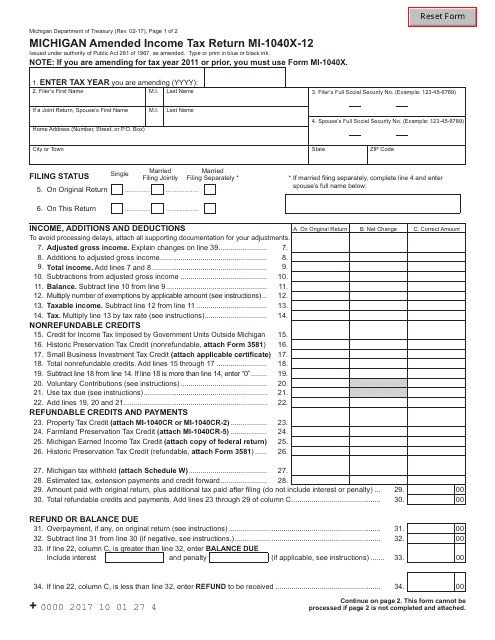

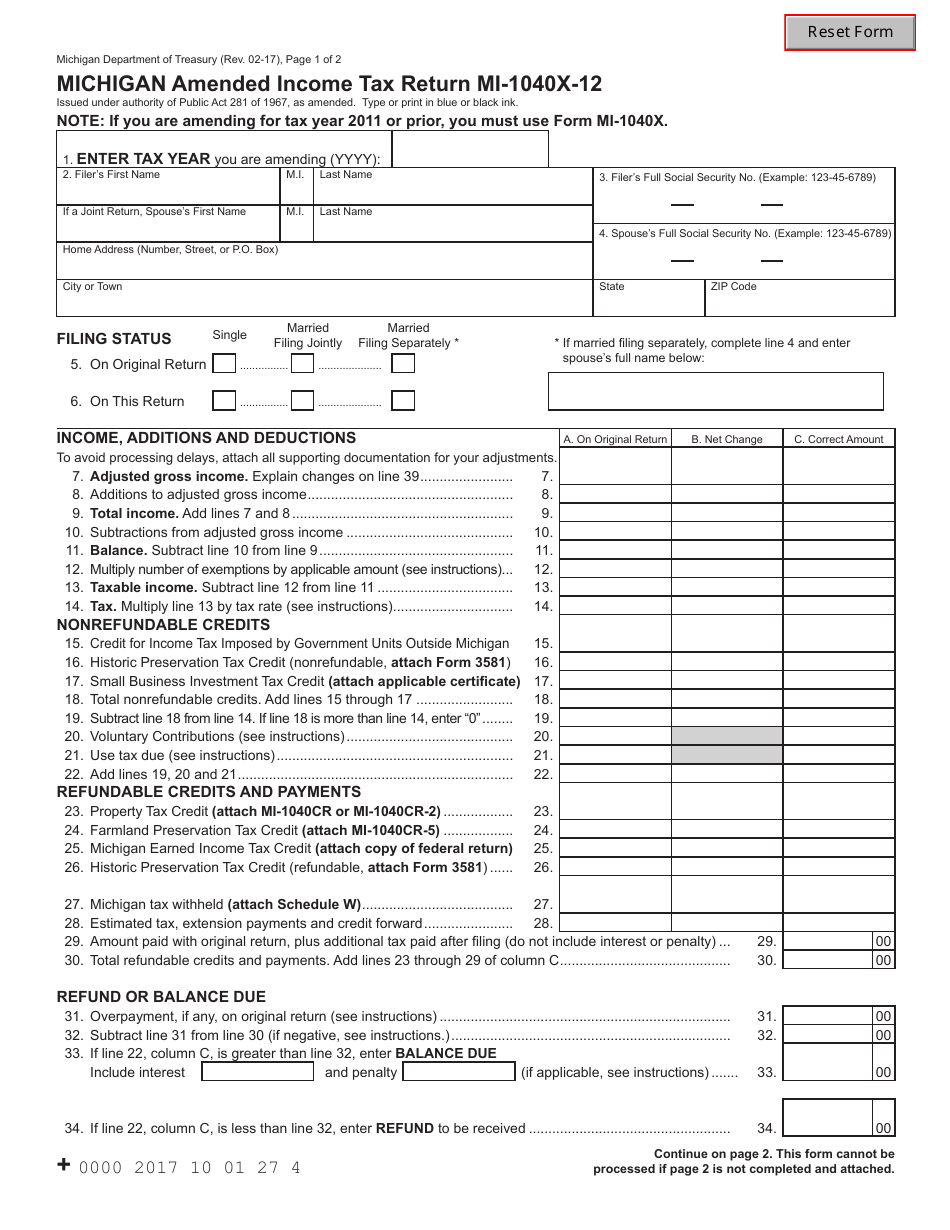

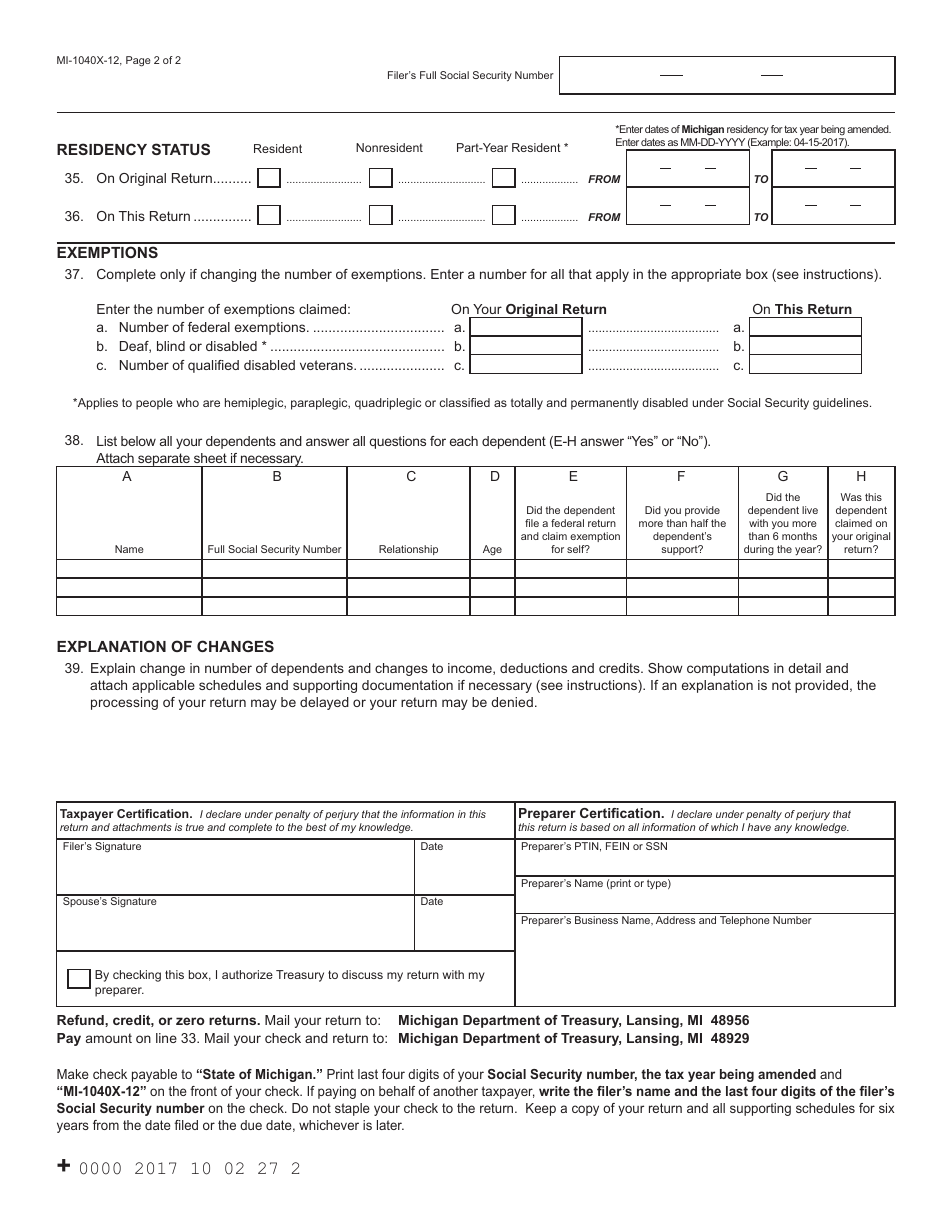

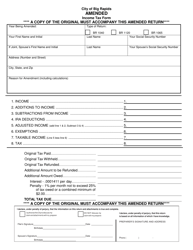

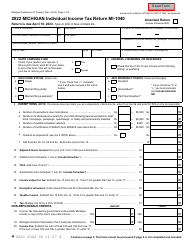

Form MI-1040X-12 Michigan Amended Income Tax Return - Michigan

What Is Form MI-1040X-12?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MI-1040X-12?

A: Form MI-1040X-12 is the Michigan Amended Income Tax Return.

Q: Who should file Form MI-1040X-12?

