This version of the form is not currently in use and is provided for reference only. Download this version of

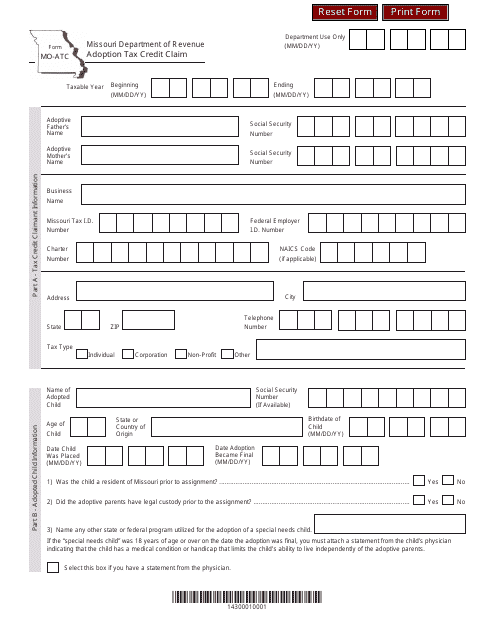

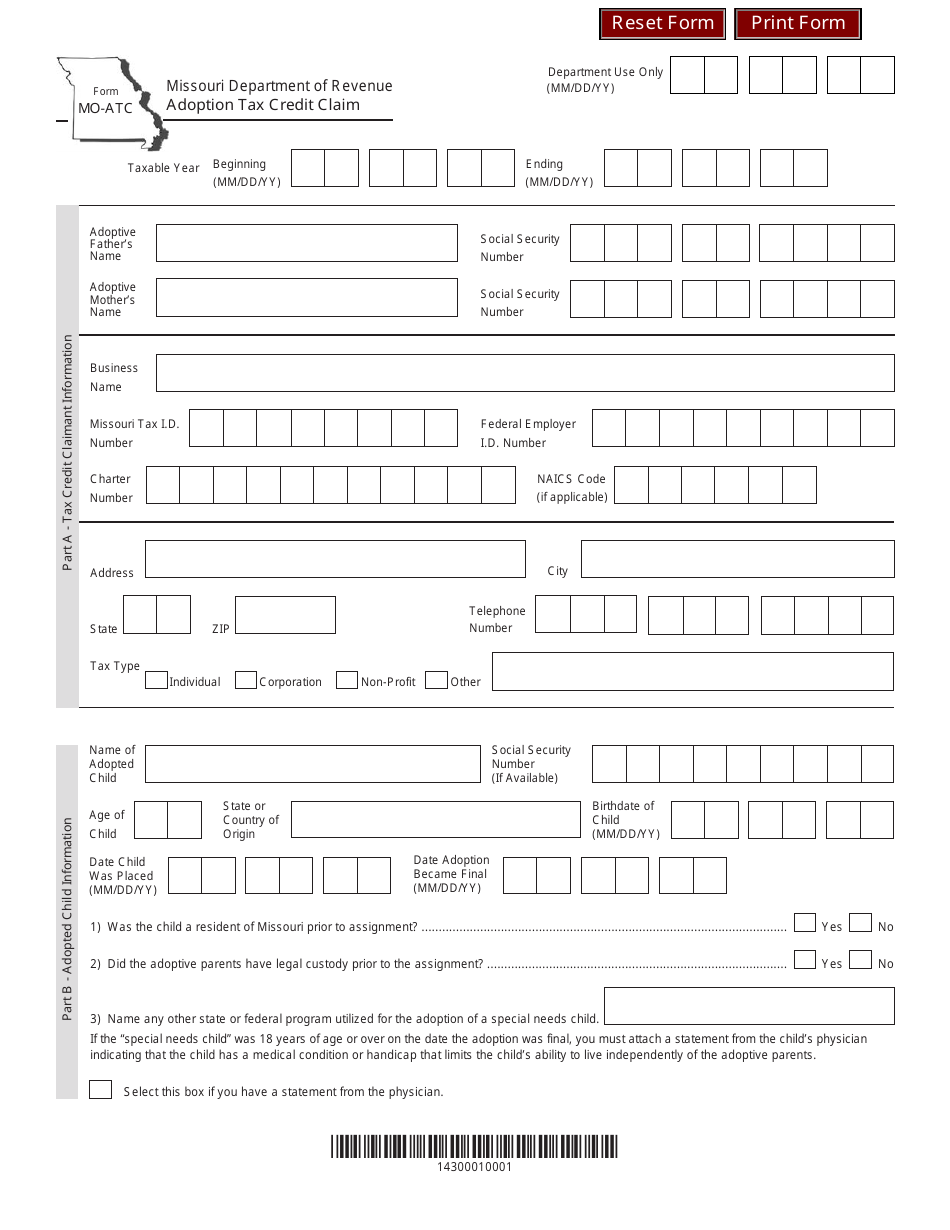

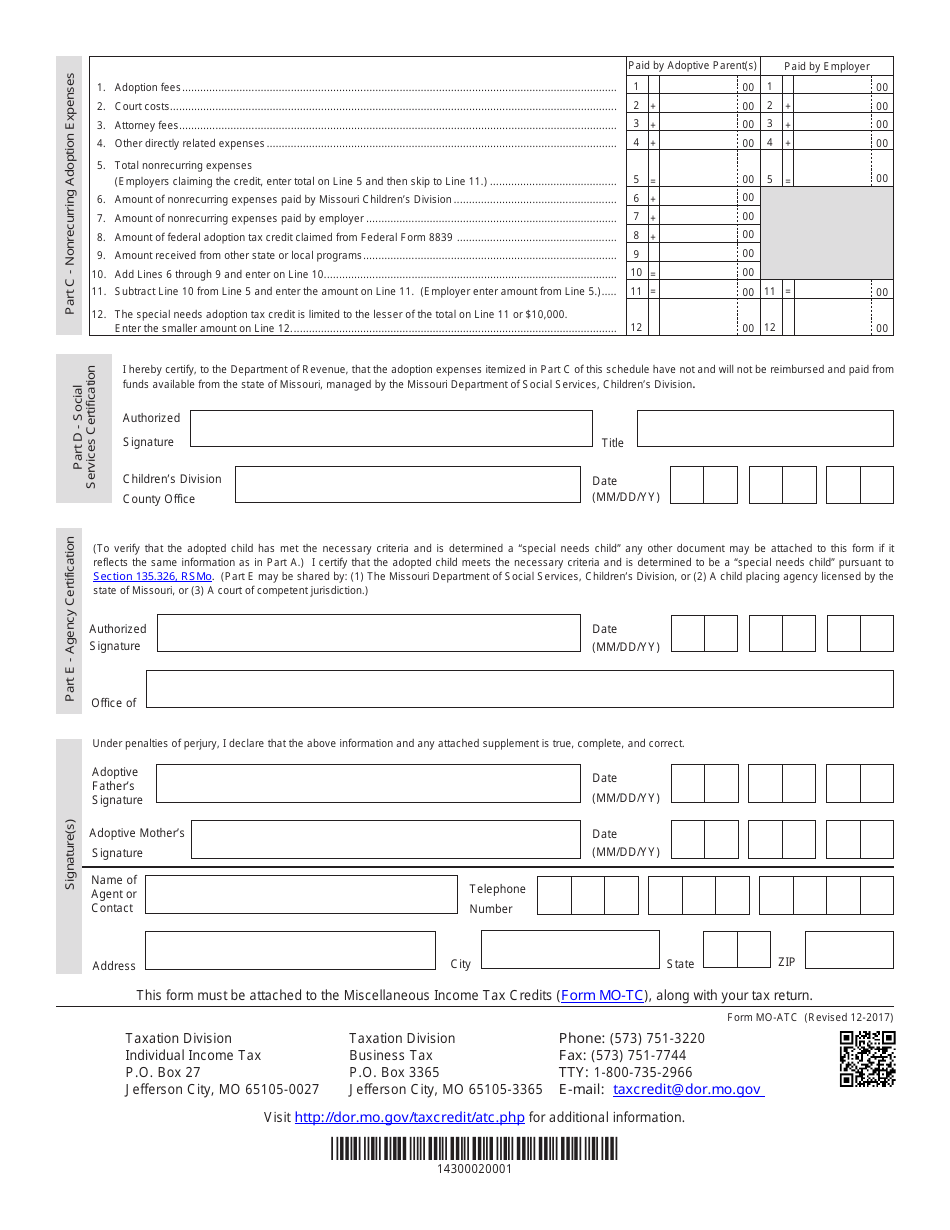

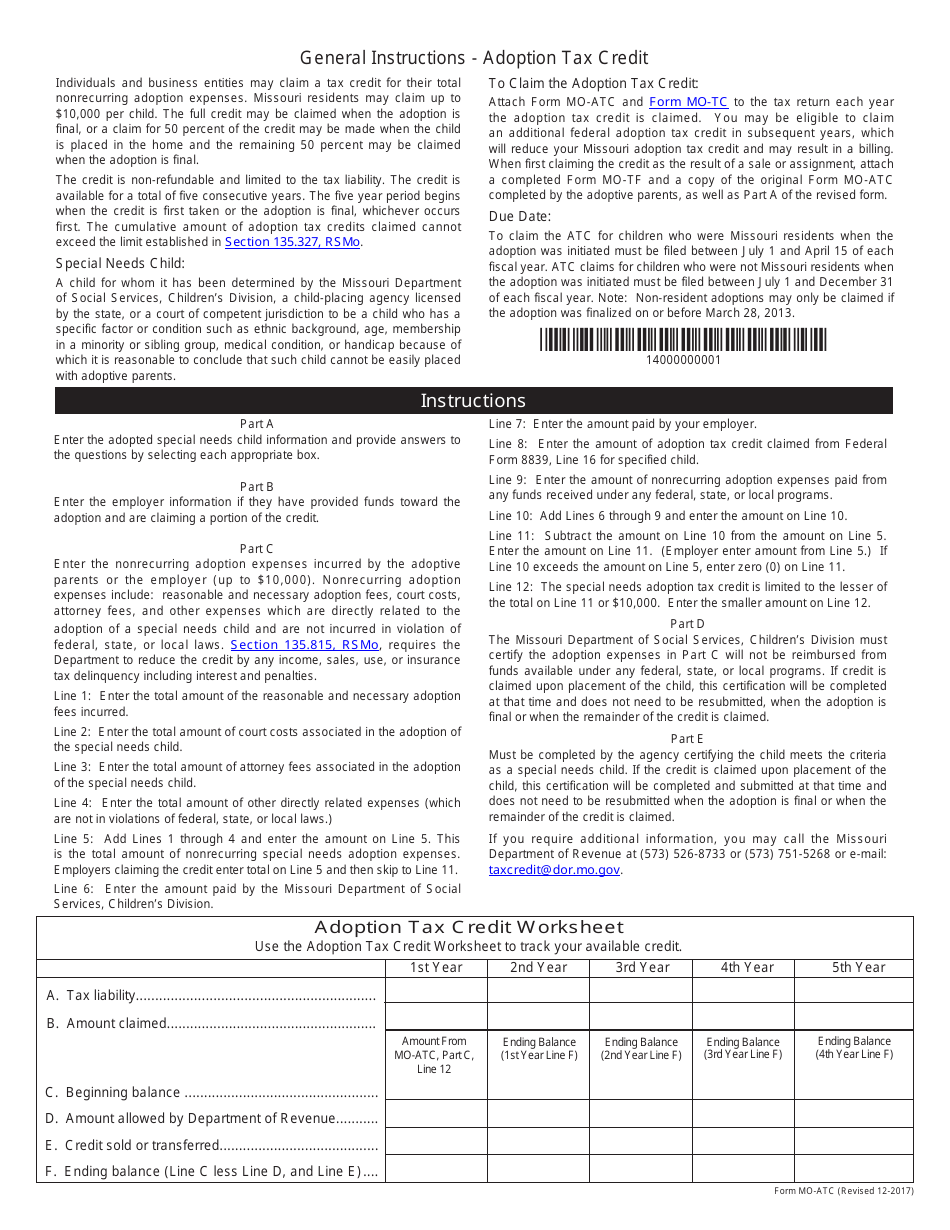

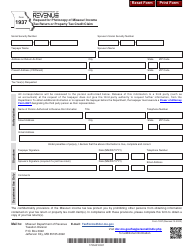

Form MO-ATC

for the current year.

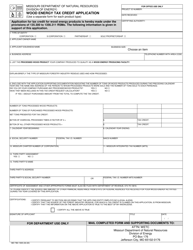

Form MO-ATC Adoption Tax Credit Claim - Missouri

What Is Form MO-ATC?

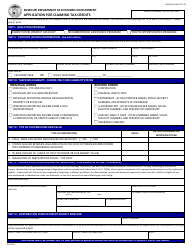

