This version of the form is not currently in use and is provided for reference only. Download this version of

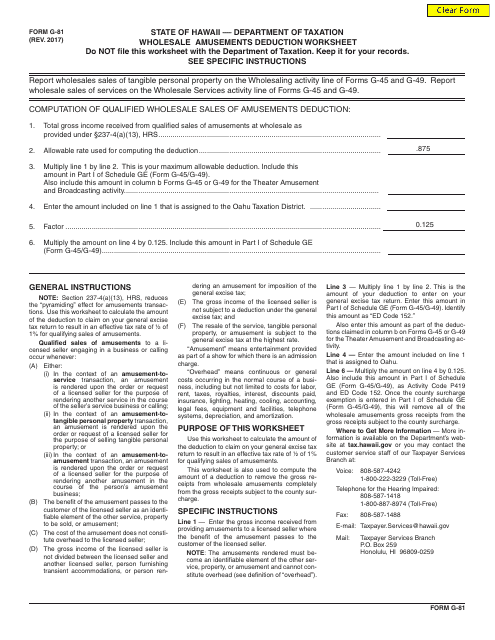

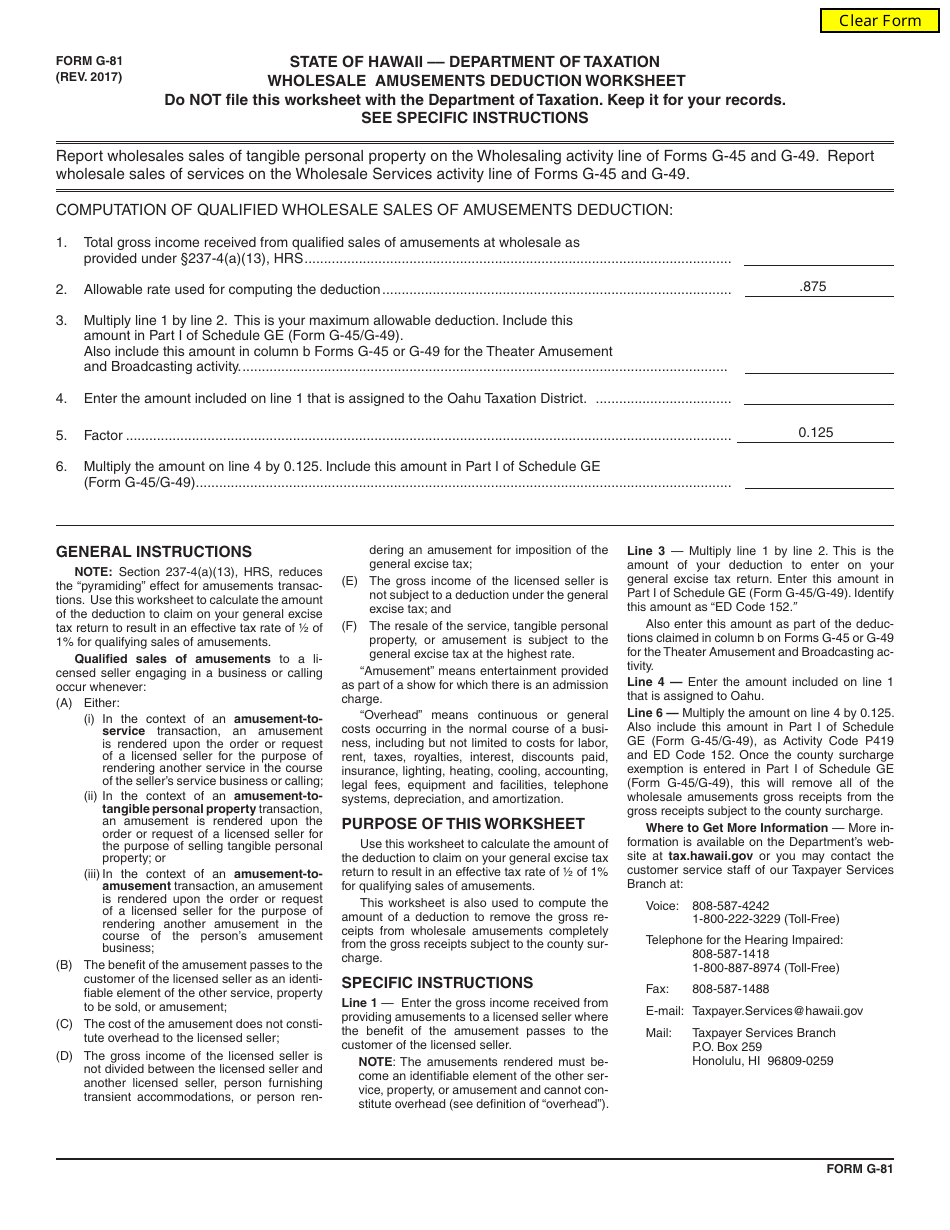

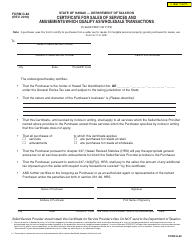

Form G-81

for the current year.

Form G-81 Wholesale Amusements Deduction Worksheet - Hawaii

What Is Form G-81?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-81?

A: Form G-81 is the Wholesale Amusements Deduction Worksheet for the state of Hawaii.

Q: What is the Wholesale Amusements Deduction?

A: The Wholesale Amusements Deduction is a deduction that allows amusement operators in Hawaii to deduct the wholesale value of amusement-related items sold to other operators.

Q: Who is eligible for the Wholesale Amusements Deduction?

A: Amusement operators in Hawaii who sell amusement-related items to other operators are eligible for the Wholesale Amusements Deduction.

Q: What is the purpose of Form G-81?

A: Form G-81 is used to calculate and report the Wholesale Amusements Deduction in Hawaii.

Q: What information do I need to complete Form G-81?

A: To complete Form G-81, you will need information about the wholesale value of amusement-related items sold and any applicable deductions.

Q: When is Form G-81 due?

A: Form G-81 is due on the same date as your Hawaii General Excise Tax return, which is usually the 20th of the month following the reporting period.

Q: Are there any penalties for late or incorrect filing of Form G-81?

A: Yes, there may be penalties for late or incorrect filing of Form G-81, so it's important to file accurately and on time.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-81 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.