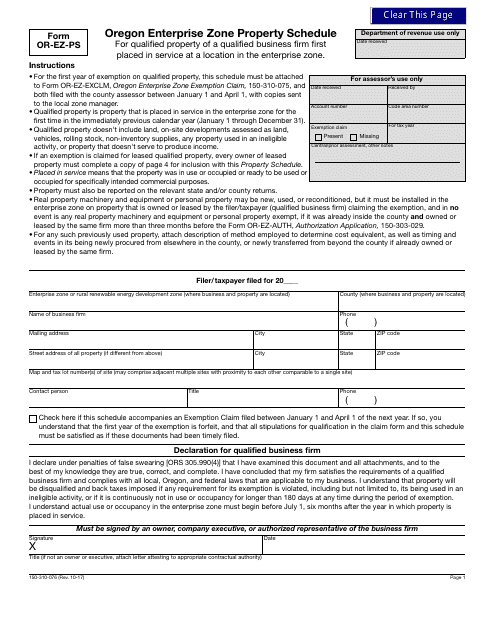

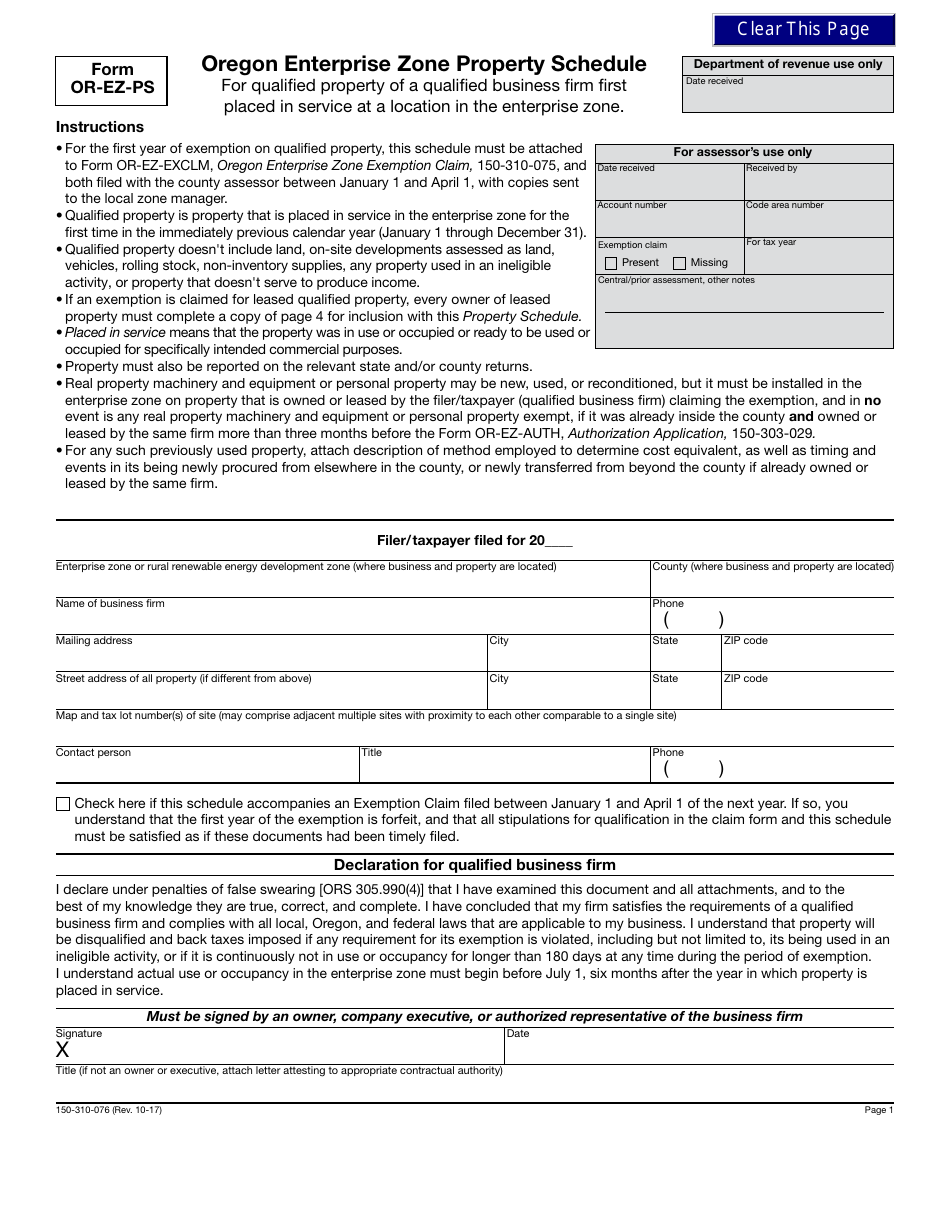

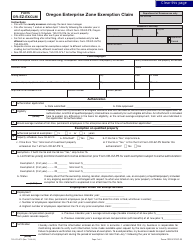

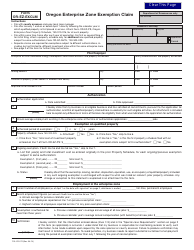

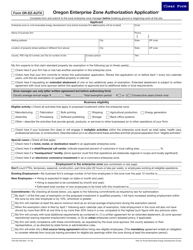

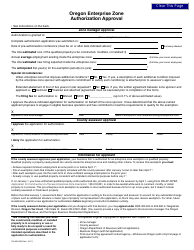

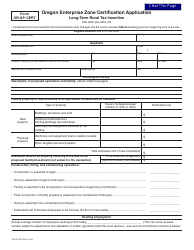

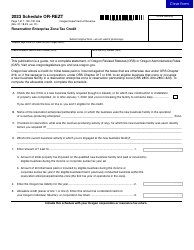

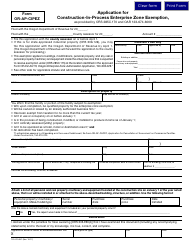

Form OR-EZ-PS Oregon Enterprise Zone Property Schedule - Oregon

What Is Form OR-EZ-PS?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OR-EZ-PS form?

A: The OR-EZ-PS form is the Oregon Enterprise ZoneProperty Schedule.

Q: What is the purpose of the OR-EZ-PS form?

A: The purpose of the OR-EZ-PS form is to report property information for businesses operating in an Oregon Enterprise Zone.

Q: Who needs to file the OR-EZ-PS form?

A: Businesses operating in an Oregon Enterprise Zone need to file the OR-EZ-PS form.

