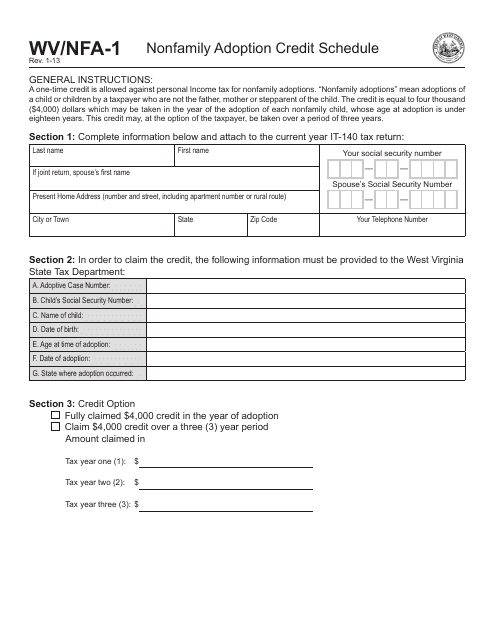

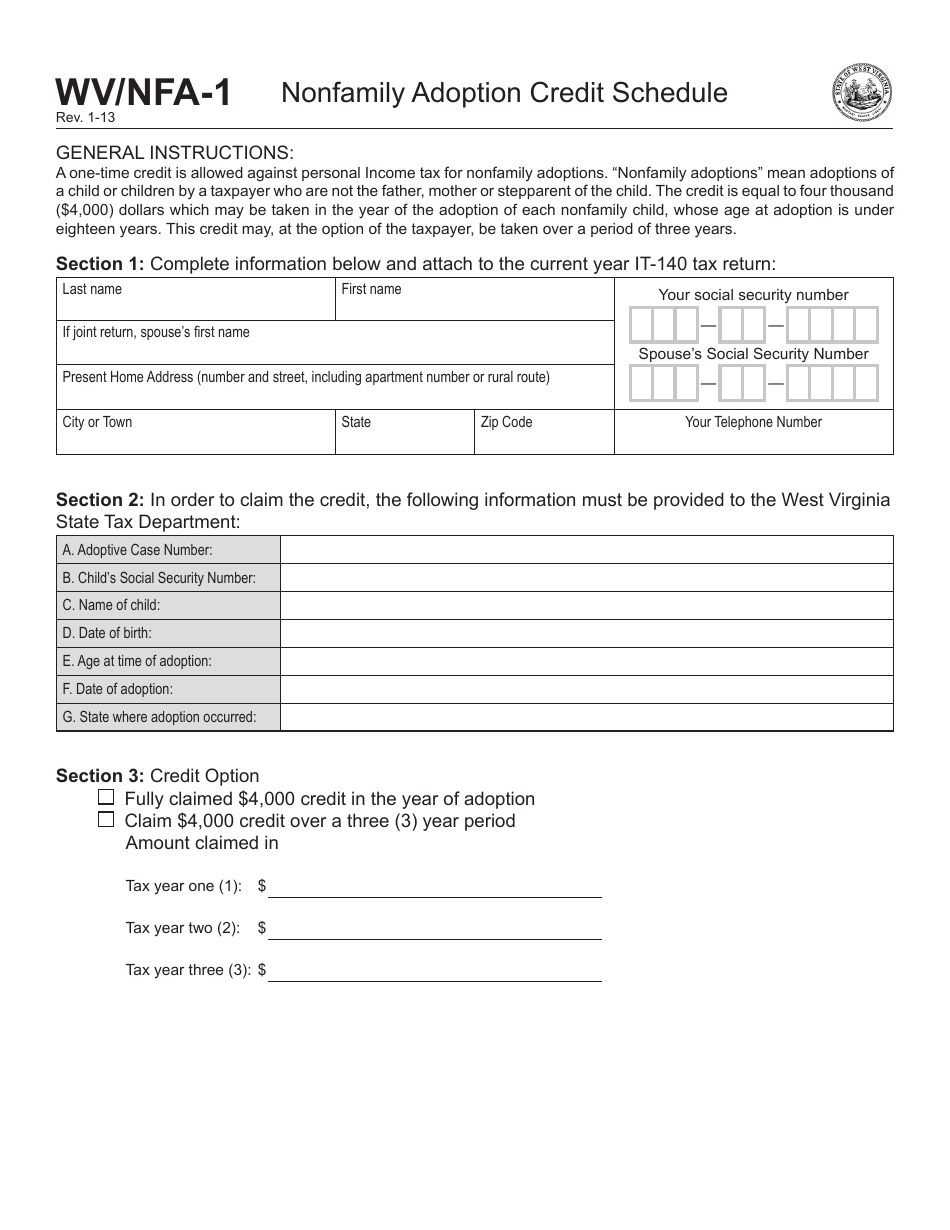

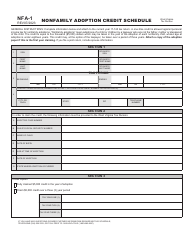

Form WV / NFA-1 Nonfamily Adoption Credit Schedule - West Virginia

What Is Form WV/NFA-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WV/NFA-1?

A: Form WV/NFA-1 is a Nonfamily Adoption Credit Schedule used in West Virginia.

Q: What is the purpose of Form WV/NFA-1?

A: The purpose of Form WV/NFA-1 is to claim the Nonfamily Adoption Credit in West Virginia.

Q: Who can use Form WV/NFA-1?

A: Form WV/NFA-1 can be used by individuals who have adopted a child and are eligible for the Nonfamily Adoption Credit in West Virginia.

Q: What information do I need to complete Form WV/NFA-1?

A: You will need to provide information about the adopted child, the adoption expenses, and your eligibility for the Nonfamily Adoption Credit.

Q: Is there a deadline for filing Form WV/NFA-1?

A: Yes, Form WV/NFA-1 must be filed with your West Virginia income tax return by the due date, which is usually April 15th.

Q: Can I claim the Nonfamily Adoption Credit if I live in a different state?

A: No, the Nonfamily Adoption Credit is specific to West Virginia and can only be claimed by residents of the state.

Q: What happens after I file Form WV/NFA-1?

A: After you file Form WV/NFA-1, the West Virginia Department of Revenue will review your claim for the Nonfamily Adoption Credit and determine if you are eligible to receive the credit.

Q: Can I e-file Form WV/NFA-1?

A: Yes, you can e-file Form WV/NFA-1 if you are filing your West Virginia income tax return electronically.

Q: Are there any additional requirements for claiming the Nonfamily Adoption Credit?

A: Yes, in addition to filing Form WV/NFA-1, you must also provide supporting documentation and meet certain eligibility criteria outlined by the West Virginia Department of Revenue.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/NFA-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.