This version of the form is not currently in use and is provided for reference only. Download this version of

Form 1040ME Schedule PTFC/STFC

for the current year.

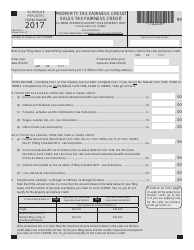

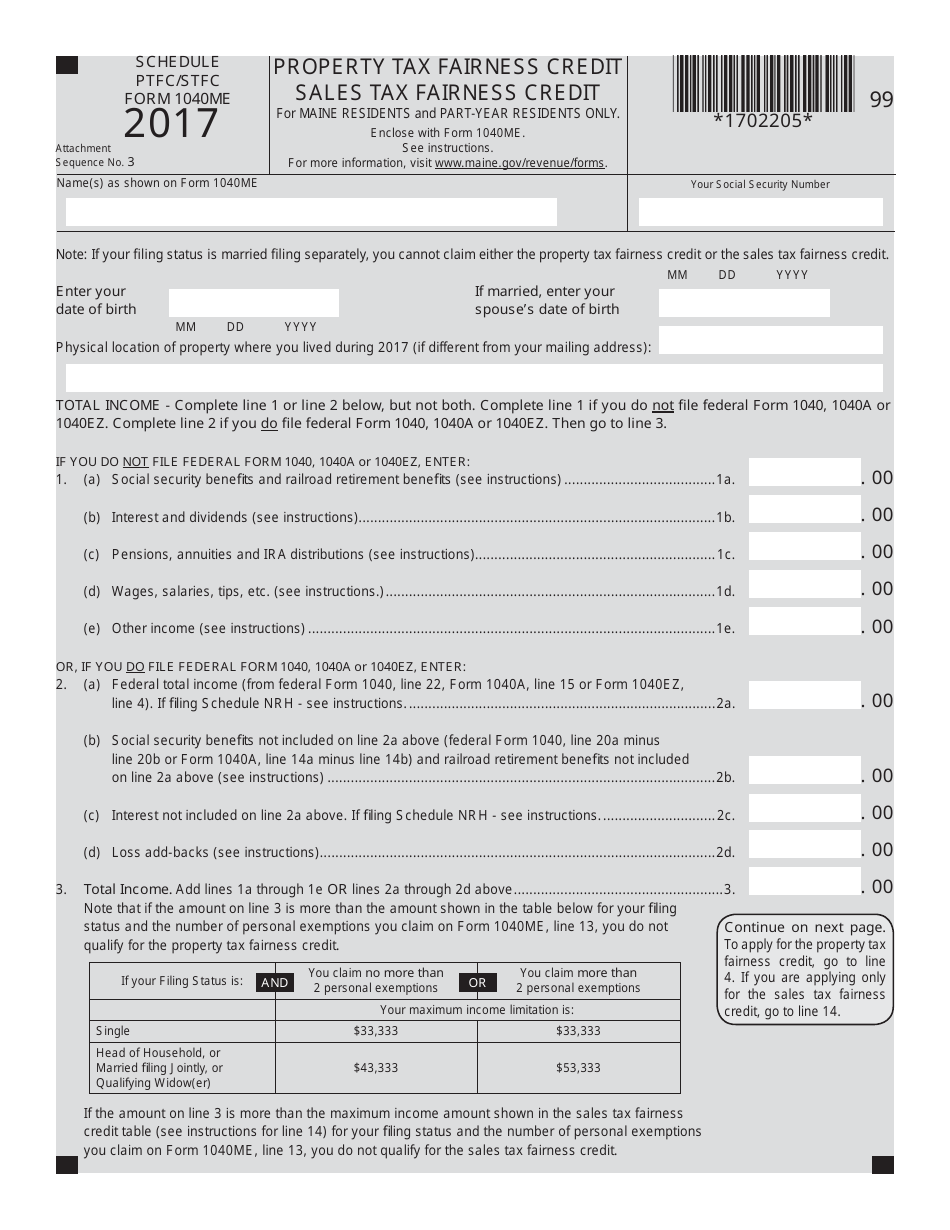

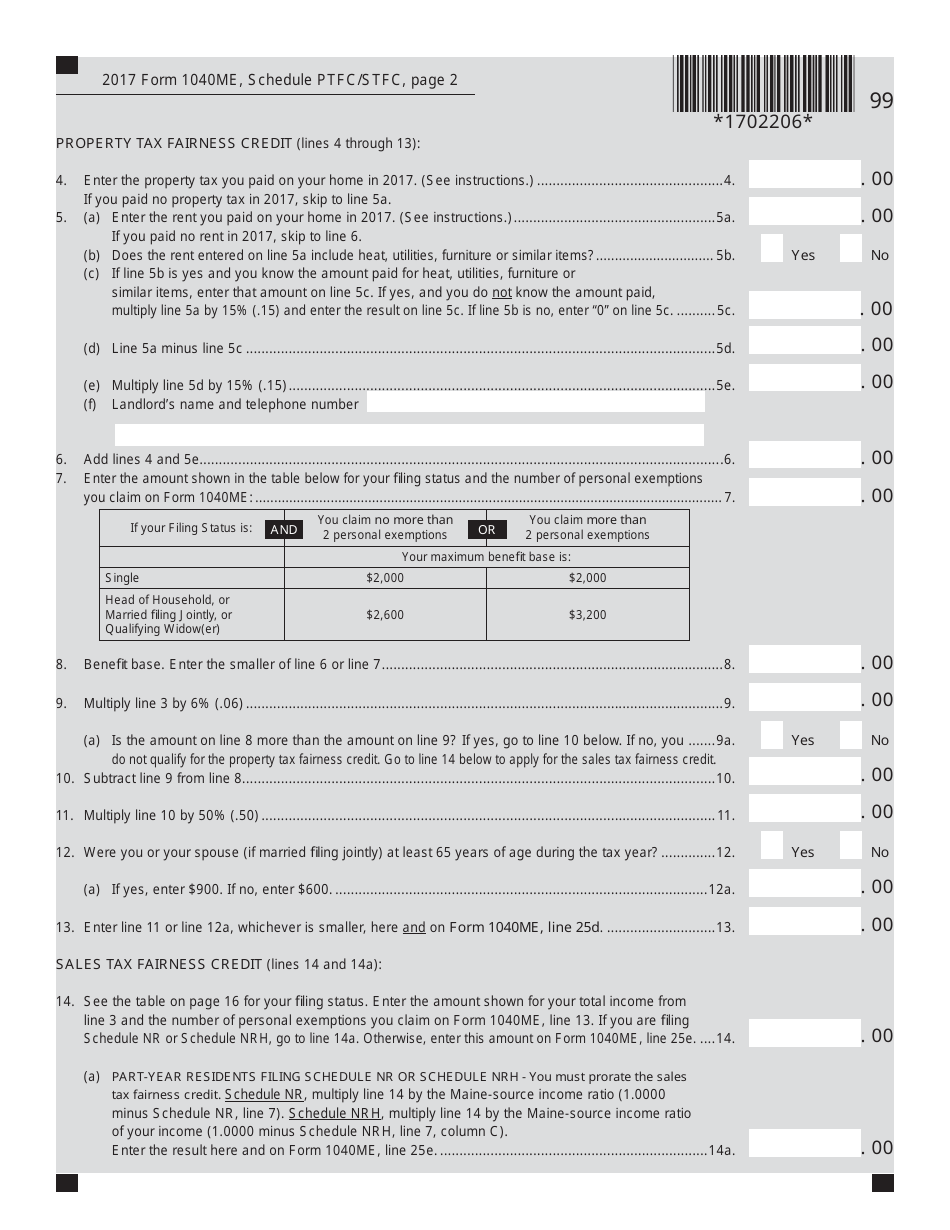

Form 1040ME Schedule PTFC / STFC Property Tax Fairness Credit Sales Tax Fairness Credit - Maine

What Is Form 1040ME Schedule PTFC/STFC?

