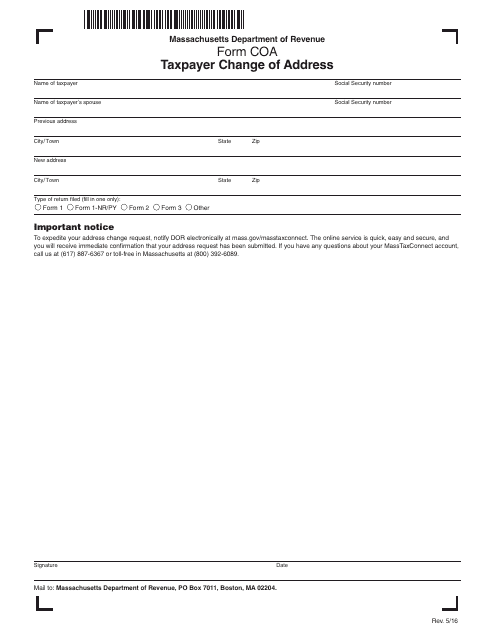

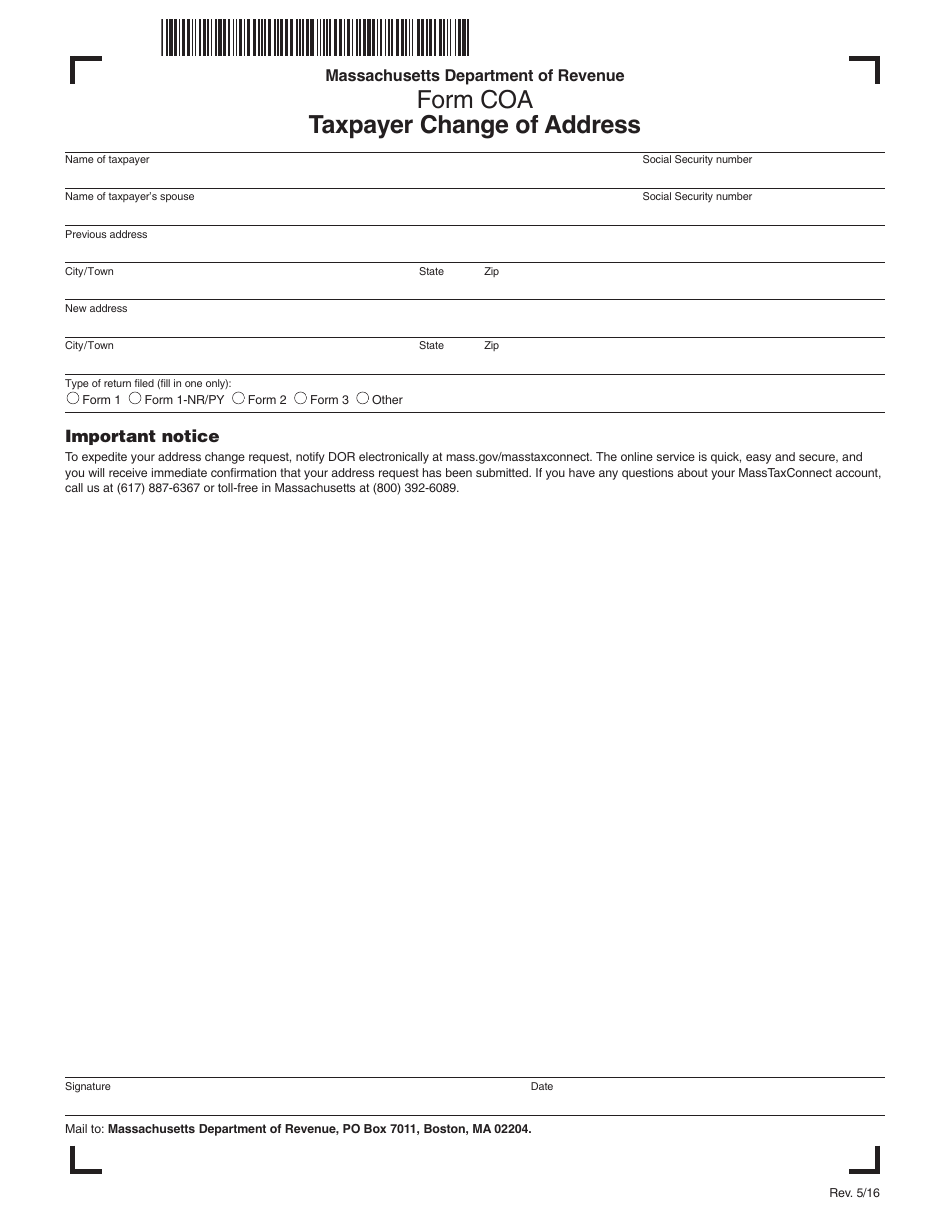

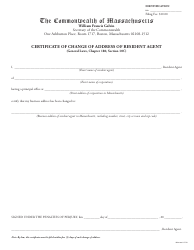

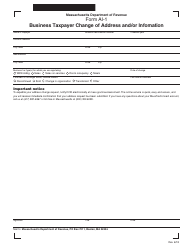

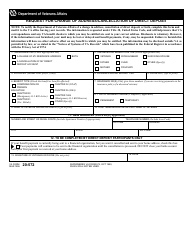

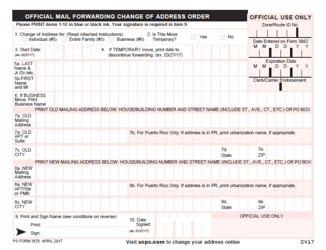

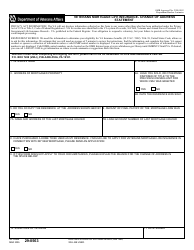

Form COA Taxpayer Change of Address - Massachusetts

What Is Form COA?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the COA Taxpayer Change of Address form?

A: The COA Taxpayer Change of Address form is a document used in Massachusetts to update the taxpayer's address with the state.

Q: What information do I need to provide on the COA Taxpayer Change of Address form?

A: You will need to provide your name, Social Security number, old address, new address, and the date of the change.

Q: Is there a deadline for submitting the COA Taxpayer Change of Address form?

A: There is no specific deadline for submitting the COA Taxpayer Change of Address form, but it is recommended to update your address as soon as possible.

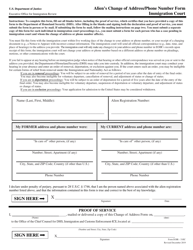

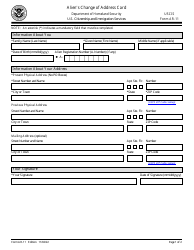

Q: Do I need to notify any other government agencies of my address change?

A: Yes, you should also update your address with the United States Postal Service and any other relevant government agencies.

Q: Are there any fees associated with submitting the COA Taxpayer Change of Address form?

A: No, there are no fees associated with submitting the COA Taxpayer Change of Address form.

Q: Will I receive confirmation that my address has been updated?

A: Yes, you should receive confirmation from the Massachusetts Department of Revenue once your address has been updated.

Q: What should I do if I have not received confirmation of my address update?

A: If you have not received confirmation of your address update, you should contact the Massachusetts Department of Revenue for assistance.

Q: Can I update my address for multiple taxpayers on the same form?

A: No, you should submit a separate COA Taxpayer Change of Address form for each taxpayer who wishes to update their address.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form COA by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.