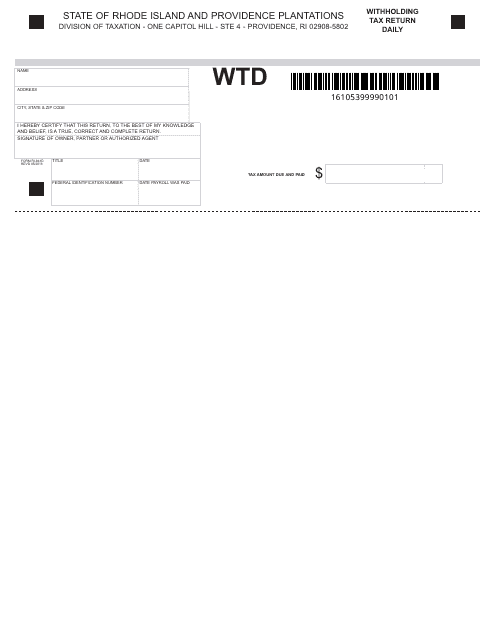

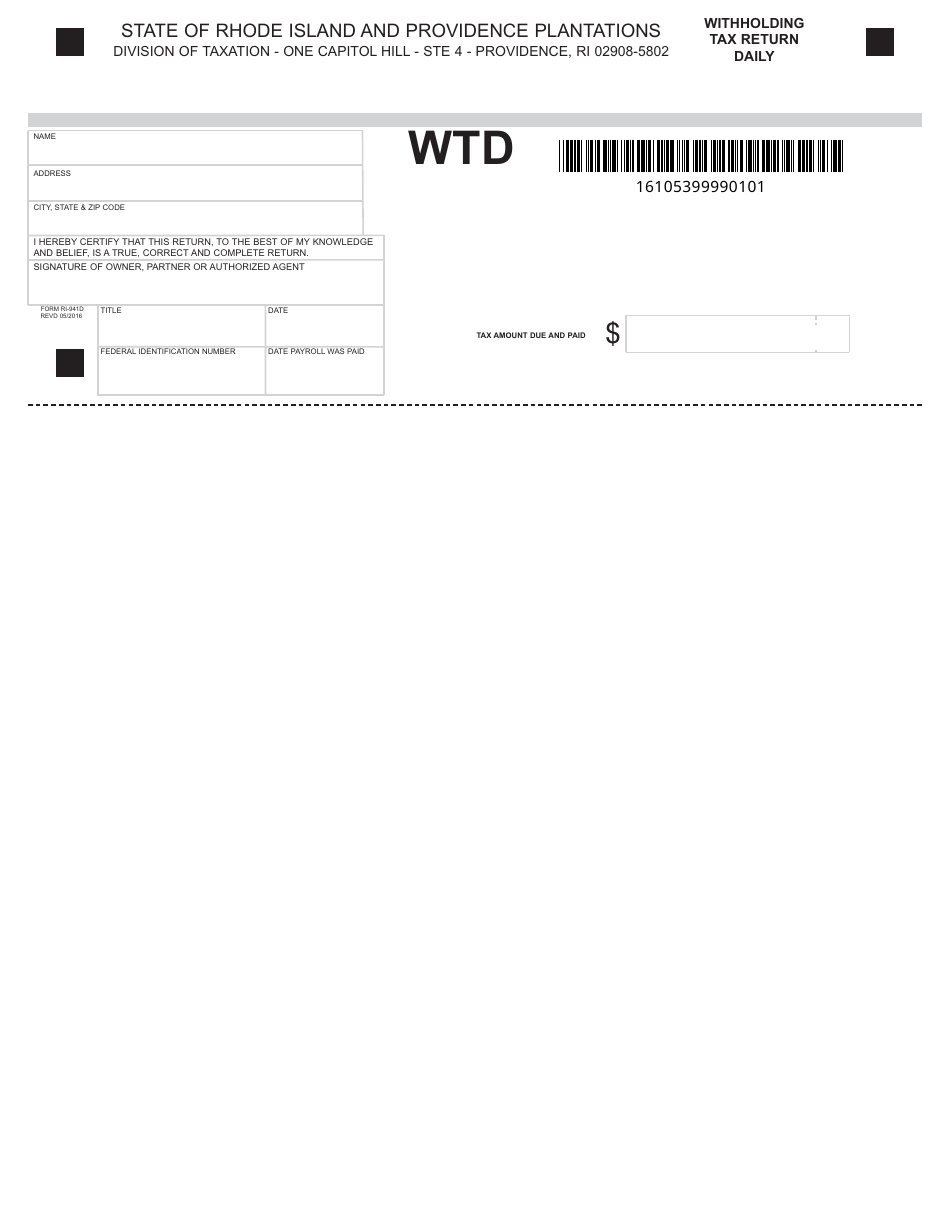

Withholding Tax Return Daily - Rhode Island

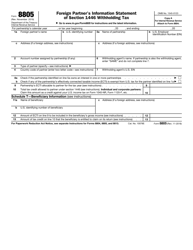

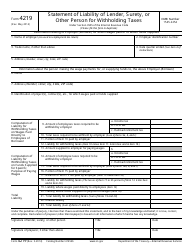

Withholding Tax Return Daily is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is the Withholding Tax Return Daily?

A: The Withholding Tax Return Daily is a tax return form used in Rhode Island to report withholding taxes deducted from employee wages.

Q: Who needs to file a Withholding Tax Return Daily?

A: Employers in Rhode Island who withhold taxes from their employees' wages need to file a Withholding Tax Return Daily.

Q: How often is the Withholding Tax Return Daily filed?

A: The Withholding Tax Return Daily is filed on a daily basis.

Q: What information is required on the Withholding Tax Return Daily?

A: The Withholding Tax Return Daily requires information such as the employer's identification number, total wages paid, and total withholding taxes.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.