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-ATC Adoption Tax Credit Claim?

A: Form MO-ATC Adoption Tax Credit Claim is a form used in Missouri to claim the Adoption Tax Credit.

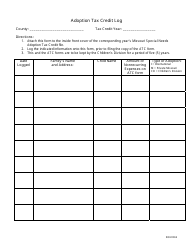

Q: Who can use Form MO-ATC Adoption Tax Credit Claim?

A: Residents of Missouri who have adopted a child.

Q: What is the purpose of Form MO-ATC Adoption Tax Credit Claim?

A: The purpose of this form is to claim a tax credit for qualified adoption expenses.

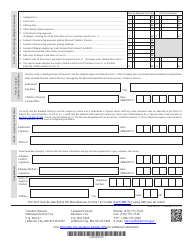

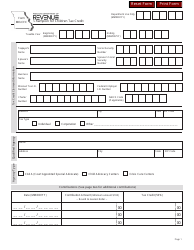

Q: What are qualified adoption expenses?

A: Qualified adoption expenses include reasonable and necessary adoption fees, court costs, and travel expenses.

Q: How much is the Adoption Tax Credit in Missouri?

A: The maximum tax credit in Missouri is $10,000 per child.

Q: How do I fill out Form MO-ATC Adoption Tax Credit Claim?

A: You need to provide your personal information, information about the adoption, and details of the qualified adoption expenses.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-ATC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.