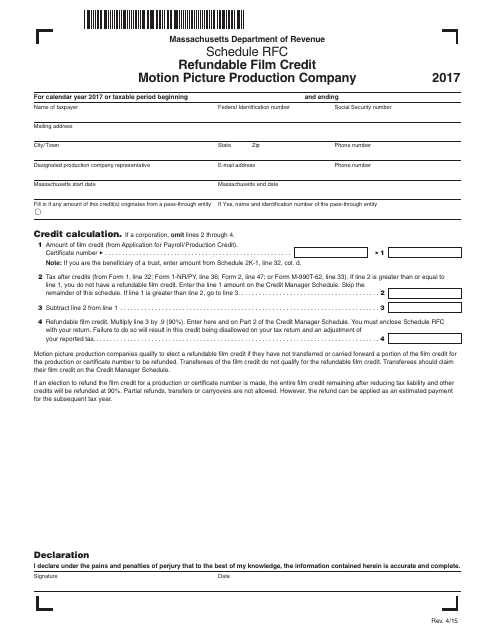

Schedule RFC Refundable Film Credit - Motion Picture Production Company - Massachusetts

What Is Schedule RFC?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Schedule RFC Refundable Film Credit?

A: The Schedule RFC Refundable Film Credit is a tax credit available to motion picture production companies in the state of Massachusetts.

Q: Who is eligible to claim the Schedule RFC Refundable Film Credit?

A: Motion picture production companies that meet certain criteria and have incurred qualified production expenses in Massachusetts are eligible to claim the Schedule RFC Refundable Film Credit.

Q: What expenses qualify for the Schedule RFC Refundable Film Credit?

A: Qualified production expenses, such as wages paid to Massachusetts residents, payments to Massachusetts vendors, and certain production-related expenses, may qualify for the Schedule RFC Refundable Film Credit.

Q: How much is the Schedule RFC Refundable Film Credit worth?

A: The amount of the Schedule RFC Refundable Film Credit can vary, but it is generally equal to a percentage of qualified production expenses incurred in Massachusetts.

Q: How do motion picture production companies claim the Schedule RFC Refundable Film Credit?

A: Motion picture production companies must complete Schedule RFC and attach it to their annual Massachusetts tax return in order to claim the Schedule RFC Refundable Film Credit.

Form Details:

- Released on April 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule RFC by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.