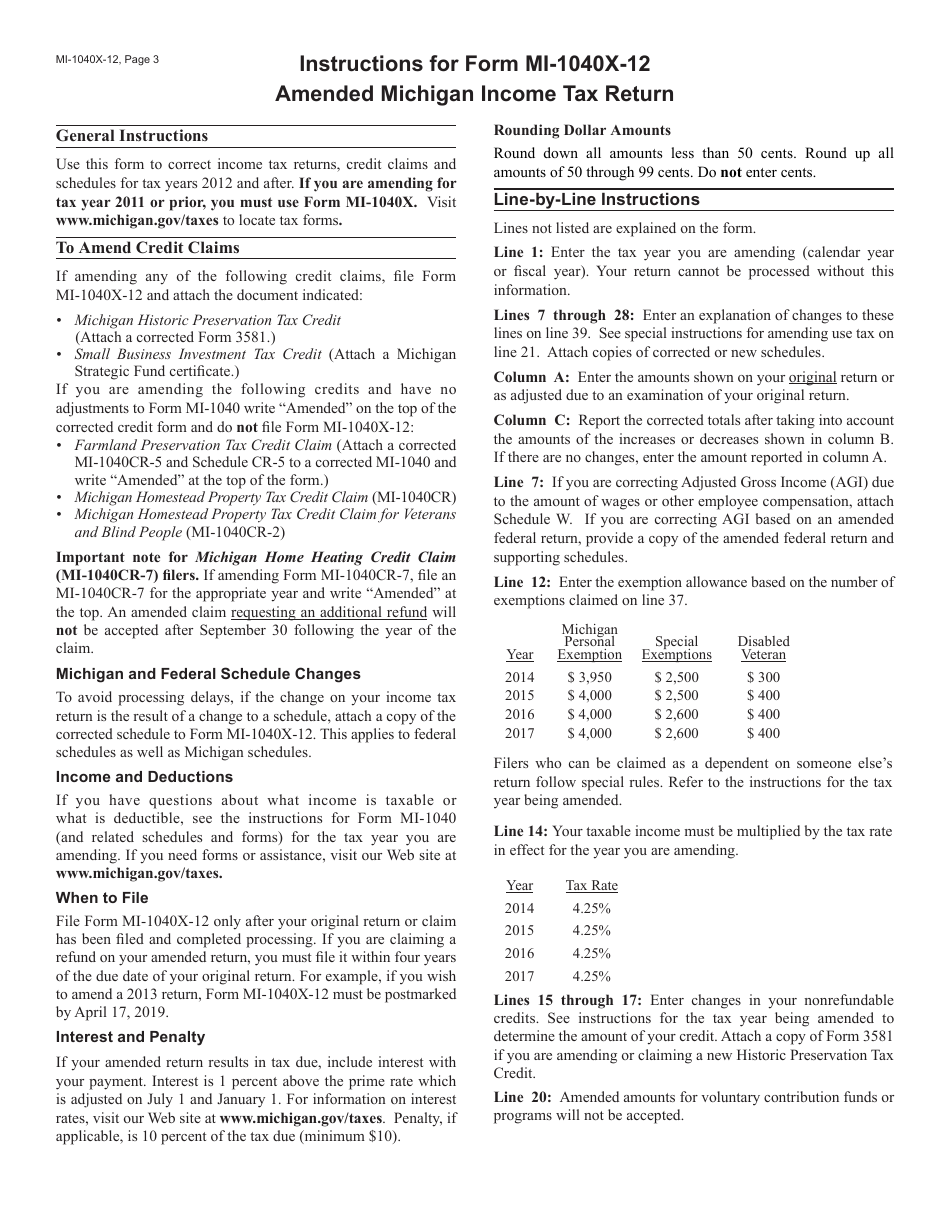

A: Michigan residents who need to make changes or corrections to their original MI-1040 tax returns should file Form MI-1040X-12.

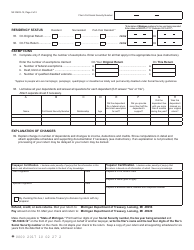

Q: What information do I need to complete Form MI-1040X-12?

A: You will need your original MI-1040 tax return information, any supporting documentation for the changes or corrections you are making, and the updated information for the amended return.

Q: What should I do if I made a mistake on my original MI-1040 tax return?

A: If you made a mistake on your original MI-1040 tax return, you should file Form MI-1040X-12 to correct the error.

Q: Is there a deadline to file Form MI-1040X-12?

A: Yes, Form MI-1040X-12 must be filed within four years from the original due date of the tax return or within one year from the date any additional taxes were paid, whichever is later.

Q: Will there be any penalties or interest for filing Form MI-1040X-12?

A: If you owe additional taxes as a result of filing Form MI-1040X-12, you may be subject to penalties and interest.

Q: Can I electronically file Form MI-1040X-12?

A: No, Form MI-1040X-12 must be filed by mail.

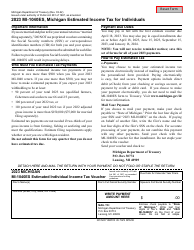

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1040X-12 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.