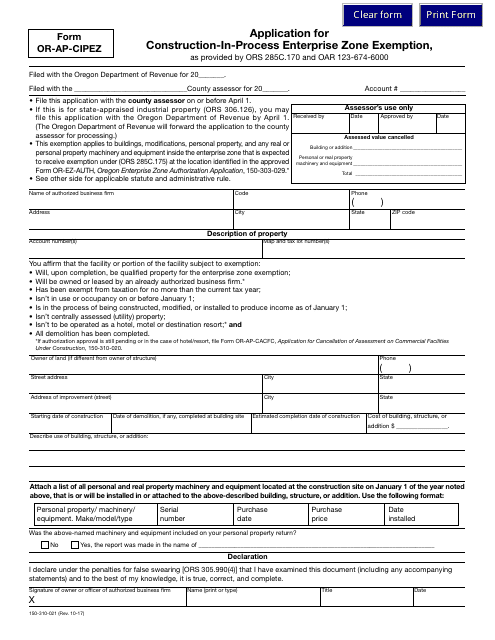

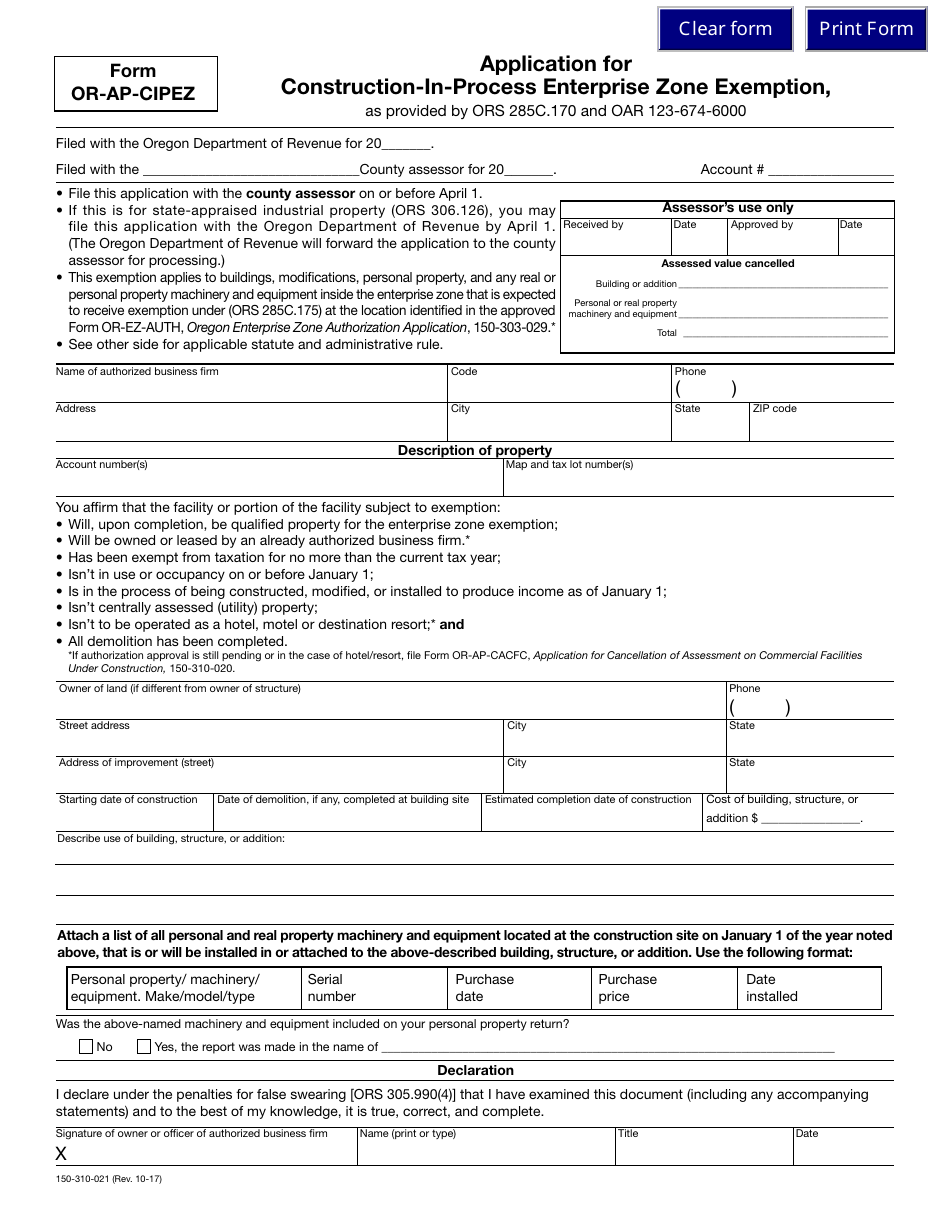

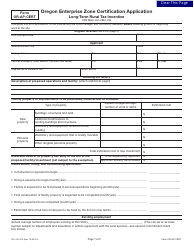

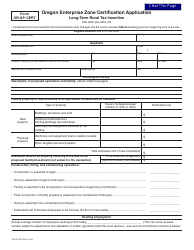

Form OR-AP-CIPEZ Application for Construction-In-process Enterprise Zone Exemption - Oregon

What Is Form OR-AP-CIPEZ?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OR-AP-CIPEZ?

