This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-330

for the current year.

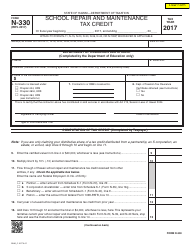

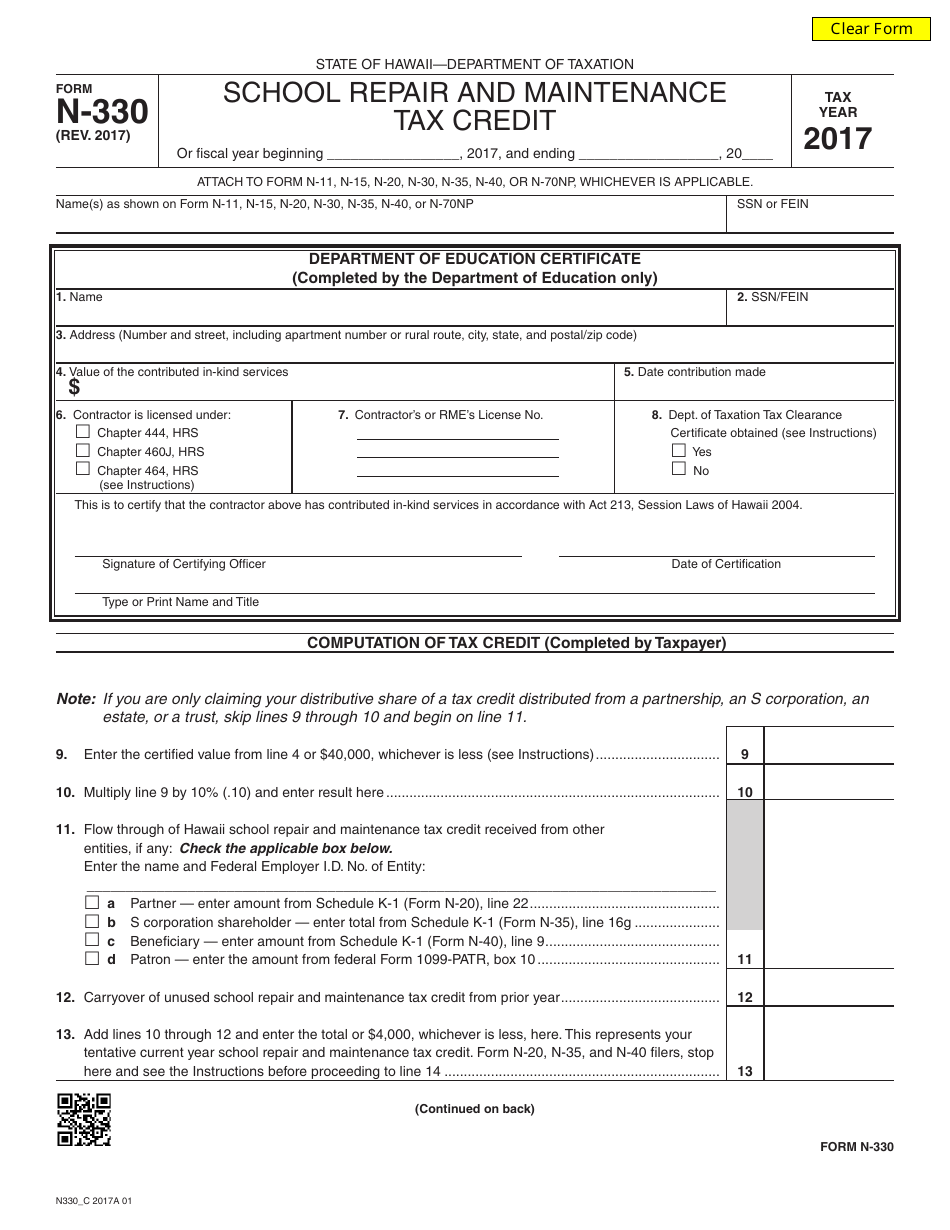

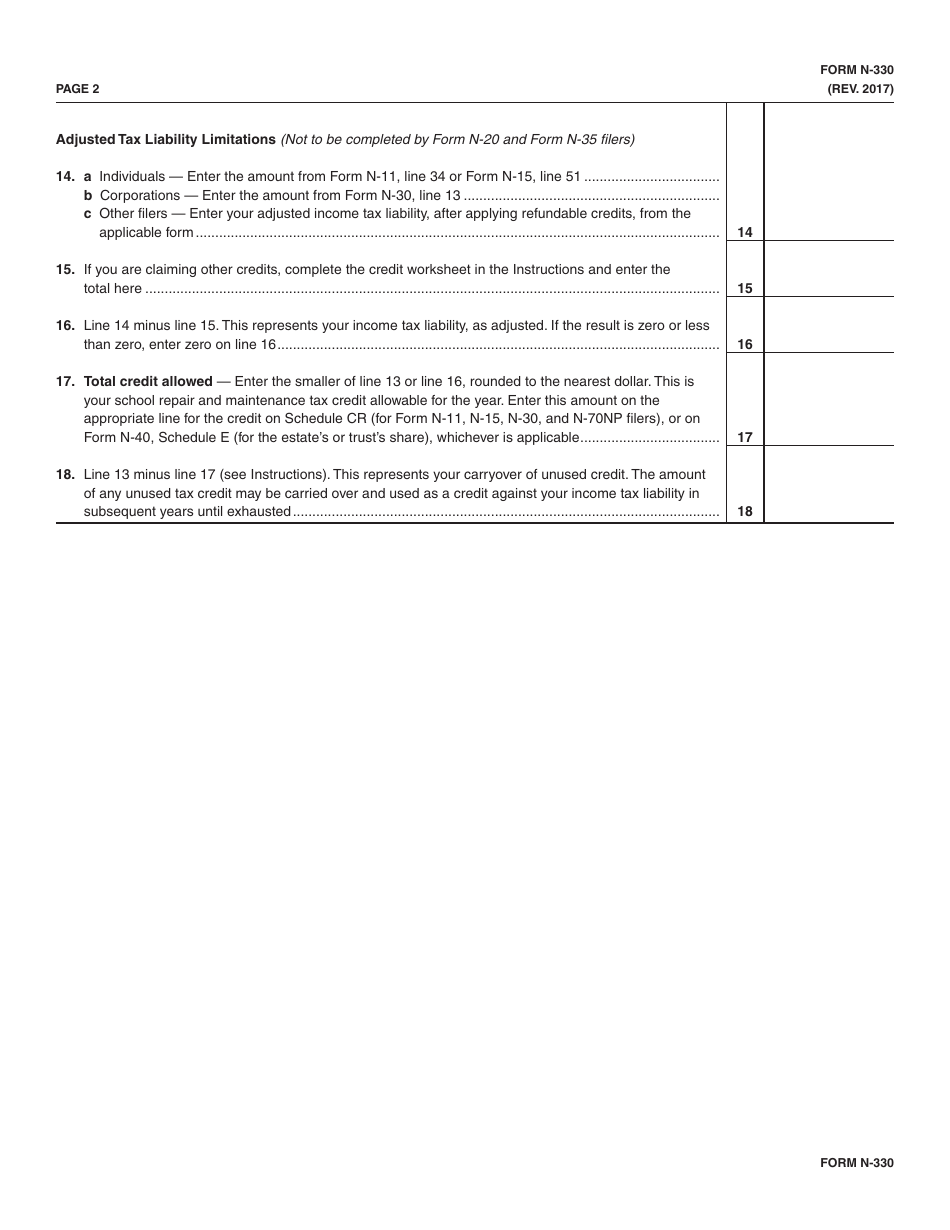

Form N-330 School Repair and Maintenance Tax Credit - Hawaii

What Is Form N-330?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-330?

A: Form N-330 is a form used in Hawaii to claim a School Repair and Maintenance Tax Credit.

Q: What is the School Repair and Maintenance Tax Credit?

A: The School Repair and Maintenance Tax Credit is a tax credit available in Hawaii for expenses incurred in the repair and maintenance of school facilities.

Q: Who is eligible to claim the School Repair and Maintenance Tax Credit?

A: Owners or lessees of real property in Hawaii that incur expenses for the repair and maintenance of school facilities are eligible to claim this tax credit.

Q: How do I claim the School Repair and Maintenance Tax Credit?

A: To claim the tax credit, you need to complete and file Form N-330 with the Hawaii Department of Taxation.

Q: What expenses are eligible for the School Repair and Maintenance Tax Credit?

A: Expenses related to repairing and maintaining school facilities, including labor, materials, and equipment costs, are eligible for the tax credit.

Q: What is the maximum amount of the School Repair and Maintenance Tax Credit?

A: The maximum amount of the tax credit is $100,000 per tax year.

Q: Are there any limitations or restrictions on the School Repair and Maintenance Tax Credit?

A: Yes, there are limitations and restrictions on the tax credit, including a maximum credit amount and a cap on total credits allowed in a tax year.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-330 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.