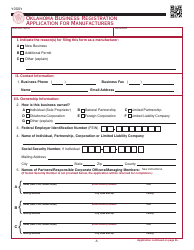

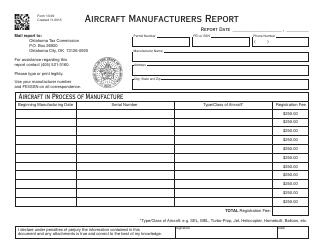

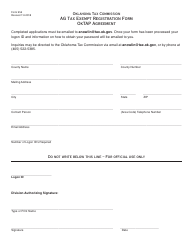

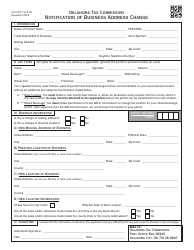

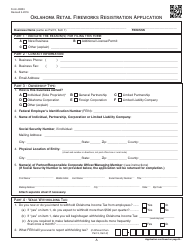

OTC Form M Oklahoma Business Registration Packet for Manufacturers - Oklahoma

What Is OTC Form M?

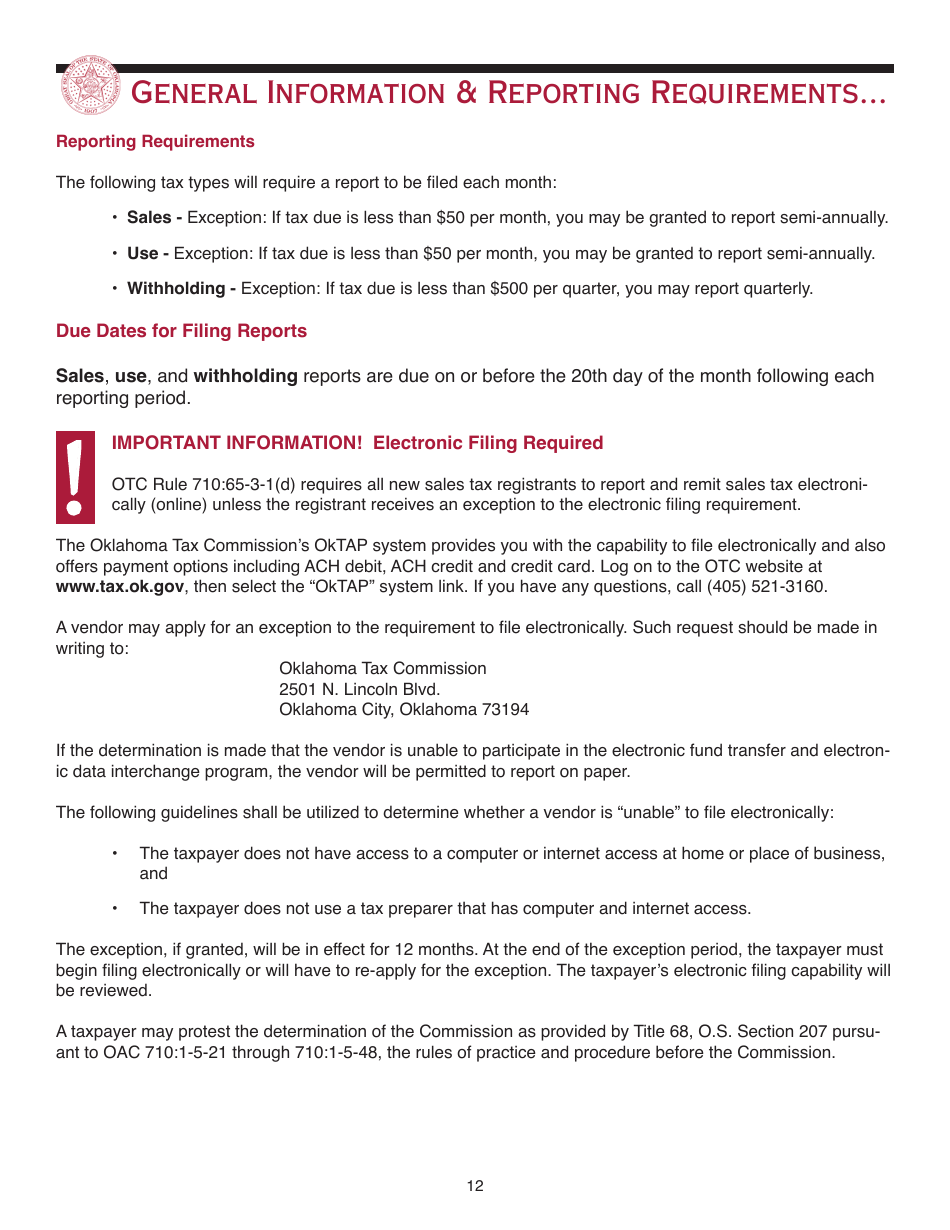

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form M?

