This version of the form is not currently in use and is provided for reference only. Download this version of

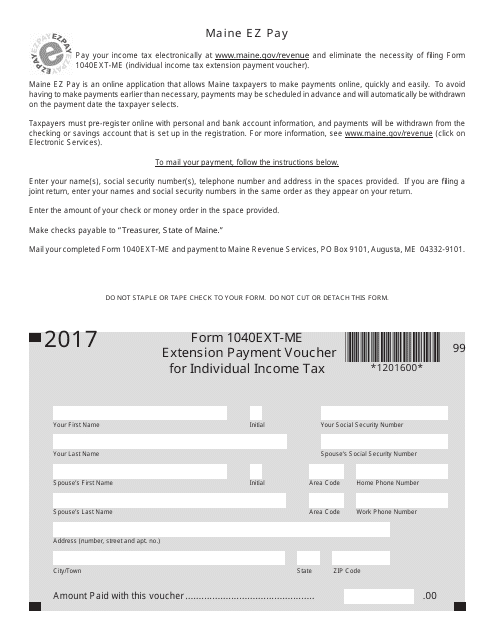

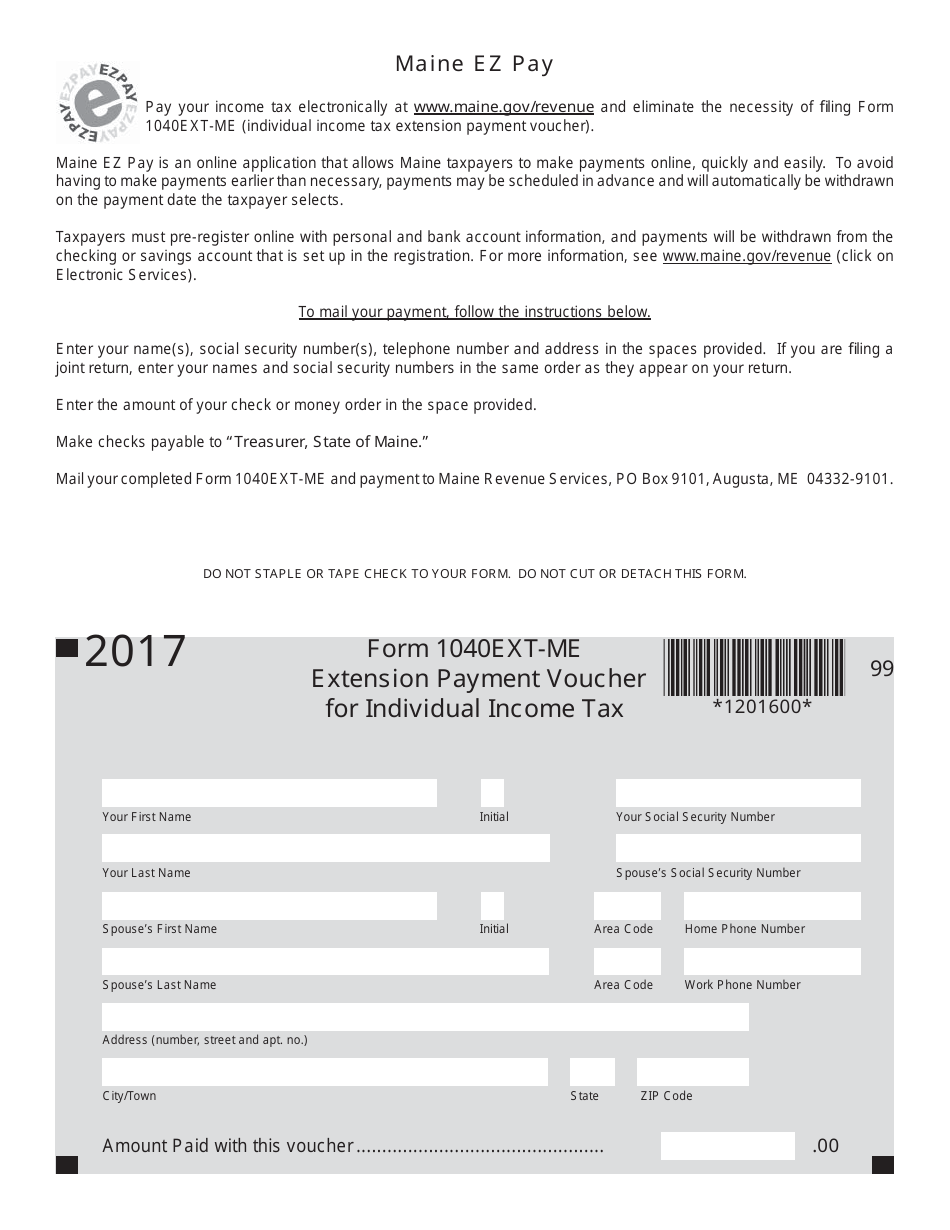

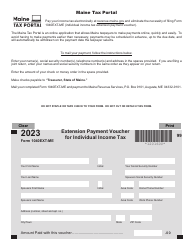

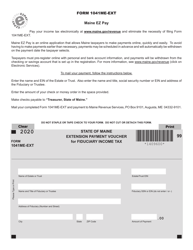

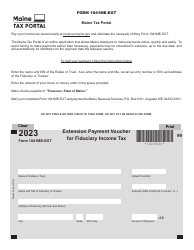

Form 1040EXT-ME

for the current year.

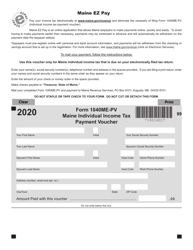

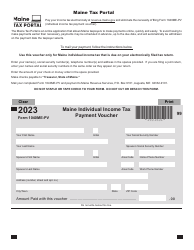

Form 1040EXT-ME Extension Payment Voucher for Individual Income Tax - Maine

What Is Form 1040EXT-ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040EXT-ME?

A: Form 1040EXT-ME is an extension payment voucher for individual income tax in Maine.

Q: Who needs to file Form 1040EXT-ME?

A: Anyone who needs to make an extension payment for their individual income tax in Maine.

Q: What is the purpose of Form 1040EXT-ME?

A: The purpose of Form 1040EXT-ME is to make a payment towards an extension request for individual income tax in Maine.

Q: What information do I need to fill out Form 1040EXT-ME?

A: You will need to provide your name, address, social security number, and the amount you are paying as an extension payment.

Q: When is the deadline for filing Form 1040EXT-ME?

A: The deadline for filing Form 1040EXT-ME is the same as the deadline for filing your individual income tax return in Maine.

Q: Are there any penalties for not filing Form 1040EXT-ME?

A: Yes, if you owe taxes and fail to file Form 1040EXT-ME or pay the required amount by the deadline, you may be subject to penalties and interest.

Q: Can I use Form 1040EXT-ME for federal income tax extension?

A: No, Form 1040EXT-ME is specifically for individual income tax extension in the state of Maine. For federal income tax extension, you need to use the appropriate federal form.

Form Details:

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1040EXT-ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.