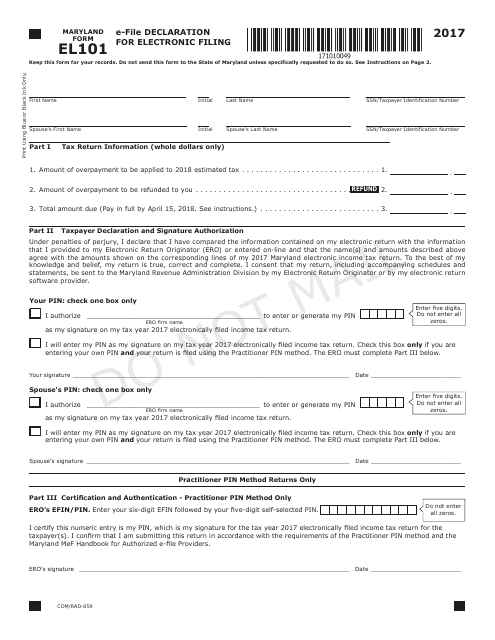

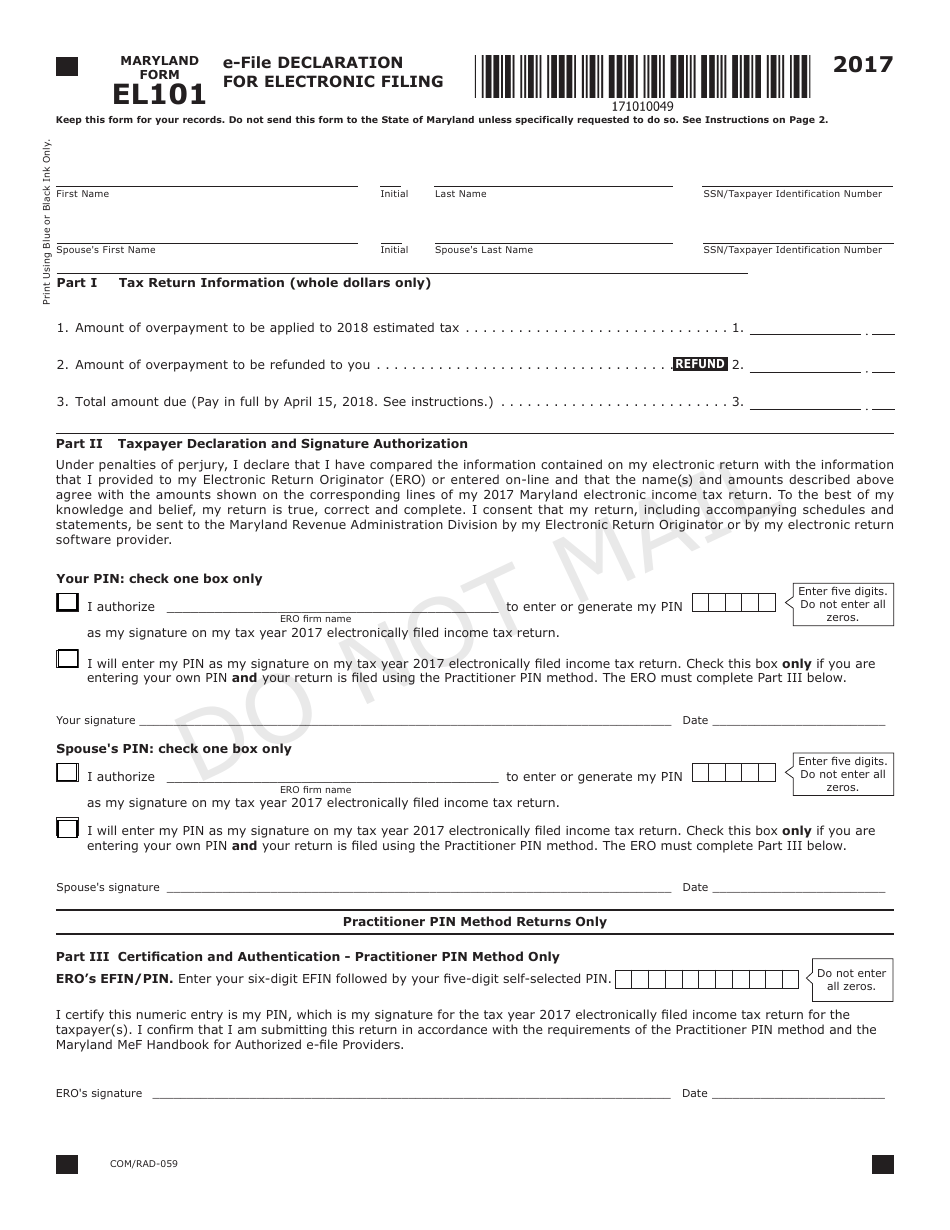

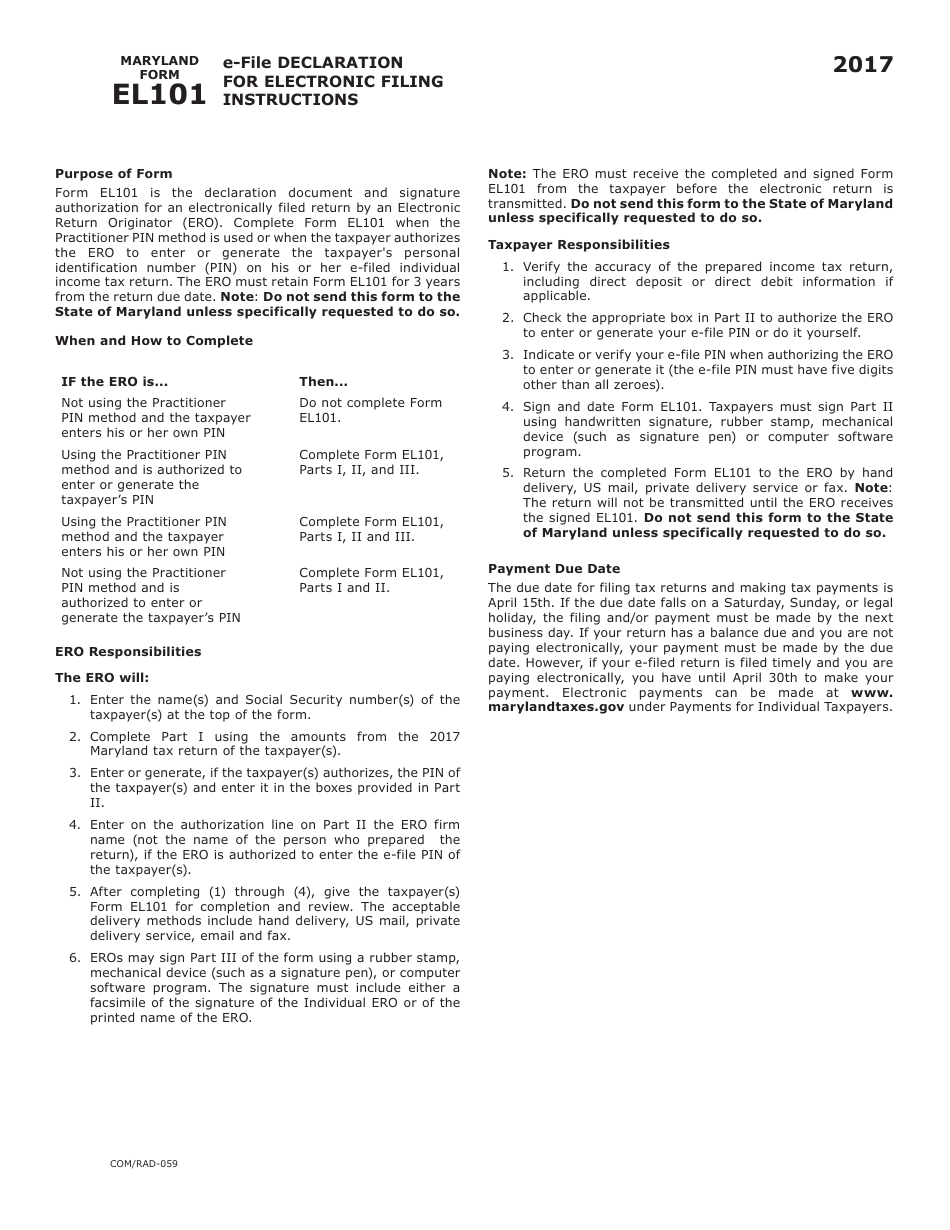

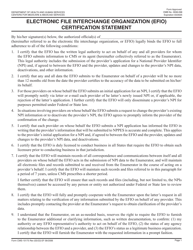

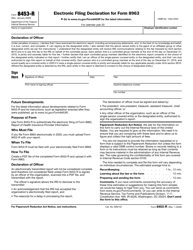

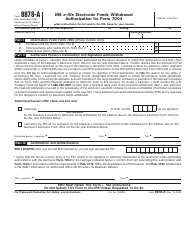

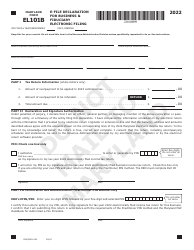

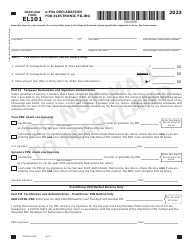

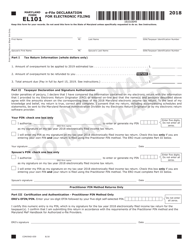

Form EL101 E-File Declaration for Electronic Filing - Maryland

What Is Form EL101?

This is a legal form that was released by the Comptroller of Maryland - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the EL101 E-File Declaration?

A: The EL101 E-File Declaration is a form used for electronic filing in Maryland.

Q: Who needs to file the EL101 E-File Declaration?

A: Anyone who is required to file their taxes electronically in Maryland needs to submit the EL101 E-File Declaration.

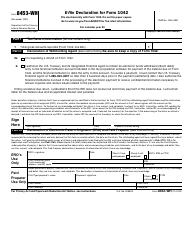

Q: What information do I need to complete the EL101 E-File Declaration?

A: You will need your personal information, Social Security number, and any additional tax-related documents in order to complete the EL101 E-File Declaration.

Q: When is the deadline for submitting the EL101 E-File Declaration?

A: The deadline for submitting the EL101 E-File Declaration follows the same deadline as your Maryland tax return, which is usually April 15th.

Q: What happens after I submit the EL101 E-File Declaration?

A: After you submit the EL101 E-File Declaration, your tax return will be processed by the Maryland Department of Revenue.

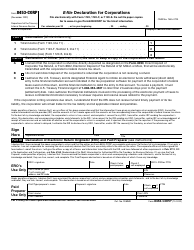

Q: Do I need to keep a copy of the EL101 E-File Declaration?

A: Yes, it is recommended that you keep a copy of the EL101 E-File Declaration for your records in case of any future inquiries or audits.

Q: Can I amend the EL101 E-File Declaration?

A: Yes, if you need to make any changes or corrections to your EL101 E-File Declaration, you can file an amended version of the form.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Comptroller of Maryland;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EL101 by clicking the link below or browse more documents and templates provided by the Comptroller of Maryland.