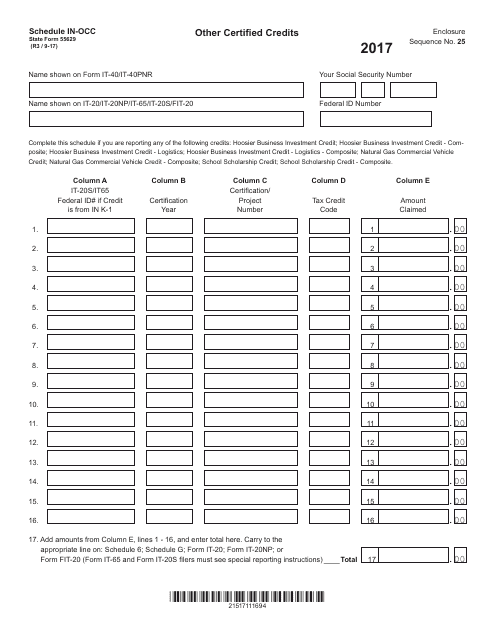

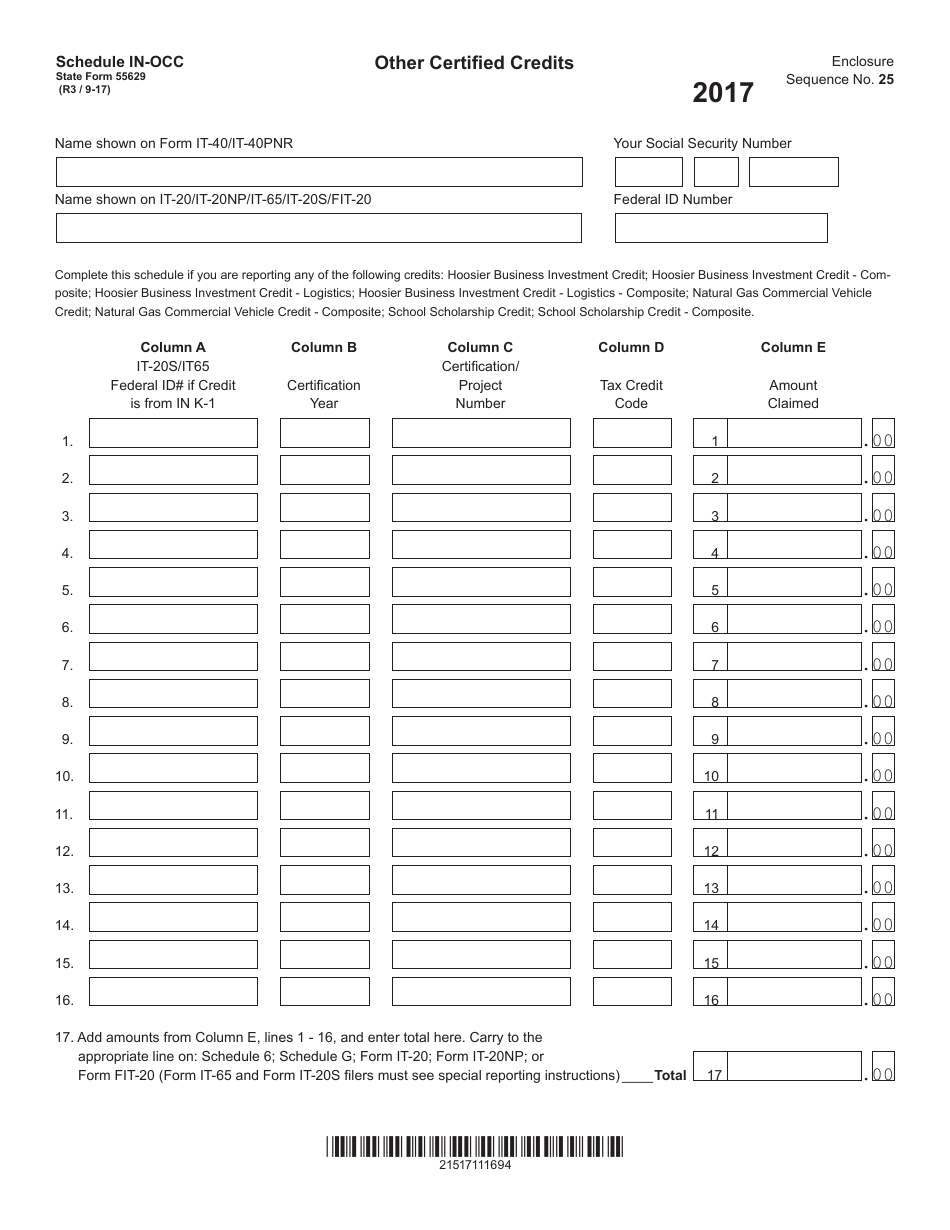

Form 55629 Schedule IN-OCC Other Certified Credits - Indiana

What Is Form 55629 Schedule IN-OCC?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 55629 Schedule IN-OCC?

A: Form 55629 Schedule IN-OCC is a tax form used in the state of Indiana.

Q: What are certified credits in Indiana?

A: Certified credits in Indiana refer to tax credits that have been officially approved or certified by the state.

Q: What is the purpose of Schedule IN-OCC?

A: The purpose of Schedule IN-OCC is to report other certified credits in Indiana.

Q: Who needs to file Schedule IN-OCC?

A: Taxpayers who have other certified credits to report in Indiana need to file Schedule IN-OCC.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 55629 Schedule IN-OCC by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.