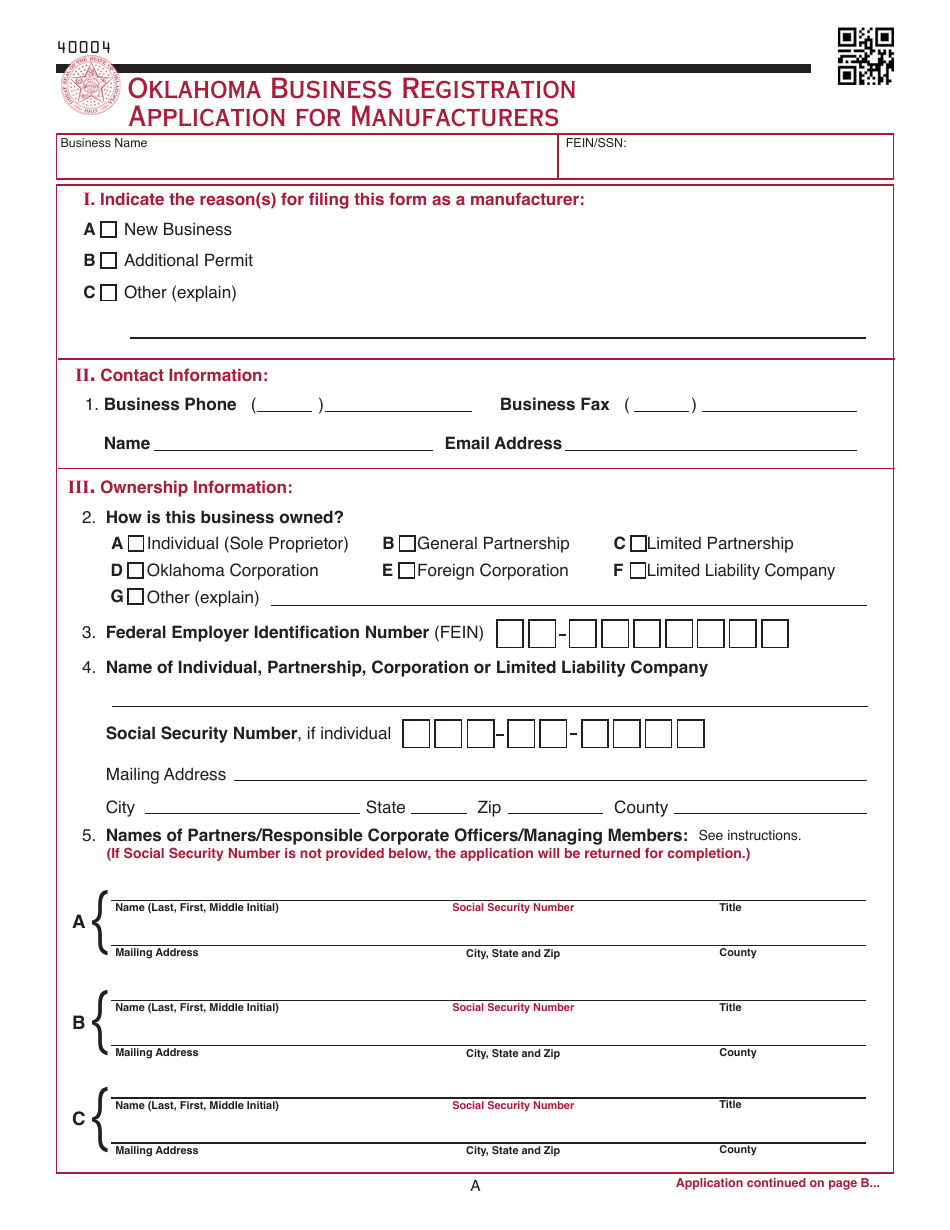

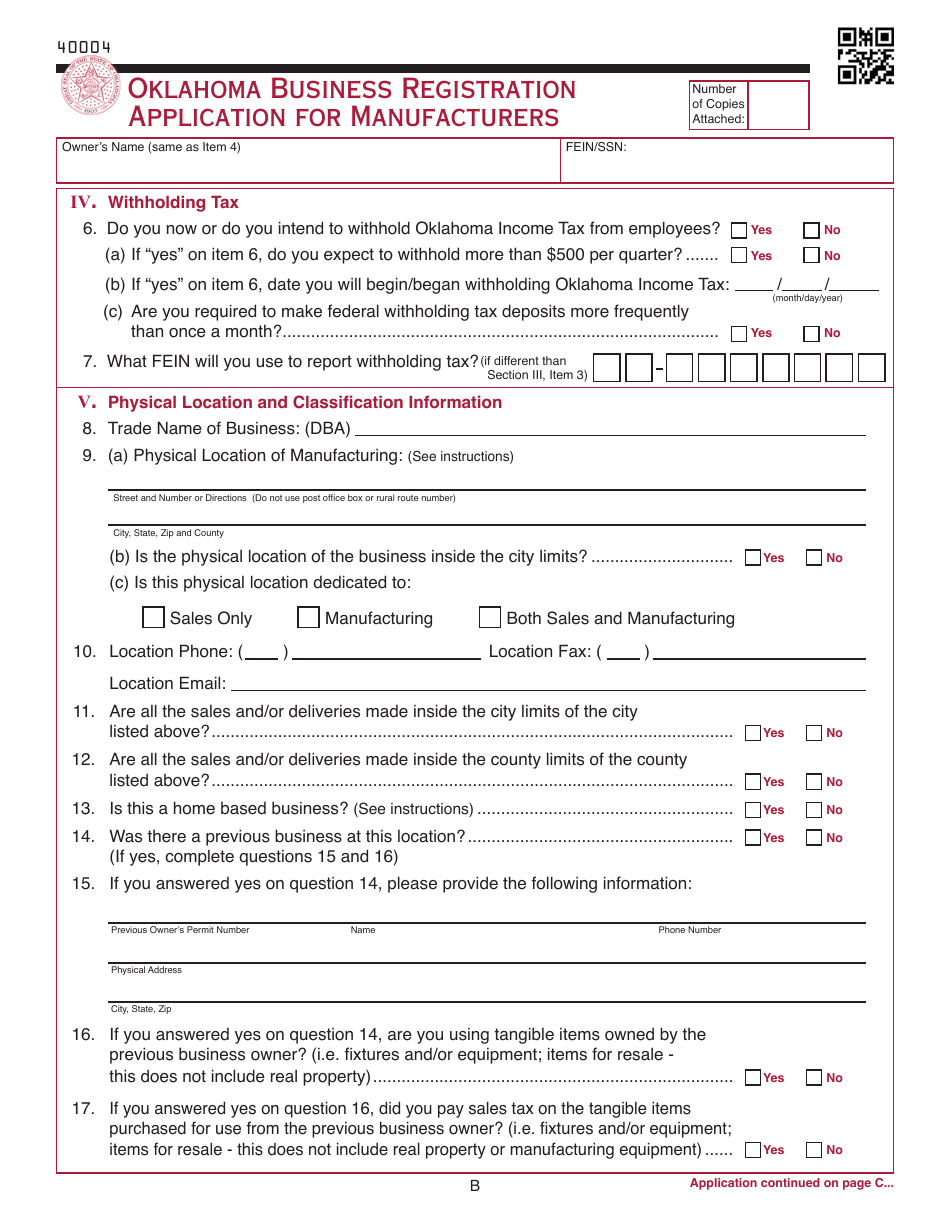

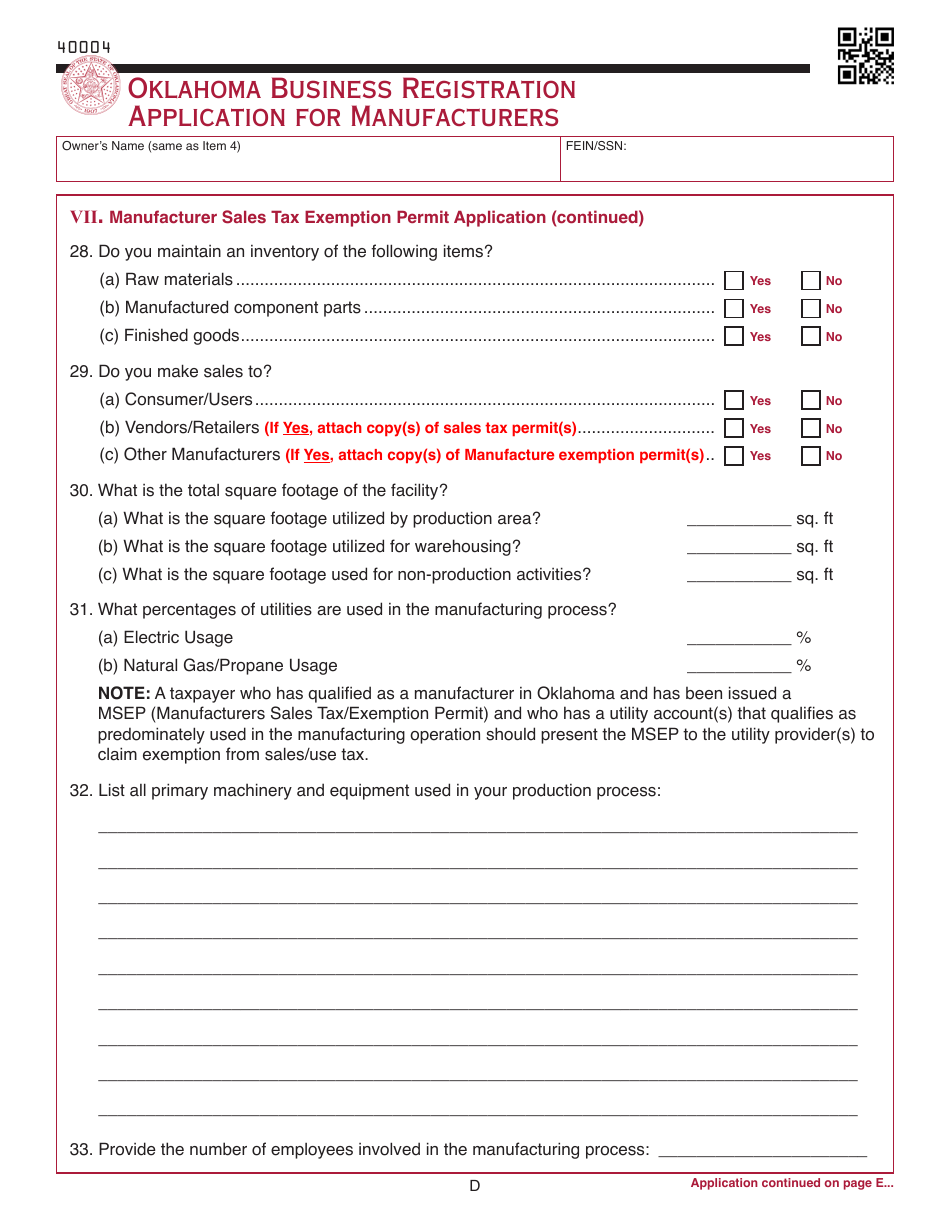

A: The OTC Form M is a business registration packet for manufacturers in Oklahoma.

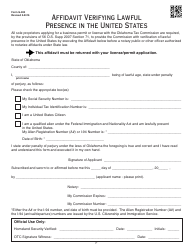

Q: Who is required to complete the OTC Form M?

A: Manufacturers in Oklahoma are required to complete the OTC Form M.

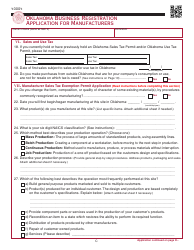

Q: What is the purpose of the OTC Form M?

A: The purpose of the OTC Form M is to register manufacturers for tax purposes in Oklahoma.

