This version of the form is not currently in use and is provided for reference only. Download this version of

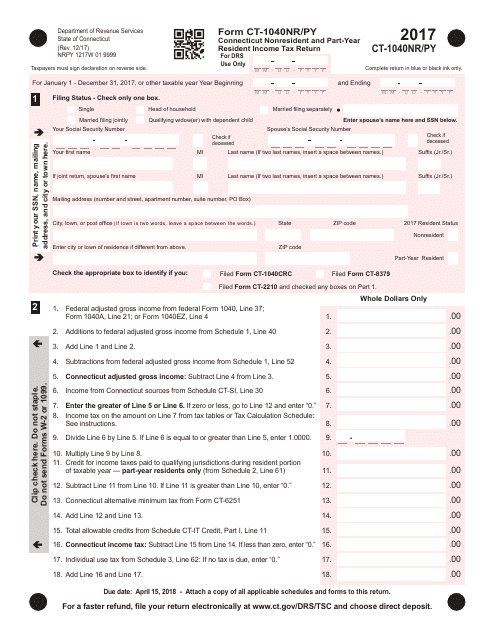

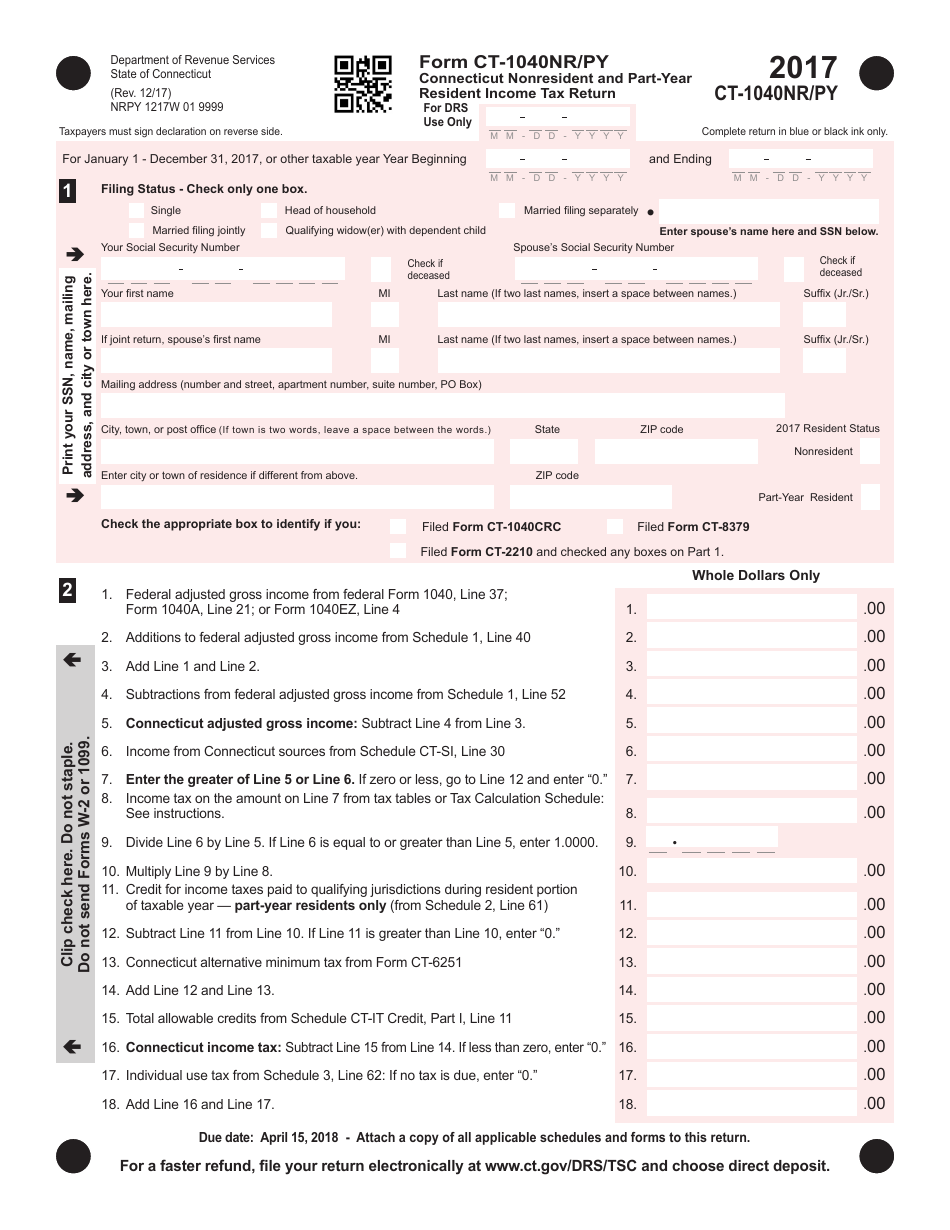

Form CT-1040NR/PY

for the current year.