A: OR-AP-CIPEZ is an application form for the Construction-In-process Enterprise Zone Exemption in Oregon.

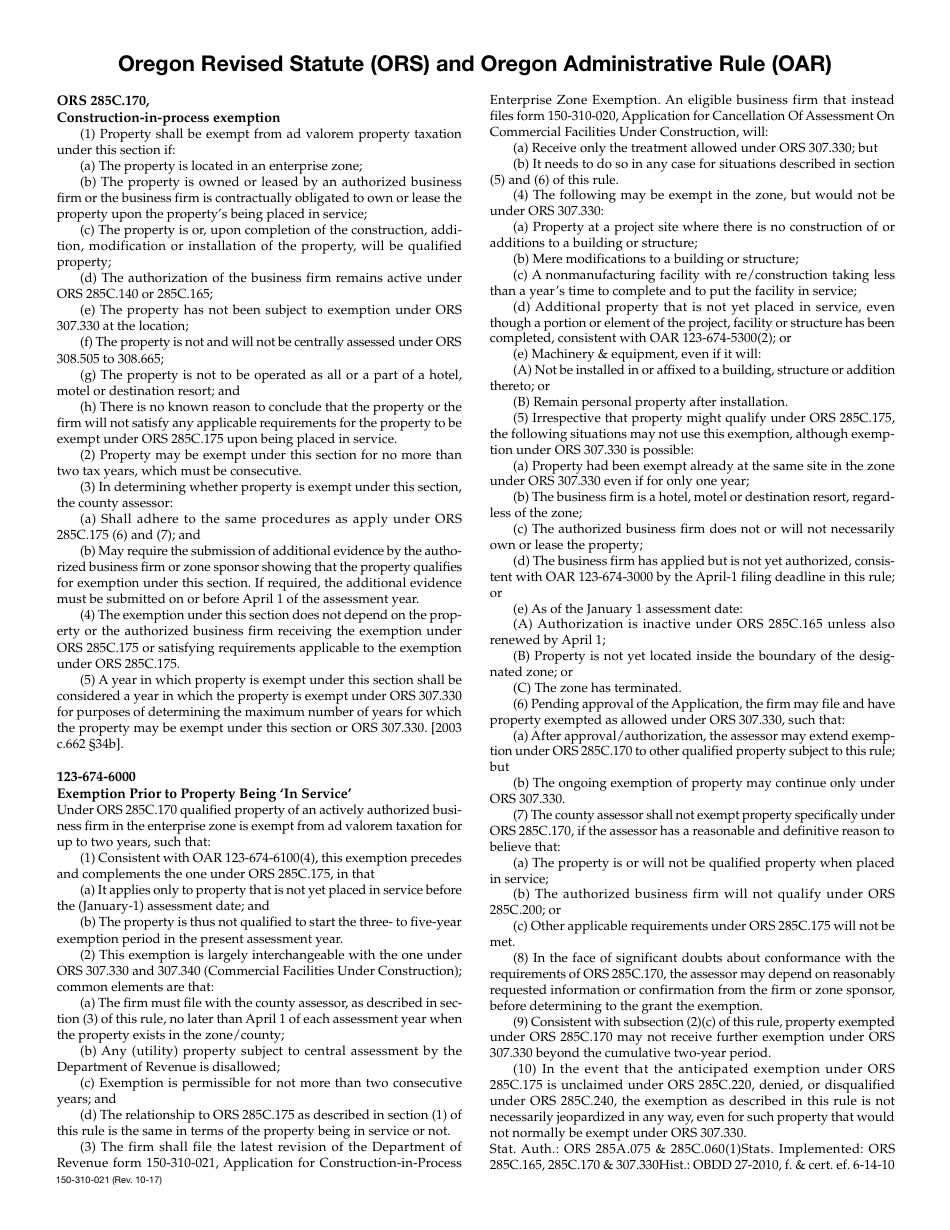

Q: What does the Construction-In-process Enterprise Zone Exemption do?

A: The exemption provides tax relief for construction projects in designated enterprise zones in Oregon.

Q: Who is eligible to apply for the exemption?

A: Businesses undertaking eligible construction projects in designated enterprise zones in Oregon are eligible to apply.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be submitted no later than April 1 of the assessment year for which the exemption is sought.

Q: Are there any fees associated with the application?

A: No, there are no fees associated with submitting the OR-AP-CIPEZ application.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-AP-CIPEZ by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.