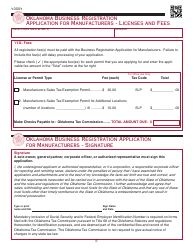

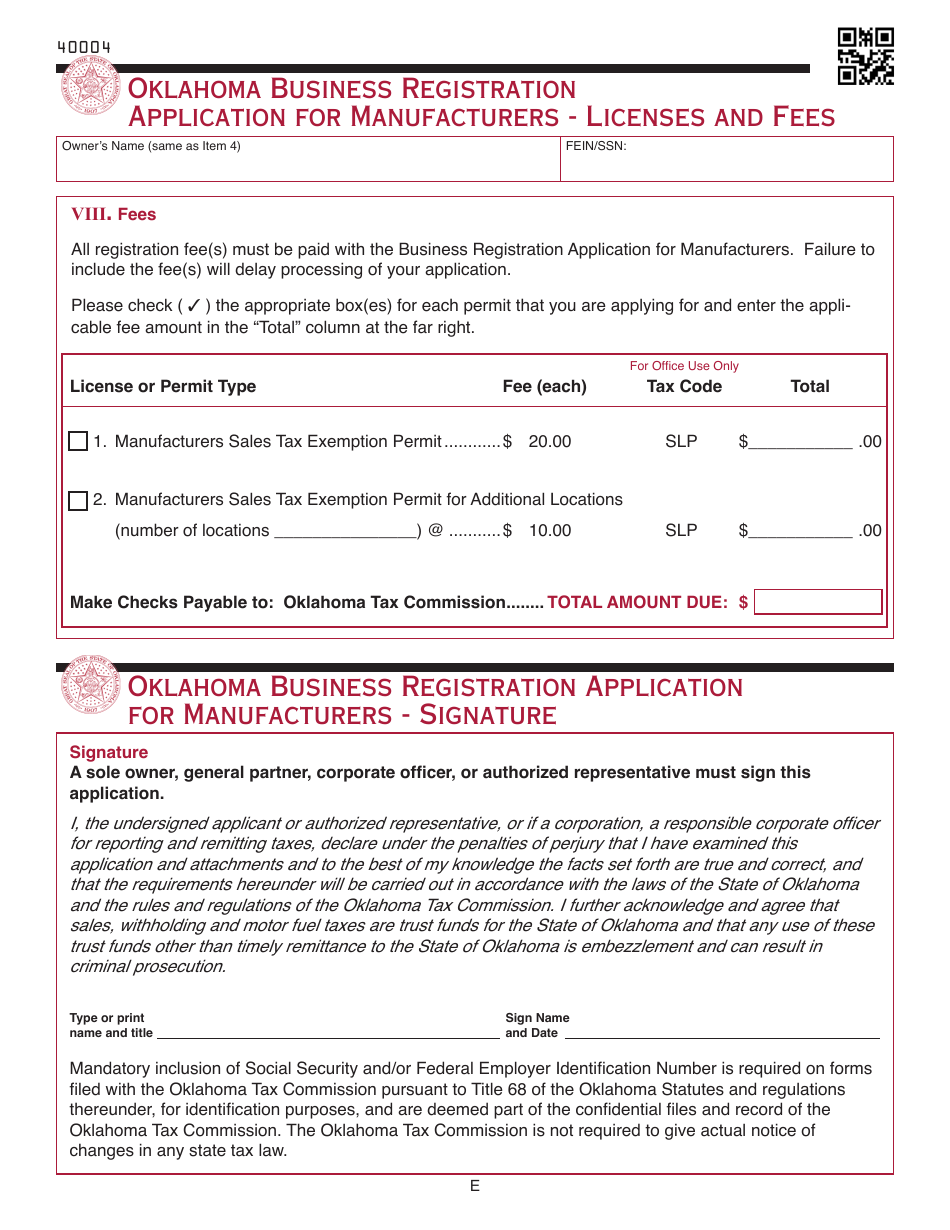

Q: Are there any fees associated with the OTC Form M?

A: Yes, there may be fees associated with the OTC Form M. You should consult the instructions provided with the form for more information.

Q: How often do I need to renew the OTC Form M?

A: The OTC Form M needs to be renewed annually.

Q: What documents or information do I need to complete the OTC Form M?

A: You will need to provide various business and tax-related information, such as your business name, address, federal employer identification number (FEIN), and other relevant details.