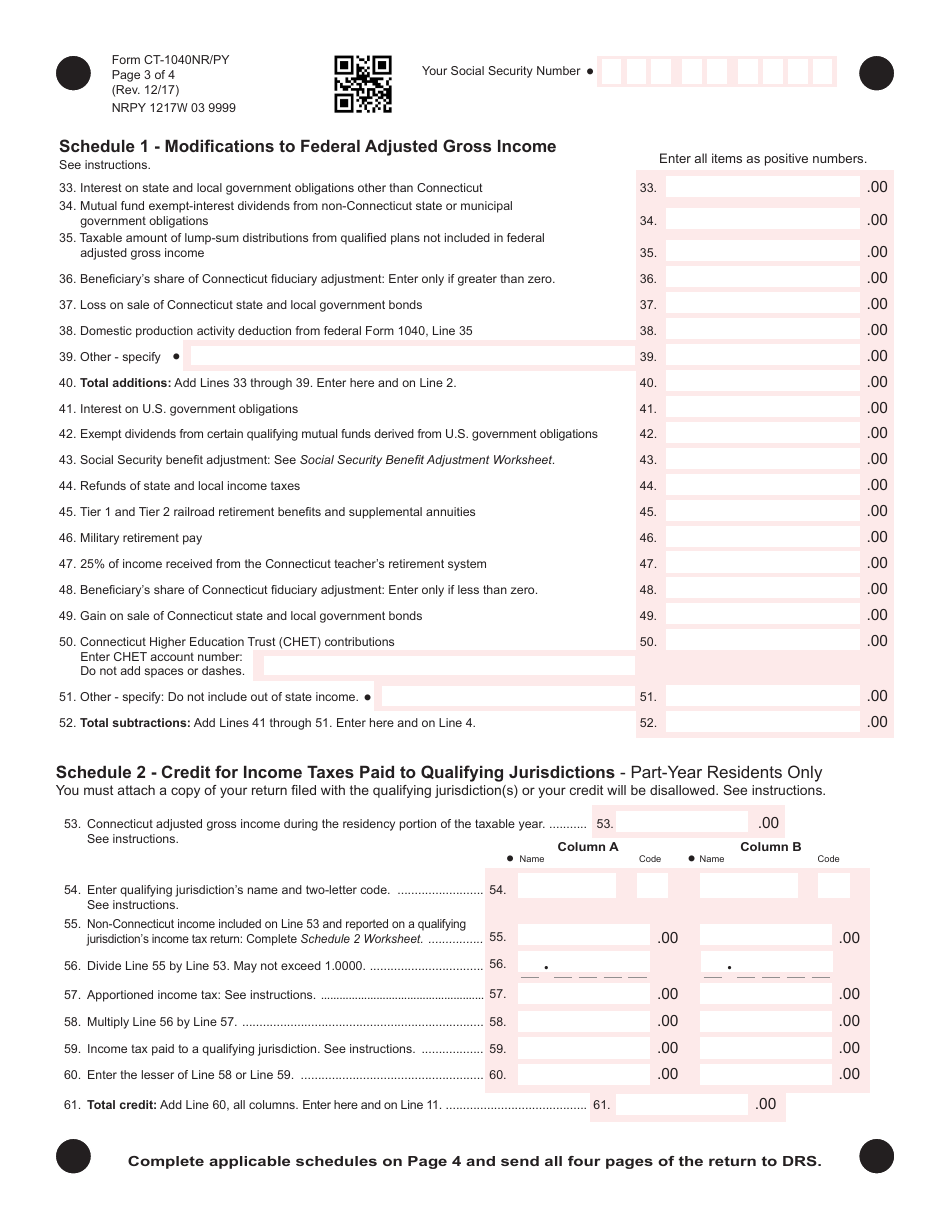

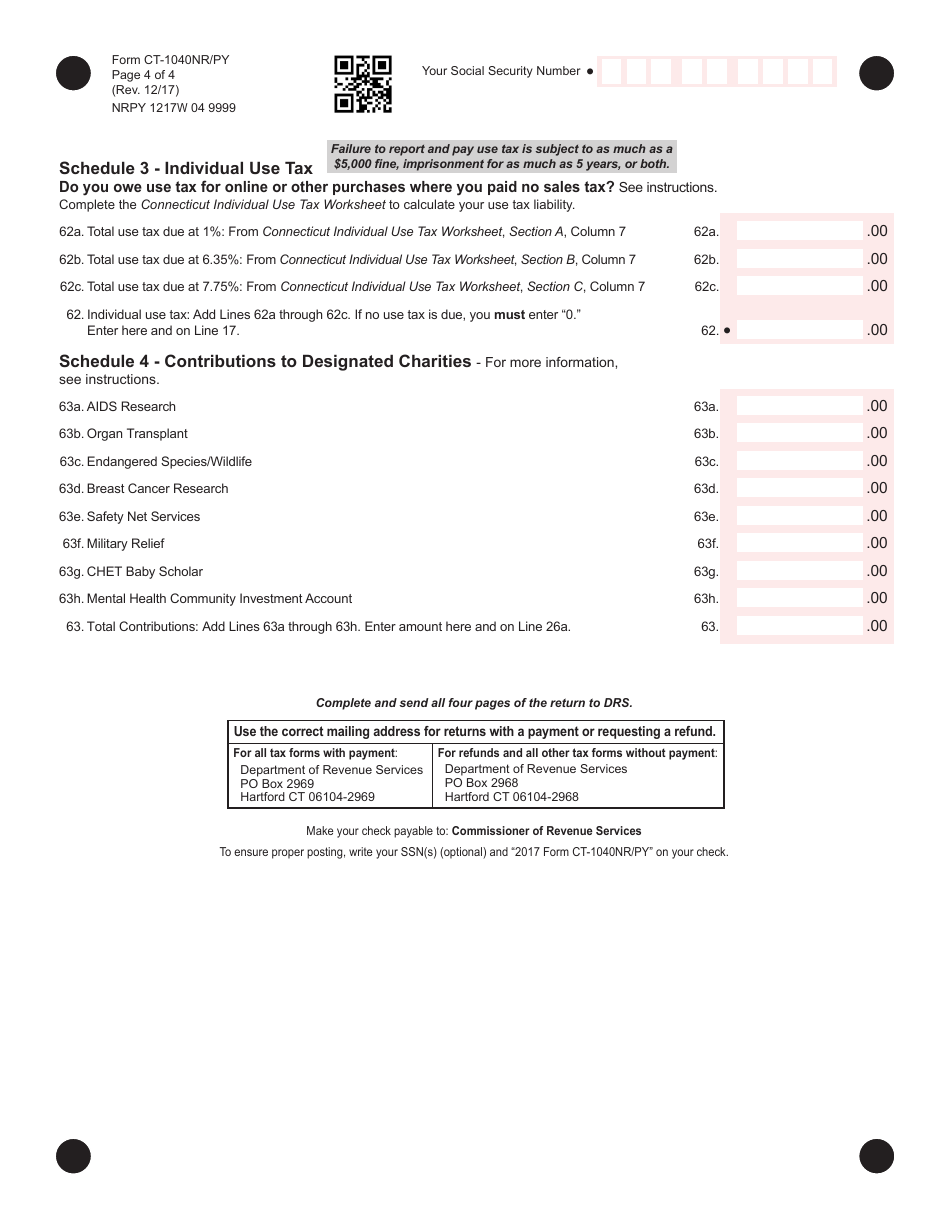

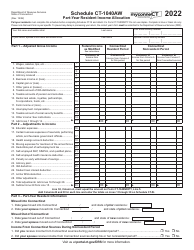

Form CT-1040NR / PY Connecticut Nonresident and Part-Year Resident Income Tax Return - Connecticut

What Is Form CT-1040NR/PY?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1040NR/PY?

A: Form CT-1040NR/PY is the Connecticut Nonresident and Part-Year Resident Income Tax Return.

Q: Who needs to file Form CT-1040NR/PY?

A: Nonresidents and part-year residents of Connecticut who have income earned in the state need to file Form CT-1040NR/PY.

Q: What is the purpose of Form CT-1040NR/PY?

A: The purpose of Form CT-1040NR/PY is to report and calculate the tax liability for nonresidents and part-year residents of Connecticut.

Q: When is the deadline to file Form CT-1040NR/PY?

