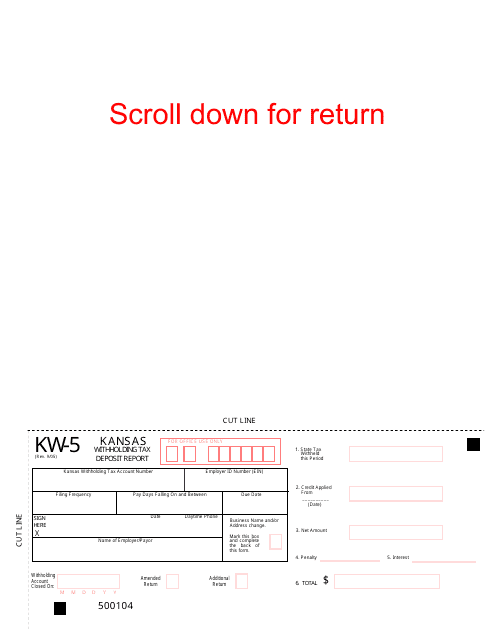

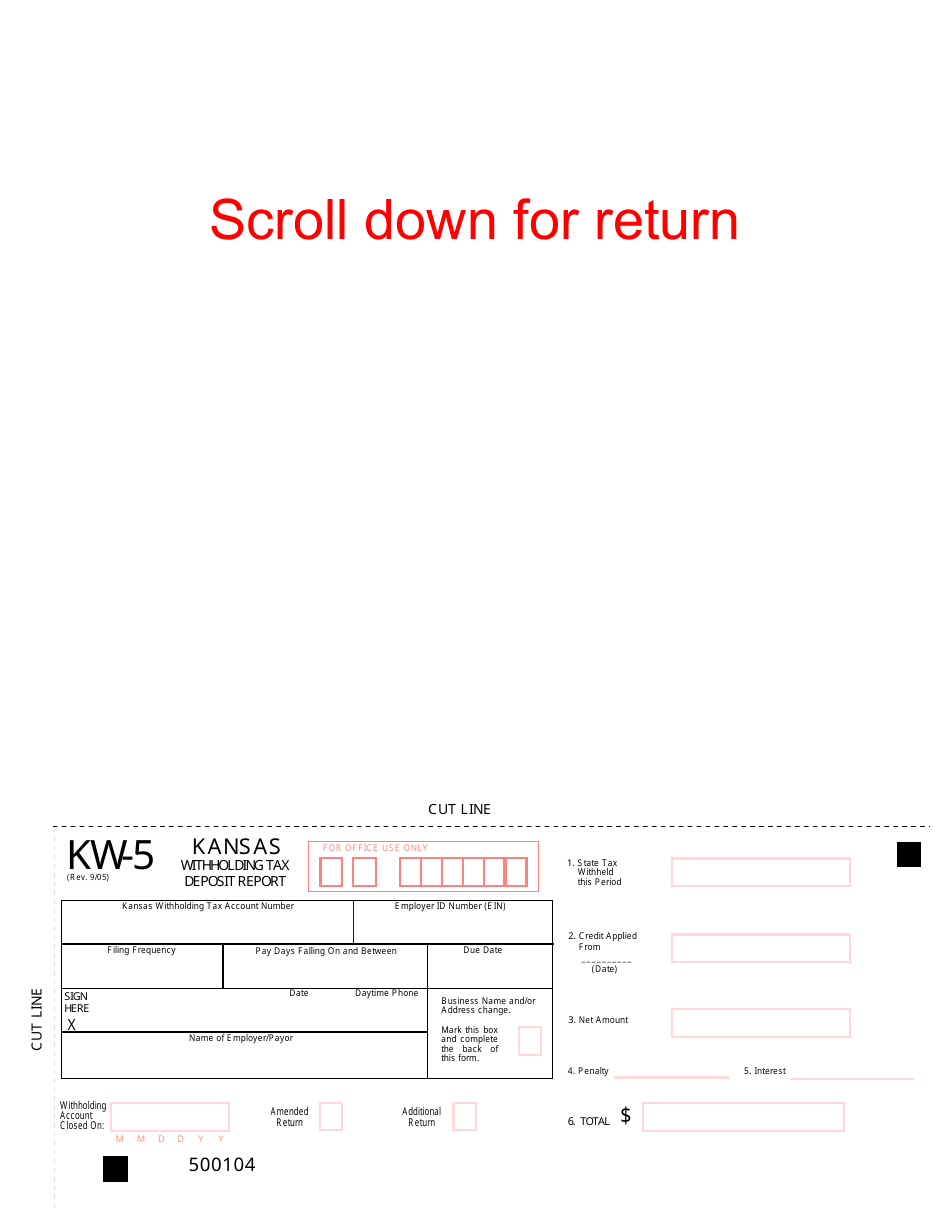

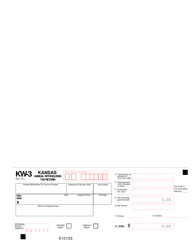

Form KW-5 Kansas Withholding Tax Deposit Report - Kansas

What Is Form KW-5?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form KW-5?

A: Form KW-5 is the Kansas Withholding Tax Deposit Report.

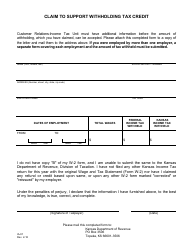

Q: What is the purpose of Form KW-5?

A: The purpose of Form KW-5 is to report and remit withholding taxes withheld from employees' wages to the state of Kansas.

Q: Who needs to file Form KW-5?

A: Employers in Kansas who withhold income taxes from their employees' wages need to file Form KW-5.

Q: When is Form KW-5 due?

A: Form KW-5 is due on a monthly or semi-weekly basis, depending on the total amount of withholding taxes withheld.

Q: What information do I need to complete Form KW-5?

A: To complete Form KW-5, you will need your employer identification number (EIN), total amount of withholding taxes withheld, and other relevant employee and payment details.

Q: What happens if I don't file Form KW-5?

A: Failing to file Form KW-5 or remit the withholding taxes on time may result in penalties and interest charges.

Q: Are there any exceptions or special rules for filing Form KW-5?

A: Yes, there are certain exceptions and special rules for filing Form KW-5. It is advisable to refer to the instructions provided by the Kansas Department of Revenue or consult a tax professional for specific guidance.

Form Details:

- Released on September 1, 2005;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form KW-5 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.