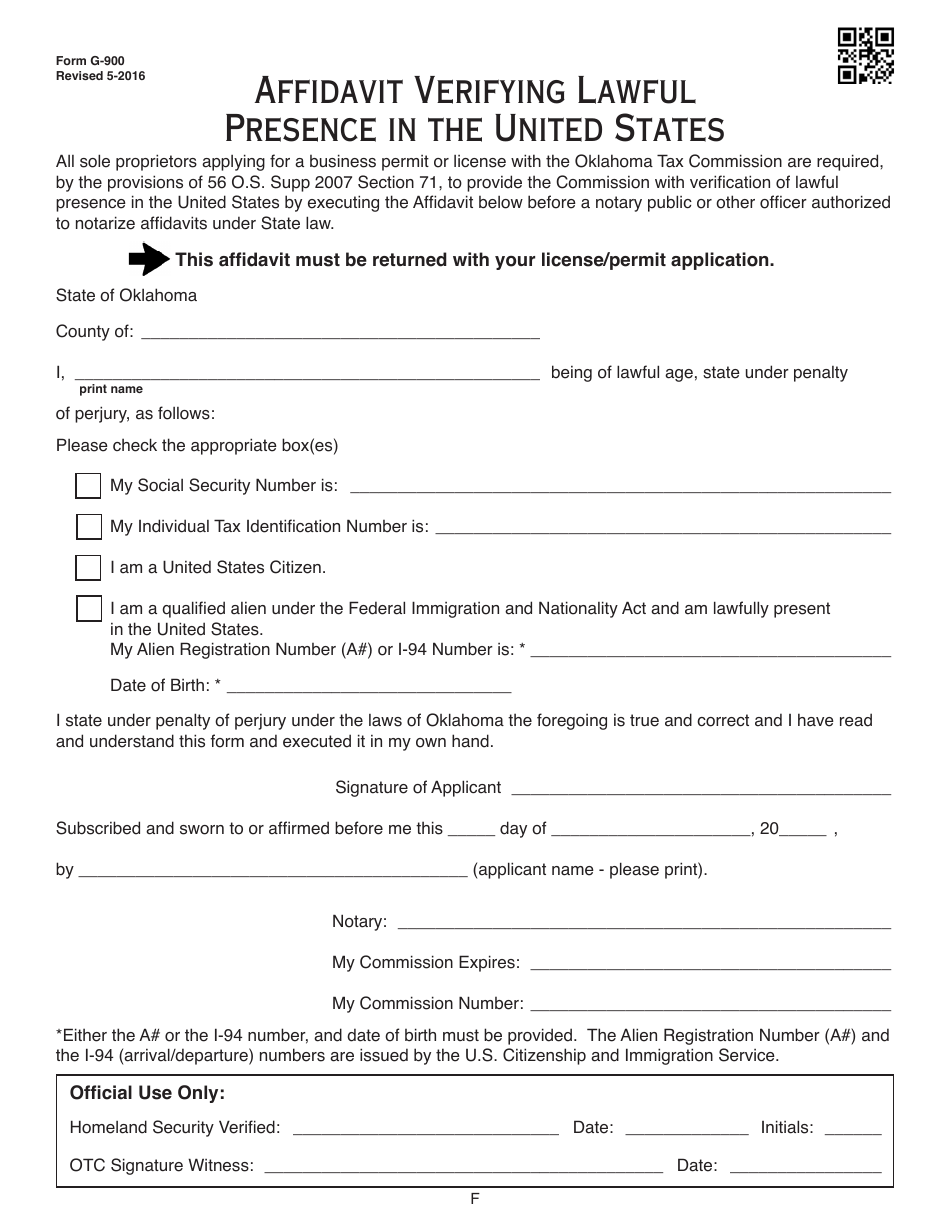

Q: Are there any specific requirements for manufacturers to register in Oklahoma?

A: Yes, manufacturers may have to meet certain requirements, such as obtaining necessary licenses or permits. It is recommended to consult with the Oklahoma Tax Commission or other relevant agencies for specific requirements.

Q: Who can I contact for assistance with the OTC Form M?

A: For assistance with the OTC Form M, you can contact the Oklahoma Tax Commission or refer to the instructions provided with the form.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form M by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.