A: The deadline to file Form CT-1040NR/PY is generally April 15th, the same as the federal income tax deadline.

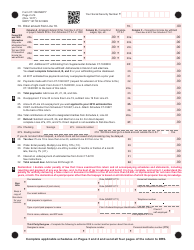

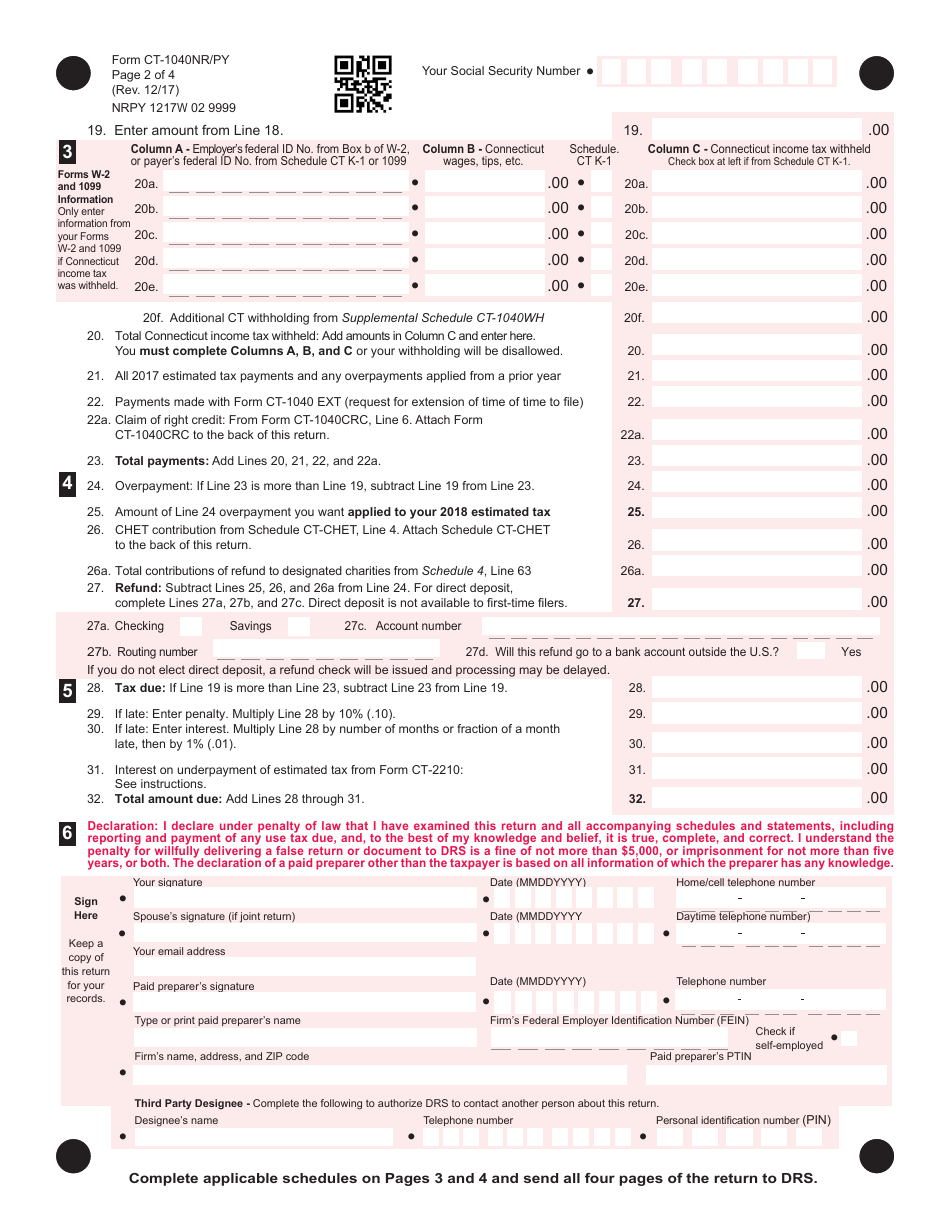

Q: What should I include when filing Form CT-1040NR/PY?

A: When filing Form CT-1040NR/PY, you should include all relevant income, deductions, and credits for the applicable tax year.

Q: What if I am unsure about how to complete Form CT-1040NR/PY?

A: If you are unsure about how to complete Form CT-1040NR/PY or have any questions, it is recommended to seek assistance from a tax professional or contact the Connecticut Department of Revenue Services.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1040NR/PY by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.