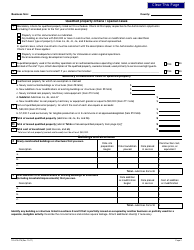

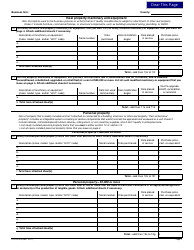

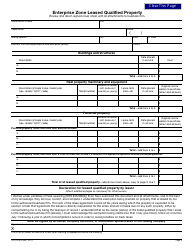

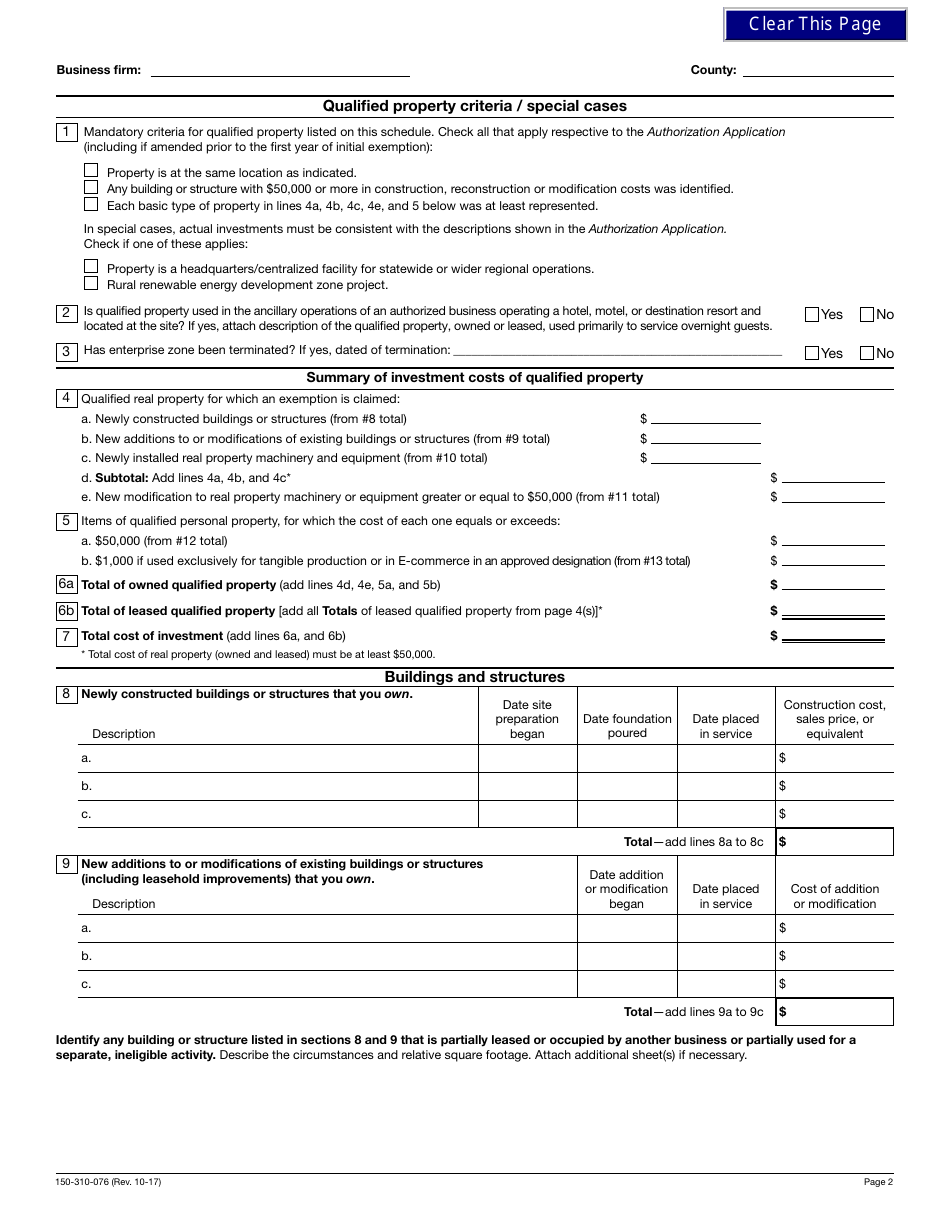

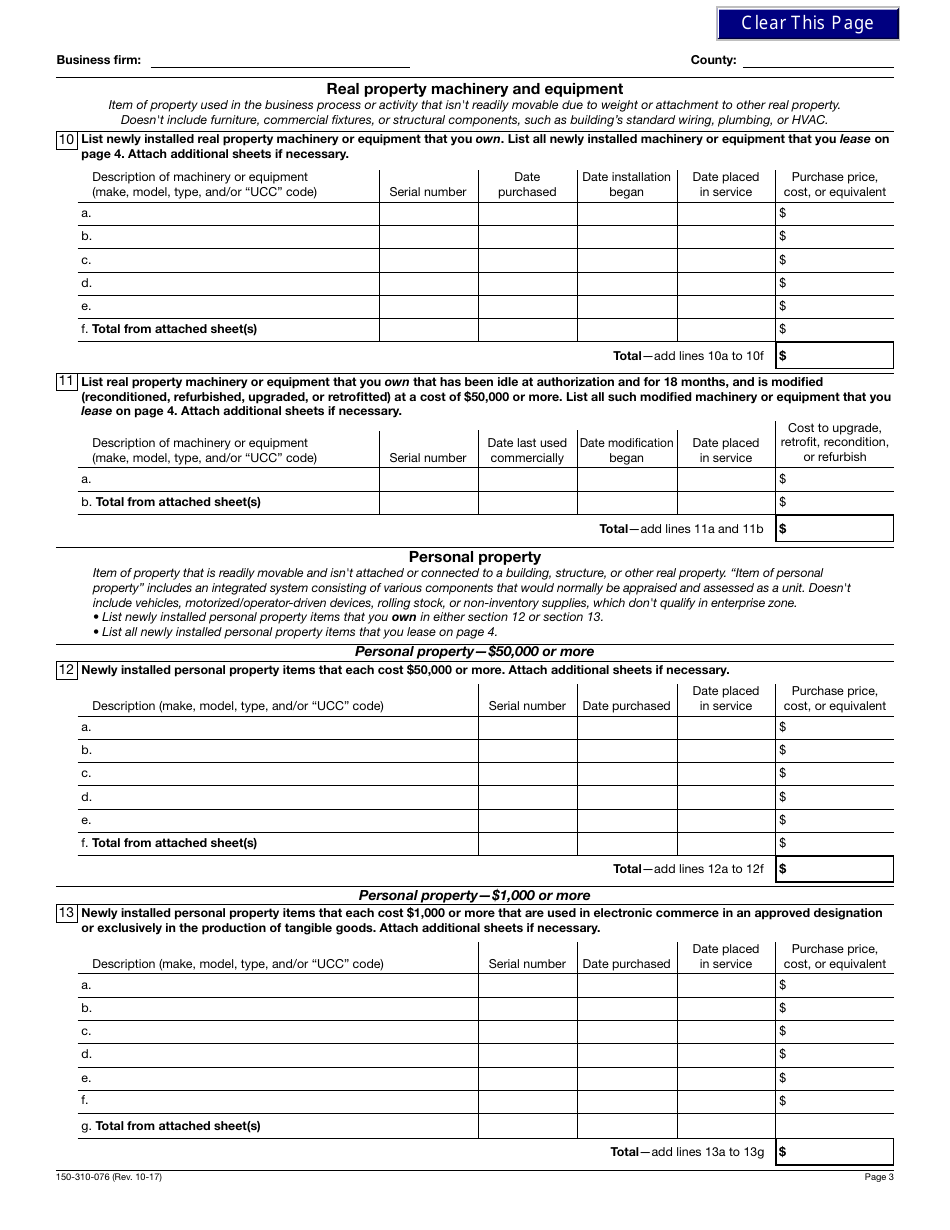

Q: What information needs to be reported on the OR-EZ-PS form?

A: The OR-EZ-PS form requires reporting of property information, such as the type of property, its location, and its value.

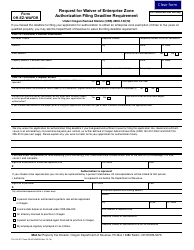

Q: Is there a deadline for filing the OR-EZ-PS form?

A: Yes, the OR-EZ-PS form must be filed by March 15th of each year.

Q: Are there any fees associated with filing the OR-EZ-PS form?

A: No, there are no fees associated with filing the OR-EZ-PS form.

Q: What happens if I don't file the OR-EZ-PS form?

A: Failure to file the OR-EZ-PS form may result in penalties or loss of benefits associated with operating in an Oregon Enterprise Zone.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-EZ-PS by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.