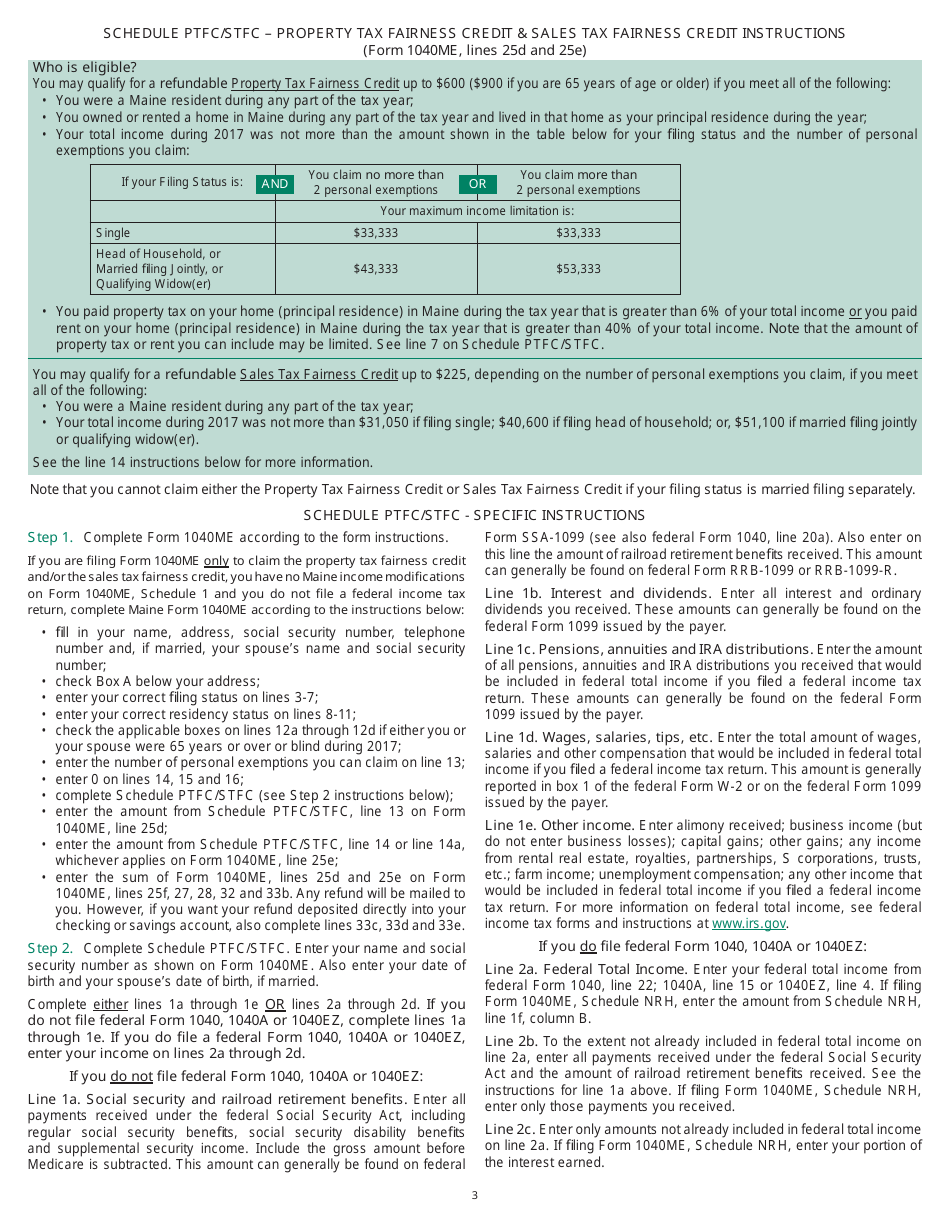

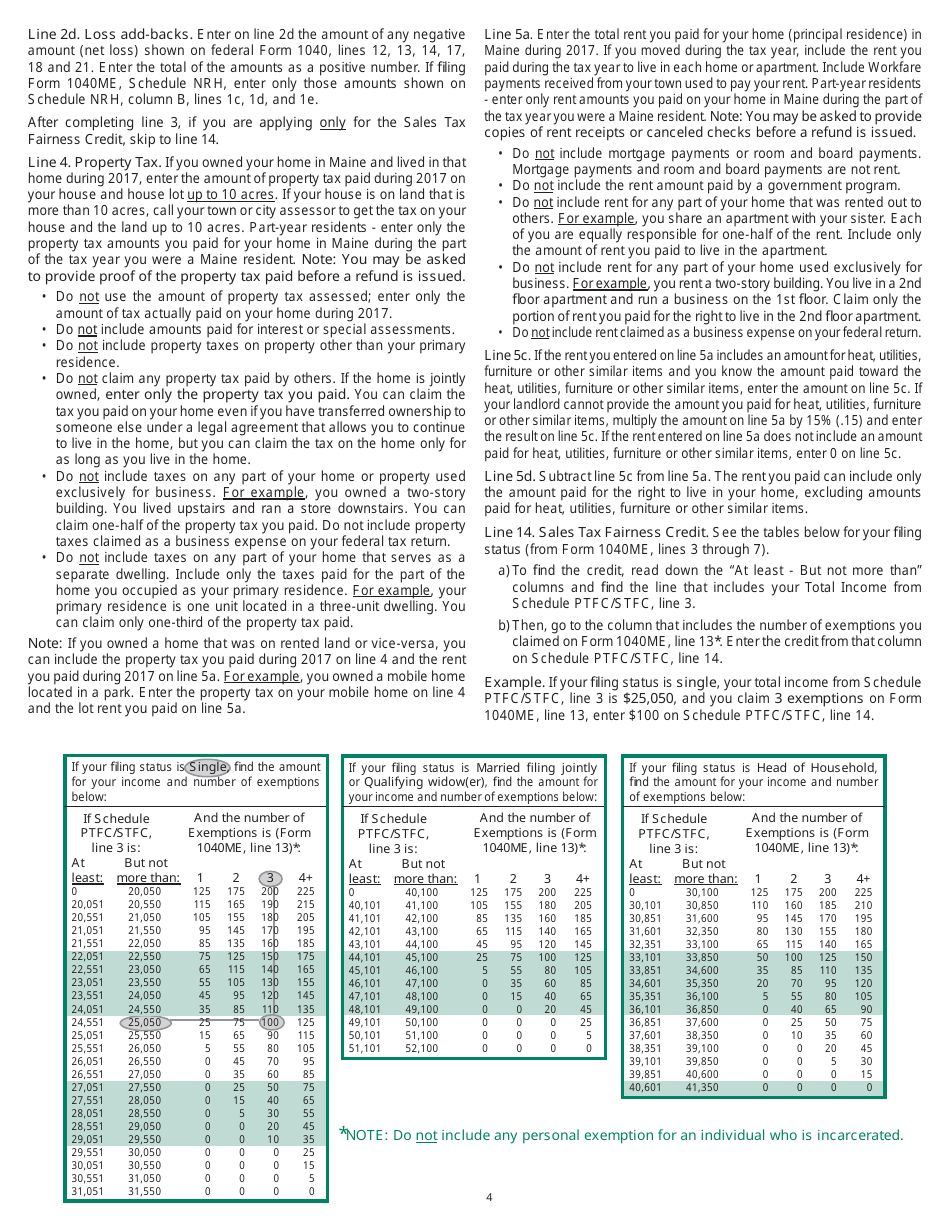

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.The document is a supplement to Form 1040ME, Maine Individual Income Tax. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040ME Schedule PTFC/STFC?

A: Form 1040ME Schedule PTFC/STFC is a form used in Maine to claim the Property Tax Fairness Credit and Sales Tax Fairness Credit.

Q: What is the Property Tax Fairness Credit?

A: The Property Tax Fairness Credit is a credit available to eligible Maine residents who pay property taxes on their primary residence.

Q: What is the Sales Tax Fairness Credit?

A: The Sales Tax Fairness Credit is a credit available to eligible Maine residents who pay sales tax on certain goods and services.

Q: Who is eligible for the Property Tax Fairness Credit?

A: To be eligible for the Property Tax Fairness Credit, you must meet certain income and residency requirements specified by the State of Maine.

Q: Who is eligible for the Sales Tax Fairness Credit?

A: To be eligible for the Sales Tax Fairness Credit, you must meet certain income and residency requirements specified by the State of Maine.

Q: How can I claim the Property Tax Fairness Credit and Sales Tax Fairness Credit?

A: You can claim the Property Tax Fairness Credit and Sales Tax Fairness Credit by completing and filing Form 1040ME Schedule PTFC/STFC along with your Maine income tax return.

Q: Is there a deadline to claim the Property Tax Fairness Credit and Sales Tax Fairness Credit?

A: Yes, there is a deadline to claim the Property Tax Fairness Credit and Sales Tax Fairness Credit. The deadline is usually the same as the deadline to file your Maine income tax return.

Q: Can I claim both the Property Tax Fairness Credit and Sales Tax Fairness Credit?

A: Yes, eligible individuals can claim both the Property Tax Fairness Credit and Sales Tax Fairness Credit on their Maine income tax return.

Q: Are the Property Tax Fairness Credit and Sales Tax Fairness Credit refundable?

A: No, the Property Tax Fairness Credit and Sales Tax Fairness Credit are not refundable. They can only be used to offset your Maine income tax liability.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1040ME Schedule PTFC/STFC by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.