This version of the form is not currently in use and is provided for reference only. Download this version of

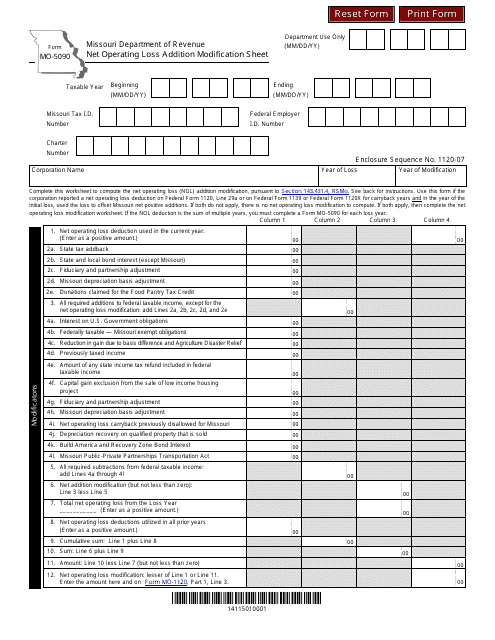

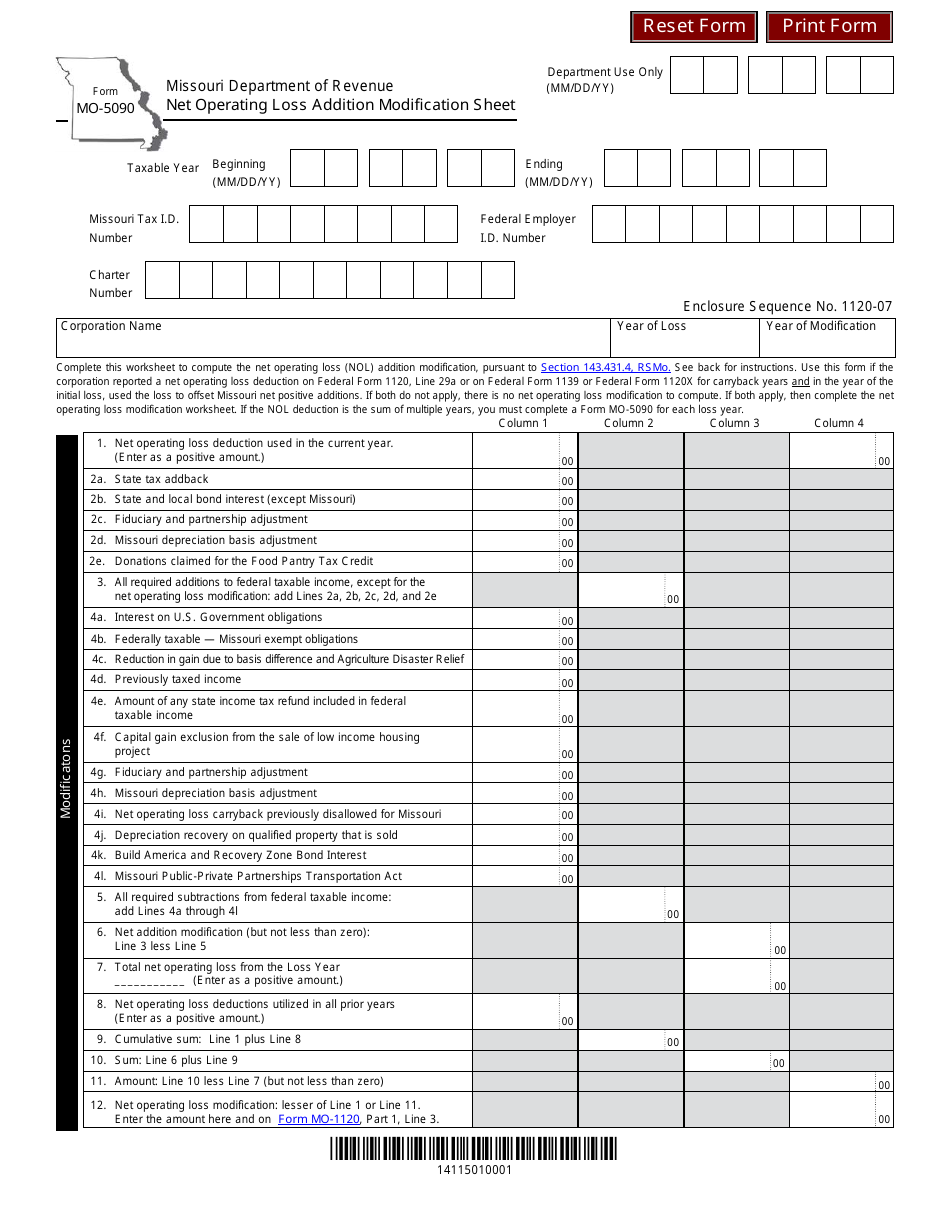

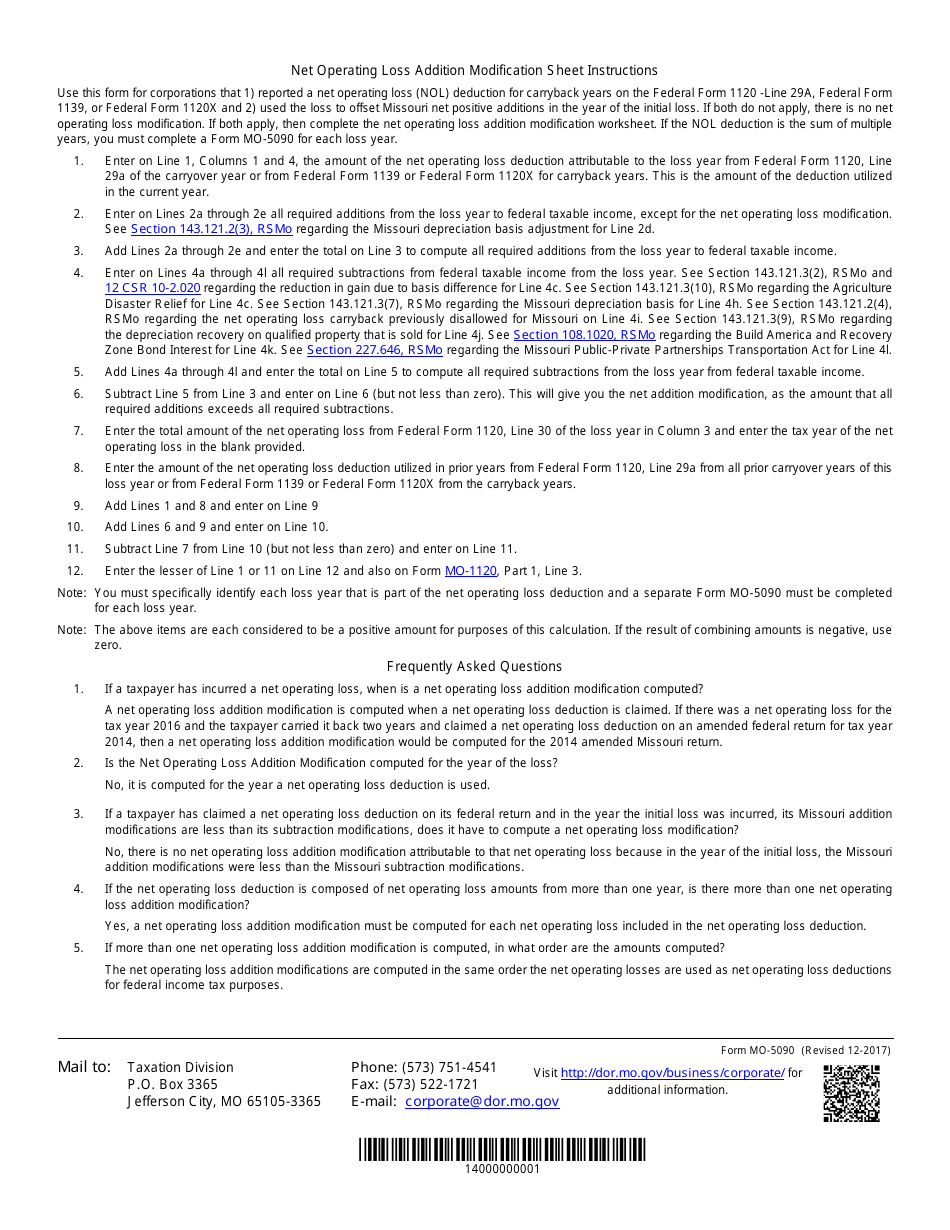

Form MO-5090

for the current year.

Form MO-5090 Net Operating Loss Addition Modification Sheet - Missouri

What Is Form MO-5090?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is MO-5090?

A: MO-5090 is the form used in Missouri for reporting the net operating loss addition modification.

Q: What is a net operating loss addition modification?

A: A net operating loss addition modification is an adjustment made to a taxpayer's net operating loss.

Q: Who needs to fill out MO-5090?

A: Anyone who is required to report a net operating loss addition modification in Missouri needs to fill out MO-5090.

Q: Is MO-5090 specific to Missouri?

A: Yes, MO-5090 is a form specific to the state of Missouri.

Q: What other information do I need to complete MO-5090?

A: You will need to have information related to your net operating loss and any additions required by Missouri tax law.

Q: Are there any filing deadlines for MO-5090?

A: Yes, MO-5090 must be filed by the due date of your Missouri tax return, which is typically April 15th.

Q: Can I amend my MO-5090 if I made a mistake?

A: Yes, you can file an amended MO-5090 if you made a mistake on your original form.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-5090 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.