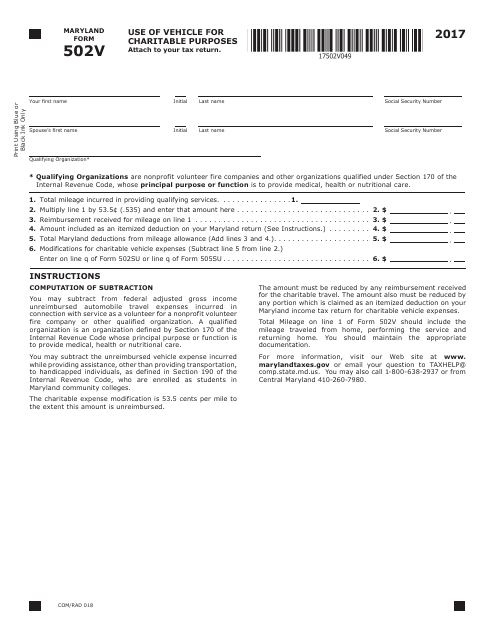

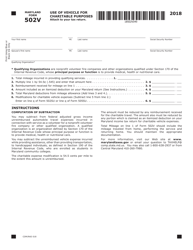

Form 502v Use of Vehicle for Charitable Purposes - Maryland

What Is Form 502v?

This is a legal form that was released by the Comptroller of Maryland - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 502v?

A: Form 502v is a form used in Maryland for reporting the use of a vehicle for charitable purposes.

Q: Who needs to file Form 502v?

A: Individuals in Maryland who used their vehicle for charitable purposes and wish to claim a deduction on their state income tax return.

Q: What qualifies as a charitable purpose?

A: Charitable purposes include volunteering for a qualified charitable organization, providing transportation for the elderly or disabled, and certain other volunteer activities.

Q: How do I fill out Form 502v?

A: You will need to provide information about the charitable organization, the dates of use, and the number of miles driven for charitable purposes.

Q: What is the deadline for filing Form 502v?

A: Form 502v must be filed by the same deadline as your Maryland state income tax return. The deadline is usually April 15th, but may vary.

Q: Is there a limit to the deduction I can claim?

A: Yes, there is a limit to the deduction you can claim based on the number of miles driven for charitable purposes. The current rate is $0.14 per mile.

Q: Do I need to keep any records to support my deduction?

A: Yes, you should keep records such as receipts, mileage logs, and any other documentation that supports the use of your vehicle for charitable purposes.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Comptroller of Maryland;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 502v by clicking the link below or browse more documents and templates provided by the Comptroller of Maryland.